Australia’s credit zombies are nowhere to be found

Last month we presented our views on the reflation trade and potential impacts on credit returns, concluding that the strong recovery in Australian economic growth should provide sufficient room for higher bond yields and relatively stable credit margins. As a follow-up, this month we analyse the respective risk and return profiles of our Australian credit portfolios with comparable credit portfolios/indices in the United States (US) market.

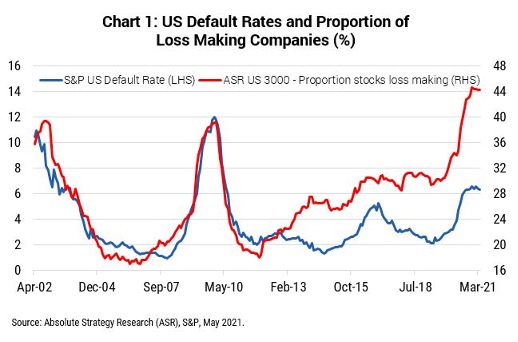

Starting with risk, there is little doubt the number of corporate zombies in the US has now reached eye-watering levels, far more than the numbers likely envisaged in The Hooters song “All you Zombies” (1983, which makes us feel very old). Currently, the percentage of loss-making businesses amongst the top 3,000 US corporates exceeds the heights of both the tech bubble and the GFC, with just under 1 in 2 in the red (refer to Chart 1).

While we expect the COVID-19 vaccine rollout and stronger US growth will reduce those numbers in coming quarters, the prospect of higher bond yields going forward may see the relationship between default rates and loss-making companies revert, with refinancing becoming more costly. In the post-GFC era of quantitative easing (QE), the relationship between the two variables has broken down, with masses of liquidity enabling loss-making corporates to more readily refinance debt. The differential between the two variables has now reached a two-decade wide.

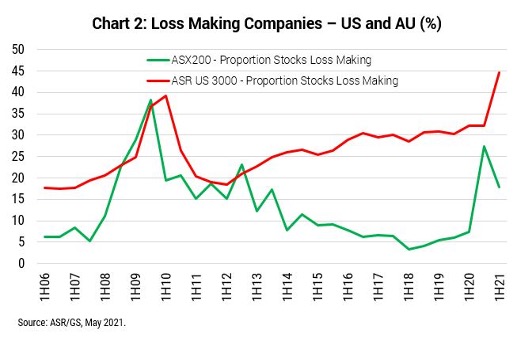

While reflation and the prospect of higher interest rates may increase defaults in the US, Australian corporates are in a far stronger position. Having only recently employed QE, Australian zombies are missing in action compared to the US. The pandemic induced surge in loss-making corporates in the ASX 200 has begun to quickly normalize, as the economy recovers and is much lower than the US (refer to Chart 2). Moreover, a significant proportion of the recent increase in Australia’s number of loss-making corporates is due to the nascent growth in homegrown technology listings who typically hold little or no debt (but have higher start-up costs).

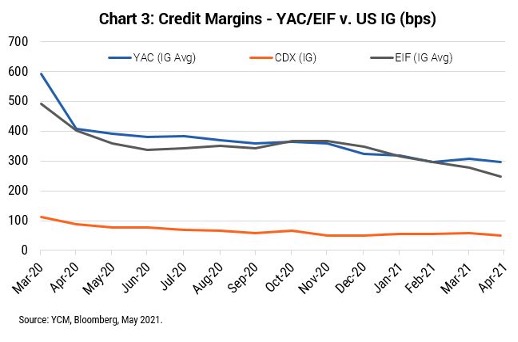

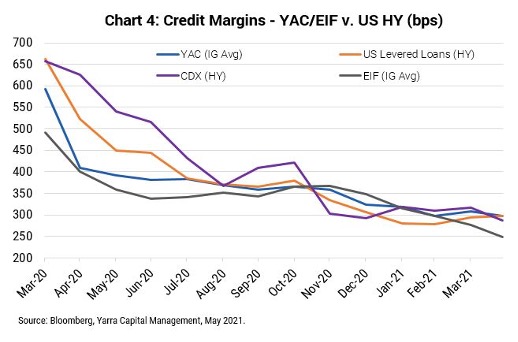

While we remain comfortable that Australian credit remains well placed compared to the US in absolute risk terms, how do returns on Yarra’s own average investment grade (IG) portfolios compare?

Pleasingly, credit margins on both the Yarra Absolute Credit Fund (YAC) and the Yarra Enhanced Income Fund (EIF) are consistently either much higher or equivalent to similar and inferior rated US portfolios/indices (refer Charts 3 and 4). For instance, despite being of far superior credit quality, with IG triple B average portfolio credit ratings, YAC and EIF’s credit margins are equivalent to far riskier sub-IG BB-rated US Levered Loans and CDX High Yield.

Putting it more simply, investors in Yarra's portfolios have seen a far higher return for the level of risk carried, with our Absolute Credit Fund and Enhanced Income Fund delivering strong 12-month returns* (8.9% and 9.6% (incl. franking) respectively). We remain confident in the higher risk-adjusted returns available in Australian credit and the sustainability of the current 3.5-4.0% yields on offer across both funds.

Want to learn more?

We offer fixed income and multi-asset products, aimed at meeting the needs of investors seeking regular stable income, diversification benefits and capital stability. Stay up to date with all our latest insights by hitting the follow button below, or visit our website for more information.

3 topics