BCA Research correctly predicted the stock market's surge in the first half of 2023. Here's its second half prediction

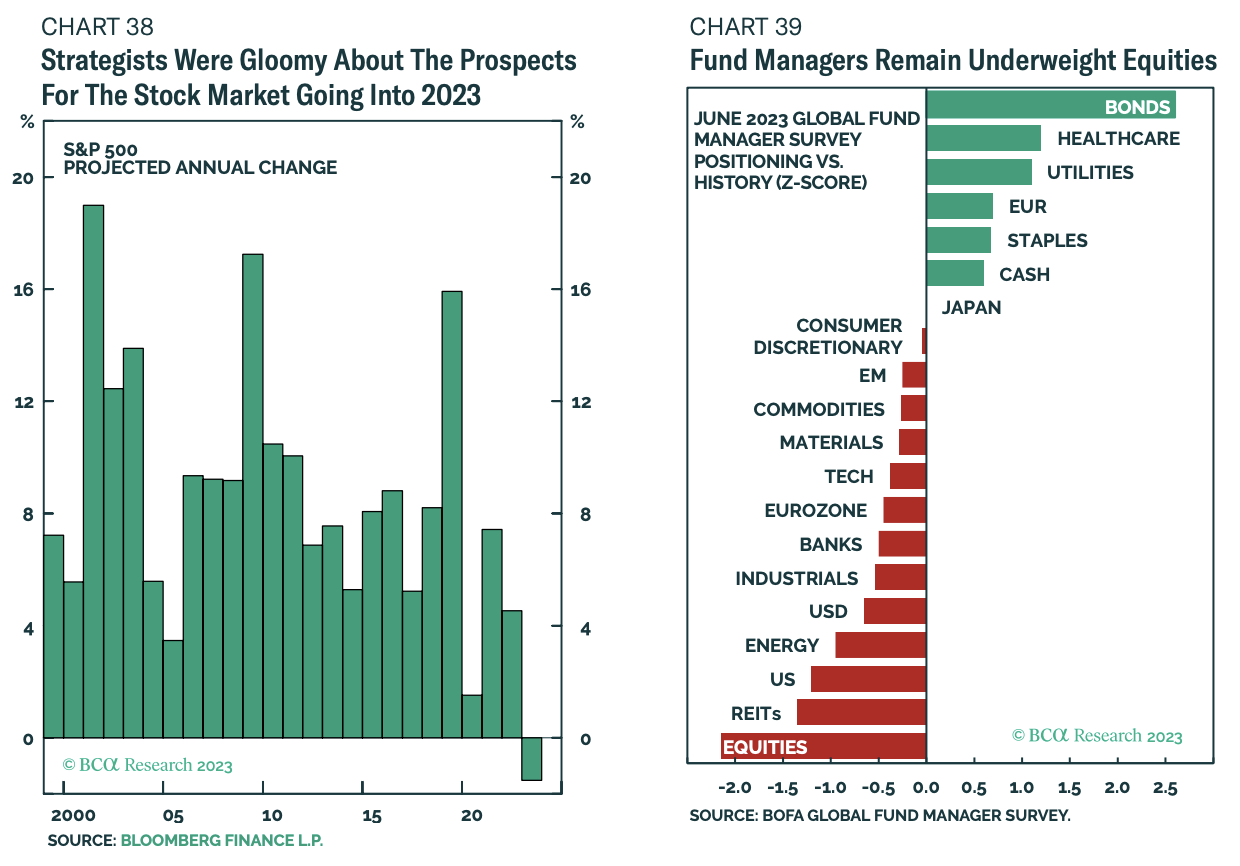

At the beginning of 2023, most research houses were expecting the bear market of 2022 to extend into this year. The Federal Reserve was going to keep hiking rates, inflation will fall but not by as much as people were expecting, quantitative tightening was going to suck all the liquidity out of financial markets, and defensive investments like cash and bonds were going to be the place to be.

While many of these things have manifested, one call was rarely talked about - equities would rally in the first half. Even the more bullish in the market, like CFRA's Sam Stovall, was talking about an equity market rally only arriving in the second half.

But one of the research houses who was talking about a bullish run for equities was BCA Research. They argued late last year that the equity rally of 2023 would come in the first half rather than the second half.

"The conventional wisdom sees stocks falling in the first six months of 2023 in anticipation of a US recession and then recovering in the back half of the year once the first green shoots appear. We think the exact opposite will happen: Stocks will rise in the first half of 2023 as hopes of a soft landing intensify, and then dip in the second half."

Well, they were right. And as Chief Investment Strategist Peter Berezin (ex-Goldman Sachs) put it in the company's market outlook paper this week - "they never see it coming". They, of course, refers to the Wall Street consensus.

But you'd think that after the run we've seen in US equities that Berezin would be taking profits. Instead, he's leaning right into the "relief rally" thesis. In this wire, I'll summarise the key takeaways from BCA Research's new market outlook piece. It's one for the short-term bulls.

BCA's key calls

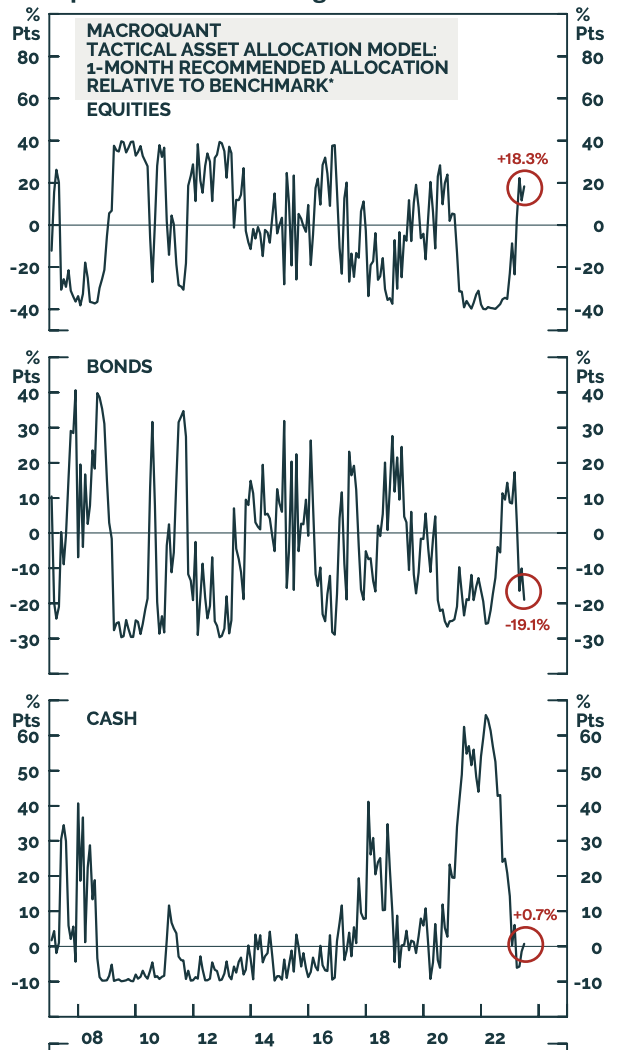

- Equities and bonds could rally over the next 3 months

- But... they expect to downgrade their overweight equities call to underweight before the end of 2023

- Bond yields will remain in a "tug of war" and corporate credit opportunities may evaporate before the end of the year

- 2024 will be 'the year of the Yen' following the Japanese stock market's rally so far this year

- Metals like gold, aluminium, and zinc over oil in the medium term

The most predicted recession (and some education on the BCA model)

Ask any strategist or economist when a US recession is coming and you'll get some wild answers. The recession, which was meant to come in the first half of 2023, has slowly been pushed out as more data reveals the world's largest economy is still hiring in droves while inflation continues to fall slowly but surely.

BCA argues the recession will still come - but when people least expect it at the back half of 2024. This is a view that they have held for some time.

"Unfortunately, just when most people become convinced that a recession has been avoided, a recession will begin in 2024," analysts wrote this week.

"We have been saying “2024” since last April. Our view that a recession was not imminent was controversial at that time but has become more mainstream as the clock kept ticking and “the most anticipated recession in history” never materialised."

Their thesis stems from a proprietary model called "the kinked curve framework". To cut a long story short, the curve in question is the Phillips Curve, and the model argues that there is an indirect relationship between inflation and unemployment. Essentially, every economy has a turning point when labour supply can no longer catch up to demand. If you ever read commentary about the US having "two job openings for every unemployed person" or the jobs-workers gap reaching record highs, that's what this concerns.

The conventional theory is that the closer inflation gets to the Federal Reserve's target, the closer the economy is to a Goldilocks - or soft landing scenario. In other words, everyone's happy and we can all breathe a sigh of relief.

But BCA see differently.

"The irony is that falling inflation can sow the seeds of its own demise. Since wages tend to be stickier than prices, falling price inflation can boost real wage growth, which in turn can boost spending and inflation," they wrote.

"Subjectively, we would assign 20% odds to a scenario where either the US economy experiences a second wave of inflation, or the Fed has to raise rates to over 6% to cool it down sufficiently to keep inflation from rising. Our baseline, however, is that demand will continue to sink to the point that the economy slips into recession next year without the need for substantially higher rates," they added.

Hang on - so why are they bullish on stocks?

The reason for the first half rally is simple - when more strategists are expecting declines rather than rises, it creates a "wall of worry" for stocks to climb over.

Then, there's the AI argument. The Magnificent Seven mega-cap tech stocks have had one almighty run. But look back to the October 2022 low and you'll see that the equal-weighted S&P 500 is up 16% since. You can't attribute all of that to AI! So why the rally?

"More than anything else, it is the hope of a soft landing that helped put a bottom under stocks on October 13 – the exact same day that the US CPI peaked on a year-over-year basis," they argued.

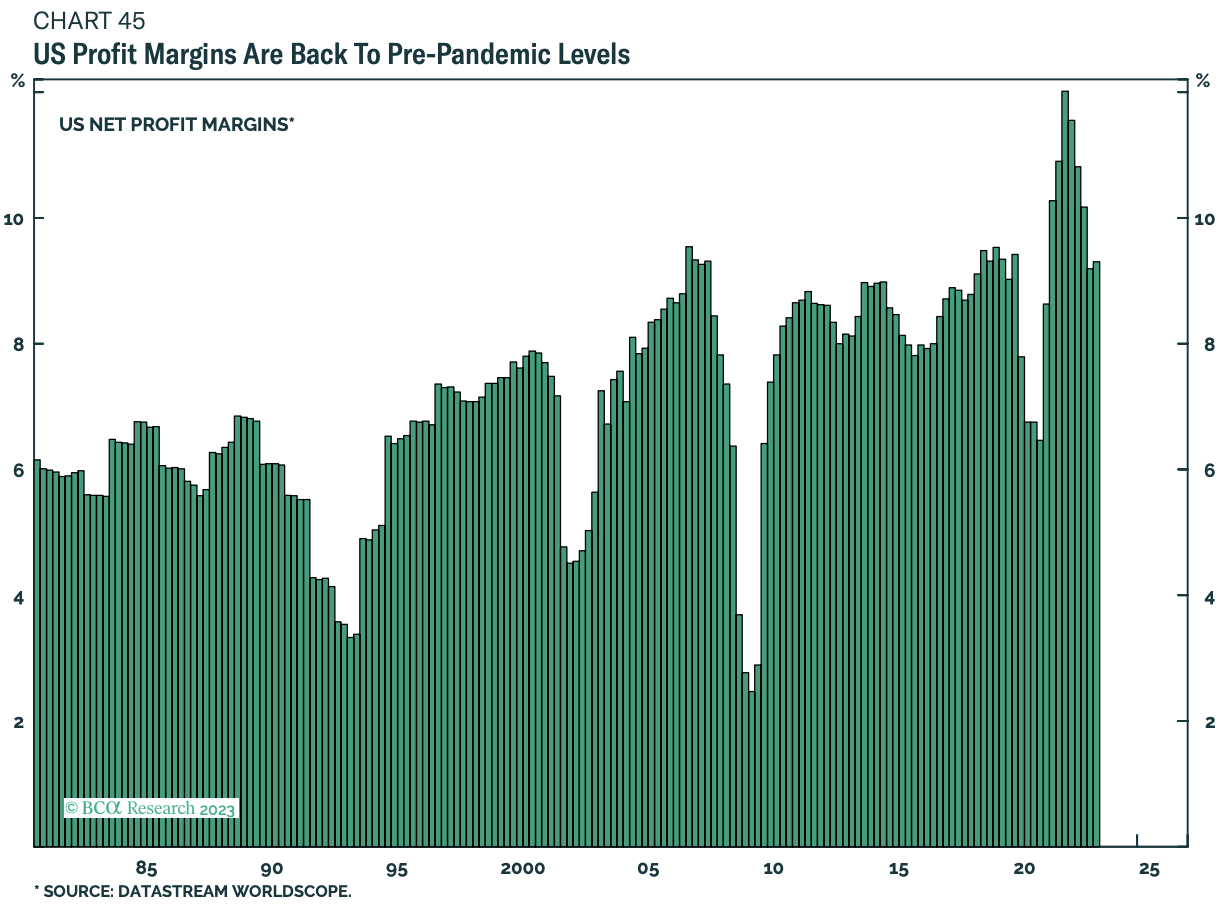

As for earnings margins, sell-side analysts have been increasing their 12-month forward estimates since February. But as BCA point out, that's likely to decrease the closer we get to a recession.

"Margins are still high by historic standards and will decline further during the

next recession. However, until that fateful

day arrives, margins are likely to remain

stable. With sales still growing, this means

that earnings will continue to rise, providing near-term support to stocks," they wrote.

For sector ideas in the US, turn to industrials, energy, technology, and consumer discretionary stocks for buying ideas. Their underweight ideas are, appropriately enough, relatively defensive - healthcare, consumer staples, and utilities. Note that this list will likely change if they end up shifting toward defensive assets later in the year.

Outside of the US, Eurozone and Japanese equities are preferred given companies in both of those regions have positive earnings momentum and are in the right place at the right time economically speaking.

In bond land

In the fixed income space, BCA are currently where everyone else is - playing in the short duration end of the market. With yields of up to 5% available on a US 2-year note, it makes sense to park your cash here and just watch the coupons roll in.

Beyond the immediate, BCA are preparing to recommend overweight US government bonds and underweight corporate credit positions to clients. That's decidedly at odds with a number of fixed income houses who continue to nibble away at the yields available in corporate credit.

"If the US does enter a recession in 2024, Treasuries will almost certainly outperform the global bond benchmark," they wrote.

And in commodities

All eyes are on the crude oil market where strategists have been cutting their price targets for Brent Crude relentlessly. The talk around a Chinese reopening-fuelled boost fizzled very quickly while surprise production cuts from key OPEC+ members Saudi Arabia and Russia have barely dented the price. And if a recession does hit the US in 2024, it won't be a good time for industrial commodities like oil.

"The prospects for oil and metals will sour next year as the global economy slips into recession. Thus, as with equities and high-yield credit, investors should prepare to turn more defensive on industrial commodities later this year," they said.

BCA has strong views on two other metals: copper and gold. For copper, the story naturally comes back to China given it makes up over half of all global demand for industrial metals like it. They note that the outlook will come down to the country's housing market.

"China’s housing sector absorbs 17% of global copper production. If the housing market resumes its slide in 2024, this will provide an important counterweight to rising demand for metals stemming from the transition to the green economy," they said.

Finally on gold, BCA recently closed its short gold trade while adding a tactical long oil trade (they use the NYSE: USO and NYSE: GLD ETFs).

2 topics

2 stocks mentioned