ASX Banks vs Miners: Which sector would you choose?

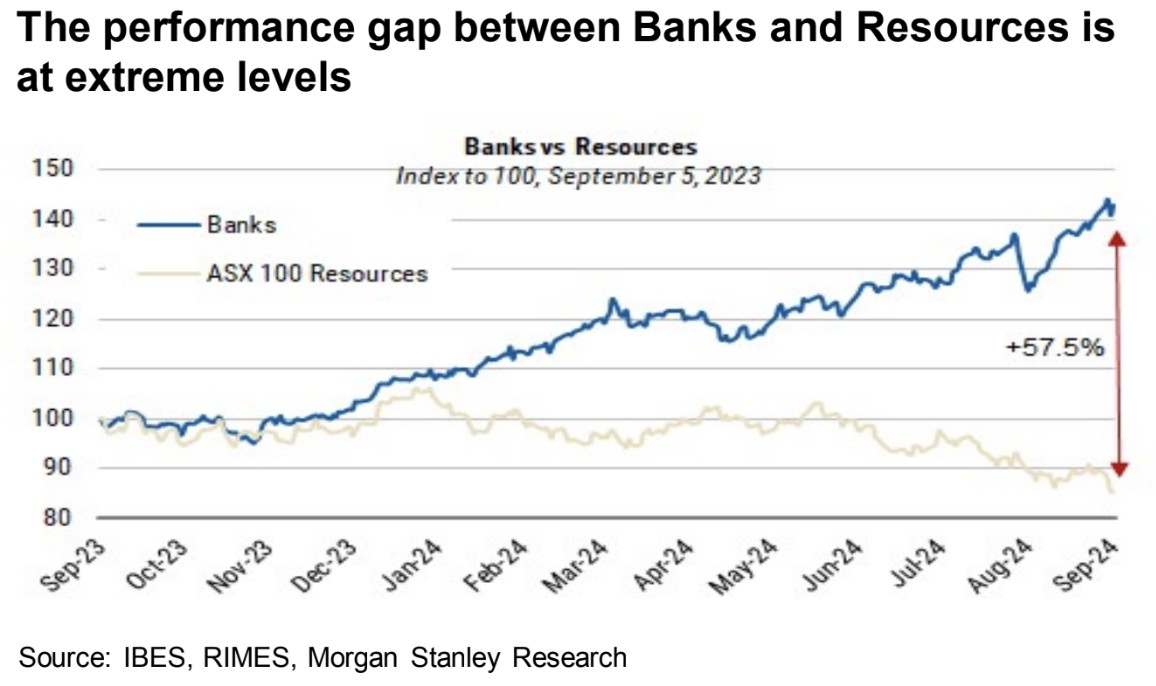

For all the talk that the Big Four plus Macquarie are way too expensive, or that resources stocks are trading at a 20% discount to their 30-year average, or that the performance gap between banks and resources stocks is too large to ignore (see chart below)...the difference in share price performance doesn't lie.

It's a conundrum that has left the entire sell-side scratching their heads. Or, more accurately, the entire sell-side minus UBS' Richard Schellbach. The Australia-based equity strategist has backed some controversial calls of late and nailed it - one of which was explained in detail on a recent episode of Livewire's Signal or Noise.

His latest controversial call sees him backing the banking sector over the resources sector, albeit with the caveat that "both sectors seem unappealing." This wire will summarise his views - as well as a sampling of the rivals who disagree with him.

Schellbach's argument in summary

Firstly, the outperformance of the Big Four was not always this way. Investors with long memories will know that although banks are "unreasonably priced" now (to quote Morgan Stanley's words), bank share prices have underperformed the ASX resources space over the last five and 10 years respectively, because the latter was benefitting from a supercycle.

But now that the banks are starting to outperform, Schellbach's second point is that history suggests the good times may last for a while yet.

"History has shown that these cycles often persist, with leadership generally lasting for five years or more. Technically this could suggest that the divergence we have seen so far this year could persist," Schellbach wrote in his client note.

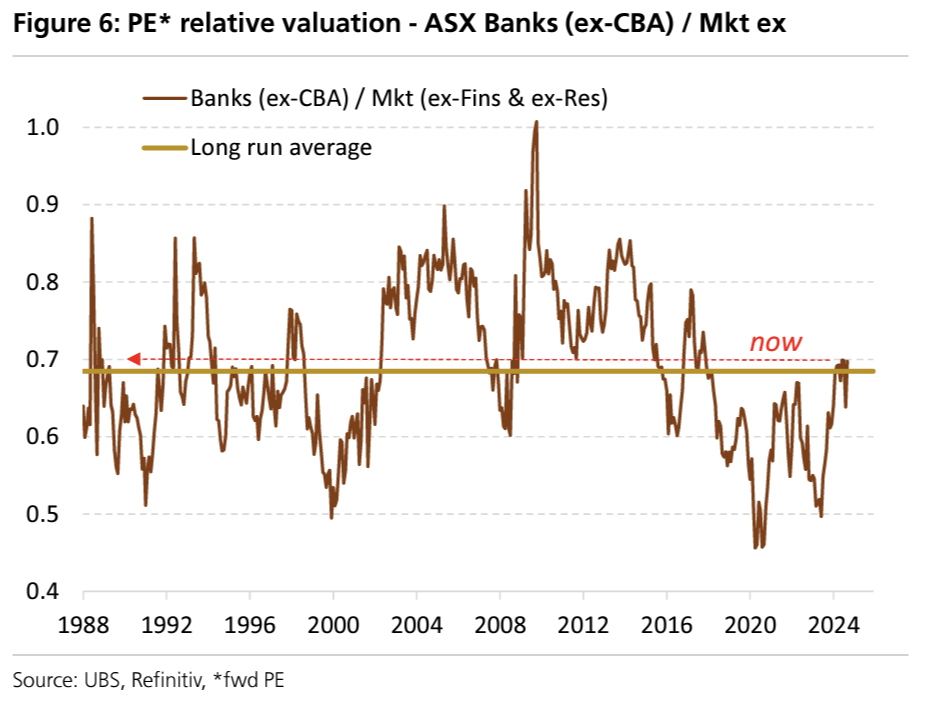

Third, the banks are a bifurcated beast. The bank index, as it is, is expensive. But a) stretched valuations are not unique to the Australian banks specifically and b) If you take out Commonwealth Bank (ASX: CBA), "the remaining Banks actually sit at just a mid-cycle valuation versus the market."

A visualisation of this latter point can be seen in the chart below:

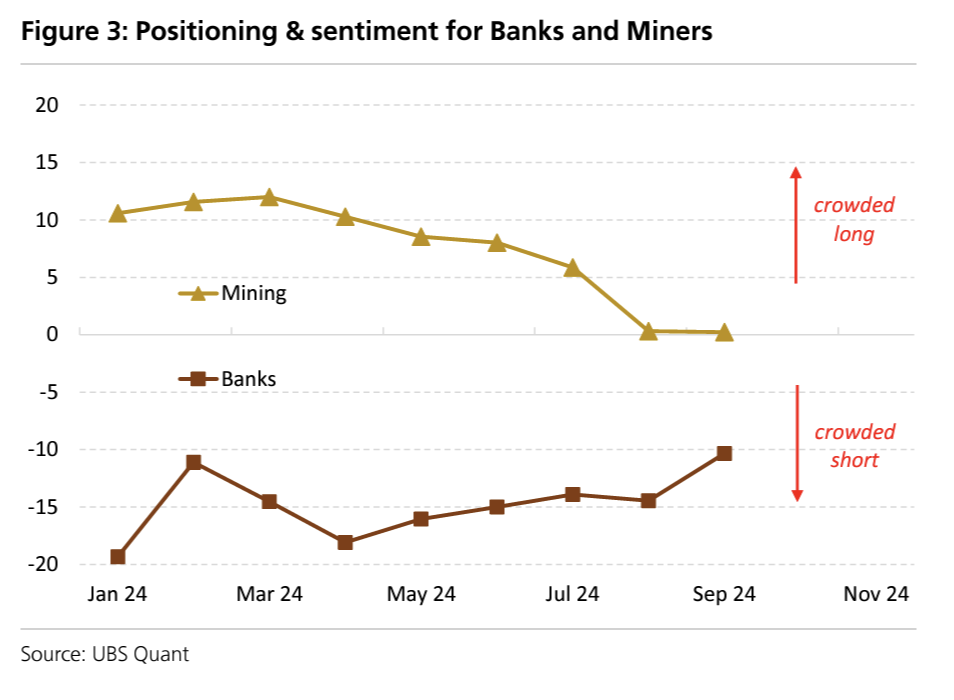

And finally, for all the talk that being in the Big Banks is a crowded trade, UBS' own data point which tracks crowding suggests that it's the miners who are coming off a crowded long and the banks are rising from crowded short levels. If sentiment were to capitulate, then Schellbach argues there is even more upside risk for bank share prices.

Morgan Stanley and Macquarie disagree

Needless to say, this is not a view shared by everyone. Macquarie's research team have been underweight the Banks for some time. In a note from last Friday, Macquarie analysts even said they "are not ready to concede this view", writing:

"We find it difficult to reconcile that just in a few years, banks' risk assessment has changed, and adverse scenarios that banks presented (which underpinned their substantial loan losses in FY20) are no longer relevant".

Morgan Stanley had similar comments:

"Australian bank multiples remain elevated above historical norms while bank sector valuation re-rating has occurred despite modest positive earnings trends," analysts wrote.

In MS' Model Portfolio, the banks have a -5.63% underweight relative to the ASX 200's weighting. That is, the banks make up 24% of the index but Morgan Stanley would only invest 18.5% of its hypothetical cash in this sector. Also of note, this -5.63 figure is the largest underweight for an individual sector, by far.

The problem for the materials and energy space

While Schellbach's view probably has many of his peers shaking their heads, none of them can deny it's also been really hard for ASX materials and energy stocks to make a serious case for an investor rotation. To quote Morgan Stanley, the resources sector is "trapped in value". To quote Schellbach:

"If China's macro continues to deteriorate, it would seem hard to believe the Aussie economy (and its miners) can escape the fallout," he wrote.

"We find that rising commodity prices are a prerequisite for the miners to outperform. It follows that to buy this dip in the miners' share prices and move overweight the sector, one has to believe that commodity prices have bottomed. With the momentum in Chinese economic data on a downward trajectory, it would seem a challenge for commodity prices to detach from this negativity," he added.

Over to you

Do you have a preference for the banks or miners?

Let us know in the comments section below.