Backing the next wave of tech titans

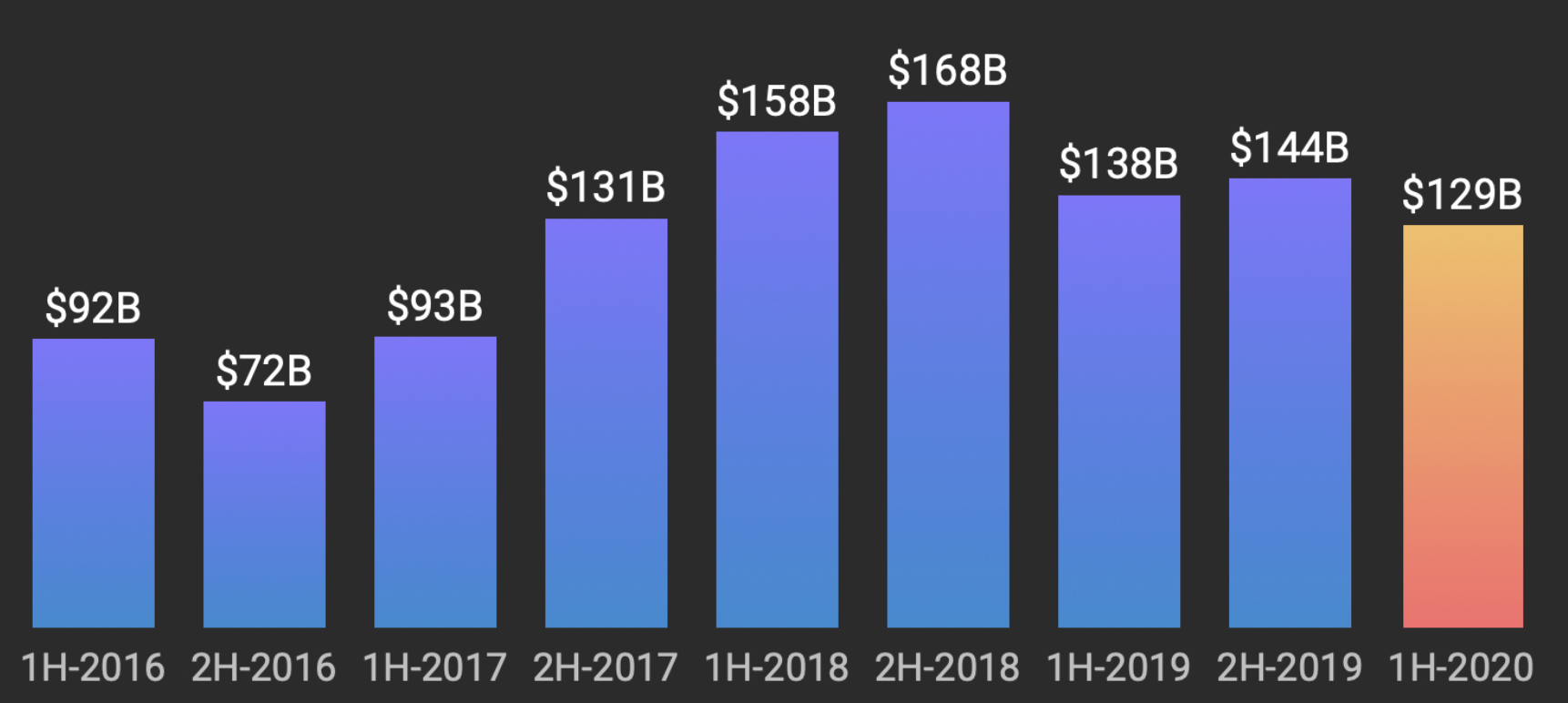

So much capital has become available to private companies in recent years that they are listing much later - and sometimes never at all. A healthy $129 billion was raised globally across all funding stages in the first half of 2020; just 7% behind the prior corresponding period. What pandemic?

Source: Crunchbase

While investors have many good reasons for caution today, not least the fragile economic picture, the tough conditions that come with market dislocations have been the cradle of many venture-stage companies that grew into household names.

The GFC gave us Airbnb and Uber for example. If history repeats, the tough times of 2020 could create the next set of tech titans.

As we wrote in a previous wire, ‘How to find the next CSL of fund managers’, part of Lucerne’s DNA is the belief that you need to be different if you want to outperform.

One way to do this is to zoom out the lens from a purely listed equity focus and bring the vast, verdant venture market into your field of view too.

This expanding sector now captures such a big part of the company life-cycle, that if you’re not participating, you risk overlooking half the market.

One firm with a distinguished twenty-year pedigree in the sector is Baltimore-based Greenspring Associates, which has over $10 billion under management. The Future Fund lists Greenspring as one of its external managers and also has a dedicated Australian venture capital mandate with it to actively monitor the market and assess opportunities.

General Partner at Greenspring Associates, Hunter Somerville, has agreed to participate in a webinar for Lucerne’s investors to discuss the venture market.

We would like to extend this invitation to Livewire readers to tune into this interesting discussion about this important asset class that is arguably under-owned by Australian investors. This will take place at 9:30 am AEST, November 13. You can register by clicking the 'CONTACT' button.

To give you a great snapshot of this market ahead of the webinar, Hunter has also kindly participated in the following written Q&A. Read on to hear about his background and his insights into this fascinating market.

Hunter, please start by telling us why you focused your career on venture capital?

Thanks, Anthony. When I was completing my MBA, I got an internship with a private equity firm working on their diversified Fund-of-Funds strategy, which had an approximate 25% focus on venture.

I quickly learned that venture was difficult and that there were areas that made it a lot harder than traditional private equity verticals like buyout. Getting access and building relationships takes time and effort and isn’t a trivial exercise, and that challenge really piqued my interest.

Once I decided I really wanted to focus on venture, I joined Greenspring Associates so I could invest in funds, as well as do direct and secondary investing, as part of one team on one platform, and specialize even more.

Investors are increasingly tapping private markets to access a portion of the market that was formerly available via the public small- and mid-cap growth segment. In addition, the maturity of the private markets offers investors incredible optionality to invest in venture across numerous subcategories with distinct characteristics and risk/return profiles.

I was also really drawn to the industry’s potential to be a force for good and a propeller of innovation. More and more, we are seeing a mission-driven element arise in venture investing, and I love to be able to tie my career to an industry that can have such a positive impact, particularly in challenging times like these.

Why do you find its investment case so compelling today?

Venture capital markets have mushroomed over the last twenty years, coming into their own as the dominant driver of technological innovation, job and wealth creation, and resultant GDP growth.

An influx of capital to private markets in recent years has resulted in more opportunities to take liquidity outside of public market listings.

We have seen companies stay private longer or opt-out of going public entirely in recent years, resulting in a meaningful contraction in the investable public universe, which is now about half the size it was 20 years ago. A robust secondary market has also emerged, and the volume and asset value of acquisitions by strategic and financial buyers have increased.

Moreover, the success and growth of venture-backed technology companies in public equity markets have contributed to increased awareness of venture capital funding as a mechanism for incubating innovative, market-dominating companies that can fuel U.S. and global economic growth.

As technology has become ubiquitous across sectors and demonstrated its ability to drive meaningful shareholder value throughout market cycles, the investment industry has witnessed talent abandoning the public markets, as well as private equity buyout investors migrating to earlier venture and growth-stage investing where technology opportunities are more pervasive.

How has the COVID-19 pandemic impacted the venture landscape?

The domino effect spurred by COVID-19 has illuminated how critical technology investment is to the health of our economy, the necessity of science and healthcare investment for humankind to survive and flourish, and the financial equity divide in our society. Venture capital is uniquely capable of closing this equity divide through access to capital, the financing of innovative technologies and life sciences, job creation, and intergenerational wealth creation.

The uptick in technology adoption resulting from COVID-19 has only accelerated the digitization in market cap that was already taking place, estimated in 2019 to be worth $50 trillion in wealth creation and business value over the next 15 years across transformative technologies.

Venture-friendly sectors such as telehealth, collaboration, and e-commerce have all seen unprecedented increases as the world adapts to a socially distant reality:

According to a McKinsey survey, consumer adoption of Telehealth skyrocketed to 46% in April, up from just 11% in 2019, with 76% of respondents highly or moderately likely to use Telehealth in the Future.

Zoom app downloads increased 300% in the second half of March versus the weekly average in Q4 2019.

Stunningly, the US and Canada have seen a 129% year-over-year growth in E-Commerce orders since Mid-April.

This acceleration in technology adoption has resulted in a generally positive environment for private companies choosing to list publicly, and one that favors verticals such as automation, cloud, digital enablement, and healthcare where venture equity is a frequent source of early capital.

The public market’s reception of recent venture-backed technology company public offerings underscores the current robust IPO environment, supplementing strategic and financial buyer transactions as a source of liquidity.

Can you describe the fund model?

We exclusively focus on venture capital out of a variety of different strategies, including fund and direct investments, both of which we do on a primary and secondary basis.

Greenspring has approached the asset class in this way for over 20 years, investing across the continuum of innovation from seed through growth and serving as an additive and desired lifecycle partner to entrepreneurs and fund managers.

Investing in a concentrated portfolio of funds can achieve geographic, vintage year, sector, and stage diversification across hundreds of underlying portfolio companies.

This can be complemented by direct investments in select growth-stage portfolio companies alongside managers and opportunistic secondary investments. This can drive higher returns or earlier liquidity and mitigate the risk inherent to a single fund portfolio of young companies.

How do you screen investments?

In selecting funds, we pay a lot of attention to team dynamics and cohesiveness, the quality of deal flow and the existence of a sustainable sourcing advantage, the establishment of a succession strategy, portfolio construction, return analysis and the investment decision-making process.

For fund opportunities that advance, we will dig deeper into portfolio analysis at the individual company level and solicit feedback from trusted partners in the ecosystem through reference calls. Finally, we typically conduct deep legal and operational due diligence and evaluate terms before ultimately investing in the fund.

One such investment that Australian investors may be familiar with, is Blackbird VC, an Australia and New Zealand based manager whose funds invest in early-stage technology companies of every type from software to space

With respect to direct investments, we typically start by reaching out to the underlying venture manager to better understand the opportunity and get background on the company. If further interest is warranted, we will assess the management team’s depth and capability, the business model and the sustainability of competitive positioning, independent financial modeling and fundamental industry research. Additional layers of due diligence are applied to impact-oriented opportunities.

How could the weak economic environment impact the venture sector?

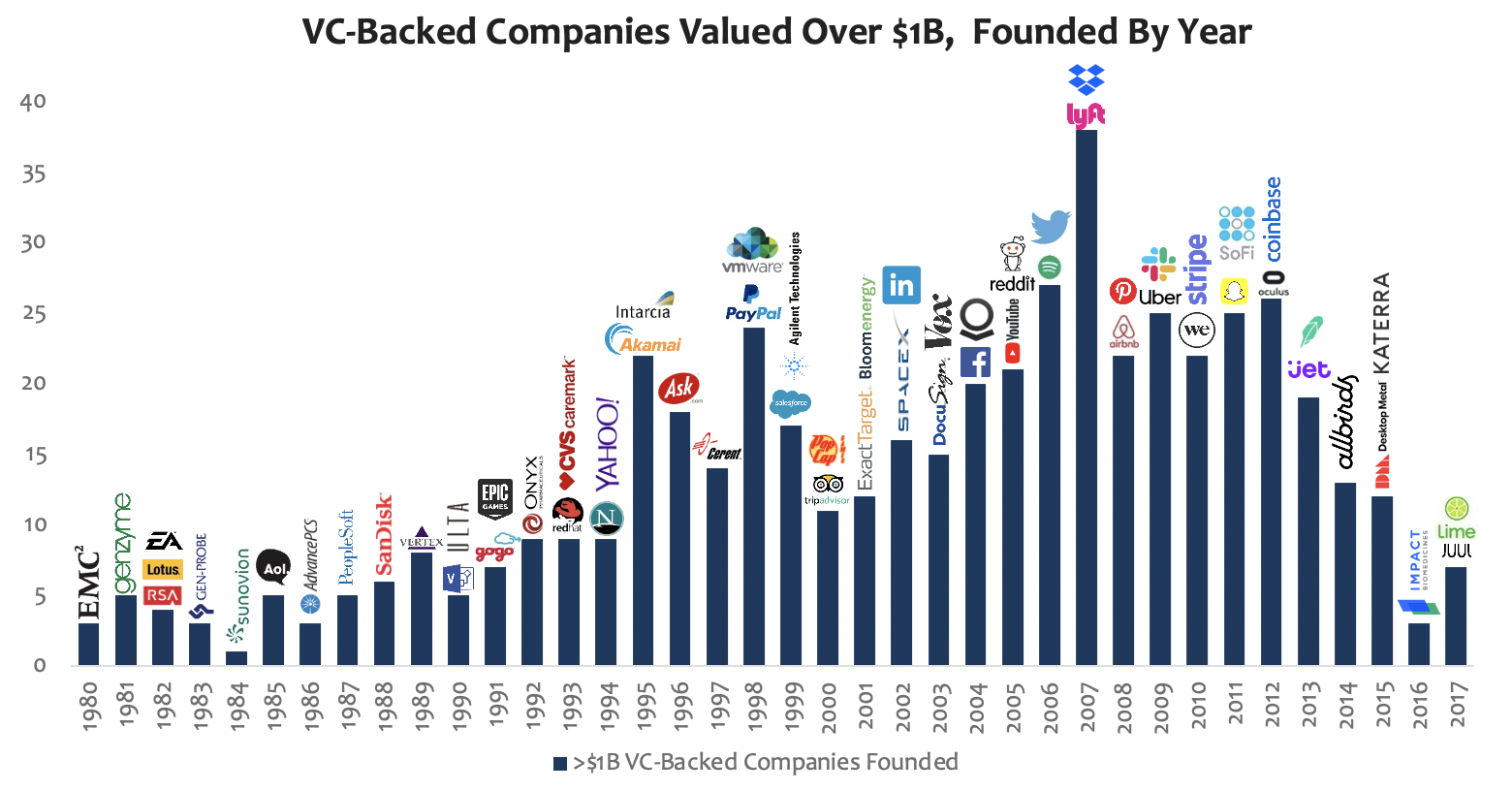

While innovation occurs across market and economic cycles, the current environment presents a compelling opportunity for investors with patient capital to invest in venture, as was the case during and immediately after the Global Financial Crisis.

Vintage years in connection with fat-tail market events have historically been characterized by venture market dislocation, providing a fertile environment for innovation and the creation of value-driving venture investments.

We expect an attractive set of new opportunities to arise over the next several years, following in the steps of other recession-founded companies like Lyft, Dropbox, Pinterest, Uber, Twilio, Slack, and Airbnb, among many others.

A different type of wealth management

Lucerne is Australia’s pre-eminent independent Investment Group, providing high net worth investors access to a family office-style service. We allocate to any investment that meets your objectives and we invest alongside you. Click ‘CONTACT’ to talk with us.

5 topics