ASX 200 to rise, relief rally on Wall Street + What's next for bond yields?

ASX 200 futures are trading 25 points higher, up 0.35% as of 8:20 am AEST.

S&P 500 SESSION CHART

MARKETS

- S&P 500 choppy but higher, closing off best levels

- Upbeat session reflects balanced messaging from Powell’s Jackson Hole speech, bond yield stabilisation, a pickup in M&A activity and a reset in positioning/sentiment indicators

- China stimulus flowing through including lower stamp duty on stock trades, restrictions on some share sales and lower deposit ratios for major financing – But continues to underwhelm market expectations

- Seasonality headwinds to emerge in September, which is historically the weakest month of the year for equities, down an average 1.56% since 1928

- Treasuries lure buyers as juicy yields offset Powell warning (Bloomberg)

- Goldman Sachs says yen to retreat to 1990 levels if BOJ stays dovish (Bloomberg)

M&A

- China's Xpeng to acquire Didi's EV unit in deal worth up to $744m (Reuters)

- China's BYD buys US Jabil's mobility unit for $2.2bn (Nikkei)

- Global science innovator Danaher buys Abcam for US$5.7bn (Reuters)

- Commercial real estate investment trust Kimco to acquire RPT Reality in US$2bn all-stock deal (Reuters)

- Goldman Sachs to sell wealth-advisory unit to Creative Planning (Bloomberg)

- US FTC suspends challenge to block Amgen’s US$28bn deal for Horizon Therapeutics (Reuters)

CENTRAL BANKS

- Fed's Mester sees another rate hike, says cuts may have to wait (Reuters)

- ECB's Kazaks says he would err on side of raising rates (Bloomberg)

- BoE's Broadbent says rates need to remain high for some time (Bloomberg)

CHINA

- China halves stamp duty on securities transactions, lowers margin requirement for buying stocks to boost investor confidence (SCMP)

- Nomura says China's stamp-duty cut won't sustain stock rally (SCMP)

- China's 5.5% stock rally fizzles in blow to market rescue effort (Bloomberg)

- Evergrande shares plummet more than 80% as trading resumes after 17 months (BBC)

ECONOMY

- Japan to issue stimulus package as soon as September to boost the country's growth potential and counteract the downside risks of inflation (Nikkei)

- Australian retail sales beat estimates on Women's Wold Cup (Bloomberg)

Sectors to Watch: Gold and Resources

Resources: Relatively positive overnight session for all-things resources. US-listed BHP and Rio Tinto finished 1.6% and 1.7% higher respectively, the S&P Metals and Mining ETF rose 1.1%, Singapore iron ore futures continue to hover 1-month highs of US$113 a tonne and a few of the resource-related ETFs rose 1-2% overnight.

Gold: Gold prices are beginning to bottom from recent lows of US$1,880 an ounce, in-line with the recent peak in bond yields and the US dollar. While gold prices have been downtrending for quite some time, a few gold names have held up relatively well. This Emerald Resources (ASX: EMR), Bellevue Gold (ASX: BGL) and Ramelius Resources (ASX: RMS).

How Far Will Bond Prices Fall (Or Yields Rise)?

The blame can be attributed to a few factors including:

- Interest rate hikes, which have extended longer than a lot of people expected

- Rate cut expectations have been pushed back to the second half of 2024

- Supply as the US bond market (the world's largest), has been issuing a lot of debt to pay down existing obligations. More supply for the same amount of demand naturally means lower prices

"We think that falling inflation will give the Fed the confidence to cut next year by more than the market is anticipating. We [also] think growth will eventually falter; that might help partly unwind the rise in investors’ expectations for the neutral rate," Mathews said.

For context, the Capital Economics team are expecting a 100 bps (1%) drop in the 10-year yield by the end of the year. That's a brave call considering the year-to-date low is 3.3% (it's currently 4.25%).

Someone who disagrees with that call is veteran investor Bill Ackman. Ackman, who runs Pershing Square Capital, recently shorted very long-dated Treasury bonds (30-year bonds, specifically). Earlier this month, Ackman argued that long-dated yields had not recalibrated to a new normal of inflation staying at 3% (above the Fed's target). His argument is that higher-for-longer inflation could see yields rise even higher and stocks, as a consequence, being hit hard. So far, that bet has paid off tepidly.

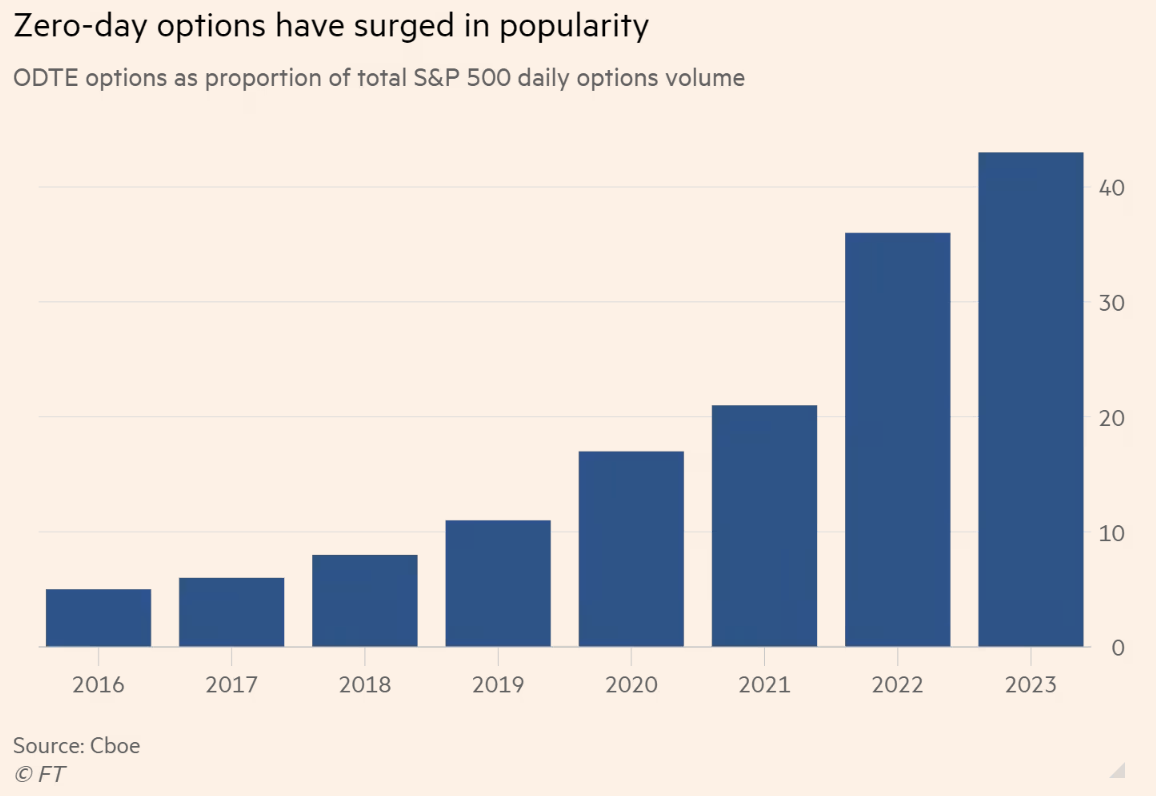

The Rise of the Zero Day Option

The surge in bond yields (mentioned above) and whipsaw in equity markets has reportedly been a big reason why people are loading up on these instruments. Note that these options can be used as bullish and bearish bets on the index.

"One self-declared “degenerate gambler” purportedly made $32,000 on Wednesday alone, though they admitted their tactic of buying bullish zero-day call options after a market dip was high risk: “Would not recommend”.

"Welcome to the democratisation of markets, I guess.

KEY EVENTS

ASX corporate actions occurring today:

- Trading ex-div: HMC Capital (HMC) – $0.06, Mitchell Services (MSV) – $0.021, Worley (WOR) – $0.25, Bega Cheese (BGA) – $0.03, The Lottery Corp (TLC) – $0.06, Regal Partner (RPL) – $0.05, Pengana Capital (PCG) – $0.01, MA Financial (MAF) – $0.06, Insurance Australia (IAG) – $0.09, Sunland Group (SDG) – $0.11

- Dividends paid: None

- Listing: None

Economic calendar (AEST):

- 4:00 pm: Germany Consumer Confidence

- 5:40 pm: RBA Bullock Speech

- 12:00 am: US JOLTS Job Openings

3 stocks mentioned

2 contributors mentioned