Australia's property outlook for 2023

As we move into 2023, there continues to be a mix of factors affecting the Australian property market. While the country’s economic and financial outlook faces many challenges in the coming year, there are some bright spots, if you know where to look. In this article, we spotlight some of the key factors underpinning the performance of the various Australian property market sectors.

Residential property market outlook

The residential property market experienced extraordinary growth fuelled in part by a post-lockdown bounce-back in 2021. Much lower volumes hit the market in 2022, with interest rate hikes and rising inflation causing a slowdown. As these conditions continue to create a level of uncertainty in the marketplace, moving forward, the market in general will hinge on the effects of interest rate rises.

Further increases in interest rates and low consumer confidence could push the housing market deeper into a downturn. Around 60% of record-low fixed-term mortgages secured in 2021 are set to expire this year, rolling back into an environment where the average new variable rates are sitting between 5-6%. This will be a major test for the stability of the housing market around the country. While the majority of homeowners will still be able to sell their homes, there may be some additional supply hitting the market as people need to sell which would likely put further downward pressure on Australian housing prices.

Will there be a housing market crash?

While a lot of the Australian property news is focused on a potential housing market crash, it is important to place market performance into context, as we can learn from previous price cycles to help shape our understanding of what could lie ahead.

Residential property markets in Australia are known for their roller coaster property price cycles. While overall the Australian property market is in a downturn, not all of the nation’s property markets are being impacted equally. Each State is at its own stage of the property cycle and within each capital city there are multiple markets with property values falling in some locations, and stable in others and there are a few locations where housing values are still rising.

The Mornington Peninsula rated in the top-10 suburbs for strongest growth in Victoria (Nov 22). (Unsplash: Pat Whelen)

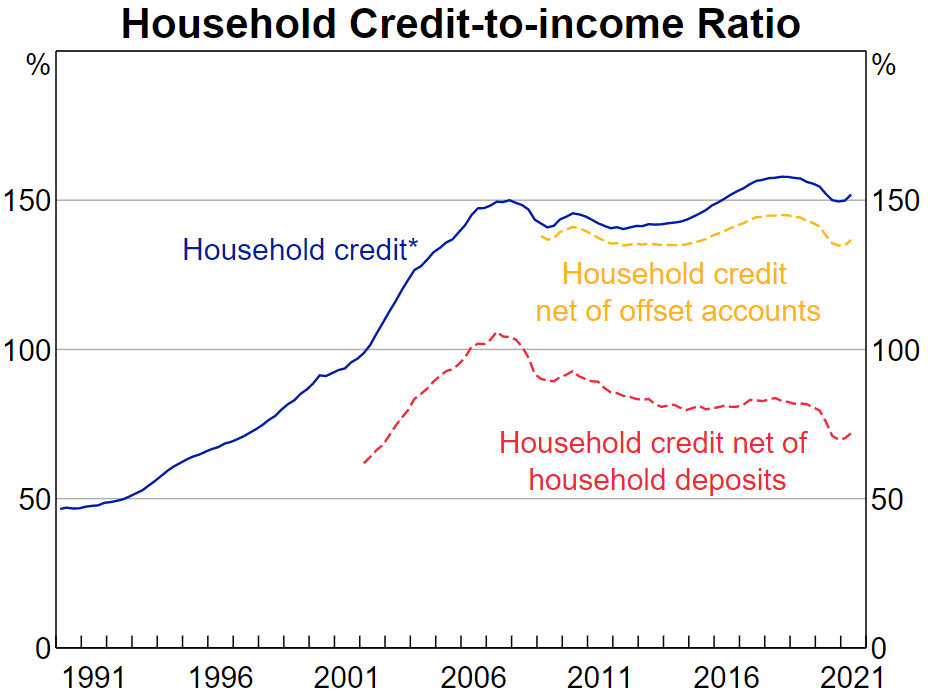

We are currently in what market commentators refer to as the adjustment phase of the property cycle. Some commentators believe this correction had to occur after house prices across the country got ahead of themselves. By both historical standards and global standards, household debt to household income in Australia, had risen to significantly high levels, driven largely by the size of mortgage debt held by households1. While interest rate rises affect the market, they are only one factor affecting home prices.

RBA Household Credit-to-income Ratio Graph

*Sum of housing credit and personal credit; housing credit nets out amounts in redraw facilities. Sources: ABS; APRA; RBA

We are currently in what market commentators refer to as the adjustment phase of the property cycle. Some commentators believe this correction had to occur after house prices across the country got ahead of themselves. By both historical standards and global standards, household debt to household income in Australia, had risen to significantly high levels, driven largely by the size of mortgage debt held by households1. While interest rate rises affect the market, they are only one factor affecting home prices.

Property markets ‘crash’ when there are forced sellers and nobody on the other side of the transaction to purchase their properties, meaning they must sell at very significant discounts. Those people selling their homes are also generally home buyers. The only reason they would be forced to sell is if they were not able to keep up with their mortgage payments, which happens when mortgage costs (interest rates) rise too high. Despite rising interest rates, they are likely going to get to where they were pre-pandemic and borrowers could cope then. Another factor that would cause a crash is when unemployment levels are high, however, that is not the case in Australia.

Demand for new developments remains strong

Low rental vacancy rates across the country indicate there continues to be strong demand for new developments, particularly apartments. Low supply continues to be the biggest issue in the apartment market right across the country, as surging development costs are cutting the supply of new apartments. As immigration resumes post-COVID and buyers, in particular owner-occupiers and downsizers, look towards more affordable apartments, demand is far outstripping supply. Immigration alone is expected to add an additional 2.3 million people to the Australian population over the next 10 years2. These individuals will all need homes and this demand represents a significant potential stimulus to the housing construction industry.

Rising interest rates are creating uncertainty to investor demand and construction costs are a challenge. However, the currently strong rental markets and forecast immigration present a compelling thesis for property development exposure.

Commercial property market outlook

The COVID-19 pandemic saw the biggest-ever shift in workplace culture over the past three years, with office workers now spending up to half the week working from home. The complete overhaul of the way people work resulted in a vast amount of office space going empty, with landlords offering huge discounts and benefits to attract tenants. A sizeable volume of office space remains vacant or below capacity, particularly in periphery CBD locations. While it’s unlikely the hybrid working preferences will change significantly in 2023, some experts are predicting these office spaces will be repurposed with plans for high-density residential apartments and student accommodation as well as childcare centres and warehouses moving in.

A unique set of opportunities and challenges

According to the Real Estate Institute of Australia’s (REIA) recently released ‘State of the Industry’ report, commercial property will outperform in regional areas in the future. The report suggests regional markets offer comparative growth opportunities for both rents and yields as interstate migration patterns continue to evolve.

While rising energy prices will have a major impact on outgoings, the OECD is forecasting Australia’s economy to outperform many other advanced economies. As international migration resumes at a significant scale, with an anticipated 235,000 people set to call Australia home next financial year, REIA president Hayden Groves, says the changing factors offer a unique set of opportunities and challenges for the commercial property market in 2023.

Providing insights on how the commercial sector will fare given these conditions, the REIA report said that while the risk premium on commercial property is tight, the sector should return to supply/demand rebalance relatively quickly as supply slows over the next few years and demand strengthens.

The report also noted that energy-efficient buildings with great base building offerings and tenant amenities still offer good long-term value for investors.

Apartment buildings with bio-wall and heliostat with motorised mirrors in Sydney Australia.

The Savills Australia 2023 Spotlight research report suggests that commercial property investment will bounce back in 2023, with one of the main drivers including clearer outlooks for interest rates.

Industrial property market outlook

While office assets may be in flux, industrial real estate has enjoyed a stellar run in recent years. A resilience to the COVID-19 pandemic created enormous buyer demand in the industrial property market, with an unprecedented appetite for logistics and warehouse premises.

Trends underpinning the solid performance of the industrial sector

As the pandemic accelerated changes in consumer preferences, especially around online shopping, demand for warehouse space has been running at historically high levels. Industrial vacancy rates tumbled to just 0.8% in the first half of 2022, making Australia the tightest logistics market in the world. With all capital cities suffering from a lack of supply, super prime industrial rents jumped up 13% in the 12 months to June, according to CBRE.

The pandemic-induced disruption of global supply chains also had a significant impact on the demand for industrial property. As supply chains were highly volatile throughout the pandemic, logistics occupiers looked to hold more stock to address supply chain risks, particularly in Sydney and Melbourne. Trade tensions also pushed businesses to reassess the resilience of their networks, which has dramatically boosted demand for industrial and logistics space in strategic locations close to major markets.

Overall, investors see enduring potential in the industrial property market, with demand expected to continue outpacing supply throughout 2023. One of the biggest challenges now facing the sector is a lack of future development and high pre-leasing occupancy on new builds.

Looking for a property-based investment opportunity?

Trilogy Funds offers different types of property-based funds which could help you diversify your investment mix by providing you exposure to a range of property assets.

3 topics

2 funds mentioned