Massive ASX mining stocks review: Coal, Gold, Lithium, Uranium

This is Part 3 of a series of articles investigating two massive research reports from major brokers Macquarie and Morgan Stanley released earlier in the week detailing changes in their outlooks for several major commodities and the ASX stocks that produce them.

You can read Part 1 on Iron Ore and ASX Iron Ore Stocks here.

You can read Part 2 on Aluminium, Copper, Manganese and Nickel and ASX Base Metals Stocks here.

Today we’re going to review the brokers’ updates for the remaining commodities, so this means coal, gold, lithium, and uranium. We’ll also look at each broker’s updated views on key ASX stocks that produce these commodities with over 30 companies covered.

COAL OUTLOOK

Macquarie

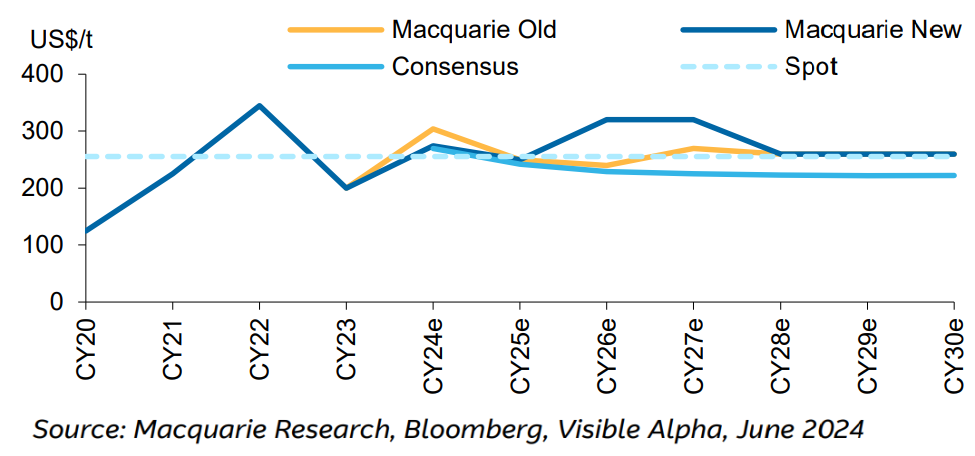

Macquarie describes its overall view on metallurgical coal (“met coal”) as “overweight”. The broker believes an even slower recovery in Australian shipments will “keep the market tight, despite Mongolian exports beating expectations”.

Macquarie has cut their 2024 met coal price target by 9% to US$274/t but left their 2025 price target unchanged at US$250/t in 2025. Macquarie notes these targets are 2% and 3% above consensus.

Longer term, met coal price targets have increased more substantially, up by +33% in 2026 and by +19% in 2027 (both to US$320/t). Macquarie notes these targets are more than 40% above consensus.

.%20Source%20Macquarie%20Research.png)

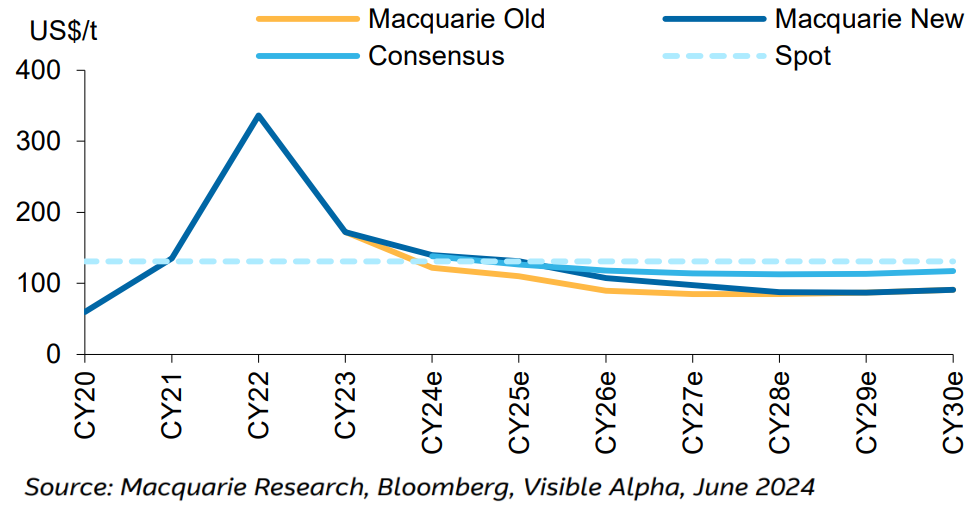

Macquarie describes its overall view on thermal coal as “underweight”. The broker has deferred anticipated declines in import demand from China and India. Assuming this, the market should remain “tight, for now”.

Macquarie has increased its 2024 thermal coal price target by 16% to US$140/t and its 2025 price target by 19% to US$131/t. 2026-27 targets are also increased by up to 20%.

Macquarie notes that while these appear to be significant upward revisions, they only align the broker with consensus in 2024-25, and put them less below consensus 2026-27.

.%20Source%20Macquarie%20Research.png)

Morgan Stanley

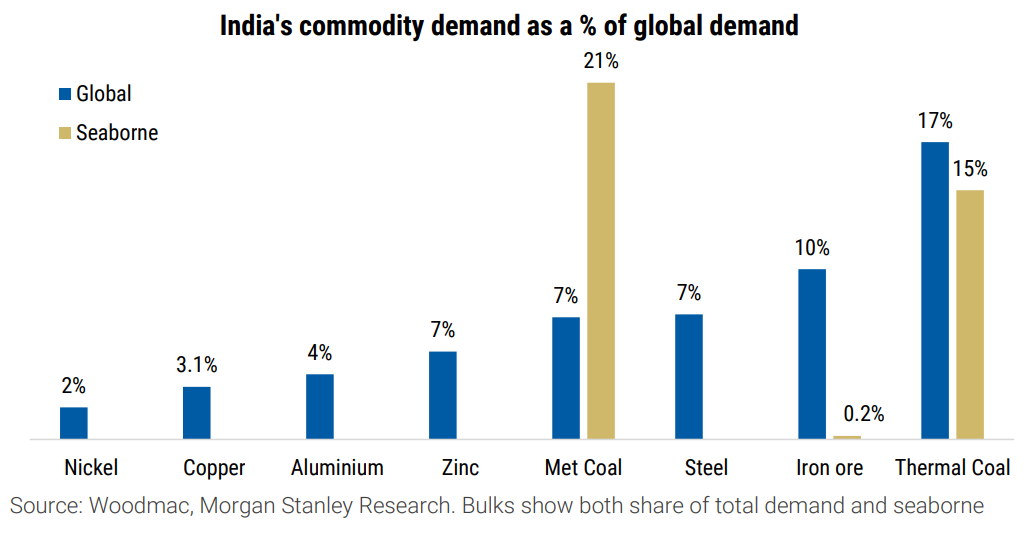

Morgan Stanley sees met coal “supported from India demand and supply tightness”.

“As growth continues to shift to India, we see met coal imports rising driven by India's infrastructure focus and met coal port inventories remain at pre-2023 levels. Supply from Australia has also disappointed and as such we see upside risk from here.”

Morgan Stanley did not make any major revisions to their met coal price targets which sit at US$277/t in 2024, US$260/t in 2025, and US$238/t in 2026.

Morgan Stanley increased their thermal coal (Newcastle) price targets by between 9%-15% over the next three years. They now sit at US$135/t in 2024, US$120/t in 2025, and US$115/t in 2026.

GOLD AND SILVER OUTLOOK

Macquarie

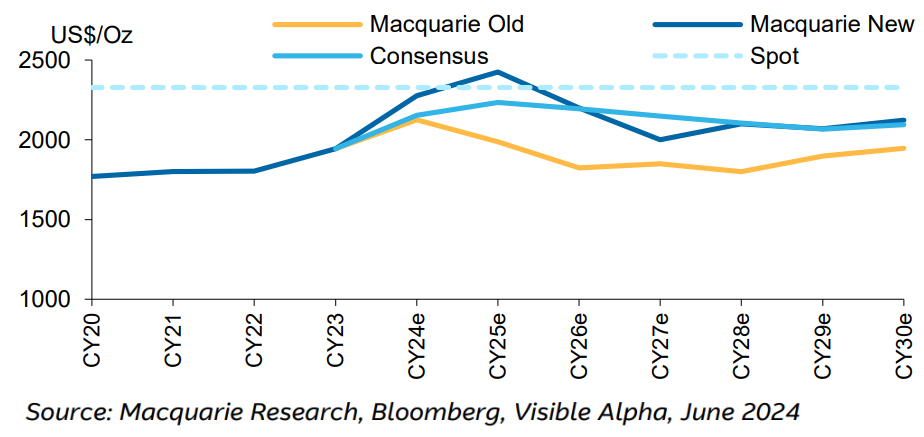

Macquarie describes its overall view on gold as “even-weight”. They note that gold has “performed impressively” on the back of rate cut expectations, challenging fiscal outlooks, and strong Chinese investor demand that is expected to persist.

Macquarie notes silver is also benefiting from the above factors, but that it’s “also benefiting from its industrial gearing to the energy transition”.

.%20Source%20Macquarie%20Research,%20Bloomberg,%20Visible%20Alpha,%20June%202024..png)

The broker increased its 2024 gold price target by 7% to US$2,276/oz and its 2025 price target by 22% to US$2,425/oz. These targets are 6% and 9% respectively above consensus.

Macquarie is forecasting the gold price to peak at US$2,500/oz in mid-2025, and then average US$2,200/oz in 2026 (this target increased by 21%). The broker's long-term forecast, that is, beyond 2028 is up 9% to $US1,800/oz in real terms.

Macquarie’s silver price targets are as follows: US$30.75/oz in FY25, US$30.25 in FY26, US$26.50/oz in FY27, and US$25.50/oz in FY28.

Morgan Stanley

Morgan Stanley expects gold to continue to be supported in the second half of 2024, “central bank buying and falling real yields”.

The broker’s gold price targets are as follows: US$2,368/oz in 2024 (+7%), US$2,538/oz in 2025 (+17%), US$2,200 in 2026 (+10%), US$2,200/oz in 2027 (+22%), US$2,000/oz in 2028 (+11%), and US$1,604/oz in the long term (-1%) (i.e. 2030 and beyond).

LITHIUM OUTLOOK

Macquarie

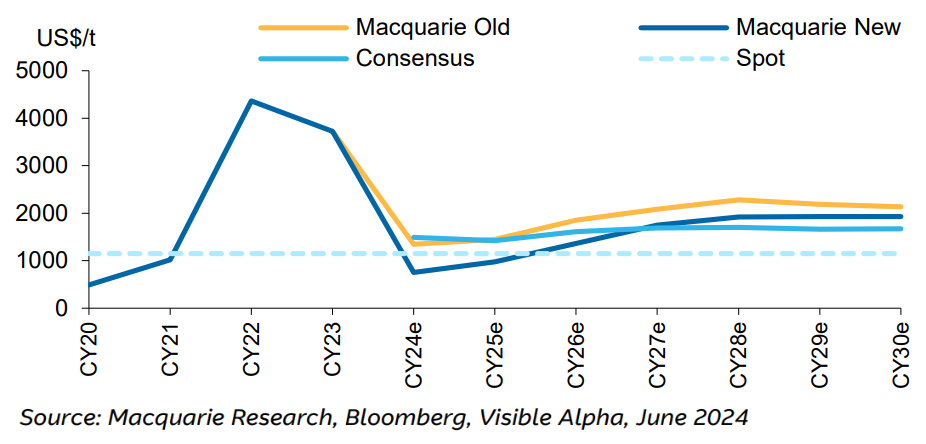

Macquarie describes its overall view on lithium as “underweight”.

The broker cut its 2024 lithium carbonate price target by 27%, and its 2024 spodumene price target by 24%. 2025 price targets for each are cut by 35%.

Macquarie blames the cuts on “short-term demand weakness and committed supply unable to react”. The supply overhang would likely linger through 2026 before “a tighter market leads to a modest price recovery”.

The broker notes that its spodumene price target in 2024 of US$1,056/t and in 2025 of US$975/t are 29% and 31% below consensus respectively – and that it’s also below spot pricing.

Such a low price could cause a “host of project deferrals”. The market should start to balance by 2026 with the spodumene price recovering to US$1,363/t (15% below consensus). This would “not be enough to sanction new green field developments”.

From 2027, “continued demand growth” would help the spodumene price recover to US$1,750/t (in line with consensus). This would be “enough to drive a supply response, but the lag between signal and response drives a deficit”.

In 2028, Macquarie’s spodumene price target of US$1925/t is 10% above consensus, and their long-term target (i.e., beyond 2028) of US$1,500/t is 15% above consensus.

Morgan Stanley

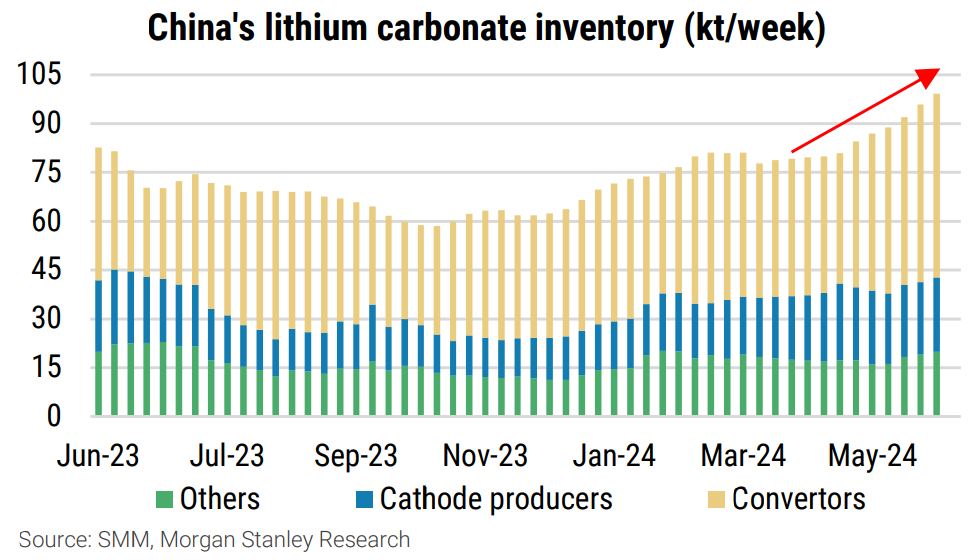

“We see Li remaining subdued as China's lithium carbonate inventory continues to move higher coupled with potentially weakening ex-China demand for Chinese EVs driven by EU/US tariffs.”

.%20Source%20SMM,%20Morgan%20Stanley%20Research.png)

Morgan Stanley’s spodumene price targets are as follows: US$1,003/t in 2024 (-18%), US$1,035/t in 2025 (-23%), US$1,350 in 2026 (unchanged), US$1,350/t in 2027 (unchanged), US$1,260/t in 2028 (unchanged), and US$1,414/t in the long term (-7%) (i.e. 2030 and beyond).

URANIUM OUTLOOK

Macquarie

Macquarie did not provide any specific commentary for uranium or price targets.

Morgan Stanley

Morgan Stanley did not provide specific commentary on uranium but did provide the following price targets: US$82/lb in 2024, US$79/lb in 2025, US$68/lb in 2026.

ASX COMMODITIES STOCK RATINGS AND PRICE TARGET CHANGES

Coal

*Macquarie Coal Coverage*

OUTPERFORM

Coronado Global Resources (ASX: CRN) – Price Target: $2.00⬆️ vs $1.80

“CRN is our met coal preference with material EPS upgrades and a relative attractive valuation to peers”

Whitehaven Coal (ASX: WHC) – Price Target: $9.00

“WHC is our key pick in the [coal] space”

NEUTRAL

New Hope Corporation (ASX: NHC) – Price Target: $4.00⬇️ vs $4.10

Rating upgraded from UNDERPERFORM due to a “more constructive view on thermal coal”

*Morgan Stanley Coal Coverage*

OVERWEIGHT

Whitehaven Coal (WHC) – Price Target: $9.75⬆️ vs $9.65

“We think the stock remains cheap with FY25e EV/EBITDA of 3.8x. FID Winchester South would boost valuation further. Further, running spot prices have a significant impact on our base-case value and FCF yield forecast”

Gold and Silver

*Macquarie Gold and Silver Coverage*

OUTPERFORM

Bellevue Gold (ASX: BGL) – Price Target: $2.10⬆️ vs $2.00

Rating upgraded from NEUTRAL

“We suspect FY25 guidance could disappoint for BGL (mainly costs - but later constructive on the 1.5Mtpa study)”

De Grey Mining (ASX: DEG) – Price Target: $1.80⬆️ vs $1.68

“Delivering on the overall inventory growth presents the key risk to our base case”

Evolution Mining (ASX: EVN) – Price Target: $4.30⬆️ vs $4.00

Rating upgraded from NEUTRAL

“While EVN is upgraded to an Outperform it remains our least preferred of the three large-cap gold stocks as we continue to see risk to Red Lake's long-term outlook and as it has the heaviest balance sheet”

Genesis Minerals (ASX: GMD) – Price Target: $2.10⬆️ vs $2.00

“In gold, we like RED and GMD”

Broker notes “potential tailwinds from permitting at Tower Hill”

Gold Road Resources (ASX: GOR) – Price Target: $1.90⬆️ vs $1.70

Rating upgraded from NEUTRAL

Broker sees “EPS improvements over the near term”

Newmont Corporation (ASX: NEM) – Price Target: $83⬆️ vs $71.00

“We prefer NEM over NST and EVN”

“We switch our senior gold producer preference to NEM due to its increasing margin expansion”

“NEM sees the most meaningful EPS upgrades which average 66% over the next 5-years, assisted by its higher cost base (leverage) and a lack of meaningful hedge exposure”

Northern Star Resources (ASX: NST) – Price Target: $18.00⬆️ vs $17.00

“NST, which has pure gold exposure, averages a 39% EPS improvement over the next 5-years”

“While we remain constructive on NST longer-term, due to its sector-leading growth outlook, we see near-term risk to FY25 guidance for NST (compared to NEM and EVN)”

Perseus Mining (ASX: PRU) – Price Target: $3.00⬆️ vs $2.70

“From the smaller-cap producers, our top pick is PRU with its strong cash generation (FCF of 19% in FY25) and development outlook led by the recently acquired Nyanzaga asset in Tanzania”

Red 5 (ASX: RED) – Price Target: $0.55⬆️ vs $0.50

“In gold, we like RED and GMD”

“from FY24-FY28 RED's EPS more than triples on average largely due to earnings coming off a small base”

Ramelius Resources (ASX: RMS) – Price Target: $2.10⬆️ vs $2.00

Rating upgraded from NEUTRAL

“RMS' study for Rebecca could be softer than the market expects, in our view.”

Regis Resources (ASX: RRL) – Price Target: $2.90⬆️ vs $2.60

“The timing of government approvals of the McPhillamys Project in NSW the updated DFS for the project remains key to RRL’s longer-term outlook and an important catalyst”

Resolute Mining (ASX: RSG) – Price Target: $0.70⬆️ vs $0.60

Broker sees “EPS improvements over the near term”

“Execution of the Syama expansion project remains key to our outlook for RSG”

St Barbara (ASX: SBM) – Price Target: $0.28⬆️ vs $0.25

Rating upgraded from NEUTRAL

“Further optimisation work for the Simberi Sulphides Project remains important while permitting at Atlantic is crucial longer-term”

West African Resources (ASX: WAF) – Price Target: $2.10⬆️ vs $1.60

Broker sees “EPS improvements over the near term”

“The volumes and grade from the underground remains important for our near-term production assumptions

“Our longer-term outlook relies on a successful development of Kiaka”

Westgold Resources (ASX: WGX) – Price Target: $2.80⬆️ vs $2.20

Rating upgraded from NEUTRAL

“Our top four target price upgrades are all (or very soon to be) unhedged gold producers [like] WGX”

“Timely development of the high-grade Great Fingall mine remains key to our mid-term outlook along with continued output growth from Bluebird. We also assume WGX completes its acquisition of Karora”

NEUTRAL

Capricorn Metals (ASX: CMM) – Price Target: $5.10⬆️ vs $4.70

Rating upgraded from UNDERPERFORM

“CMM could see slower-than expected permitting for Mt Gibson”, and delivery of this project remains “important for CMM’s longer-term outlook”

*Morgan Stanley Gold and Silver Coverage*

OVERWEIGHT

Evolution Mining (EVN) – Price Target: $4.15⬆️ vs $3.90

Broker notes current EVN share price implies “the lowest gold price for our coverage at US$1820/oz”

Broker notes approximately 30% revenue from copper, and EVN is preferred to Sandfire Resources (SFR)

Broker notes EVN has “little to no hedging allowing for more potential upside vs NST”

“There remains opportunity at Red Lake (from CY32+) and Northparkes (mine life extension with capex-light approach)”

Regis Resources (RRL) – Price Target: $2.10⬇️ vs $2.50

Broker notes RRL has “little to no hedging allowing for more potential upside vs NST”

“We like RRL's unhedged position to gold prices with the company set to generate high FCF yields of 20%+ for FY25e”

EQUAL-WEIGHT

Northern Star Resources (NST) – Price Target: $14.90⬆️ vs $14.50

“We see the KCGM mill expansion and potential for Fimiston underground being developed as being largely priced-in to the stock”

KCGM mill expansion carries with it “potential for capex risks”

“Given the catalysts available, we see both upside and downside risks”

Lithium

*Macquarie Lithium Coverage*

OUTPERFORM

Arcadium Lithium (ASX: LTM) – Price Target: $6.60⬇️ vs $9.40

LTM's hedged LiOH exposure provides support

“Longer term it recovers and has the growth pipeline to support its valuation, albeit at lower levels than we previously had ascribed”

Patriot Battery Metals (ASX: PMT) – Price Target: $1.50⬇️ vs $1.90

“incorporating lower lithium price forecasts and changing our assumed equity funding assumptions drives 1-18% EPS increases in FY25-28”

Piedmont Lithium (ASX: PLL) – Price Target: $0.25⬇️ vs $0.36

“PLL’s spodumene production is ramping up with more spodumene shipments expected in CY24. We cut our earnings significantly to losses until CY27 before profitability is restored”

NEUTRAL

Mineral Resources (ASX: MIN) – Price Target: $62.00⬇️ vs $75.00

Rating downgraded from OUTPERFORM

“MIN gets hit with lithium and iron ore price cuts at the same time; its EPS is cut 96%/55% across FY25/26”

Pilbara Minerals (ASX: PLS) – Price Target: $3.25⬇️ vs $4.20

“PLS's target price of A$3.25ps has reduced by 23% on the back of 36-66% earnings changes across FY25-27”

“still prefer MIN over IGO and PLS”

IGO (ASX: IGO) – Price Target: $6.00⬇️ vs $7.60

“IGO's target price of A$6.00ps has reduced by 21% on the back of 40-60% EPS declines”

“Like PLS, IGO benefits from a tier one asset base and a well capitalised balance sheet, which minimises its EPS impact”

Liontown Resources (ASX: LTR) – Price Target: $1.05⬇️ vs $1.30

“we incorporate lower lithium prices which drives material EPS reductions in FY24, 91% reductions in FY26, and 26-32% reductions in FY27-28”

Core Lithium (ASX: CXO) – Price Target: $0.09⬇️ vs $0.15

“we push back an assumed Finiss restart by an additional 12 months to FY27 in addition to incorporating lower lithium price forecasts”

Sayona Mining (ASX: SYA) – Price Target: $0.04

“We cut our estimates for SYA, where earnings are negative until FY28”

Global Lithium Resources (ASX: GL1) – Price Target: $0.30

“GL1 suffers development leverage from the changes in our price forecast, and will need to defer its project in our view”

Atlantic Lithium (ASX: A11) – Price Target: $0.42⬇️ vs $0.46

Rating downgraded from OUTPERFORM

“medium term cuts drive negative until FY27, after which production leads to profitability”

UNDERPERFORM

Argosy Minerals (ASX: AGY) – Price Target: $0.08⬇️ vs $0.16

Rating downgraded from NEUTRAL

Galan Lithium (ASX: GLN) – Price Target: $0.20⬇️ vs $0.25

Rating downgraded from NEUTRAL

“GLN suffers acutely from the changes in our price forecast, with negative earnings out to FY28”

*Morgan Stanley Lithium Coverage*

OVERWEIGHT

Mineral Resources (MIN) – Price Target: $79.00⬇️ vs $85.50

“We like MIN's commodity mix, with an improving backdrop for iron ore, especially as the Ashburton iron ore project begins to ramp. We see MIN's leverage levels improving from FY25 onwards”

UNDERWEIGHT

Pilbara Minerals (PLS) – Price Target: $2.75⬇️ vs $3.35

“Limited LCE growth vs peers over the next few years. We remain wary of further capex/cost increases as the P1000 expansion project ramps up”

IGO (IGO) – Price Target: $5.05⬇️ vs $6.05

“IGO offers diversified exposure to clean energy metals and despite seeing value in this theme, we think this is more than accounted for in the current stock price. We remain cautious on several risk factors such as: higher capex, slower ramp-up at Kwinana, volume build at Greenbushes”

Uranium

*Macquarie Uranium Coverage*

N/a

*Morgan Stanley Uranium Coverage*

OVERWEIGHT

Paladin Energy (ASX: PDN) – Price Target: $16.65⬇️ vs $17.45

“We think the [Langer Heinrich] restart should be relatively straightforward, with some debottlenecking initiatives helping improve production from historical operating rates”

“Key growth option is Michelin (6Mlb p.a. project) in Canada, which, alongside LH, could make PDN a sizeable uranium player vs international peers”

FY25 and FY26 earnings benefit from increases to our uranium price forecast.

EQUAL-WEIGHT

Boss Energy (ASX: BOE) – Price Target: $4.65⬆️ vs $4.60

“BOE expects to restart its flagship Honeymoon mine in 1HCY24. We see risks around ramp-up at the asset”

“We also see risks to realizing cost savings per BOE's 2021 Enhanced Feasibility study, especially in an inflationary environment”

“Recently acquired US asset, Alta Mesa, has limited valuation impact as it is a small project (1.5Mlpba 100%), with BOE at only 30% ownership”

This article first appeared on Market Index on Friday 28 July 2024.

5 topics

34 stocks mentioned