ASX 200 to rise, S&P 500 closes at 19-month high + Is good news no longer bad news?

ASX 200 futures are trading 16 points higher, up 0.22% as of 8:30 am AEDT.

S&P 500 SESSION CHART

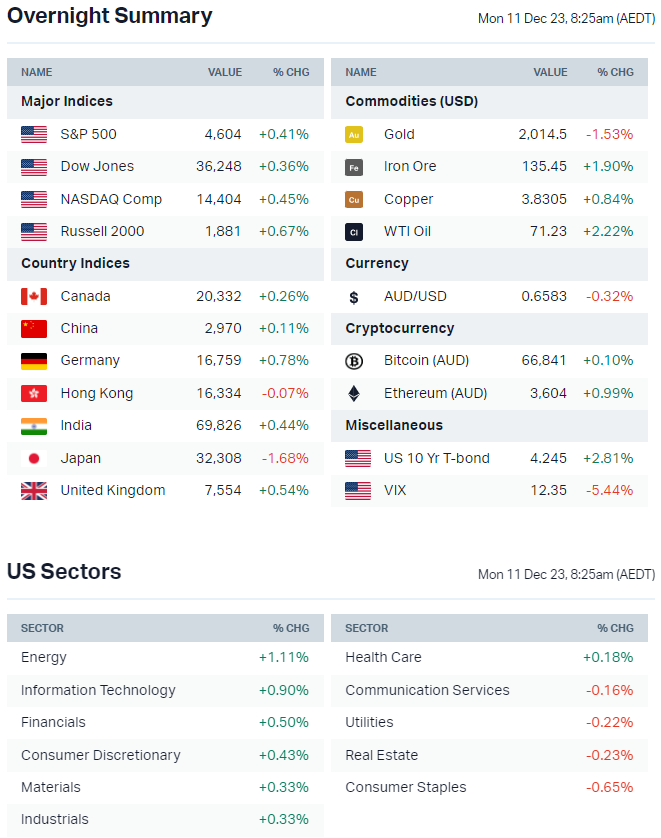

MARKETS

- S&P 500 higher, finished near best levels and at a fresh 19-month high

- S&P 500 and Nasdaq both locked in a sixth consecutive week of gains

- Yields higher off the back of strong US jobs data, bouncing from 4-5 month lows

- WTI crude settled higher, back above US$70 a barrel but still logged its seventh consecutive week of declines

- Bullish focus points for the week: Goldilocks data including strong US jobs data, disinflation momentum, falling oil prices and AI tailwinds (Alphabet and AMD shares up big last week)

- Bearish focus points for the week: Overbought conditions kicking in, sentiment and positioning no longer a positive with BofA Bull & Bear indicator up to 3.8 from 2.7 (largest jump in over a decade), China stocks facing brutal selloffs and BoJ policy normalisation

- BofA's Hartnett says markets will suffer in the first quarter of 2024 as a rally in bonds would signal sputtering economic growth (Bloomberg)

- Money market assets hit all-time high after 7th straight weekly inflow (Bloomberg)

- US nonfarm payrolls challenge market's dovish rate narrative (Bloomberg)

- Increasing bets for Japan to change negative rate narrative (Bloomberg)

- Gas prices expected to fall even further as futures sink to 2-year low (Bloomberg)

STOCKS

- Apple aims to build more than 50 million iPhones annually in India (Reuters)

- PayPal shares fall after Amazon announces it will no longer accept Venmo as a payment options (CNBC)

- Boeing ramps up 737 production plans slower than anticipated (Reuters)

- Lululemon shares jumped on better-than-expected results (CNBC)

CENTRAL BANKS

- At least two thirds of economists expect BOJ to scrap NIRP by April (Bloomberg)

- Shrinking economy in Japan casts doubt on BOJ rate hike bets (FT)

- Economists clash with markets on timing of first ECB rate cut (Bloomberg)

- RBA sticks to inflation target in revised pact with Government (Bloomberg)

GEOPOLITICS

- US pressures Israel to end war against Hamas 'in a month' (London Times)

- China dismisses EU's concerns about trade deficits, saying gap will be significantly lower this year (Bloomberg)

CHINA

- China stock market benchmarks test key levels as rout deepens (Bloomberg)

- China will spur domestic demand and consolidate and enhance the economic recovery in 2024 (Bloomberg)

ECONOMY

- Solid US job growth, unemployment rate drops 0.2% to 3.7% in November (Reuters)

- US consumer confidence rebounds back to August levels, one-year inflation expectations tumble to 3.1% from 4.5%, now the lowest since March 2021 (Reuters)

Is Good News Finally Good News?

The US jobs report for November came out unexpectedly strong last week.

- Employers added 199,000 jobs ahead of consensus 175,000

- Unemployment rate eased 0.2% to 3.7% below consensus 3.9%

- Average hourly earnings up 0.2 percentage points to 0.4% month-on-month a bit hotter than the 0.3% expected

- Participation rate up 0.1 percentage points to 62.8%, the highest since February 2020

The data shifted rate cut expectations from March 2024 to May 2024.

- Prior to the jobs report, markets saw a 60% likelihood of rate cuts beginning in March 2024 (now 45.7%)

- Odds of rate cuts beginning in January fell from 16% to 6.1%

- The Fed has not mentioned anything about rate cuts beginning in 2024

But through all of this – The S&P 500 finished 0.4% to a fresh 20-month high and the gains were led by Energy, Tech and Financial sectors.

Are markets finally at a place where good news is ... good news?

Or is the good news just feeding into the soft landing narrative but leaving the peak rates narrative in the dark? If so, we could be in for a rude awakening this week. We've got the Fed rate decision and FOMC economic projects, Bank of England rate decision and Eurozone rate decision on Thursday and Friday.

Sectors to Watch: Copper, Homebuilders and Gold

Copper: Copper prices have been incredibly choppy and currently settling above the 200-day moving average (blue) but below the key trendline. It's worth noting that there aren't many large cap copper exposures left on the ASX (outside of Sandfire Resources (ASX: SFR).

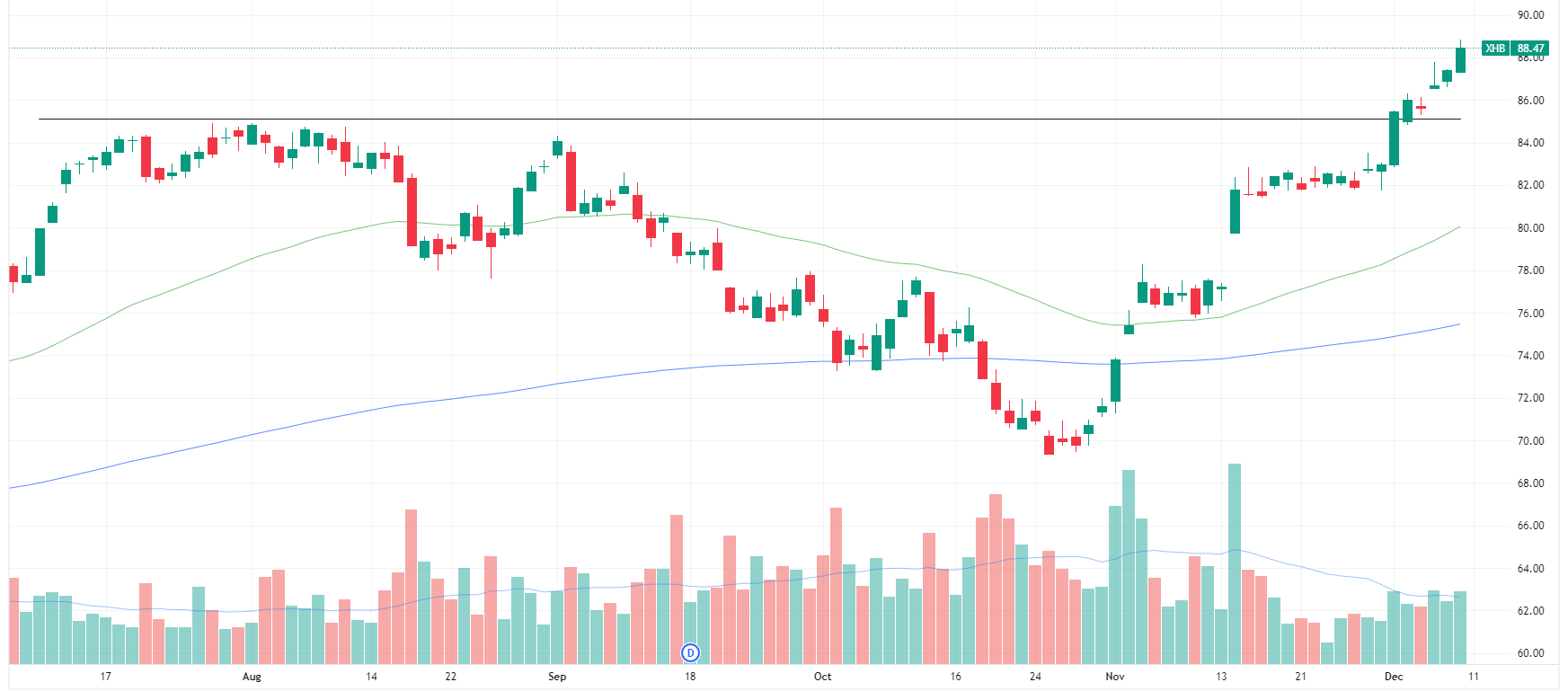

Homebuilders: SPDR Homebuilders ETF hits another record high overnight. There are quite a few constructive charts in the local construction and building materials space including CSR (ASX: CSR), Mader (ASX: MAD) and Boral (ASX: BLD).

Gold: Gold prices sold off 1.2% overnight after the strong US jobs data pushed the US dollar and bond yields higher. The VanEck Gold Miners ETF finished the session down 2.1%.

KEY EVENTS

ASX corporate actions occurring today:

- Trading ex-div: Advanced Share Registry (ASW) – $0.003

- Dividends paid: None

- Listing: LTR Pharma (LTP) at 11:00 am

Economic calendar (AEDT):

No major economic announcements.

4 stocks mentioned