ASX energy stocks like Woodside, Santos and Paladin are going cheap say big brokers: 50-60% upside on tap

Delve into the typical Aussie stock portfolio and you’ll likely find a few of the Big 4 banks, BHP, RIO, and Fortescue of course, probably some Woolworths, Wesfarmers and Telstra, and tucked away in the bottom drawer among them, a bit of Woodside and Santos.

There’s nothing wrong with this "Great Aussie Portfolio", as generally over the long term, it's done well and has probably furnished investors with a good whack of fully franked dividends. But it's also fair to say that some part of the Great Aussie Portfolio has at times, underperformed.

Right now, in this Trump Trade War uncertain world – the suffering is likely broadening. Well, "Nothing goes up in a straight line", as they say in the classics! But, one's portfolio shouldn’t go down in a straight line either, should it?

Unfortunately, the “Down in a straight line” theme has been the case for many ASX energy stocks for nearly two years now – well before President Trump’s latest tariff antics. It looks like the ASX energy sector is broken, and what might be construed by some as deep value – just keeps getting deeper and deeper.

Is it time to add to your holdings of ASX energy stocks like Woodside, Santos, Beach Energy, Karoon? What about the refiners like Ampol and Viva Energy? Or coal stocks like Whitehaven Coal and Coronado Resources? And don’t forget uranium stocks are also part of the ASX energy sector – so perhaps you should consider Boss Energy and Paladin Energy too?

If this is a question you’ve been grappling with lately, then this is the article for you. We’ve raided our Broker Consensus archives to bring you the latest updates from the biggest brokers on what the think of 10 of the biggest ASX energy stocks in this post-Trump tariffs world.

What’s the consensus on how the looming trade war is going to impact them? Are they a buy, hold, or sell, and at what price? Let’s start with the oil and gas producers, then we’ll look at the refiners, coal, and uranium producers.

(Spoiler alert 🚨! It looks like the big brokers are tipping at least some collateral damage from President Trump’s tariffs is unavoidable – but the good news is – substantial value is emerging.)

Group 1: Oil & Gas Producers WDS, STO, BPT, KAR

For all of the stocks covered, to obtain a Broker Consensus Rating, we assign a Rating Value of +1 to any broker rating better than HOLD/NEUTRAL/MARKETWEIGHT; a Rating Value of 0 for any broker rating equivalent to HOLD/NEUTRAL/MARKETWEIGHT; and a Rating Value of -1 to any broker rating worse than HOLD/NEUTRAL/MARKETWEIGHT.

We then take the average of all Rating Values and assign a Broker Consensus Rating of BUY to values +0.5 or above; a Broker Consensus Rating of HOLD for values between -0.5 and +0.5; and a Broker Consensus Rating of SELL for values -0.5 or below.

The Broker Consensus Target is simply the average of the target prices we have on file for each broker. Typically, brokers define their target price as a 12-month forecast, and each target price is based on a broker’s fundamental valuation assumptions. We have only assessed broker ratings and target prices within the last 3 months to account for recent relevance.

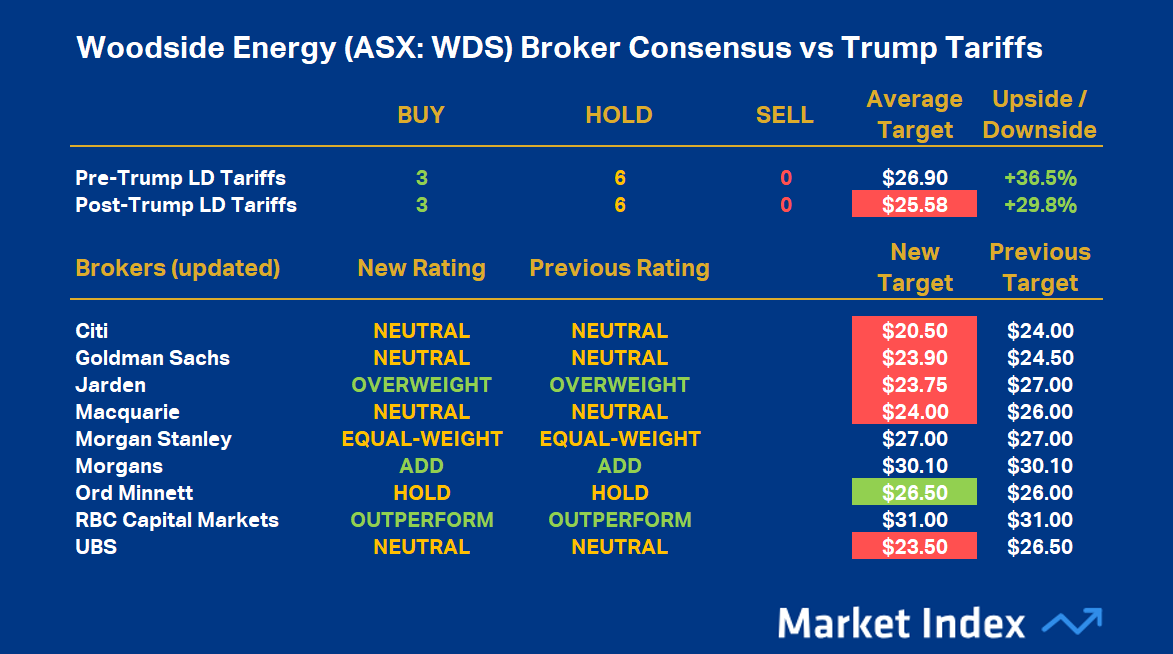

Woodside Energy (ASX: WDS)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

WDS’s average Rating Value is +0.33, resulting in a Broker Consensus Rating of HOLD. This is unchanged from its prior average Rating Value of +0.33 and Broker Consensus Rating of HOLD.

WDS’s Broker Consensus Target is $25.58 (down 4.9% from $26.90 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 29.8% undervalued based upon the closing price on Tuesday, 22 April of $19.71.

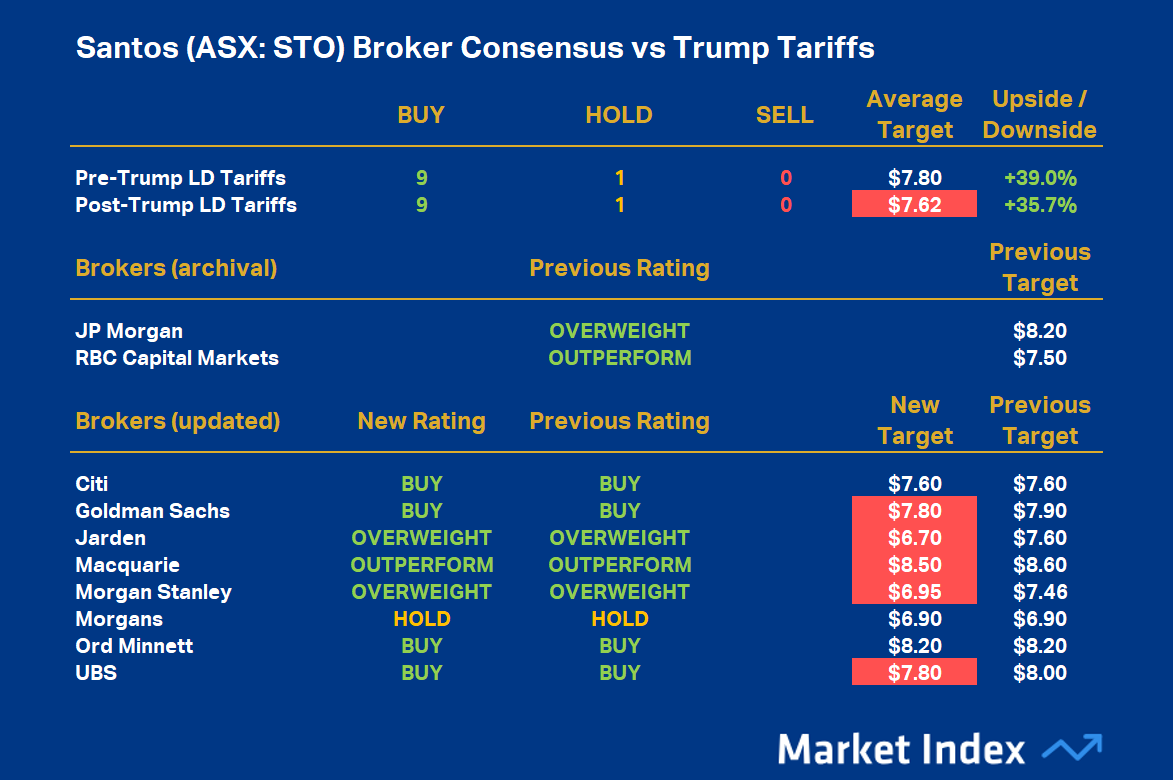

Santos (ASX: STO)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

STO’s average Rating Value is +0.90, resulting in a Broker Consensus Rating of BUY. This is unchanged from its prior average Rating Value +0.90 and Broker Consensus Rating of BUY.

STO’s Broker Consensus Target is $7.62 (down 2.3% from $7.80 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 35.7% undervalued based upon the closing price on Tuesday, 22 April of $5.61.

Note however, if we only consider broker updates received since 2 April, STO’s average Rating Value falls to +0.87 (still a Broker Consensus Rating of BUY) and its Broker Consensus Target rises to $7.56 (34.8% undervalued).

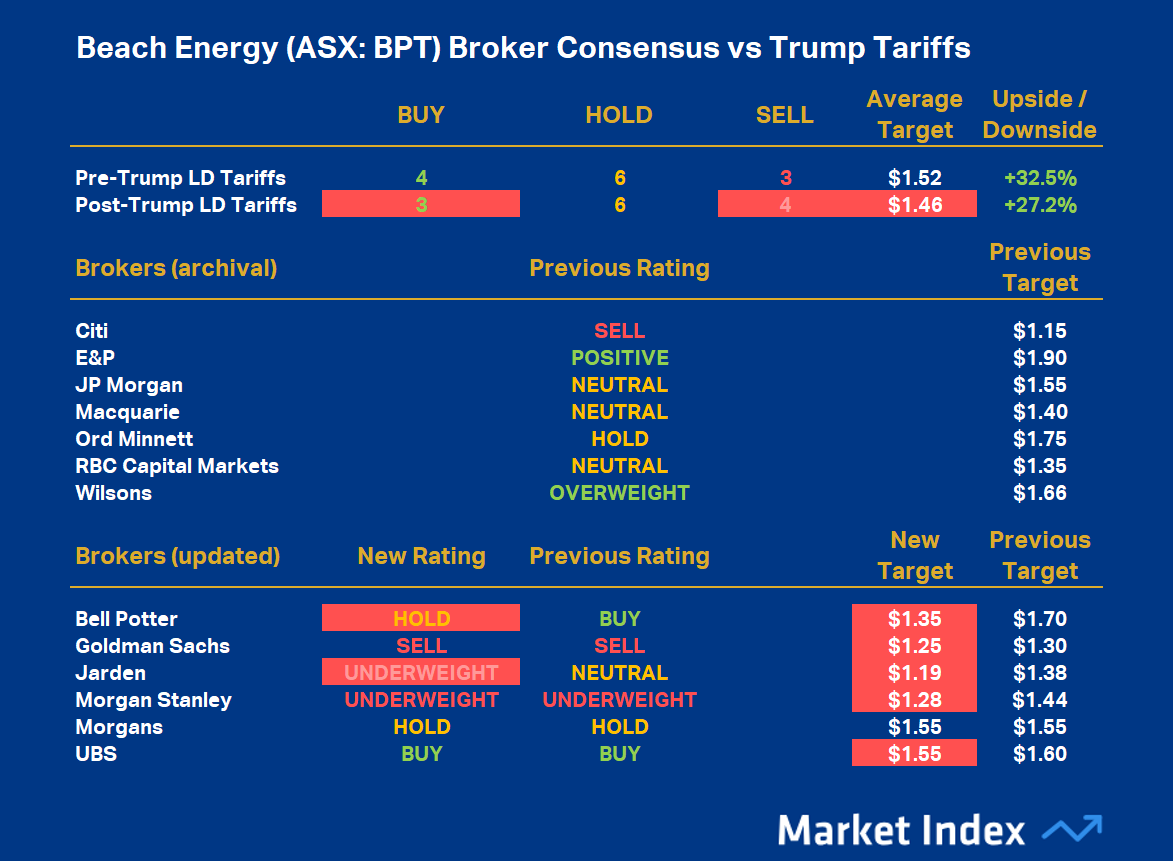

Beach Energy (ASX: BPT)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

BPT’s average Rating Value is -0.08, resulting in a Broker Consensus Rating of HOLD. This is down from its prior average Rating Value of +0.08 and Broker Consensus Rating of HOLD.

BPT’s Broker Consensus Target is $1.455 (down 4.1% from $1.52 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 27.2% undervalued based upon the closing price on Tuesday, 22 April of $1.145.

Note however, if we only consider broker updates received since 2 April, BPT’s average Rating Value falls to -0.33 (still a Broker Consensus Rating of HOLD) and its Broker Consensus Target falls to $1.36 (18.8% undervalued).

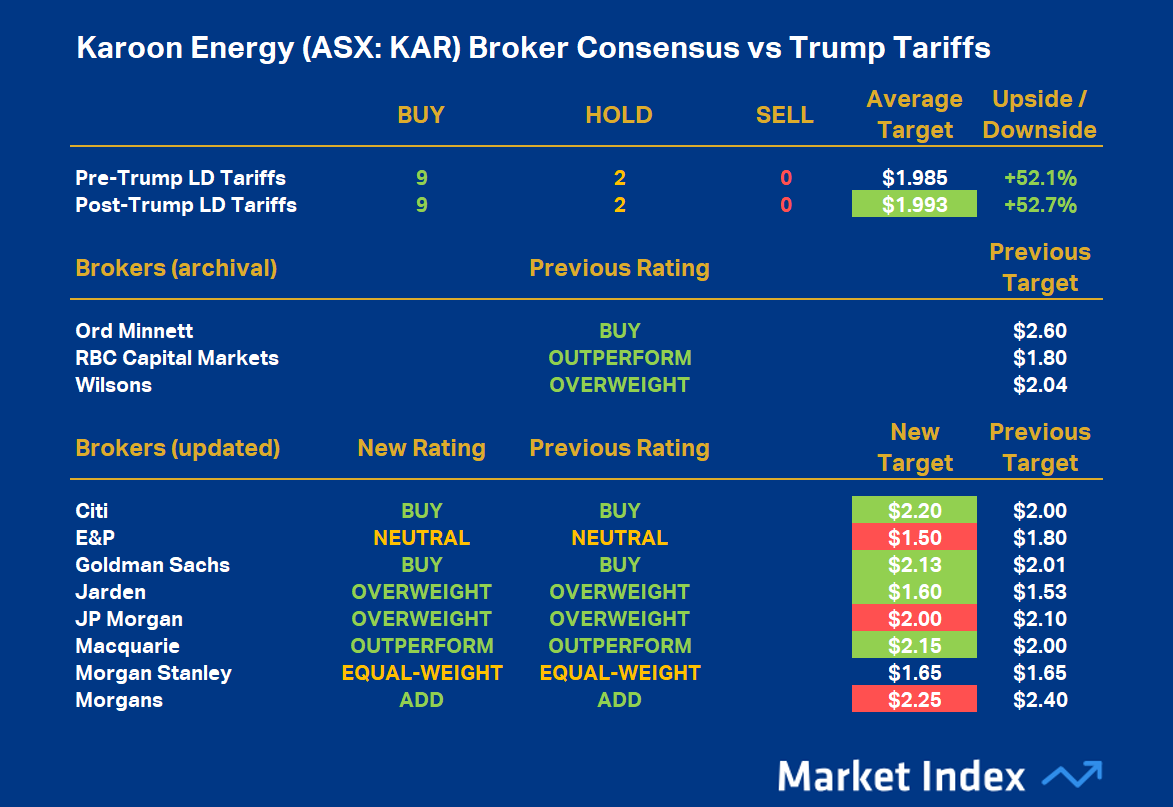

Karoon Energy (ASX: KAR)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

KAR’s average Rating Value is +0.82, resulting in a Broker Consensus Rating of BUY. This is unchanged from its prior average Rating Value +0.82 and Broker Consensus Rating of BUY.

KAR’s Broker Consensus Target is $1.993 (up 0.4% from $1.985 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 52.7% undervalued based upon the closing price on Tuesday, 22 April of $1.305.

Note however, if we only consider broker updates received since 2 April, KAR’s average Rating Value falls to +0.75 (still a Broker Consensus Rating of BUY) and its Broker Consensus Target falls to $1.94 (48.7% undervalued).

Group 2: Refiners ALD, VEA

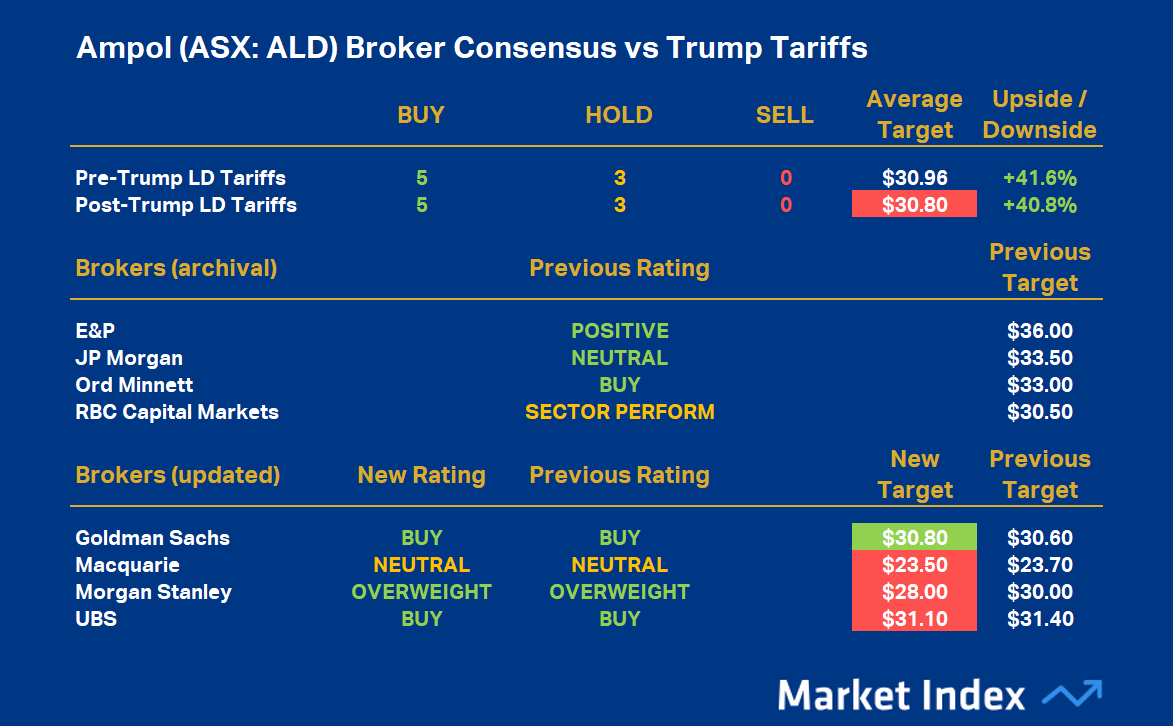

Ampol (ASX: ALD)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

ALD’s average Rating Value is +0.63, resulting in a Broker Consensus Rating of BUY. This is unchanged from its prior average Rating Value of +0.63 and Broker Consensus Rating of BUY.

ALD’s Broker Consensus Target is $30.80 (down 0.5% from $30.96 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 40.8% undervalued based upon the closing price on Tuesday, 22 April of $21.87.

Note however, if we only consider broker updates received since 2 April, ALD’s average Rating Value rises to +0.75 (still a Broker Consensus Rating of BUY) but its Broker Consensus Target falls to $28.35 (29.6% undervalued).

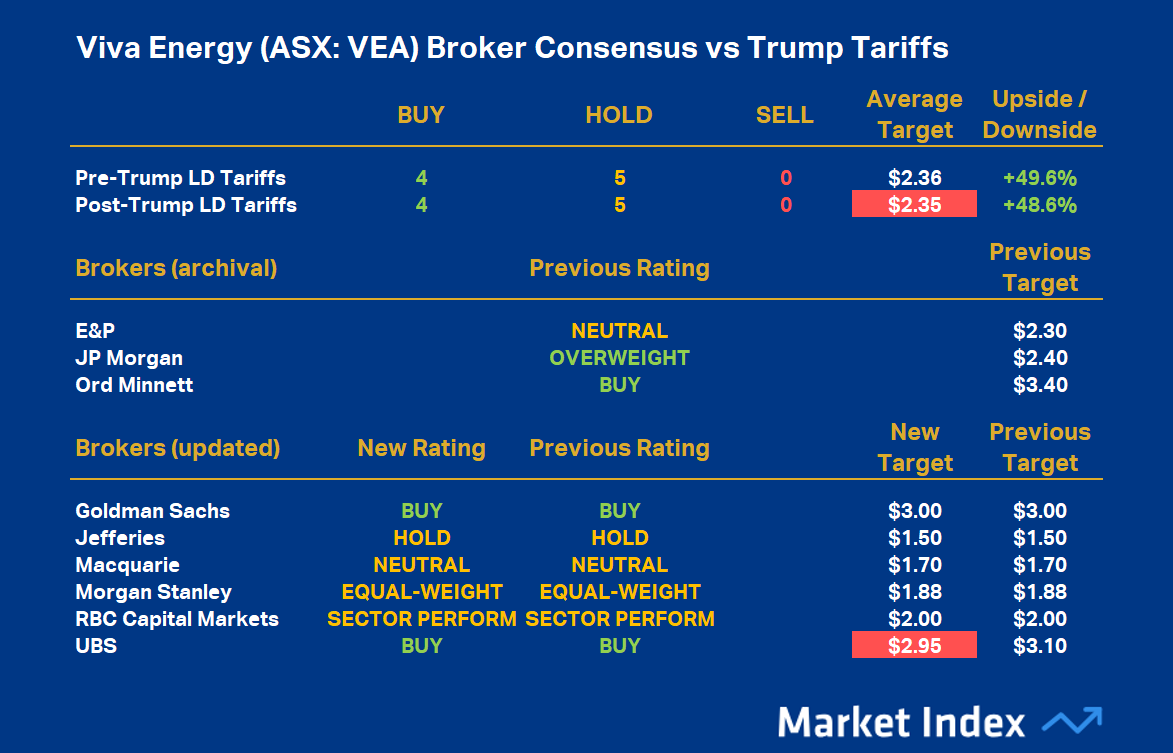

Viva Energy (ASX: VEA)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

VEA’s average Rating Value is +0.44, resulting in a Broker Consensus Rating of HOLD. This is unchanged from its prior average Rating Value +0.44 and Broker Consensus Rating of HOLD.

VEA’s Broker Consensus Target is $2.35 (down 0.7% from $2.36 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 48.6% undervalued based upon the closing price on Tuesday, 22 April of $1.58.

Note however, if we only consider broker updates received since 2 April, VEA’s average Rating Value falls to +0.33 (still a Broker Consensus Rating of HOLD) and its Broker Consensus Target falls to $2.17 (37.3% undervalued).

Group 3: Coal WHC, CRN

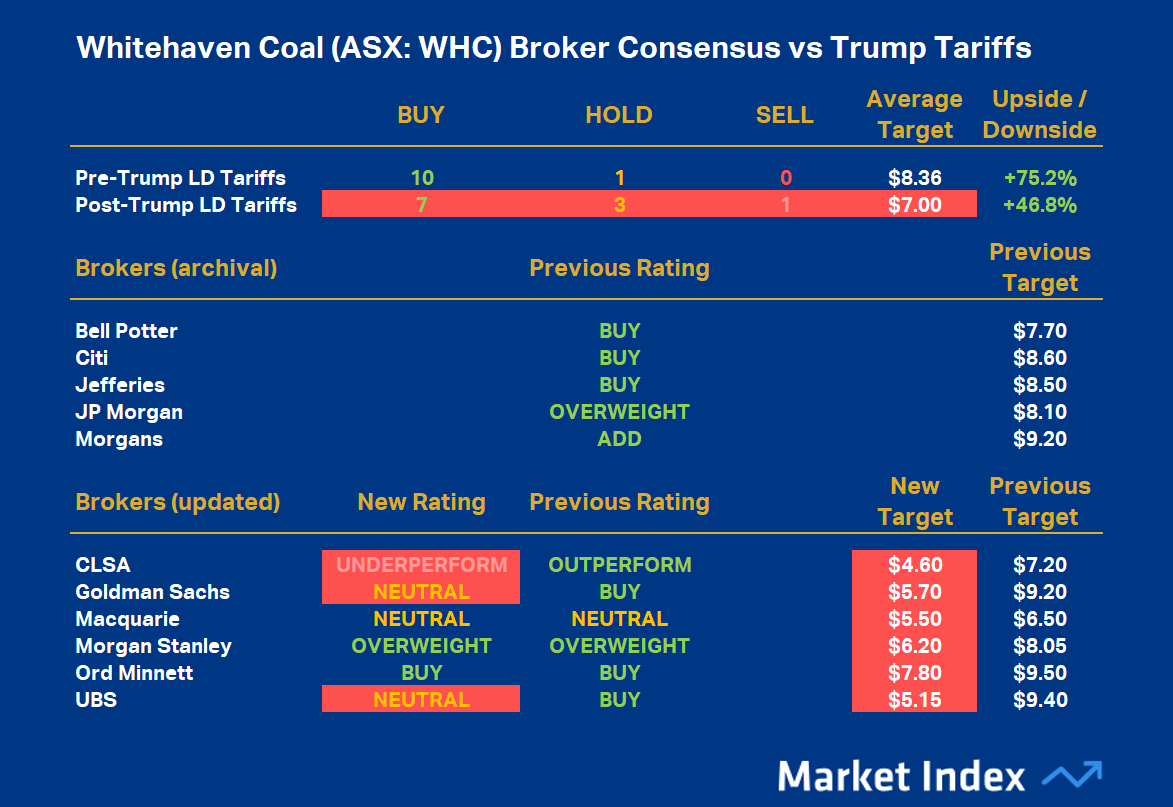

Whitehaven Coal (ASX: WHC)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

WHC’s average Rating Value is +0.55, resulting in a Broker Consensus Rating of BUY. This is down from its prior average Rating Value +0.91 and Broker Consensus Rating of BUY.

WHC’s Broker Consensus Target is $7.00 (down 16.2% from $8.36 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 46.8% undervalued based upon the closing price on Tuesday, 22 April of $4.77.

Note however, if we only consider broker updates received since 2 April, WHC’s average Rating Value falls to +0.16 (effectively a Broker Consensus Rating downgrade to HOLD) and its Broker Consensus Target falls to $5.83 (22.2% undervalued).

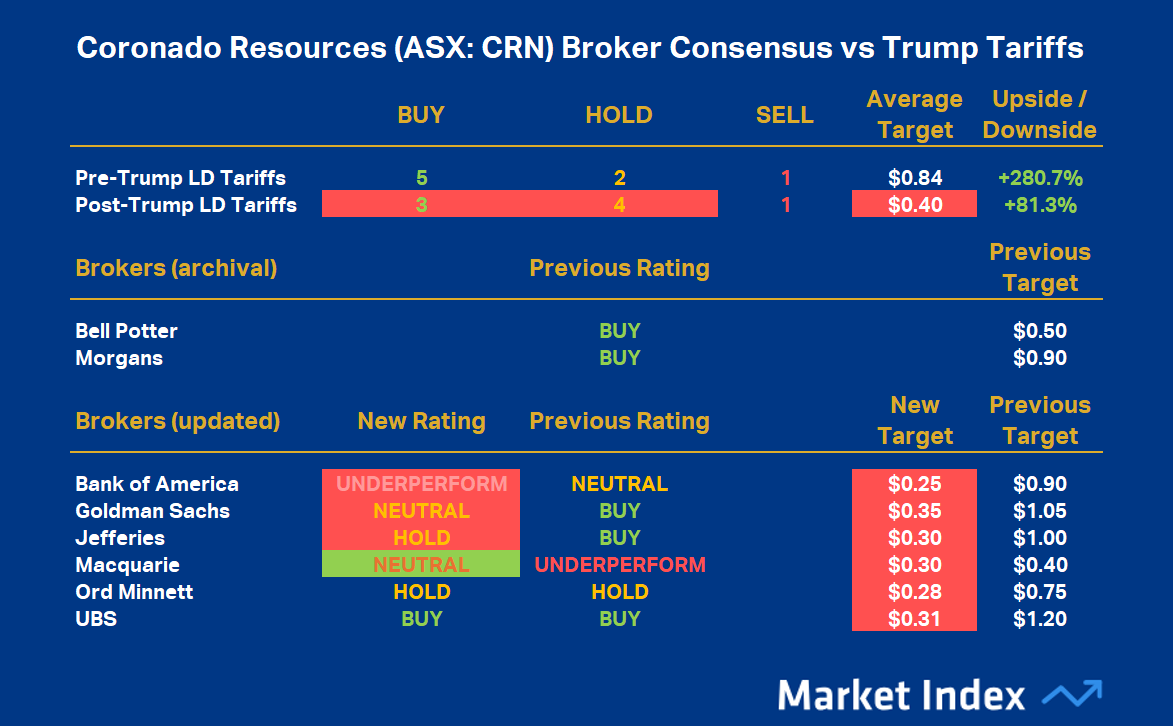

Coronado Global Resources (ASX: CRN)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

CRN’s average Rating Value is +0.25, resulting in a Broker Consensus Rating of HOLD. This is effectively a consensus downgrade from its prior average Rating Value of +0.50 and Broker Consensus Rating of BUY.

CRN’s Broker Consensus Target is $0.400 (down 52.4% from $0.840 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 81.3% undervalued based upon the closing price on Tuesday, 22 April of $0.220.

Note however, if we only consider broker updates received since 2 April, CRN’s average Rating Value falls to +0.00 (still a Broker Consensus Rating of HOLD) and its Broker Consensus Target falls to $0.30 (36.4% undervalued).

Group 4: Uranium BOE, PDN

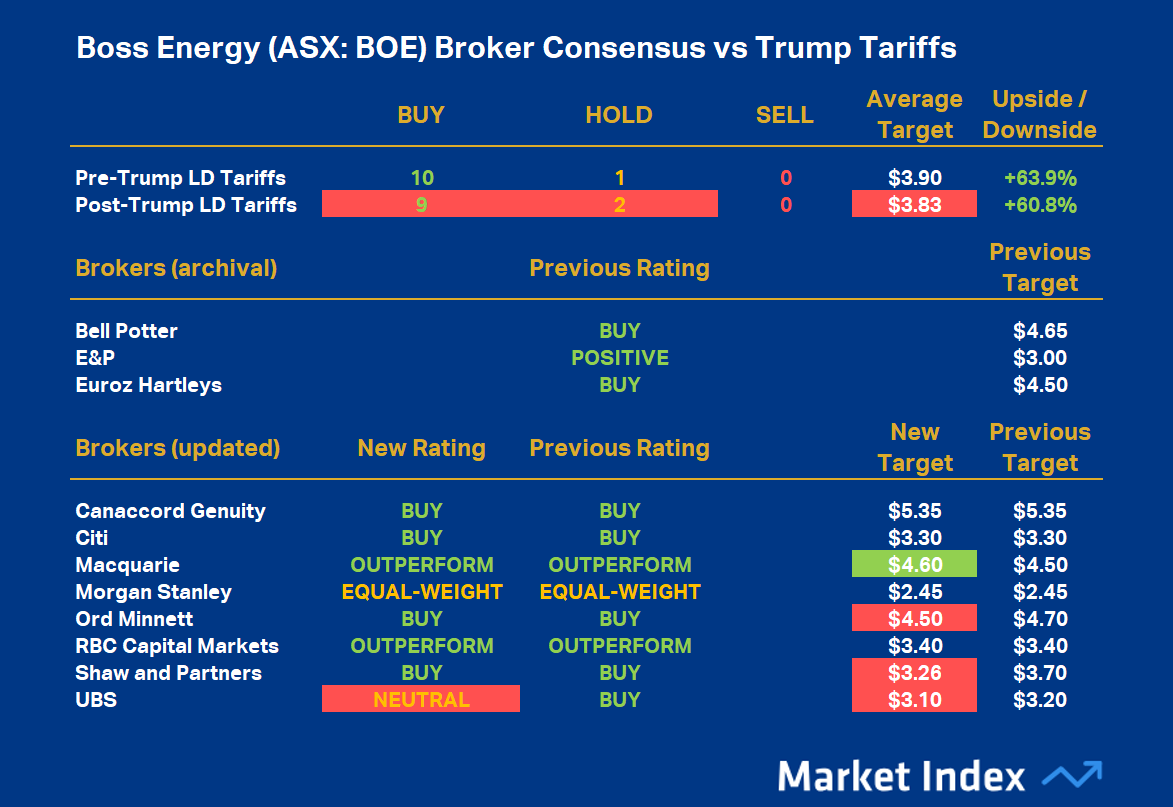

Boss Energy (ASX: BOE)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

BOE’s average Rating Value is +0.82, resulting in a Broker Consensus Rating of BUY. This is down from its prior average Rating Value of +0.91 and Broker Consensus Rating of BUY.

BOE’s Broker Consensus Target is $3.83 (down 1.8% from $3.90 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 60.8% undervalued based upon the closing price on Tuesday, 22 April of $2.38.

Note however, if we only consider broker updates received since 2 April, BOE’s average Rating Value falls to +0.75 (still a Broker Consensus Rating of BUY) and its Broker Consensus Target falls to $3.75 (57.6% undervalued).

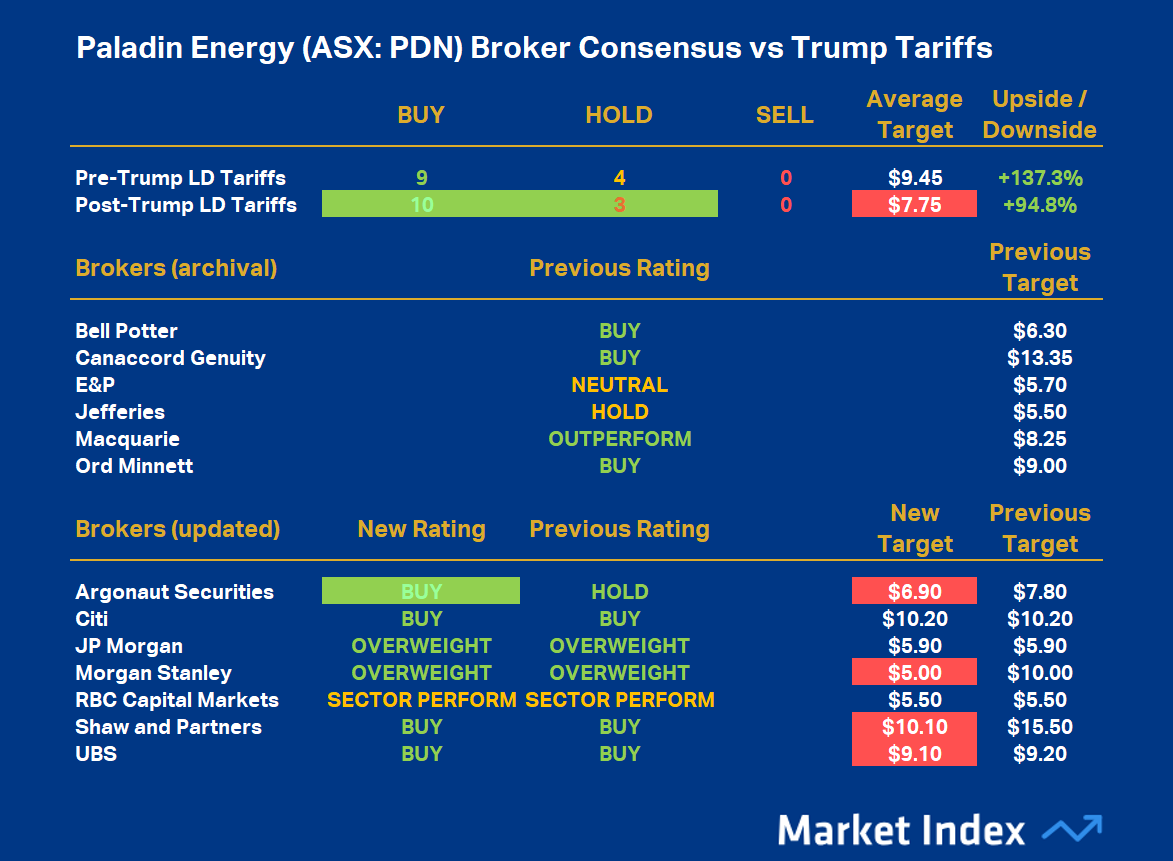

Paladin Energy (ASX: PDN)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

PDN’s average Rating Value is +0.77, resulting in a Broker Consensus Rating of BUY. This is up from its prior average Rating Value +0.69 and Broker Consensus Rating of BUY.

PDN’s Broker Consensus Target is $7.75 (down 17.9% from $9.45 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 94.8% undervalued based upon the closing price on Tuesday, 22 April of $3.98.

Note however, if we only consider broker updates received since 2 April, PDN’s average Rating Value rises even further to +0.85 (still a Broker Consensus Rating of BUY) but its Broker Consensus Target falls to $7.53 (89.2% undervalued).

Conclusions

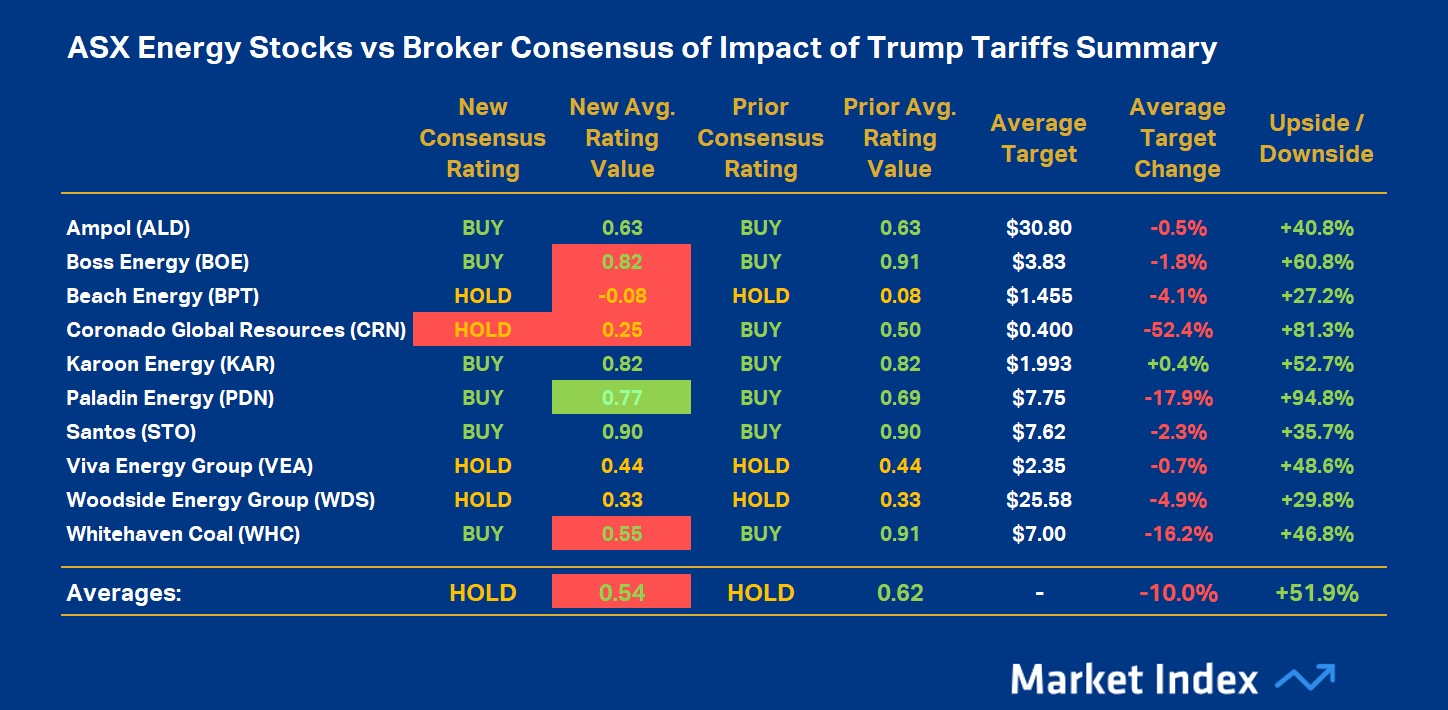

The big brokers have done the analysis, they’ve tweaked their valuation models, and through their new ratings and target prices, we can get a better idea of the likely impact of President Trump’s tariffs on ASX energy stocks.

Generally, the impact is likely to be negative, with target prices across the 10 major energy stocks covered here falling by around 10% on average. But this doesn’t mean the brokers aren’t seeing substantial value in our biggest energy companies.

If we look at the impact on average Rating Value, at 0.54 it’s still the equivalent of a BUY, albeit only just, and down modestly from 0.62 prior. Confirming this “still a buy” thesis, it’s clear from the average Upside/Downside to Broker Consensus Target of 51.9%, that the big brokers generally feel our biggest ASX energy stocks are substantially undervalued.

It's also worth highlighting specific winners, for example PDN, whose average Rating Value increased from +0.69 to +0.77, and ALD, as the only stock among the group to see its average Rating Value increase since 2 April (from +0.63 to +0.75). Both companies, however, still saw Broker Consensus Target declines – and substantially so for PDN. The only ASX stock among the group to see its Broker Consensus Target increase was KAR (from $1.985 to $1.993).

As for the biggest losers among the group. The big brokers generally saw fit to lop their targets for all 10 of the major energy stocks covered here, with CRN suffering the most – a massive 52.4% decline. CRN was also the only stock among the group to suffer a consensus rating downgrade (from HOLD to BUY). Stablemate coal producer WHC also deserves a special mention here, it only narrowly hung onto its consensus rating of BUY, as its average Rating Value dropped from 0.91 to 0.55.

One could argue there is a silver lining for these 10 ASX energy companies – the big brokers broadly consider their shares are undervalued – by at least 27.2% (BPT) and as much as 94.8% (PDN). Other notable standout Average Rating / Broker Consensus Rating / Broker Consensus Target Upside picks include: ALD (+0.63, BUY, +40.8%), WHC (+0.55, BUY, +46.8%), KAR (0.82, BUY, +52.7%), and BOE (+0.82, BUY, +60.8%).

Notes on Broker Consensus data: The data used in this sector review is a snapshot as of close of trading Tuesday 22 April. Brokers are regularly updating their views, ratings, and price targets for ASX stocks, and you should expect the ratings and price targets shown here to change over time.

This article first appeared on Market Index on Wednesday 23 April 2025.

5 topics

10 stocks mentioned