Australian CPI rose 5.2% y/y, US final GDP grew 2.1% q/q

Another choppy week for global equity markets. During the week, we moved office to 402/6a Glen St, Milsons Point, NSW. Visitors welcome!

If you would prefer to watch than read, please click below:

Let’s hop straight into five of the biggest developments this week.

1. Australia’s CPI y/y rose 5.2%

The annual inflation reading for the year to August ticked up 5.2%. It rose from the previous 4.9% which was in line with market expectation, as rising petroleum prices standing out as the main driver. This was a tacit sign that price elevation is creeping back into the economy and markets await the RBA’s interpretation of these developments.

2. Spanish flash CPI y/y surged 3.5% for September

The Eurozone is facing unprecedented economic headwinds after Spanish flash CPI rose 3.5% for the twelve months to September. The significant rise from the previous 2.6% was priced in by markets with power and petroleum prices accounting for the differential. Europe is caught in a balancing act where inflation is on the ascendance while interest rates are at historic highs.

3. German IFO business climate fell to 85.7 in September

The German business climate deteriorated further in September to 85.7, from the 85.8 upward revised figure in August. The regression was much slower than expected as markets anticipated a slump to 85.2. The slower deterioration is partly due to revelations that Germany was making a backdoor arrangement to buy cheaper Russian gas in the summer, a deal that could shield it from the worsening energy crisis in Europe.

4. US consumer confidence fell to 103.0 in September

US consumer confidence declined for a second consecutive month with a report of 103.0 from the upward revision of 108.7 in August. The major cause of waning confidence is income worries as strikes currently witnessed in the motor industry are prolonged. Rising prices was also a notable concern as petroleum prices soared.

5. US final GDP q/q grew 2.1%

The US economy grew by 2.1% in the second quarter of 2023, growing at the same pace as the first quarter. This showed relative strength and resilience despite the sustained interest rates hikes. This was however at a slower rate than the 2.2% forecasted by markets. Consumer and government spending accounted for the lion’s share of the reported growth.

Below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Oats surged on rising demand and depleted supplies, owed to adverse cold weather conditions, and the Russian debacle keeping off supplies. Severe weather also constricted supply for lumber and orange juice while spiking demand for petroleum products amidst rising demand. Demand for cotton also remained high on seasonality. The VIX remained elevated on fears of the looming US government shutdown. This uncertainty provide volatility to equities as well. Coffee, sugar and cocoa slackened for the week on oversupply concerns, while gold and silver prices corrected from the frenzy of overbuying last week.

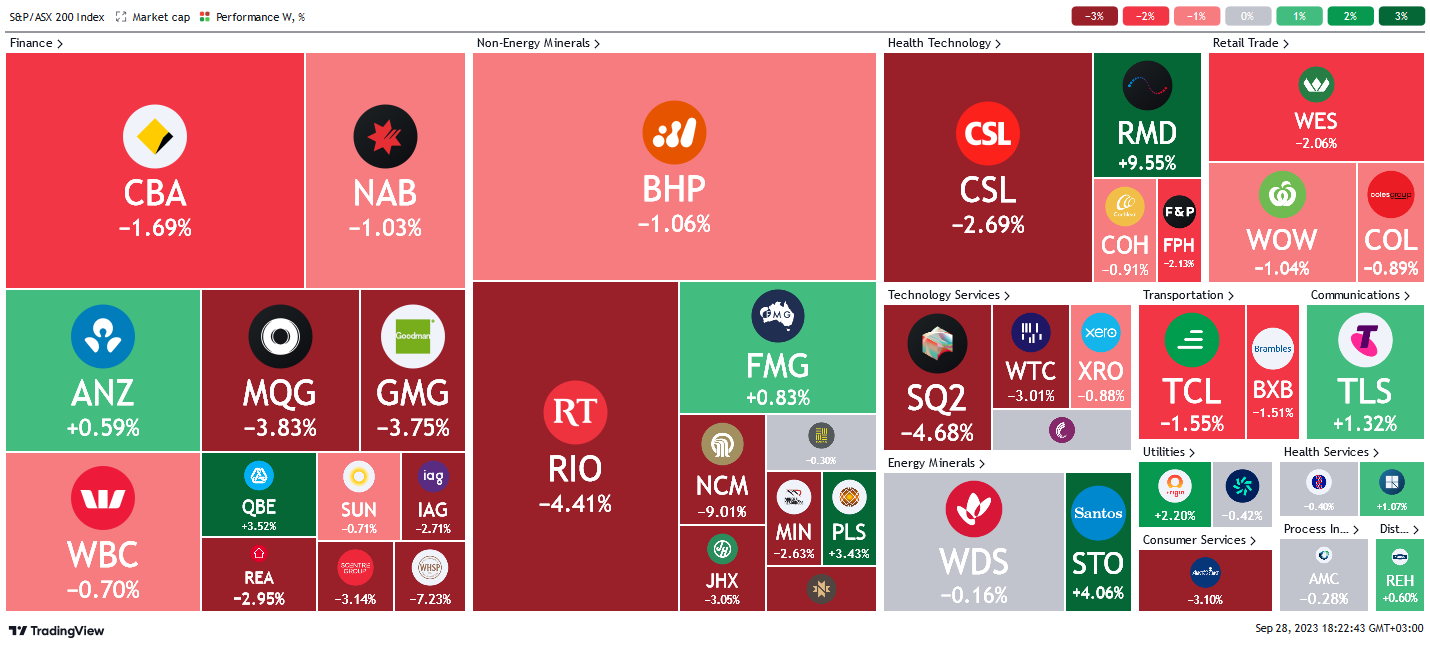

Here is the week's heatmap for the largest companies in the ASX.

It was a case of bad to worse for the ASX this week as the index plunged further. Financials led the rout with CBA, NAB and WBC all down significantly. QBE and ANZ stood out. Miners continued to be choppy with NCM, RIO and MIN all declining over -2.5%. PLS rebounded after previous bouts of selling pressure. Energy minerals were however a rare patch of green as the cold season drove up demand to keep the sector in the green.

Below shows our proprietary trend following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

3 topics

5 stocks mentioned