ASX 200 to rise, S&P 500 logs 3-month losing streak + Uranium hits fresh 15-year high

ASX 200 futures are trading 35 points higher, up 0.51% as of 8:20 am AEST.

S&P 500 SESSION CHART

MARKETS

- S&P 500 higher, finished at best levels but finished October down 2.1%

- S&P 500 extends gains for a second session but still 50 pts below the key 200-day

- No major directional drivers at play as the market waits for the Fed decision and press conference tomorrow

- Recent support from oversold conditions, dampened selling pressure, largely contained Middle East tensions, lower VIX and a bounce for big tech

- US bond yields firmer, adding to yesterday’s uptick

- Gold back below US$2,000 after logging a two day losing streak

- Strategists cut year-end S&P targets on geopolitical risks, rate headwinds (Bloomberg)

- Bond funds on track for 3rd consecutive year of negative returns (Reuters)

- Monday marks busiest day in nearly two months for bond issuance (Bloomberg)

STOCKS

- Nvidia faces potential risk to US$5bn in Chinese orders due to new US restrictions

- Microsoft launches Windows 11 update featuring Copilot assistant (CNBC)

- Tesla valuation continues to decline amid concerns over weak EV demand (Bloomberg)

- BP earnings miss on weaker gas trading (Bloomberg)

- Samsung forecasts memory chip recover in 2024, tops earnings estimates (Bloomberg)

- Apple unveils new Mac and third-gen Mac processors (Reuters)

- X valued at US$19bn in new employee stock plan, half Musk's initial price tag (Fortune)

- Panasonic cuts full year outlook, blaming slower sales of Tesla EVs (FT)

- Zillow and other real estate stocks plummet after jury finds National Association of Realtors and other industry organizations guilty of collusion to maintain high brokerage commissions (Bloomberg)

EARNINGS

BP (-4.6%): Big earnings miss with takeaways focused on oil production miss and weaker gas trading. Management expect refining margins across oil and gas industry to be significantly lower towards the end of 2023. No update on progress to find a permanent CEO after Bernard Looney resigned almost 50 days ago.

Caterpillar (-6.7%): Double beat, operating profit up 42% to US$1.0bn on favourable price realisation and higher sales volume but guidance disappointed. Management flagged an unexpected drop in order backlogs (the first time since 2020) and unfavourable dealer inventories.

CENTRAL BANKS

- BOJ relaxes YCC flexibility, dials back daily fixed purchase operations (FT)

- RBA warns economic shocks to heighten rate volatility (Guardian)

GEOPOLITICS

- Israeli forces advance deeper into Gaza as Netanyahu rejects calls for ceasefire (FT)

- Netanyahu urged EU to encourage Egypt to accept Gaza refugees (FT)

- China Communist Party advocates enhancing US-Sino relations (Bloomberg)

- EU and US still debating green subsidies and trade agreements (FT)

ECONOMY

- China factory activity unexpectedly contracts ( Bloomberg)

- Japan industrial production rebounds by less than expected (Reuters)

- South Korean industrial output strengthens for a second month (Yonhap)

- Eurozone Q3 GDP growth weaker than expected (Reuters)

- Eurozone inflation drops to lowest in over two years (Reuters)

- France posts slight growth in Q3 (Bloomberg)

- Italy avoid a recession by narrowest margin (Bloomberg)

Sectors to Watch

Markets are bouncing but is this just a bounce from oversold levels or are we truly setting in a low (and just in time for the Santa rally).

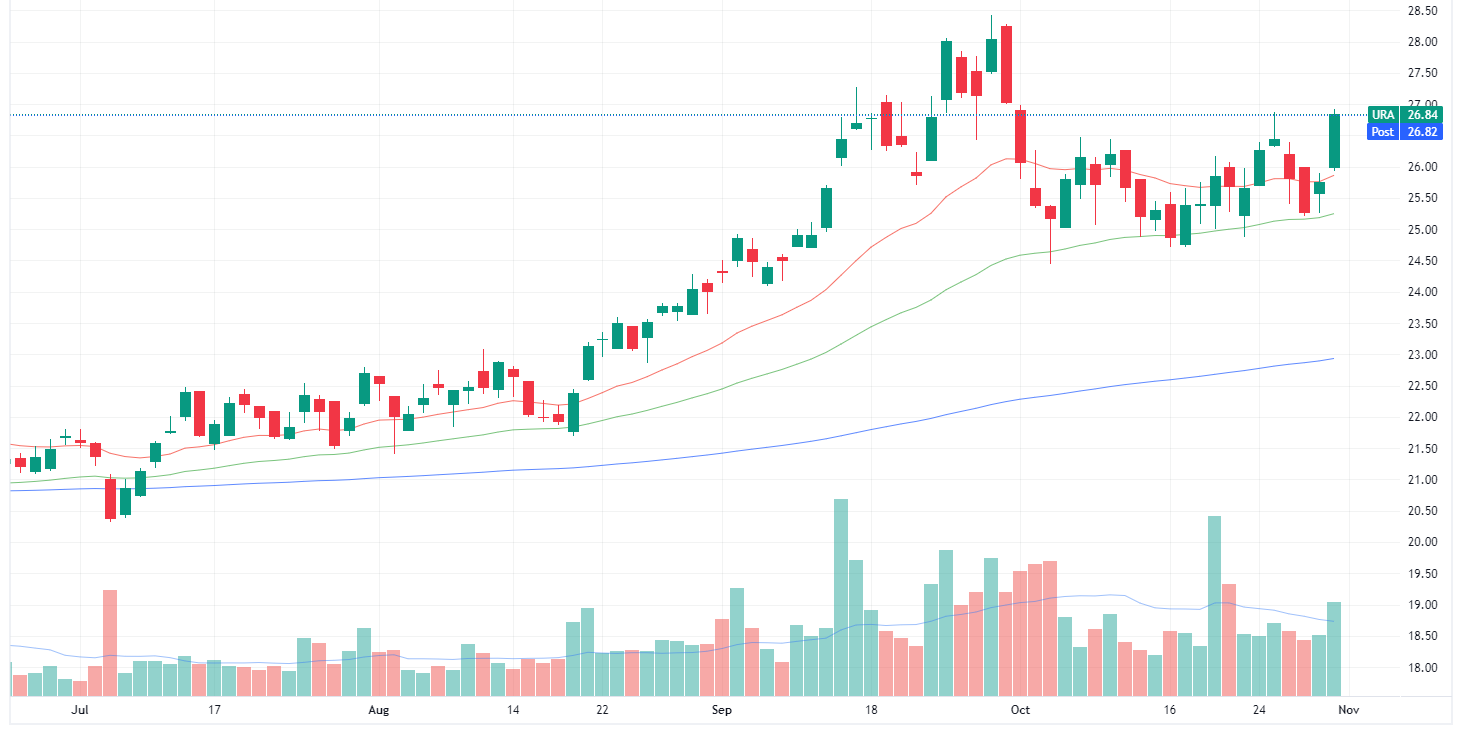

Uranium: Global X Uranium ETF rallied 4.2% overnight to a 1-month high. This follows two notable developments:

- Uranium spot prices inched higher to a new 15-year high of US$74.45 a pound according to fuel brokers Evomarkets

- One of the world's largest uranium miners Cameco topped Q3 earnings estimate and raised its full-year outlook. The stock rallied 7.8% to a 16-year high, it's up almost 80% year-to-date

Let's see if this results in some follow through for local names like Paladin Energy (ASX: PDN), Boss Energy (ASX: BOE), Deep Yellow (ASX: DYL) etc.

Messy Markets

Various interesting tidbits about the current state of markets.

- Cannacord's Macro Strategy Update: "... the equally weighted S&P 500 closed the week at a 52-week low while the Russel 2000 and KBW Bank Indices are down 33% and 51% ... we are not just entering a bear market – For most stocks, we have been in one for almost two years and it might be time for a bounce."

- Commodity Trading Advisor (CTA) positioning: CTAs (typically utilise futures, options and commodity contracts to express bullish or bearish bets) were previously short US$25bn in US equities, one of the largest short positions in 8 years

Markets are clueless about rates: CME Fedwatch Tool is currently pricing in a 96.7% likelihood of the Fed keeping rates on hold tomorrow. But there's an unexpected 3.3% chance of a cut. It gets a little messy here with probabilities showing cuts from June 2024 but a small chance of another hike in January 2024. The bottom line is that futures have no idea what the Fed is going to do.

KEY EVENTS

ASX corporate actions occurring today:

- Trading ex-div: Tribune Resources (TBR) – $0.20, Rand Mining (RND) – $0.10

- Dividends paid: None

- Listing: None

Economic calendar (AEDT):

- 9:00 am: AI Group Industry Index

- 12:45 pm: China Caixin Manufacturing PMI

- 1:00 am: US ISM Manufacturing PMI

- 1:00 am: US JOLTs Job Openings

- 5:00 am: Fed Interest Rate Decision

This Morning Wrap was written by Kerry Sun.

3 stocks mentioned

1 contributor mentioned