ASX 200 to slip, S&P 500 lower on Nvidia weakness + Copper, gold stocks to fall

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 16 points lower, down -0.20% as of 8:20 am AEDT.

S&P 500 SESSION CHART

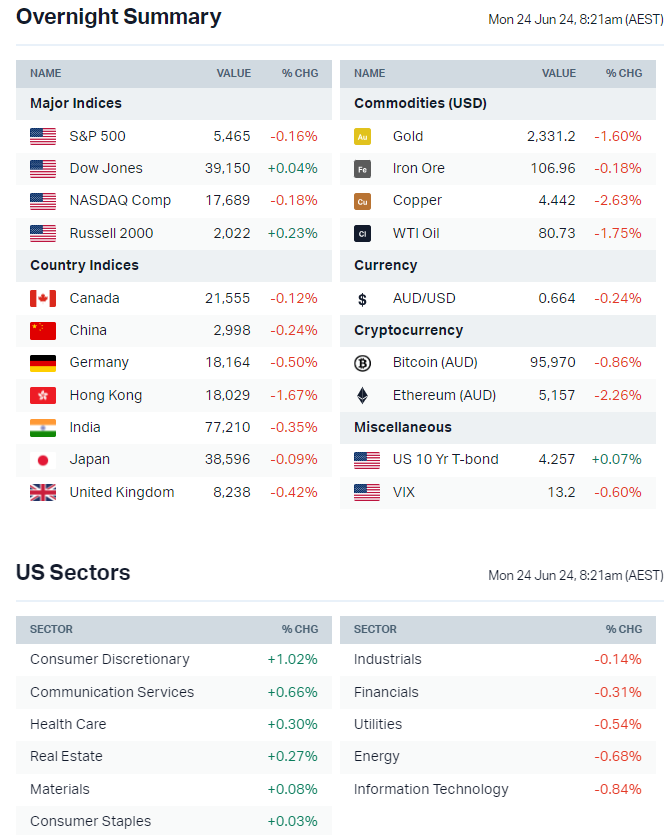

OVERNIGHT MARKETS

- Major US benchmarks were mixed in relatively uneventful Friday trading

- US weekly recap – Dow (+1.45%), Russell 2000 (+0.79%), S&P 500 (+0.61%), Nasdaq (+0.00%)

- Equal Weight S&P 500 outperformed the official index by 56 bps last week

- The big question – Is the rally beginning to rotate into other sectors outside of tech or is this the beginning of a broad-based sell off?

- AI frenzy drives record inflows into tech funds (Bloomberg)

- Tech investor trimming his Nvidia holdings after questioning earnings growth prospects (Bloomberg)

- Yen falls to 34-year lows, nears level that triggered suspected intervention in April (Bloomberg)

STOCKS

- American Airlines flight attendants moving closer to strike (Reuters)

- Gilead Sciences shares pop after its twice-per-year shot preventing HIV was 100% effective in a late-stage trial (CNBC)

- Hertz shares surge after upsizing bond offering to US$1bn (CNBC)

- Records show Tesla has reduced its workforce by just over 121,000 people this year, representing 14% of total (CNBC)

CENTRAL BANKS

- Richmond Fed's Barkin wants more conviction on inflation path before cutting rates (Bloomberg)

- Fed's Goolsbee sees Fed in position to cut rates if inflation continues to cool like it did last month (Bloomberg)

- BOJ deputy governor Uchida flags readiness to hike rates further (Reuters)

GEOPOLITICS

- China and EU reach agreement for talks on planned imposition of tariffs on Chinese-made EVs imported to Europe (Reuters)

- Yemen's Houthi fighters undeterred by US-led airstrikes, continue to threaten some of the world's most vital shipping routes (Washington Post)

- US-China resume semi-official nuclear arms talks in March for the first time in five years (Reuters)

- Canada preparing to follow EU on tariffs for China EV imports (Bloomberg)

- US adds Japan to currency manipulation watchlist, calls for more China transparency (Reuters)

ECONOMY

- US services PMI posted 55.1 in June vs. consensus 53.5, the highest reading since April 2022 (Reuters)

- US manufacturing PMI edged up to 51.7 vs. consensus 51.0, with selling price inflation easing amid slower growth in input costs (Reuters)

- Eurozone flash PMI for June weakens to three-month low (Bloomberg)

- UK retail sales recovered in May after weather-related impact dampened the April data (Reuters)

- Japan core inflation rebounds to 2.5% in May from 2.2% in April, backing case for BOJ rate hike (Bloomberg)

- Japan services PMI swings to contraction for first time since Aug-2022 (Reuters)

- South Korean export growth over first 20 days of June softens amid weaker demand from China (Bloomberg)

ASX TODAY

- ASX 200 set for a relatively softer start to the week

- Commodity prices sold off last Friday, led by declines from copper (-2.6%), gold (-1.6%), iron ore (-1.5%) and nickel (-0.7%)

- ASX 200 Financials Index finished last week up 2.0% – the banking sector's relentless rally continues to confused analysts, who view it as overvalued and fraught with significant risks. UBS analysts estimate the sector to be approximately 20% overvalued

- Anglo American preparing to launch sale process for portfolio of Australian coal mining assets, valuing them at approximately $7.5 billion (The Aus)

- Australian supermarkets could face multimillion-dollar fines under stricter grocery code for anti-competitive behaviour (Bloomberg)

- Bapcor expected to turn down offer from Bain as it seeks higher bid (The Aus)

- Cleanaway Waste in advanced talks to acquire Citywide Service Solutions' commercial waste division (AFR)

- IFM well-placed in race for Healius’ Lumus Imaging business (The Aus)

- Mitsubishi Motors discloses 5% interest in FleetPartners (FPR)

- Webjet provides further details on proposed demerger of Webjet B2C business (WEB)

BROKER MOVES

- Aristocrat Leisure resumed Buy; target increased to $56 from $44.20 (UBS)

- Evolution Mining downgraded to Neutral from Buy; target cut to $3.80 from $4.45 (UBS)

- Light & Wonder initiated Neutral with $162 target (UBS)

- Pilbara Minerals upgraded to Add from Hold; target cut to $3.70 from $4.10 (Morgans)

- ResMed downgraded to Neutral from Positive; target cut to $33 from $34 (E&P)

KEY EVENTS

Companies trading ex-dividend:

- Mon 24 June: None

- Tue 25 June: None

- Wed 26 June: Fisher & Paykel (FPH) – $0.218

- Thu 27 June – REITs: HealthCo Healthcare and Wellness REIT (HCW) – $0.002, Centuria Industrial REIT (CIP) – $0.04, Centuria Office REIT (COF) – $0.03, Homeco Daily Needs REIT (HDN) – $0.021, Arena REIT (ARF) – $0.043, Charter Hall Long Wale REIT (CLW) – $0.065, Garda Property Group (GDF) – $0.016, Hotel Property Investments (HPI) – $0.095, Charter Hall (CHC) – $0.23, Charter Hall Social Infrastructure REIT (CQE) – $0.04, Waypoint REIT (WPR) – $0.041, GDI Property Group (GDI) – $0.025, National Storage (NSR) – $0.055, Goodman Group (GMG) – $0.15, Stockland (SGP) – $0.166, Growthpoint Properties (GOZ) – $0.097, Dexus Convenience Retail REIT (DXC) – $0.053, Dexus Industria REIT (DXI) – $0.041, Dexus (DXS) – $0.213

- Thu 27 June – Everything else: Rural Funds Group (RFF) – $0.029, Virgin Money (VUK) – $0.039, Mirvac Group (MGR) – $0.06, Region Group (RGN) – $0.07

Other ASX corporate actions today:

- Dividends paid: Cardno (CDD) – $0.10

- Listing: None

- Earnings: Metcash (MTS)

- AGMs: GUD Holdings (GUD)

Economic calendar (AEST):

No major economic announcements.

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment