BBB rated, A+ returns

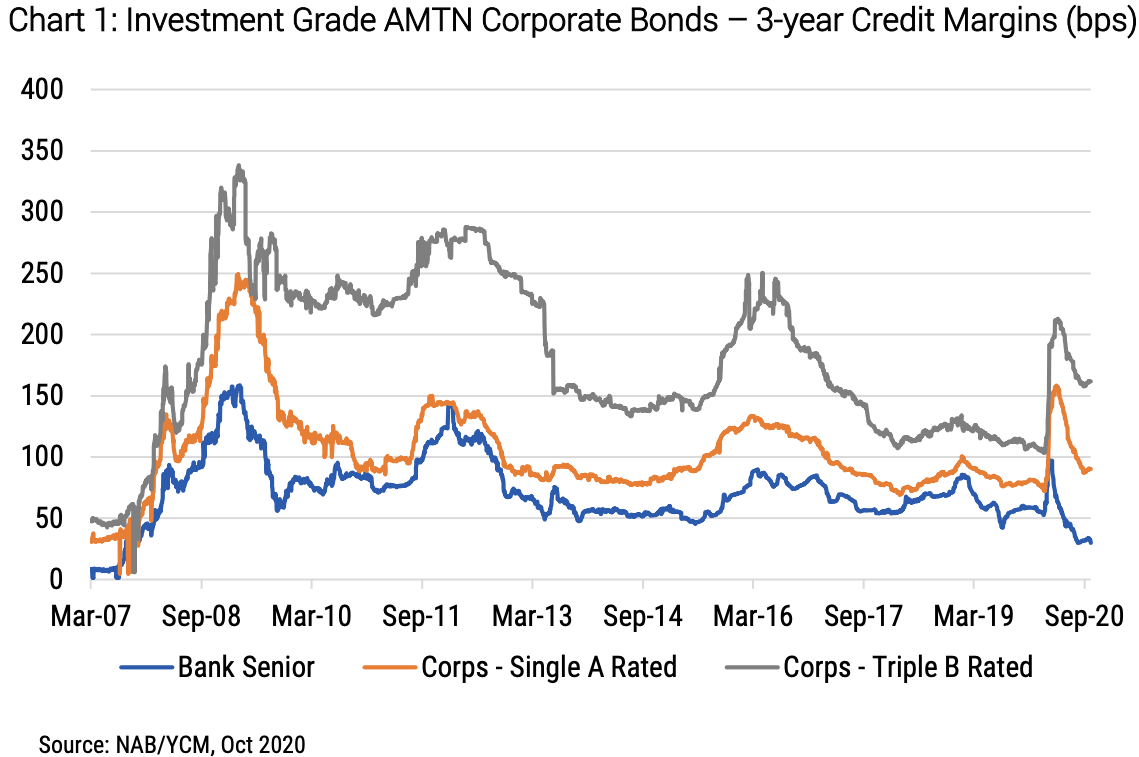

With exceptionally low yields across most developed markets and asset classes, investors are increasingly having to take more risk to achieve higher returns. Even beyond 12-month term deposits (paying ~1%), term bank senior yields and credit margins are now at their lowest levels since 2007 (refer Chart 1).

Yields and credit margins on other investment grade (IG) corporate bonds, particularly in the BBB rating band, however, tell a different story.

There are ample opportunities for investors to construct attractive, low-risk portfolios yielding consistent returns of 3.5-4.0% p.a.

But is the lure of higher consistent returns in BBB corporate credit – margins are currently four times bank senior and double those prior to the onset of COVID-19 – both justifiable and sustainable?

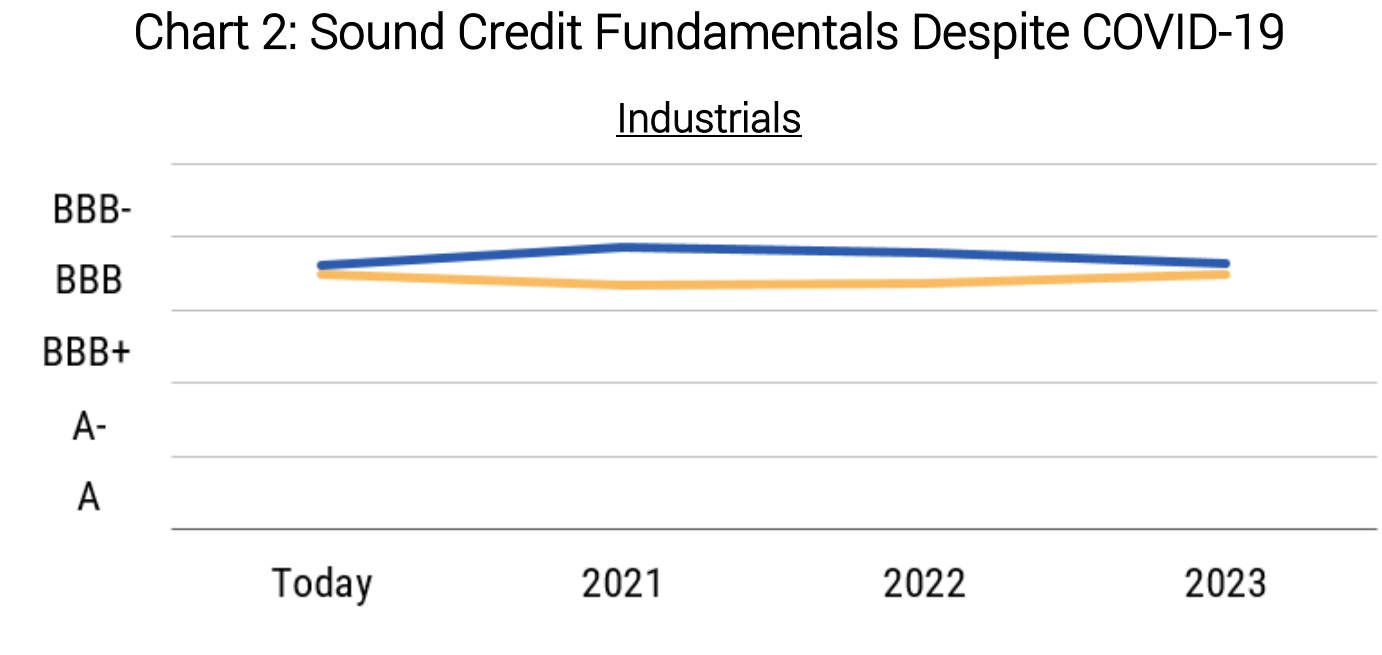

Our proprietary credit analysis of Australia’s BBB universe is providing strong evidence in support of the strong risk-adjusted returns on offer. While there are some COVID-19 impacted outliers (e.g. QANTAS), we expect underlying credit quality among IG Australian corporates (38 Australian issuers) will remain relatively stable looking out to 2023 (refer Chart 2).

Our view is positively influenced by the levers increasingly being deployed to preserve IG credit ratings, including: (i) cutting shareholder dividends; (ii) shelving growth capital expenditure; and (iii) raising fresh equity capital (in some cases).

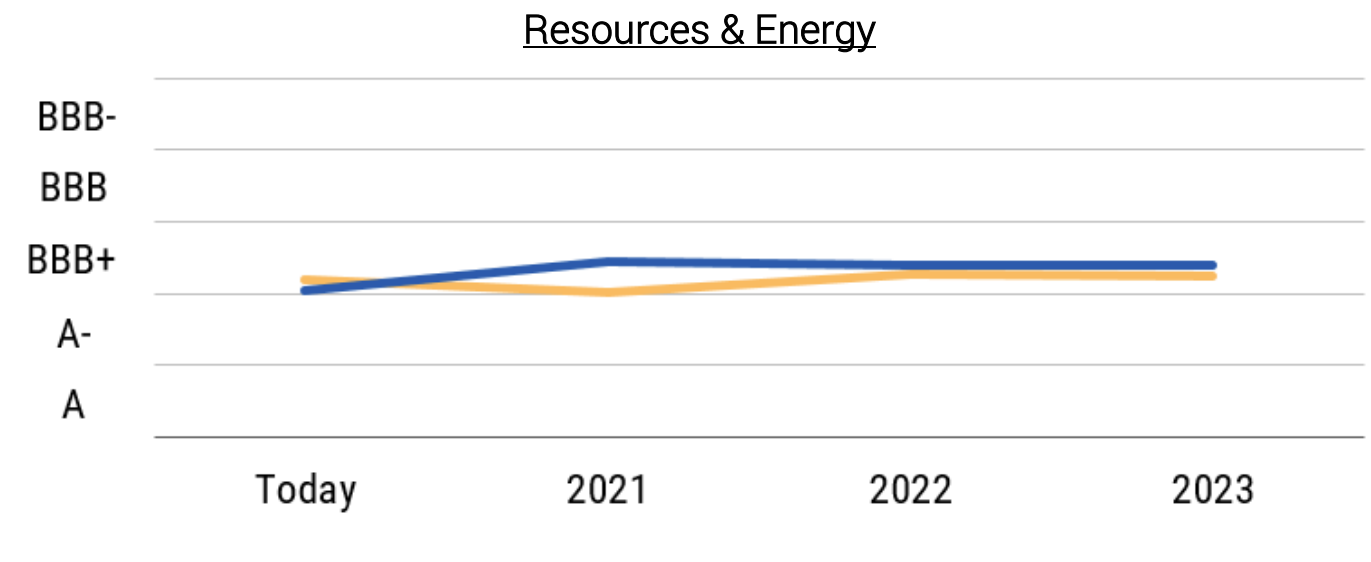

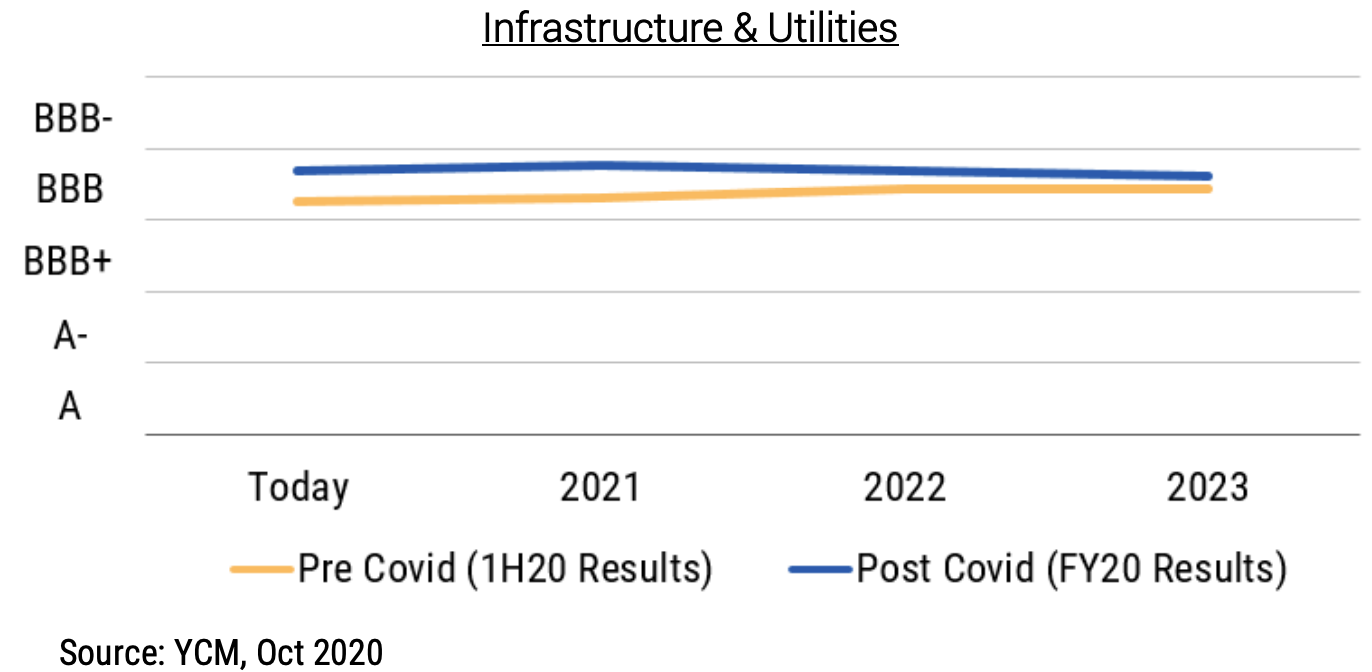

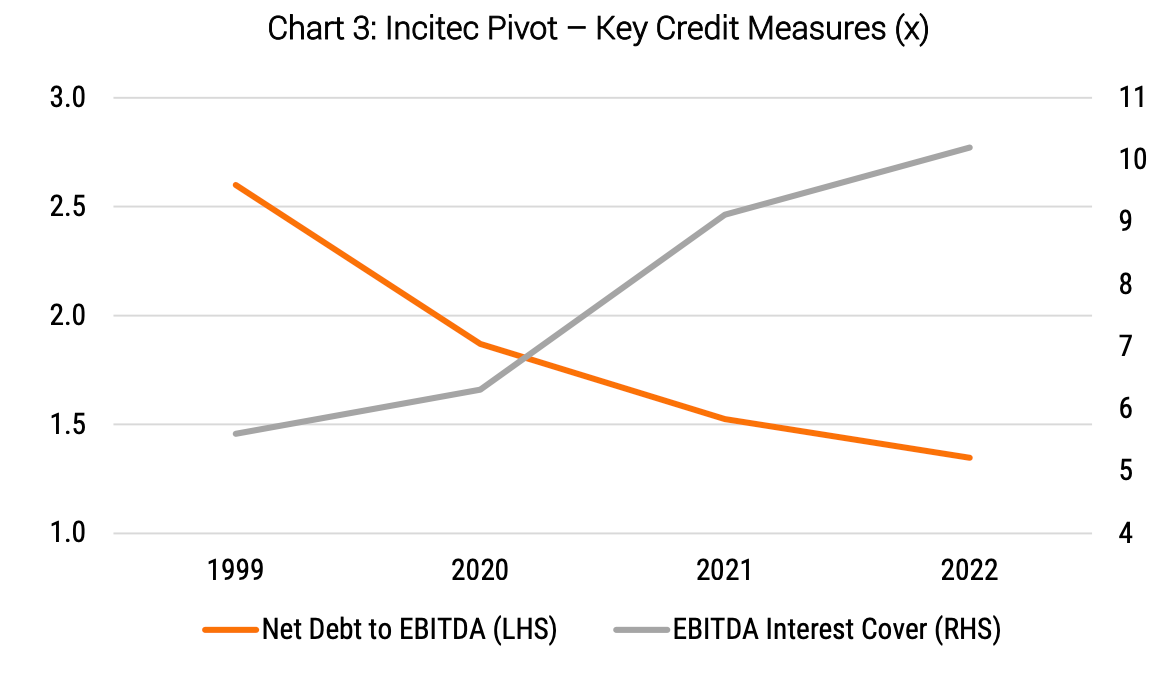

The BBB rated Incitec Pivot (IPL) provides a good case in point. Despite being less impacted by the pandemic than many Australian Industrials, IPL raised $600m of new equity in May 2020, significantly de-leveraging its balance sheet and removing any medium-term credit risk. The company’s pro-forma Net Debt to EBITDA now sits below two-times, with debt serviceability (EBITDA Interest Cover) forecast to increase significantly through to 2022 (refer Chart 3).

Furthermore, with supportive agricultural conditions (positive for fertiliser volumes) and explosives demand stabilising, IPL’s 2026 bonds have performed strongly. During March/April sell-off, we purchased these bonds in secondary markets at a relatively distressed yield of ~5%. With a current credit margin of ~250 bps and outright yield of ~2.80%, these securities continue to offer compelling value.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

5 topics