ASX 200 to rise, Rate cut bets ease, Bendigo Bank reiterated neutral at Goldmans

ASX 200 futures are up 47 points, of 0.6%, at 8:10am AEST.

The Americans and the Europeans are on holidays so there is no clear lead at the moment for Australian shares. There is also no major corporate news to speak of at this point but tech stocks will be in focus given the NASDAQ hit another all-time high. In fact, at this point, the most significant release this week could be Australian monthly inflation on Wednesday (where economists currently forecast a print of around 3.4%).

Locally on the corporate front, Mesoblast and Smartpay are expected to release earnings. Dicker Data hosts an AGM. And Goldman Sachs has issued a fresh note, arguing the share price of Bendigo and Adelaide Bank (ASX: BEN) is now fully valued following its trading update last week. It's kept its NEUTRAL rating and $10.51 target price despite this.

Let's dive in.

There was no US trade on Friday, so there is no S&P 500 Session Chart and no Sectors Table included in today's Wrap. The US stock market figures are the weekly performances (e.g. the NASDAQ 100 closed the week 1.1% higher.)

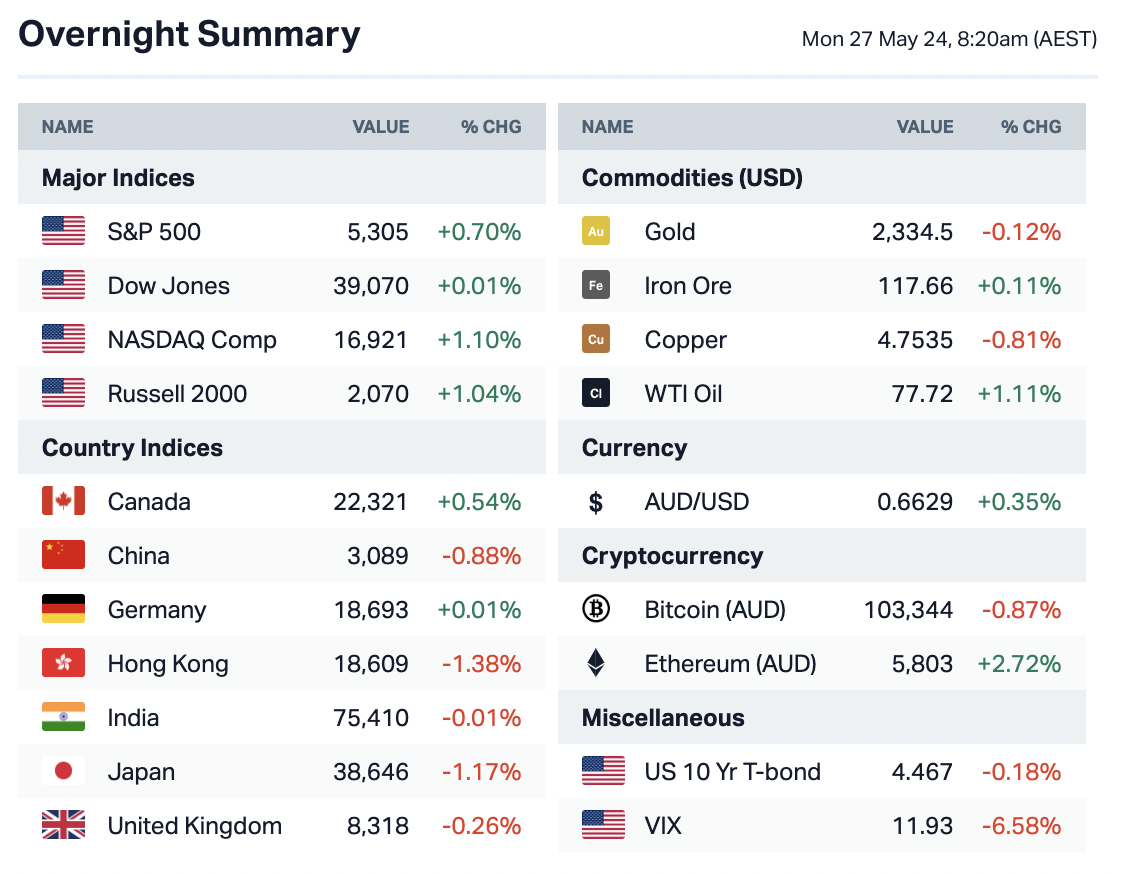

OVERNIGHT MARKETS

Nasdaq closes Friday at record high as Nvidia and the AI trade rallies on

European stocks close lower as interest rate outlook weighs on sentiment; British grocery retailer Ocado up 6%

Treasury yields are flat as traders assess economic data

Oil prices bounce back from three-month lows but book a loss for the week

Gold loses momentum on ebbing rate cut speculation

MARKETS

US markets closed tonight for Memorial Day holiday

European banks in Russia face ‘awful lot of risk’, Yellen says

The Fed probably won’t be delivering any interest rate cuts this summer (Current FedWatch pricing suggests there is now just a 45% cut of a September cut, down from 50% last week and spurred on by a stronger than expected Services PMI reading)

Key Events

Trading ex-dividend this week:

Dalrymple Bay Infrastructure (DBI) - 27 May - $0.054

Elders Ltd (ELD) - 28 May - $0.18

Nufarm Ltd (NUF) - 29 May - $0.04

Technology One Ltd (TNE) - 30 May - $0.051

This Morning Wrap was written by Hans Lee and Chris Conway. This is the final edition of The Morning Wrap in caretaker form. Kerry Sun returns to Wrap and Weekend Newsletter duties tomorrow.

2 topics

1 stock mentioned