ASX insiders "buy the dip" at record levels in March quarter

Firstly, apologies that this quarterly 'insider moves' is a little late - there's been a bit going on in markets that we needed to cover. That said, this quarter's data makes for very interesting reading.

We know from both the research and our own observations in previous 'insider moves' updates that directors are adept at buying when their stock is 'cheap'. So with the ASX hammered from the mid-February high to the end of March (and beyond), who has been stepping up and filling their boots?

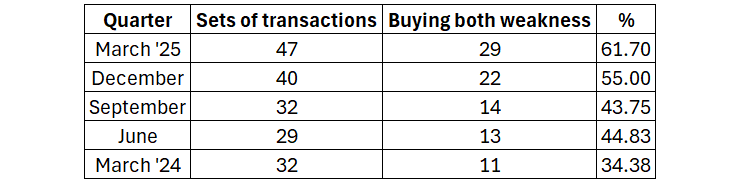

At a broad level, the quarter just gone saw a record number of sets of buying transactions over the past year - a 'set' is defined as three or more insiders making moves. Within those buying sets, we also saw a record percentage of buying on 3-month and 1-year weakness (buying both weakness) - see table below

Multiple insiders making moves

For those new to the series, here is some important background information.

When multiple insiders buy or sell, it can tell an interesting story. Don't forget that these insiders are all sitting around the same boardroom table and responding to the same stimulus.

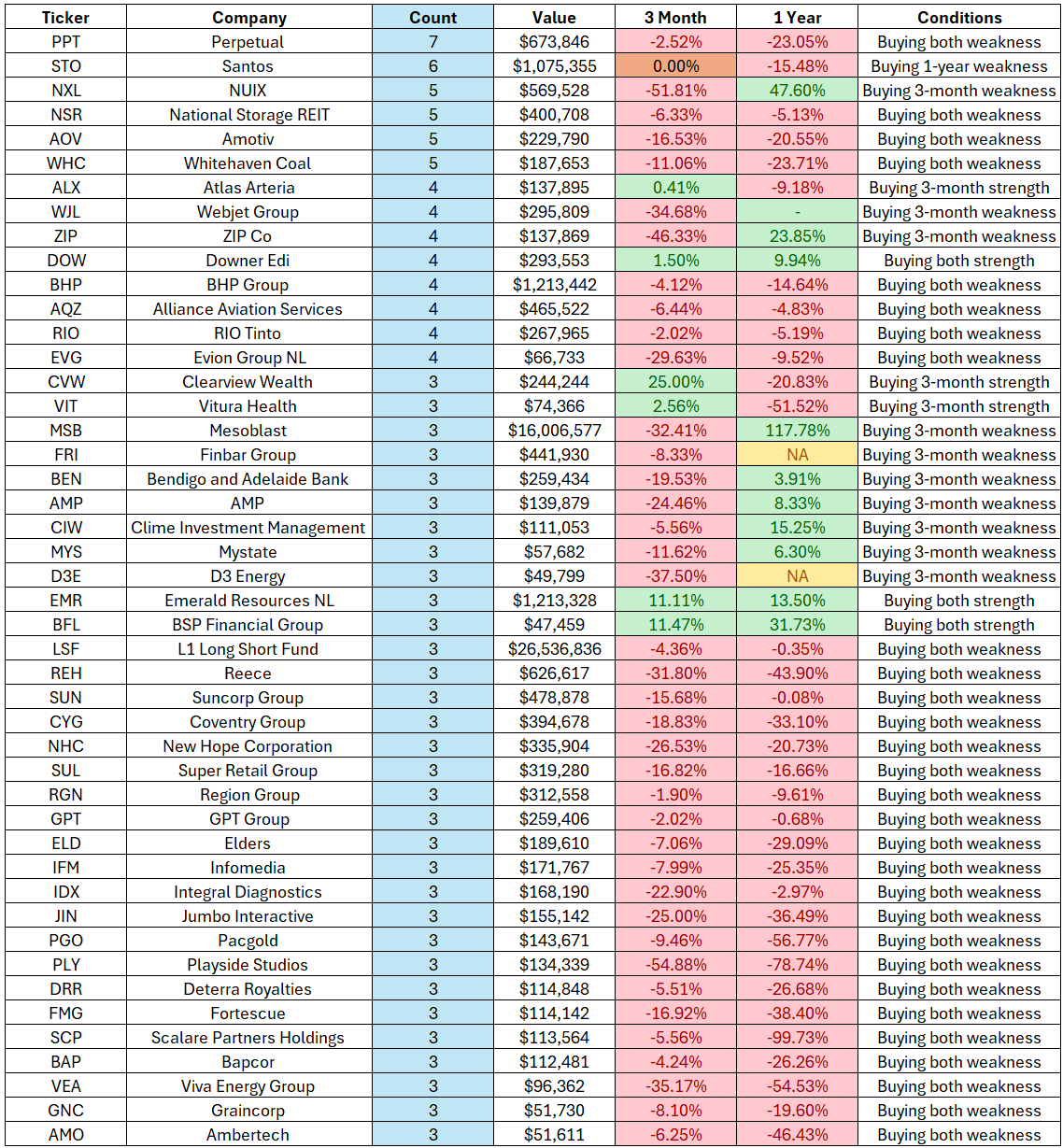

During the March quarter, 57 companies (up from 50 in the prior quarter) had three or more different insiders making moves - they are separated below into net buying and net selling. I've also analysed under what type of circumstances the transactions occurred, based on 3-month and 1-year performance share price performance.

As explained in the first wire that introduced this series, research shows that the percentage of insider trades decreases as the share price moves from 52-week lows, towards 52-week highs. Put simply, insiders buy more when their stocks are incredibly cheap, and buy less when they are expensive (or, as will be seen below, start selling).

It should come as no surprise that the main set of conditions under which insiders in the table below were buying was "buying both weakness"—which translates to buying stock when the share price is down over both a 3-month and 1-year period.

Please note that these are simply observations based on the data. We cannot possibly know the true motives of why any director buys or sells stock in their own company (unless they tell the market). The table below only includes on-market transactions. It does not include rights issues, participation in share purchase plans, options exercised, or dividend reinvestment plans.

Transactions that involved NET BUYING

- Of the 46 sets of transactions that involved NET BUYING, 29 of them saw that buying on both 3-month and 1-year weakness.

This is once again the dominant category in the data, which plays into the research outlined above, i.e., these are insiders buying when their stock is 'cheap'.

- 10 instances saw insiders buying on 3-month weakness (despite 1-year positive performance) - this cohort is 'buying the shorter dip'.

- 6 instances (3 each) saw insiders buying on both 3-month and 1-year strength or buying on 3-month strength - these are the momentum riders. both long-term and short-term.

Transactions that involved NET SELLING

- Of the Nine sets of transactions that involved NET SELLING, three instances saw insiders selling on both 3-month and 1-year weakness - perhaps getting out whilst they still can.

- Two instances saw insiders selling on both 3-month and 1-year strength - these are insiders selling when their stock has rallied.

Interesting Moves

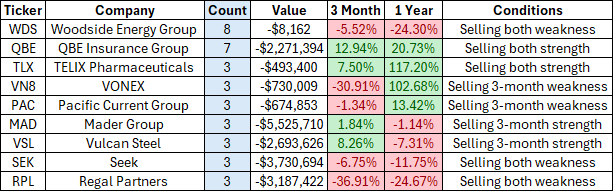

Woodside (ASX: WDS) recorded a small negative sum of insider transactions but the breakdown is quite fascinating. A $183,342 sell down by CEO Meg O'Neil was largely offset by buying from seven other directors, with parcels ranging from $9,403 to $46,318.

Woodside has landed itself in a challenging spot, with the stock down 34% year-to-date and around 50% from its September 2023 high.

"The increasingly discounted implied oil price suggests the equity could be presenting a deep value opportunity which could play out if tariffs unwind or fiscal stimulus packages are announced," Citi analysts said in a note earlier this month.

"These risks however are balanced with downside risks which may see a more prolonged bear market and even softer commodity prices."

The potential long-term value at current prices may have encouraged broad (but small) buying from Woodside insiders.

%20Share%20Price%20-%20Market%20Index.png)

Similarly, six unique QBE Insurance (ASX: QBE) directors bought parcels that range between $21,483 to $68,292, offset by a sizeable $2.47 million sell down by CEO Andrew Horton.

QBE has been a strong performer over the past one and two years, up 18% and 40% respectively. This strong performance is in-line with the broader insurance sector, driven by favourable conditions like rising interest rates, which enhance returns on fixed-income assets, and a supportive premium rate environment that has bolstered profitability.

Despite the recent share price run, most analysts, including Morgan Stanley, Macquarie and Goldman Sachs, see more upside ahead due to:

- Valuation is not demanding at ~11x FY26e EPS compared to historical average of ~13%.

- Bond yields remain elevated amid upside inflation risks and anchored inflation expectations.

- QBE upgraded its combined operating ratio (COR) guidance during its FY24 result (21-Feb).

While Mr Horton is selling into strength, it is understandable why the broader set of directors are topping up their positions.

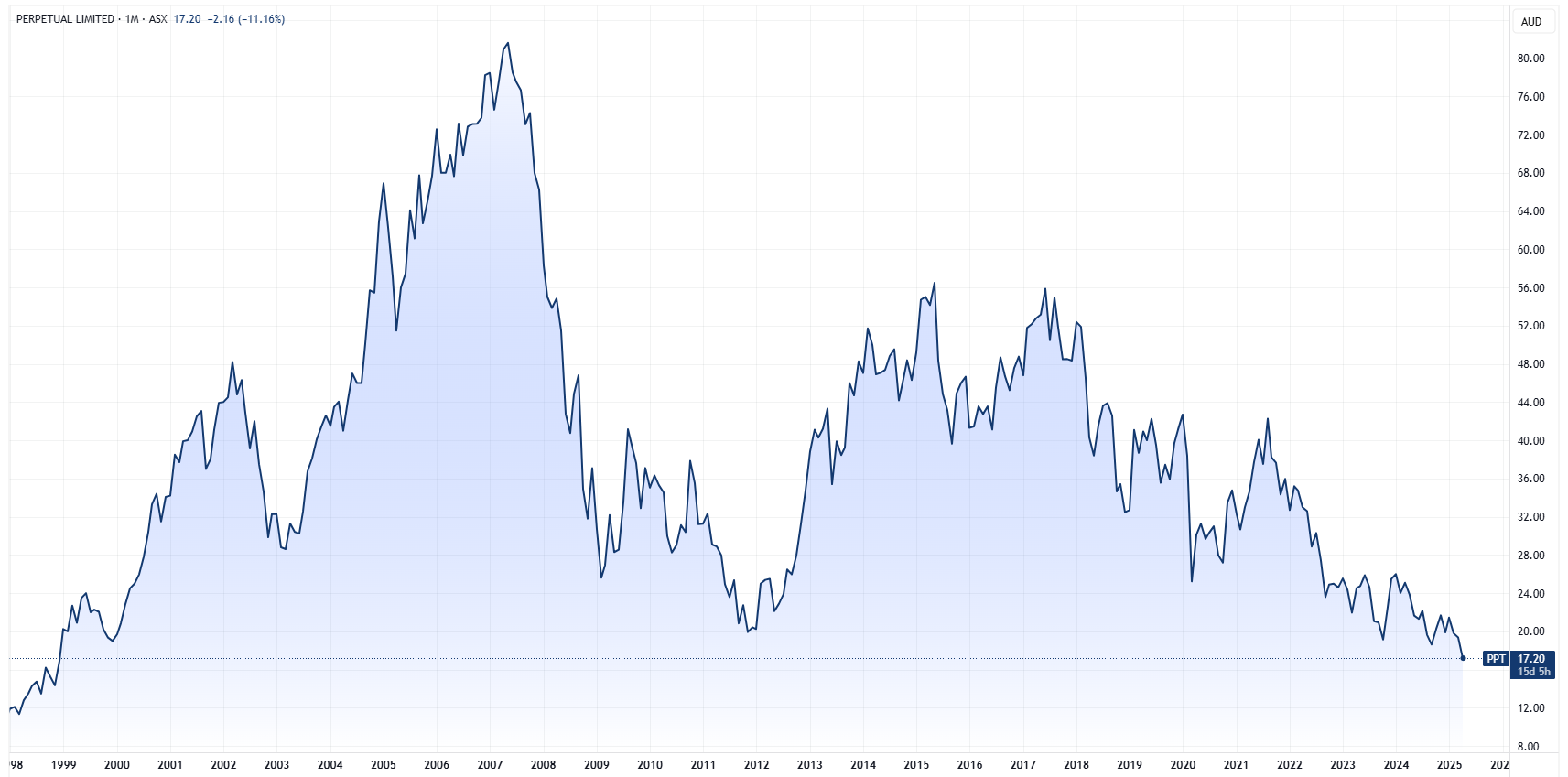

Perpetual (ASX: PPT) has seen broad-based buying from 7 unique directors, across 11 separate transactions, totalling $673,846.

The stock experienced a sharp 15% selloff (26-27 Feb) following the release of its half-year FY25 result. The persistent selling pressure plus recent market volatility has dragged the stock down 32% in the past twelve months.

"Although we can understand the sell-off in PPT stock post result, in our view, it leaves the stock looking inexpensive," said Citi analysts in a note dated 27 February.

"However, looking through this, Corporate Trust should be a relatively high multiple business and Wealth Management should attract a price sufficient to allow Perpetual to extinguish much of its debt, even taking tax into account."

Despite the potential value play, the analysts flagged a broad range of risks including:

- Significant one-off costs

- Market scepticism about the company's ability to deliver on cost savings targets

- Gearing is relatively high and could become more "uncomfortable" if the market were to correct significantly.

The recent selloff has dragged Perpetual shares down to levels not seen since 1998.

Helia (ASX: HLI) may have just experienced one of the most unfortunately timed CEO sell downs in recent quarters. The stock took a brutal 25% hit on Monday 24 March after the company said that its key client, Commonwealth Bank, had entered exclusive talks with a rival lenders mortgage insurance provider. This is a significant blow for Helia, as the CBA contract accounted for approximately 44% of its gross written premiums in FY24, making it a cornerstone of the company’s revenue stream.

Helia had first disclosed in June 2024 that CBA was exploring alternative LMI providers, so the market had some prior notice of the potential risk.

Leading into the announcement, CEO Pauline Blight-Johnston offloaded roughly 393,000 shares ($2.3 million) across seven separate transactions. This reduced her stake by nearly half, leaving her with 420,630 shares.

%20Share%20Price%20-%20Market%20Index.png)

4 topics

4 stocks mentioned