ASX 200 to rise, S&P 500 logs another record high, Tesla soars on Q2 deliveries beat

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 19 points higher, up 0.24% as of 8:30 am AEST.

S&P 500 SESSION CHART

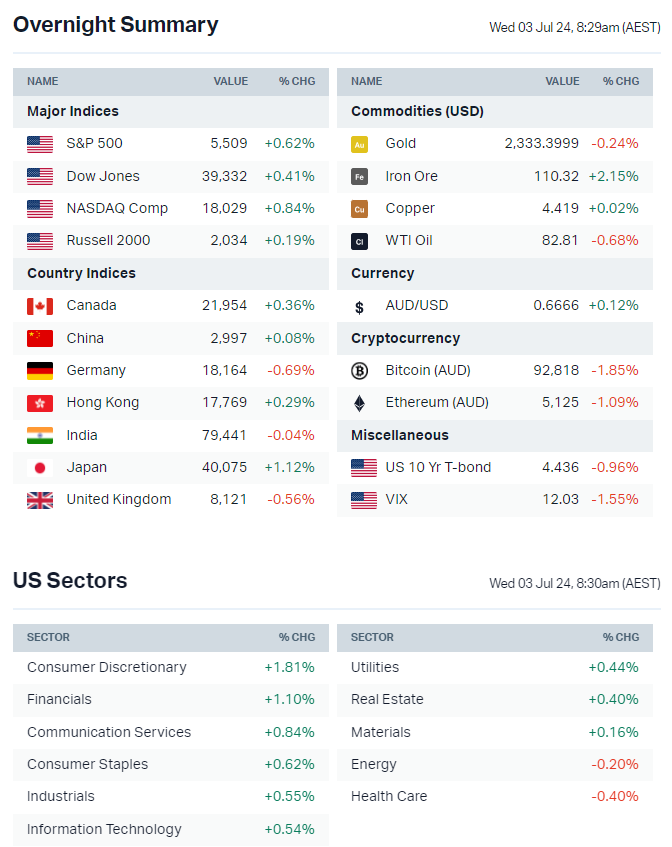

OVERNIGHT MARKETS

- Major US benchmarks finished higher and near best levels, led by big tech – Tesla (+10.2%), Apple (+1.6%) and Amazon (+1.4%)

- Breadth remains a concern – While the Nasdaq hit a fresh all-time high, only 51% of its constituents ticked higher and there were more new lows than new highs

- US markets opened choppy but finished stronger amid several moving pieces – Bond yields stabilised following an 18 bp backup over the prior two sessions, Powell highlighted progress on inflation, stronger-than-expected US JOLTs and positive Q2 Tesla deliveries

- Strategists debate what a Trump presidency would mean for Treasuries (Bloomberg)

- Dotcom bubble memories haunt the AI-driven US stock market rally of 1H24 (Reuters)

- French markets rebounded Monday but investors look beyond first round with focus on policy instability risk (Bloomberg)

- OPEC oil production rises for second straight month driven by Iran and Nigeria (Reuters)

STOCKS

- Tesla deliveries fall less than expected, down 5% in Q2 as price cuts helped offset cooling demand, China-made EV sales fell almost 25% year-on-year in June (Bloomberg)

- GM Q2 deliveries best in three years and EV sales up 40% from last year (CNBC)

- Robinhood reportedly considering offering crypto futures in US and Europe (Reuters)

- Nvidia set to face anti-competitive allegations from French regulators (Reuters)

- Amazon's international arm set to swing to an annual profit after years of losses (FT)

CENTRAL BANKS

- Powell welcomes recent data but seeks greater confidence that inflation is moving sustainably towards the 2% target before loosening policy (Bloomberg)

- Fed's Goolsbee says with inflation on path to 2%, holding rates steady means policy tightening (Bloomberg)

- ECB's Lagarde says services inflation doesn't need to be at 2% (4.1% in June) as manufacturing goods are below 2% (Bloomberg)

- ECB Lagarde says more time needed to assess if inflation risks have passed (Bloomberg)

- RBA weighed rate hike in June, saw stronger case to remain on hold (Bloomberg)

POLITICS

- Democrat party leadership mulling early Biden nomination to shore up support though internal anger mounts(Bloomberg)

- French parties scramble to block far-right path to power after election shock (FT)

- UK PM Sunak issues new appeal to stop Labour super majority (FT)

- June was busiest month for Houthi ship attacks so far this year (Bloomberg)

ECONOMY

- US job openings unexpectedly jump to 8.14m vs. 7.9 consensus in May, with government, durable goods and manufacturing reporting the biggest gains (Bloomberg)

- Eurozone inflation slows to 2.5% as slowing energy and food prices were offset by persistently high services prices (FT)

- South Korean inflation falls by more than expected to lowest since Jul-2023 (Bloomberg)

- Private China data showed yearly sales declines for Chinese property developers continued to narrow in June (Bloomberg)

ASX TODAY

- ASX 200 set to log its first positive session for FY25 following a strong overnight lead, a bounce for value/cyclical pockets of the market and bond yield stabilisation

- Relatively quiet session as far as overnight catalysts and current announcements are concerned

- Ramelius Resources enters into four-year, $175m revolving debt facility (RMS)

- Red Hill Minerals declares special DPS of $1.50 per share, record 10-Jul – This could be a banger as the special divvy represents a yield of 22.7% (RHI)

WHAT TO WATCH TODAY

- Coal: Most coal names continued to push higher on Tuesday following two incidents over the weekend (Anglo American's 3.5Mtpa Grosvenor met coal mine was halted after an underground gas ignition incident and a collision on the Blackwater rail line in Queensland – Grosvenor accounts for 1% of the ~350Mt global met coal export market and the rail incident could halt ~12% of global seaborne exports, according to Morgan Stanley). A name like Whitehaven is up 12% in the last two sessions.

- Overnight winners/losers: Financials, resources (gold, copper) ticked higher overnight while biotech, uranium and lithium continued to trend lower

BROKER MOVES

- Deterra Royalties upgraded to Buy from Neutral but target cut to $4.70 from $5 (Goldman Sachs)

- G8 Education upgraded to Outperform from Neutral; target up to $1.35 from $1.26 (Macquarie)

- Life360 initiated Buy with US$37 target (Stifel)

- Light & Wonder initiated buy with $122 target (BofA)

- Zip Co initiated positive with $1.81 target (E&P)

KEY EVENTS

Companies trading ex-dividend:

- Wed 3 July: Graincorp (GNC) – $0.24

- Thu 4 July: Clime Capital (CAM) – $0.014

- Fri 5 July: None

- Mon 8 July: Collins Foods (CKF) – $0.155

- Tue 9 July: None

Other ASX corporate actions today:

- Dividends paid: Orica (ORI) – $0.19

- Listing: None

- Earnings: None

- AGMs: None

Economic calendar (AEST):

- 9:00 am: Australia Ai Group Industry Index (Jun)

- 11:30 am: Australia Retail Sales (May)

- 12:00 am: US ISM Services PMI (Jun)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment

most popular

Equities

Dogs of the ASX for the 2024 Financial Year

Atlas Funds Management

Equities

How to unearth value in the mining sector

Blackwattle Investment Partners

Equities

Where the greenies have coal wrong (and our #1 small cap pick)

Seneca Financial Solutions