ASX 200 to rise, miners in focus following Federal Budget, GameStop shares close 60% higher

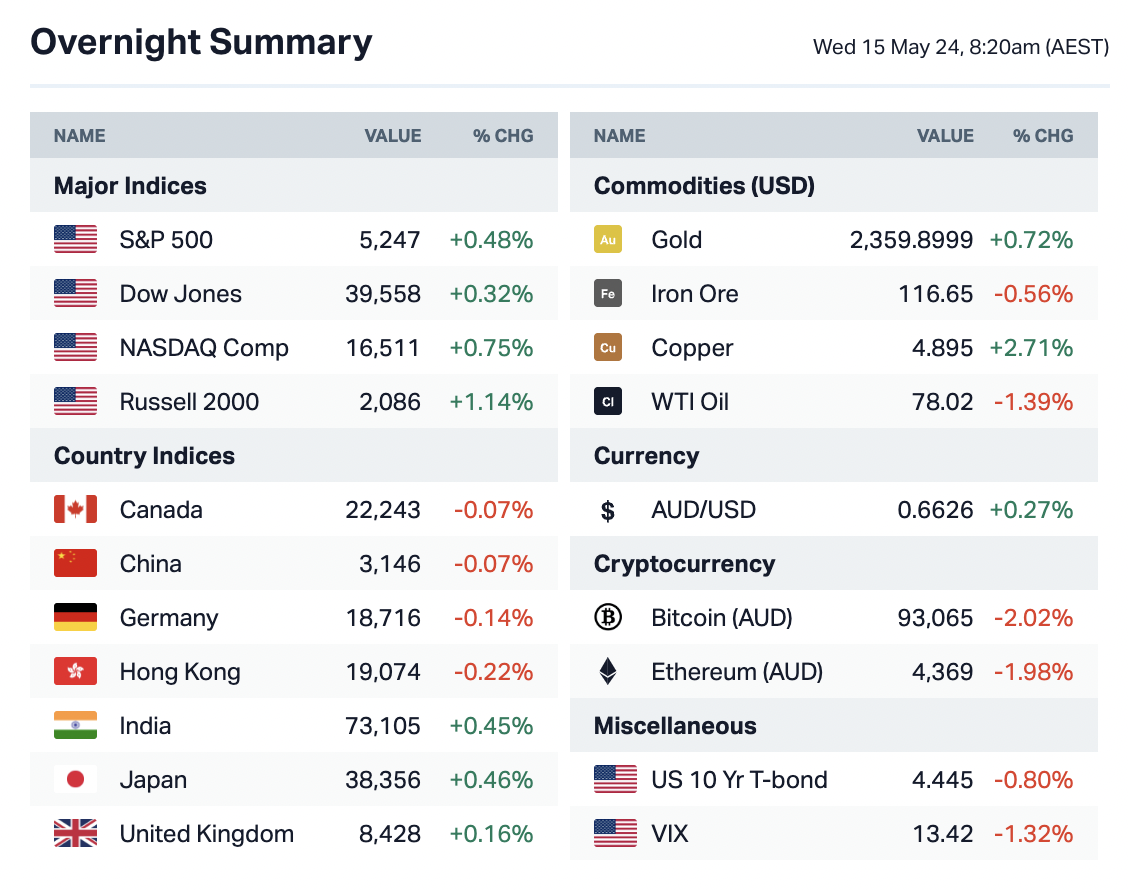

ASX 200 futures are up 36 points, or +0.46%, as of 8:20am AEST.

In some respects, the week really starts tonight with US inflation and retail sales data. Fed Chair Jerome Powell has already signalled that inflation has been higher than previously thought and that he expects rates to remain steady.

On the local front, the Federal Budget will put the miners in focus today after it was confirmed that $24 billion will be given to the sector over the next decade. Look out for names like Fortescue (ASX: FMG), Mineral Resources (ASX: MIN), IGO (ASX: IGO), Pilbara Minerals (ASX: PLS), Liontown Resources (ASX: LTR), the uranium miners, and even conglomerates like Wesfarmers (ASX: WES) who have exposure to this megatrend.

Let's dive in.

S&P 500 SESSION CHART

- Nasdaq jumps to record close, Dow adds more than 100 points ahead of consumer inflation report

- Fed Chair Powell says inflation has been higher than thought, expects rates to hold steady

- European stocks close slightly higher as investors digest U.S. inflation data; Delivery Hero up 26%

- 10-year Treasury yield wavers after release of fresh inflation data

- Oil dips as U.S. data suggests inflation is stickier than expected

- Gold regains ground following hot inflation report

- Google rolls out its most powerful AI models as competition from OpenAI heats up

- Reddit shares close near record after two-day rally driven by meme stocks

- Alibaba shares fall 7% after the Chinese tech giant posts 86% drop in profit

- AMC (NYSE: AMC) completes $250 million stock sale during meme rally, shares jump 30%

- GameStop (NASDAQ: GME) jumps for a second day, but ends session well off highs as meme enthusiasm starts to fade

- Sony reports 7% drop in annual profit as PlayStation 5 sales miss trimmed target

- Latest Reuters poll shows two-third of economists think Fed will cut starting in September

- BoE chief economist Pill sees rate cut possible over summer; says labour market remains tight

- SF Fed study says corporate price gouging not primary driver of US inflation

- Wall Street economists warn US recession could trigger debt crisis

- Strong Eurozone wage growth poses a challenge for ECB policy easing plans

- ZEW survey shows German economic sentiment grows in May

- UK jobs data show ongoing cooling, boosting BoE rate cut hopes

- Japan CPGI in April steady as weak yen pushes up import costs

- South Korea terms of trade improve for fifth consecutive month in April

KEY EVENTS

Upcoming floats and listings

Sun Silver – 15 May @ 11am

Companies trading ex-dividend:

Sandon Capital Investments (SNC) – 15 May - $0.028

Autosports Group (ASG) – 16 May - $0.10

Economic calendar (AEST):

11:30am – AUD – Wage price index

4:45pm – EUR – French Final CPI

7:00pm – EUR – Flash employment change, flash GDP, industrial production

Tentative – EUR, GBP – 30-year and 10-year bond auction in Germany and England

10:30pm – USD – Core CPI, core retail sales, CPI m/m and y/y, Empire State manufacturing, retail sales

3 topics

8 stocks mentioned