Aussie investors are missing out on a big opportunity

In 2020, 35% of Australians held shares directly, with a quarter of investors buying shares for the first time in the past two years. But while many of us own shares, only 15% of Aussie investors directly own international shares – that’s 5% of all Australians - and the percentage that own shares in small and medium-sized (SMID cap) international companies is even lower.

Why do so few Australians own global SMID caps?

I see two main reasons: the first is the difficulty of access. There are only around 30 funds available in Australia with some exposure to global SMID caps and it’s only relatively recently that online broking platforms allowed investors to buy international shares directly. The second reason is that many direct investors lack confidence in picking stocks themselves. There are nearly 8,000 stocks available in the global SMID index, an enormous choice, and there’s often limited information available on each stock, particularly for smaller markets and foreign language markets. This makes it more difficult for investors to confidently choose individual stocks, as they lack the wealth of material and professional analysis that is available for larger companies.

Despite the difficulties, I see three main reasons that Australians should consider adding global SMIDs to their investment portfolios: diversification, performance, and the opportunity to capitalise on inefficiencies.

1. Diversification benefits of global SMIDs

The Australian sharemarket represents around only 2% of the total investable global sharemarket. While markets are, in general, closely intertwined, limiting your portfolio to companies domiciled in Australia naturally narrows access to the huge diversity of markets, economic cycles, and underlying business drivers that operate simultaneously across the globe.

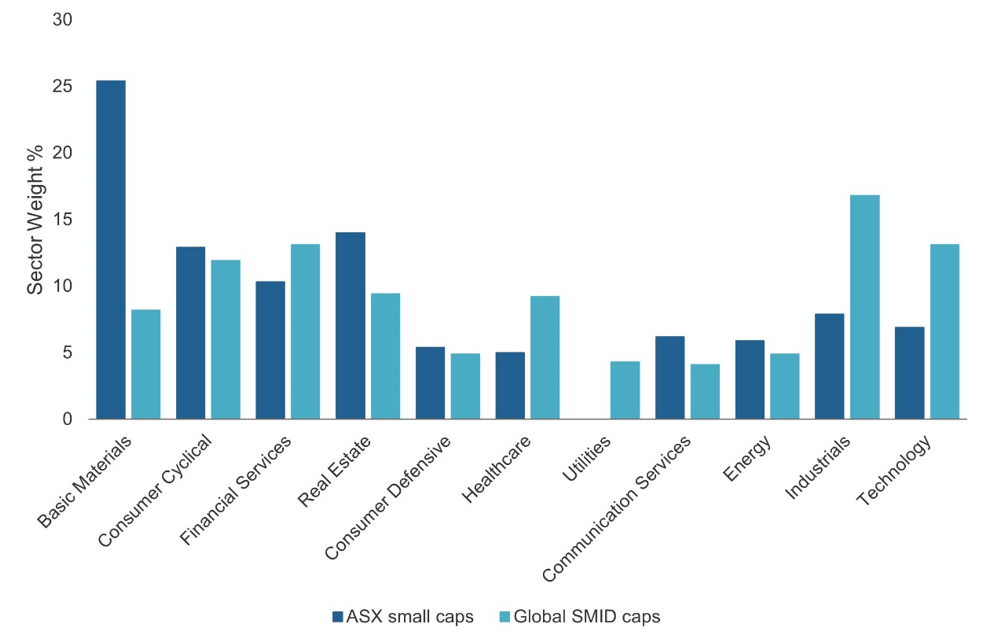

As well as introducing greater geographic diversity, investing in global equities also increases sectoral diversity. The S&P ASX small caps has a very high percentage of Materials (25%), but a relatively small allocation to Technology (7%) whereas the comparative global benchmark, the MSCI ACWI SMID Cap Index, has only 8% Materials, but nearly twice as large an exposure to Technology (13%). There are other significant differences in the comparative weightings of sectors like Real Estate, Healthcare, Industrials and Utilities as you can see in the charts below:

Morningstar, June 2022

Another diversification benefit that global SMID-caps offer is size. While some global SMIDs are indeed very small, other companies within the global SMID-cap universe are larger than some Australian large-caps, due to the comparative size of the markets. Australian large caps are generally considered to be over A$10 billion, there are currently 760 companies over A$10 billion on the MSCI ACWI SMID Cap Index, and the largest company is A$90 billion – around the same size as CSL, Australia’s third largest company.

2. SMIDs offer better returns than large caps

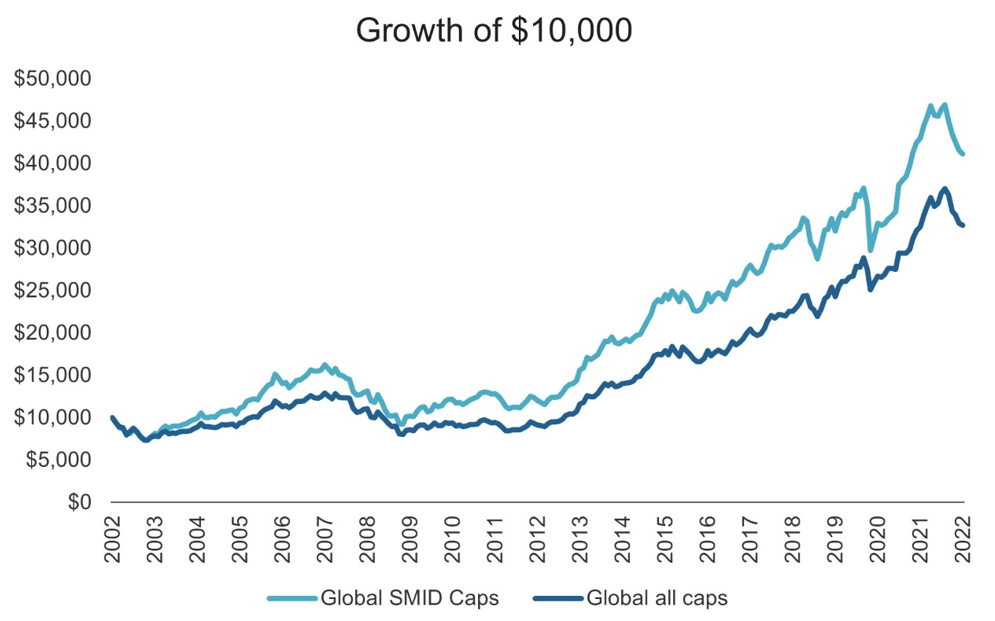

If you look at the relative performance of global SMID caps compared to global large caps over the past 20 years, they’ve clearly delivered better returns in the long-term. This can be seen in the graph below where, if you invested $10,000 in global SMID caps (MSCI ACWI SMID) in January 2001, by the end of April 2022 your investment would have grown to $39,309. Whereas $10,000 invested in the comparable global large cap index (MSCI ACWI) over the same timeframe would have grown to $26,485 – a difference of $12,824.

Past performance is not a reliable indicator of future performance.

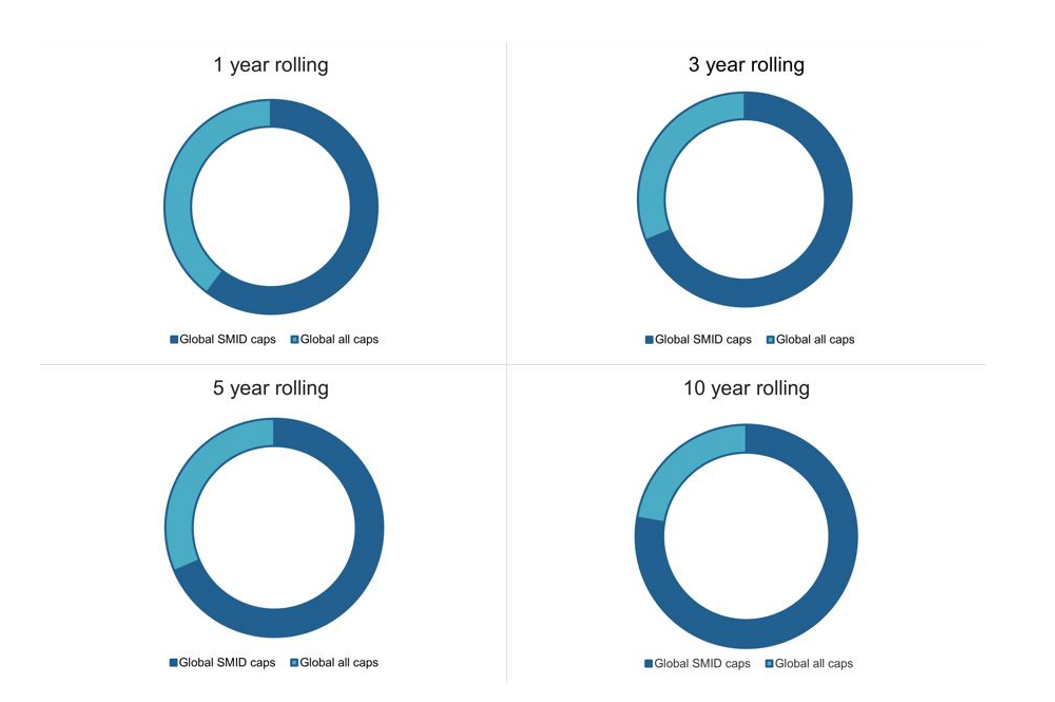

Of course, returns for a specific time period can change significantly depending on the start and end dates selected, so looking at rolling returns over the same 20-year period gives a better indication of how often global SMIDs outperform global large caps (rolling returns split the period into multiple monthly increments of the same time period). For 1-year rolling returns over the 20-year period, global SMID caps outperformed global large caps 63% of the time. The difference in relative performance becomes starker the longer the investment period.

Over that same 20-year period global SMIDS outperformed global large caps:

- 69% of the time for 3-year rolling returns

- 69% of the time for 5-year rolling returns

- And 78% of the time for 10-year rolling returns

Past performance is not a reliable indicator of future performance.

3. The inefficiency opportunity

There are two key drivers of inefficiencies in a sharemarket:

- The number of stocks and

- The quality of research on each stock.

In the global SMID cap market (MSCI ACWI SMID) you have nearly 8,000 companies spread across 47 countries (around half are developing countries), speaking multiple different languages and subject to a very wide array of different market forces and economic conditions. Compare this to the S&P ASX Small Ordinaries where you have around 200 companies which are much more similar in terms of the external forces affecting them.

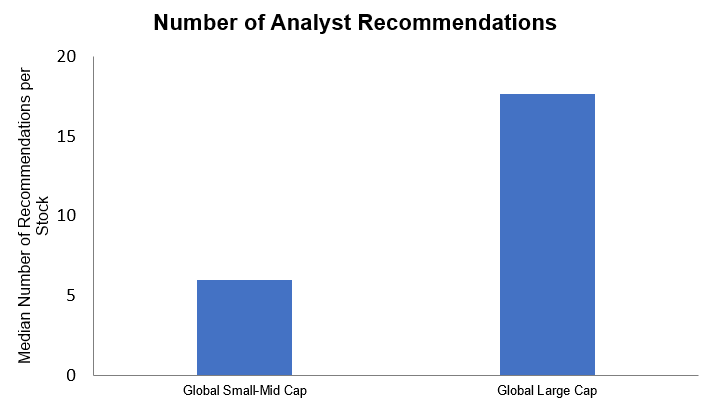

The sheer size, and diversity, of the global small and mid-cap market makes it much more difficult for investors to develop high quality, in-depth stock research. This means that many companies are under-researched, and not well understood by the market in general. This is illustrated in the chart below which shows that there are 3-4 times as many analyst recommendations per stock for companies in the large cap index compared to the small cap index.

Source: Factset, July 2022

This develops inefficiencies, or asymmetries, that are much larger in global SMID caps than in larger caps (or Aussie small caps) and so greater opportunities for astute investors to outperform the benchmark.

Summarising the opportunities in global SMID caps

Global SMID caps offer great potential for Australian investors. They offer significant diversification benefits in geography, size and sector for investors with all-Australian portfolios. They have also offered investors better returns than global large caps for a high percentage of the last 20 years.

Lastly, global SMID caps could be a particularly fruitful hunting ground, right now, for investors looking for stocks with the potential to outperform. Such a large, little-understood index of companies almost always acts more inefficiently than a smaller, more closely monitored index. And these inefficiencies are particularly pronounced right now as high recent volatility has caused significant repricing, and so significant opportunity, across the global SMID cap index.

Access global SMID caps without the work

Investors Mutual has partnered with Houston-based investment manager Vaughan Nelson to give Australian investors access to the Vaughan Nelson Global Equity SMID Fund (ASX:VNGS). To find out more, please visit our website.

4 topics