Australian shares are at record highs, here’s your 2025 playbook

The S&P/ASX 200 is trading at 8388 at the time of writing and is tracking very nicely to close at a new record high today. Things have literally never been so good for Aussie investors. It could be argued these are the main reasons for recent share price strength:

In September, Beijing announced the first of several initiatives to boost the Chinese economy. These, and further promised measures to come, are aimed at boosting consumption, reversing the slide in property prices, and alleviating the burden on heavily indebted local governments and property developers. A strong Chinese economy is generally expected to benefit economic growth here and around the world.

The Trump + Red Sweep in the recent US elections provided a nice bump for several key S&P/ASX 200 index constituents, particularly those with substantial US earnings, but Aussie banks have also hitched a ride on US bank stocks that are seen as major beneficiaries. US fiscal policy is expected to be expansionary moving forward, and despite the threat of a potential trade war between the US and China, the US presidential result is generally considered to be the most positive of the potential outcomes for the global economy.

More generally, there is a growing feeling among economists and research analysts that we’re in for a ‘no landing’ scenario, that is, the economic rebound from after the COVID-19 pandemic largely continues despite central banks running higher interest rates to combat the inflation that it caused. Further, rates are now generally being dialled down from restrictive settings in most economies, and this could help sustain global economic growth even further.

How 2025 is shaping up for the Aussie economy

In a research note released earlier this week, Morgan Stanley predicted that global economic growth would be a healthy 3% in 2025, with the USA driving “the bulk of it”. In 2025, global growth will slow (from 3.2% in 2024) “but not be derailed” the broker said.

Turning closer to home, Morgan Stanley predicts that 2025 will also be a sound growth period for the Australian economy with tailwinds from fiscal spending in the lead-up to the next Federal election, a strong employment market, and modest interest rate cuts from the RBA likely beginning in May.

–Morgan Stanley, 2025 Australia Macro+ OutlookSo for 2025 we hold off on calling the Australian landing just yet.

Resources could be 2025’s big winners

On the topic of China, Morgan Stanley notes it could be a net-flat result in 2025 as Beijing aims to mitigate the negative impact of new US tariffs by ramping up its own economic stimulus measures.

If this scenario plays out, Australian resources companies could be big winners, notes the broker. Morgan Stanley describes its exposure to Australian resources companies as “quite spread”, but that it favours the large, diversified miners, gold, and energy stocks (including uranium).

Morgan Stanley presently has OVERWEIGHT ratings (its highest conviction rating) on large, diversified miners BHP Group (ASX: BHP), Rio Tinto (ASX: RIO), and Mineral Resources (ASX: MIN). It also likes Nickel Industries (ASX: NIC) (nickel exposure only). In energy it likes Whitehaven Coal (ASX: WHC) and Paladin Energy (ASX: PDN) (uranium).

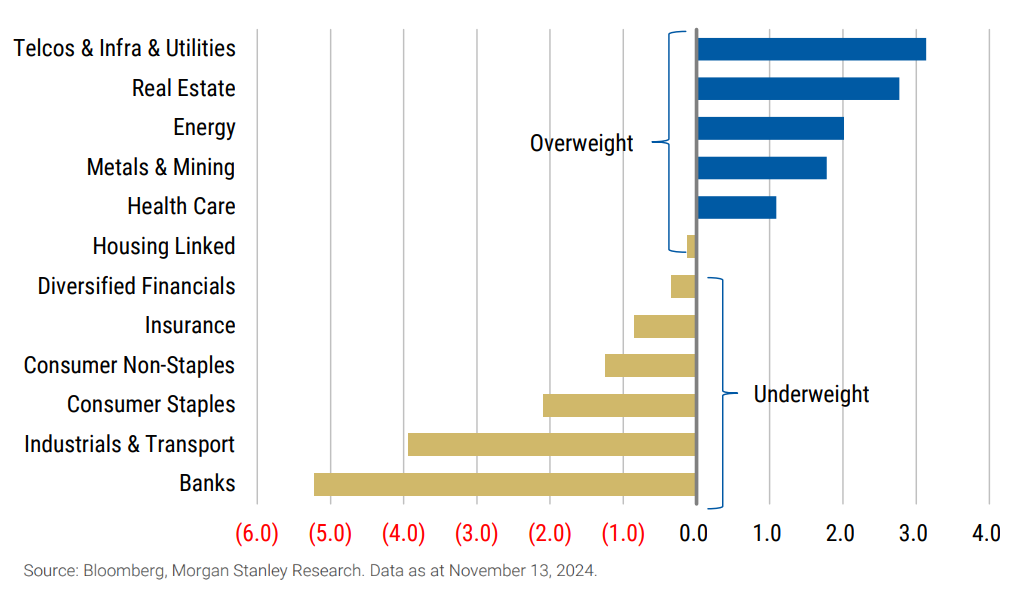

Other areas of the Australian stock market Morgan Stanley would be “Overweight” in 2025 include telecommunications, infrastructure and utilities, real estate, and health care. It prefers to be “Underweight” sectors like financials (banks, insurance and diversified financials), industrials and transport, consumer-related, and housing linked.

Further (modest) upside for Australian stocks in 2025

Morgan Stanley notes Aussie stocks have exceeded its forecast in 2024 but without delivering on the earnings growth the broker had forecast at the start of the year. Their original 2024 S&P/ASX 200 target was 8,100, but it’s nearly 300 points or roughly 4% higher than that today. The Australian stock market missed its earnings growth expectations by around 13% this year, concludes Morgan Stanley.

But the good news is it should make this up to a large extent in 2025 due to the factors mentioned above. Morgan Stanley tips S&P/ASX 200 companies will grow their earnings by around 10% in 2025, helping the benchmark index to reach the broker’s 8,500 end-of-year target.

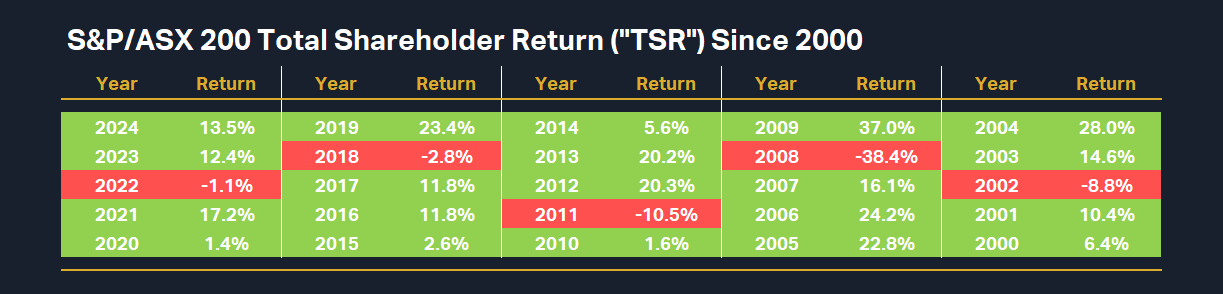

It’s important to remember that targets like these are made on an ex-dividend basis. As stocks pay dividends, their share price falls. So, whilst Morgan Stanley’s 2025 target sounds like slim pickings, one should add in the 4.2% dividend yield also forecast. The total shareholder return (“TSR”) forecast for Aussie stocks in 2025 is therefore closer to 5.5%.

This would be a moderately below-average performance if it were to come to fruition, given the average annual TSR for the S&P/ASX200 over the last 20 years closer to 9.6%.

%20Since%202000.png)

This article first appeared on Market Index on Friday 22 November 2024.

5 topics

6 stocks mentioned