ASX 200 to rise, S&P 500 fades early strength + Is the Energy trade making a comeback?

ASX 200 futures are trading 31 points higher, up 0.42% as of 8:20 am AEST.

S&P 500 SESSION CHART

MARKETS

- Major US benchmarks mostly higher but off best levels

- Relatively uneventful session ahead of Monday’s US Labour Day holiday

- S&P 500 finished the week up 2.6%, Dow up 1.4% and Nasdaq up 3.25%

- Volatile session for Treasury yields, the 2-year yield fell as much as 11 bps to 4.76% but recovered to 4.88% by market close

- WTI crude rallied 2.9% and marked its largest weekly gain since March

- Soft landing and peak Fed expectations reaffirmed by stronger-than-expected nonfarm payrolls and ISM manufacturing data as well as an unexpected uptick in unemployment to 3.8% from prior 3.5%

- Bullish focus points for the week: Pullback in bond yields, funds flipped back to the buy side following unwinding of stretched longs earlier this month, renewed AI momentum, dovish comments from the Fed and ECB, China raising policy support

- Bearish focus points for the week: Unsustainable bad news is good news dynamic for stocks, downside risks to inflation, S&P approaching overbought territory, China growth remains a concern

- Oil heads for robust weekly gain as Russia extends export cuts and China extends support measures (CNBC)

STOCKS & EARNINGS

- Tesla slashes Model S, X prices in China (Bloomberg)

- Dell sales top estimates in positive signal for PC market (Bloomberg)

- Broadcom earnings best estimates, forecast disappoints (Yahoo)

- Airlines slump on rising oil prices, lower demand and earnings cuts (Bloomberg)

- Arm prepares to meet investors ahead of blockbuster IPO (Reuters)

- Lululemon tops earnings expectations, shares rally (CNBC)

CHINA

- China to cut banks' FX reserve ratio to rein in yuan weakness (Reuters)

- China to take further action to support debt-riddled property sector (Reuters)

- China's slowing economy overshadows property easing moves (Reuters)

- Country Garden to delay key vote as China rolls out more support (Reuters)

- Major China banks cut yuan deposit rates to protect profits (Morningstar)

ECONOMY

- US payrolls rise by more than forecast while wage growth cools (Bloomberg)

- US manufacturing sector stabilising at weaker levels in August (Reuters)

- Eurozone manufacturing showing signs of recovery (Reuters)

- UK house prices decline the most in 14 years (Bloomberg)

- Asia's factory activity weakens, China's rebound offers some hope (Reuters)

It's Energy Time

A resurgence is taking place across the energy sector. WTI crude oil is up almost 30% since 28 June and quickly approaching the key US$90 level. The momentum is building amid a stronger-than-expected US economy, OPEC extending its voluntary production cuts and an easing of China's growth concerns.

The move also coincides with 4 consecutive weeks of growth in the US Strategic Petroleum Reserves. The largest sequence of weekly increases since the pandemic.

But it's not just oil that's having a good time.

- Uranium prices rose to US$58.5/lb last week, marking a seventh consecutive week of gains to levels not seen since April 2022

- Newcastle coal futures are up around 20% from mid-June lows of US$131, now closer to US$160

In terms of uranium, the world's largest producer Cameco provided a rather interesting production and market update last Friday. It noted:

- "We maintain the flexibility to source material through various means beyond production if required, including increasing our market purchases, pulling forward long-term purchases, using inventory or borrowing product."

- "Any pounds we do not produce this year will remain available to us and, with increasing supply pressures, potentially become more valuable when delivered in the future."

From a technical perspective:

Woodside (ASX: WDS) is on the verge of taking out its recent high. (Note: This chart has been adjusted for dividends)

A uranium bellwether like Paladin Energy (ASX: PDN) marked its highest weekly close since September 2022.

A major coal name like New Hope (ASX: NHC) is testing the key $5.90 level after trading sideways for around 6 months.

Bank of America: Charts of Interest

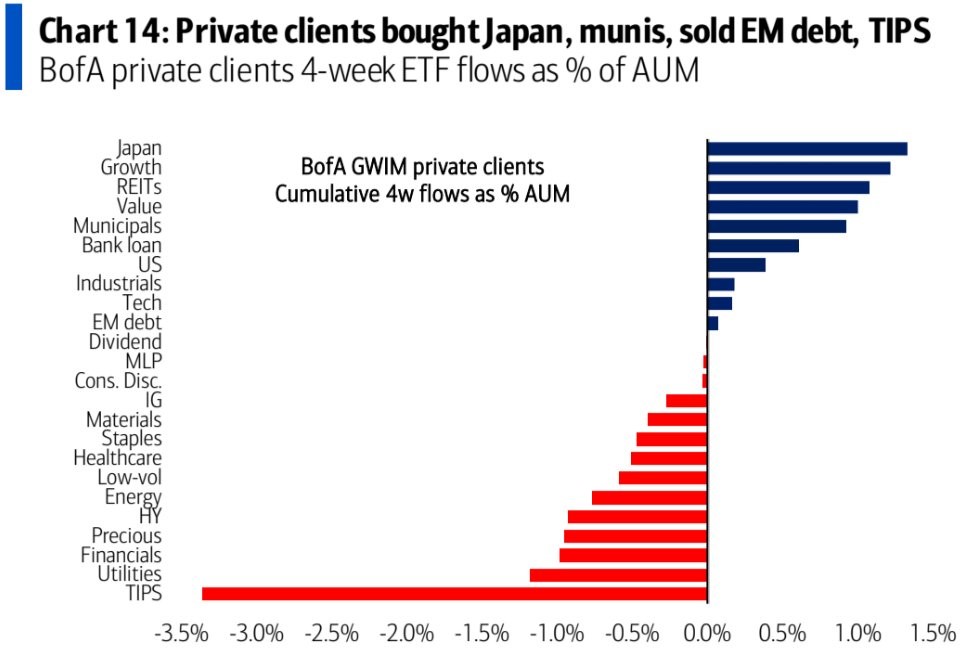

Bank of America's private clients ETF flows in the last four weeks:

- Buying: Japan, Growth, REITs and Value

- Selling: TIPS (Treasury Inflation-Protected Securities), Utilities and Financials

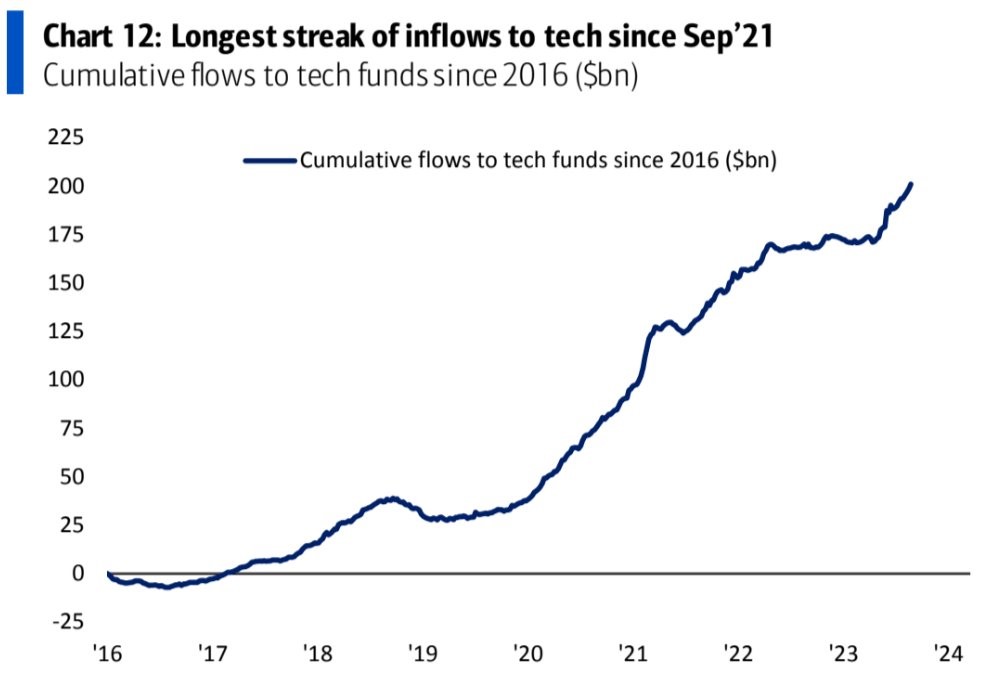

Tech funds experienced their 10th consecutive week of inflows (US$5.1bn), the largest since May 2023.

KEY EVENTS

ASX corporate actions occurring today:

Trading ex-div: McPherson’s (MCP) – $0.01, Nib Holdings (NHF) – $0.15, IDP Education (IEL) – $0.20, Fortescue Metals (FMG) – $1.00, Beach Energy (BPT) – $0.02, Altium (ALU) – $0.29, Bendigo & Adelaide Bank (BEN) – $0.32

- See full list of ASX stocks and ETFs trading ex-dividend here

- Dividends paid: None

- Listing: None

Economic calendar (AEST):

- 11:30 am: Australia Company Gross Profits

- 4:00 pm: Germany Balance of Trade

This Morning Wrap was written by Kerry Sun.

3 stocks mentioned

1 contributor mentioned