Australia's top performing fund managers

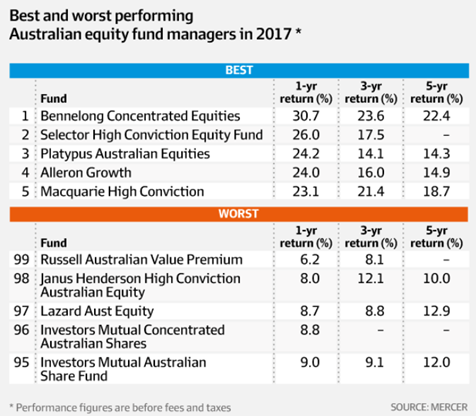

I keep a track of what some of the better fund managers are doing. It is all part of my "Flow Analysis" highlighted in this article. Below is a table from the AFR on 25/1/2018 listing the best and worst performing fund managers last year. One way to track what they are doing is to go onto their websites and they will be only too happy to tell you about their funds and let you read their monthly or quarterly reports which usually includes their top 20.

I keep track of them through substantial shareholders notices as well and my (bloody expensive) systems allow me to track fund managers and their latest purchases and sales which is essential information before making a move in midcaps. You might want to add the top five funds on this list to your bookmarks and check in on them on a regular basis.

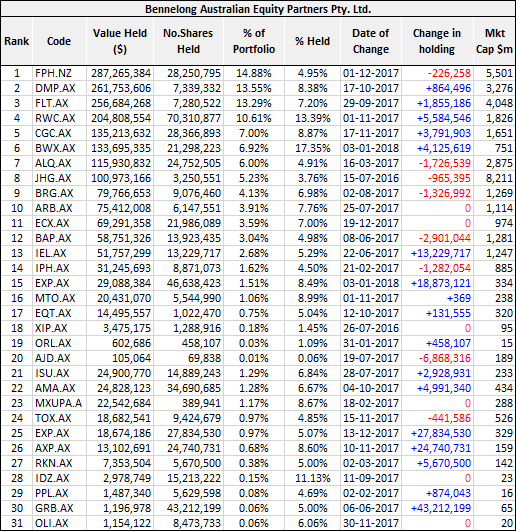

Bennelong Concentrated Equities - Holds between 20 and 35 high conviction stocks. Focus on capital growth. Target return is 4% above the ASX 300 accumulation index on a rolling three-year basis. It is run by a guy called Mark East. They have a 15% performance fee. Main holdings – CSL, BWX, ALL, FLT, RWC plus EXP, CGC, TWE, MTO, DMP, RHC, FPH, IEL - CLICK HERE

Here are the top Bennelong holdings and recent movements (may not reflect this particular fund).

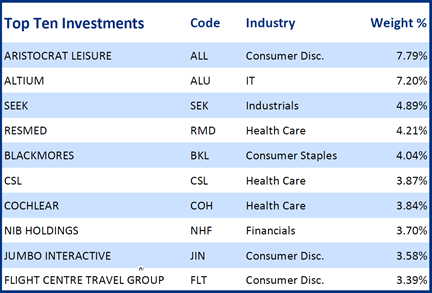

Selector Funds Management - The Selector Ex-50 High Conviction Equity Fund excludes the top 50 stocks. The business was founded by Tony Scenna and Corey Vincent. They say the greatest value lies in the smaller, less researched businesses. They are both high conviction and “index agnostic”. They typically hold 15-30 stocks with cash of 0-20%. They have a maximum holding size of 5% at cost and 10% at market price. The benchmark is the ASX All Ordinaries accumulation index. They have a 20% performance fee. They say stock selection is a four-step process including (1) Quantitative screening (2) Best ideas shortlist (3) Detailed qualitative research (4) Portfolio construction. CLICK HERE Top 10 holdings below:

Platypus Australian Equities - This is a high conviction growth fund with a small bias. They hold 25-35 stocks. The benchmark is the ASX 300 accumulation index. Top five holdings include big stocks, which suggests that they are “index aware” - they include BHP, WBC, MQG, CSL, ALL. 58% of the fund is in the top 50 stocks. 28% is in financials 18% is in healthcare. At the moment they have just 1.4% cash. They have a performance fee of 15.375%. They recently bought NXT, sold ASG, added to ALL and took the IPO in WGN. They also hold CTD, IEL, MQG and WOW having sold CBA. CLICK HERE

Alleron Growth – The Alleron Growth High Conviction Equity fund invests in 25-35 stocks “on an index independent basis”. They talk about buying undervalued stocks to have a margin of safety and a real possibility for transformational growth. They say a “valuation edge occurs when the short-term price behaviour fails to reflect longer-term fundamental factors. Stocks held include ELD, LOV, OZL, JHC, COH, MND, NAN, NXT, QBE, OSH. They have reduced holdings in MIN and SYD and added to MQG. CLICK HERE – Top Ten holdings - not sure they are quite as “index independent” after all. They have 85% of their fund in the top 100 stocks:

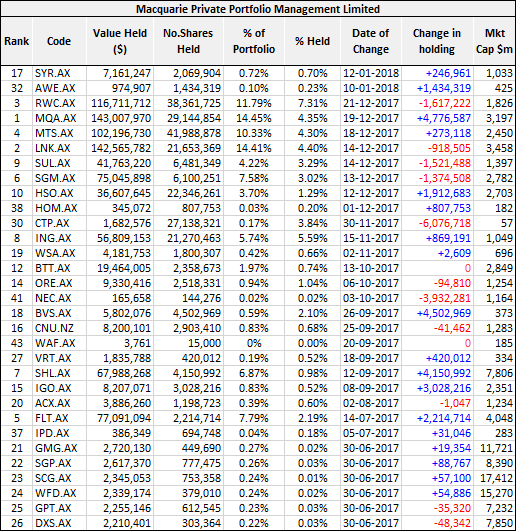

Macquarie High Conviction – This is a concentrated Australian equities portfolio with an ASX 200 accumulation index benchmark. The fund is over $1 billion. They have a 15% outperformance fee. They typically hold less than 25-30 stocks. They also invest in derivatives. It is run by Mark Harrison. Stocks they hold include BSL, MTS, WFD, BHP, QAN, RMD. CLICK HERE

This is a table of Macquarie Private holdings (which may or may not relate to this particular Macquarie Fund).

There are many other top performing midcap fund managers. These are only the best in 2017. We keep a track of about 30. They include Wilson Asset Management, Thorney, Greencape, Acorn, Realindex (Macquarie again), Cadence, Colonial First State, Norges Bank, Dimensional, Cyan, Challenger, Pengana, Paradice, Forager, PM Capital, Perennial (email me if I’ve missed one). And we are constantly adding to the list as we spot interesting substantial shareholders holding quality stocks.

Marcus Padley is the author of the Marcus Today stock market newsletter. To sign up for a 14-day free trial please click here.

1 topic