Australian shares have advantages other countries must envy

Many Australian companies offer the allure of healthy dividend payments, ie, income, plus potential share-price growth.

But that's not all. Australia's franking system means that for low-tax investors, one dollar of pre-tax income from a fully franked dividend is actually worth $1.43 after the franking refund.

The trade-off between risk and reward has shifted in recent years as interest rates have reached historic lows and investors in traditionally safe investments have been caught short.

People used to relying on cash investments are hardly being rewarded, given their poor returns, and equities warrant a second look.

This wire considers the income potential of investing in Australian shares and how they have enviable advantages over equities in other countries.

Australia is the lucky country

When it comes to generating income, Australian equities have attractive and unique characteristics.

As you probably know, shareholders in a company are entitled to share in the company’s earnings. These are paid in the form of dividends, usually twice a year.

Many Australian companies also distribute franking credits. These are a kind of tax rebate that shareholders receive when a stock pays franked dividends, because the company’s profit has already been taxed at the corporate level.

But there's another advantage that's often overlooked. Franked dividends are especially tax-effective for certain low-tax investors, including retirees and self-managed super funds.

For example, for pension-phase and tax-exempt investors, one dollar of pre-tax income from fully franked dividends is actually worth $1.43 after the franking refund.

Another bonus, as we’ve just seen in the August ASX reporting season, comes when companies decide to pay special dividends.

Income equals equities

Over the long-term, Australian equities have been the outstanding asset class for income. An initial $100,000 investment into the ASX 300 in 1980 would now be generating around $80,000 annually in dividend income, and that’s assuming all dividends received along the way are spent (as a retiree would need to do).

But this strong performance is not just historical.

This asset class is arguably more important than ever because of the record-breaking low yield of other asset classes, such as fixed interest.

Interest rates are likely to remain flat for some time. Reserve Bank governor Philip Lowe recently indicated they are unlikely to rise until 2024.

Generating meaningful income from so-called "safe" cash-backed assets is almost impossible. To generate $60,000 to pay your bills from a term deposit, you would need to invest around $20 million!

On the other hand, we project the ASX 200 will generate a gross yield of around 5.2% over the next year. We're confident that active and tax-effective portfolio management will deliver even more income.

Of course, we always have to consider risk. Listed equities are towards the high end of the risk scale but they are also very liquid, that is, they can be priced easily and bought and sold quickly.

We can't stop talking about COVID

The ongoing impact of the COVID-19 pandemic remains a key topic of debate in the world of equity income.

We are always looking for strong dividend-paying Australian companies and in doing that we must be confident of their continued ability to deliver both strong dividends and capital growth.

We are generally positive on the outlook for a sound continued economic recovery as vaccination rates accelerate but we’re not taking a hugely bullish or bearish position on the economic outlook. That's not our job.

Instead, we think income investors are better served identifying sectors and companies that are likely to thrive over the next 12 months and avoiding those which will take much longer to recover.

Watch out for dividend traps

In this environment, investors need to be particularly wary of dividend traps. Some of the hardest-hit companies and sectors are unlikely to provide income for their investors any time soon, even if their share prices strengthen.

For example, Qantas appears to have managed its operations and balance sheet very well throughout the pandemic but we think it's unlikely to be able to prudently pay significant dividends for a number of years.

On the other hand, many of the dire outcomes predicted for other parts of the market simply haven’t eventuated, specifically retail and banking.

As we approach so-called “normalisation”, equity income investors need to be selective and nimble.

Set and forget won't work

We have a very active approach to dividend investing and think the set-and-forget model is flawed, particularly in the current environment.

Our rotation policy allows us to move in and out of various areas of the market in search of the strongest dividends.

Some retailers are cleaning up

Recently we’ve seen exceptional dividends and capital growth from select retailers in our portfolio and think this can continue.

We own Super Retail Group (ASX: SUL), Woolworths (ASX: WOW) and Metcash (ASX:MTS), which have all declared strong dividend increases and posted robust results over the past year.

These businesses benefited from pent-up demand after the first wave of COVID and that strength has continued this year.

Another factor is that the full normalisation of overseas travel remains some way off. We’re likely going to see another Christmas with very little international travel.

The enormous sums Australian tourists usually spend abroad are still being spent at home.

Carbon emissions must come down

COVID is the obvious headwind right now but taking a long-term view we think that over the next few decades, high carbon-emitting stocks that aren’t legitimately dedicated to improving their carbon footprint, pose a huge risk for all investors, including equity income investors.

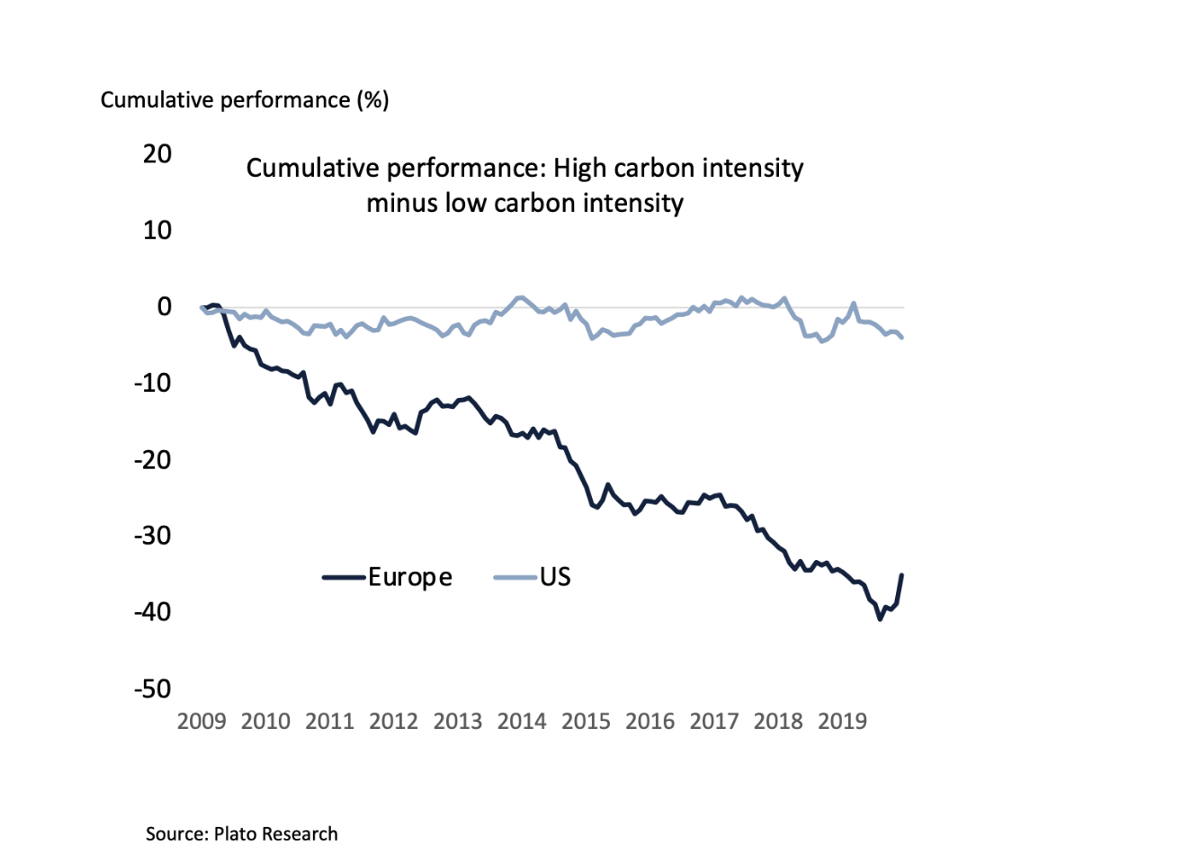

Recently we researched the performance of high-emission stocks versus low-emission stocks across various sectors and geographies.

The graph below compiled by the Plato team shows in Europe high carbon intensity stocks have underperform by more than 30%.

While, the underperformance in the US isn’t as pronounced at this stage, it must be remembered that Europe is one of the only jurisdictions to have priced carbon over a number of years. Other major economies are only just beginning as more voters demand action.

Investors shouldn’t ignore this. We’ll likely see the same trends continue to accelerate in the Australian equity market.

Assessing company management and its ambitions to go green and work towards net zero is key in mitigating this major emerging risk factor.

Learning from the past

Crises influence how one invests. I started my career in investing during what then Treasurer Paul Keating called "the recession we had to have". Then came the Internet bubble, 9/11, the global financial crisis and now the pandemic.

The GFC stands out as the most worrying and influential in changing my thinking. All have shown, though, that markets tend to overreact.

The GFC showed me that value stocks could underperform significantly for long periods. Cheap stocks can get cheaper. In the context of income stocks, cheap high-yield stocks can become cheap and nasty dividend traps. At Plato we have developed techniques to avoid them. This is key to successful income investing.

Don’t miss out on a piece of the dividend pie

Plato Investment Management is dedicated to helping retirees get more from their share portfolios. For more insights, visit the Plato website or click 'contact' below to make a direct enquiry.

4 topics

4 stocks mentioned

1 fund mentioned