Bear Schmer... It's sector rotation time!

I think bears get a bad rap.

They are billed as grumpy ravenous destructive campfire wreckers.

However, among friends, I am sure they are quite the cultured ones with a fine nose for honey and pretty dab hands when it comes to tossing salmon.

I am never rude about bears in public.

This does not mean that I want to be one or wear a bear onesie.

Everything has a season

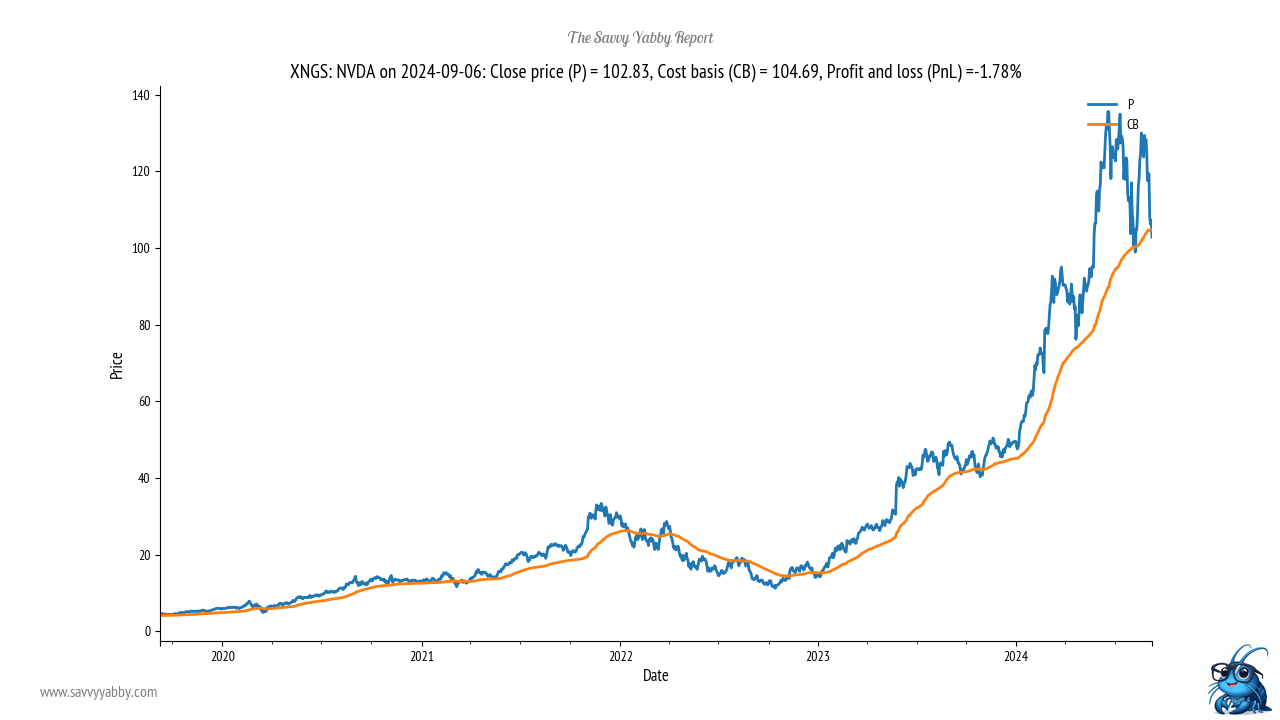

We know that it has been a stonking good bull market in technology.

Nvidia is getting narrower earnings beats with each quarterly call NYSE: NVDA.

Folks like me continue to mistreat Gen AI as a tool for parody.

Sure, the technology is cool, but the kids doing it are not.

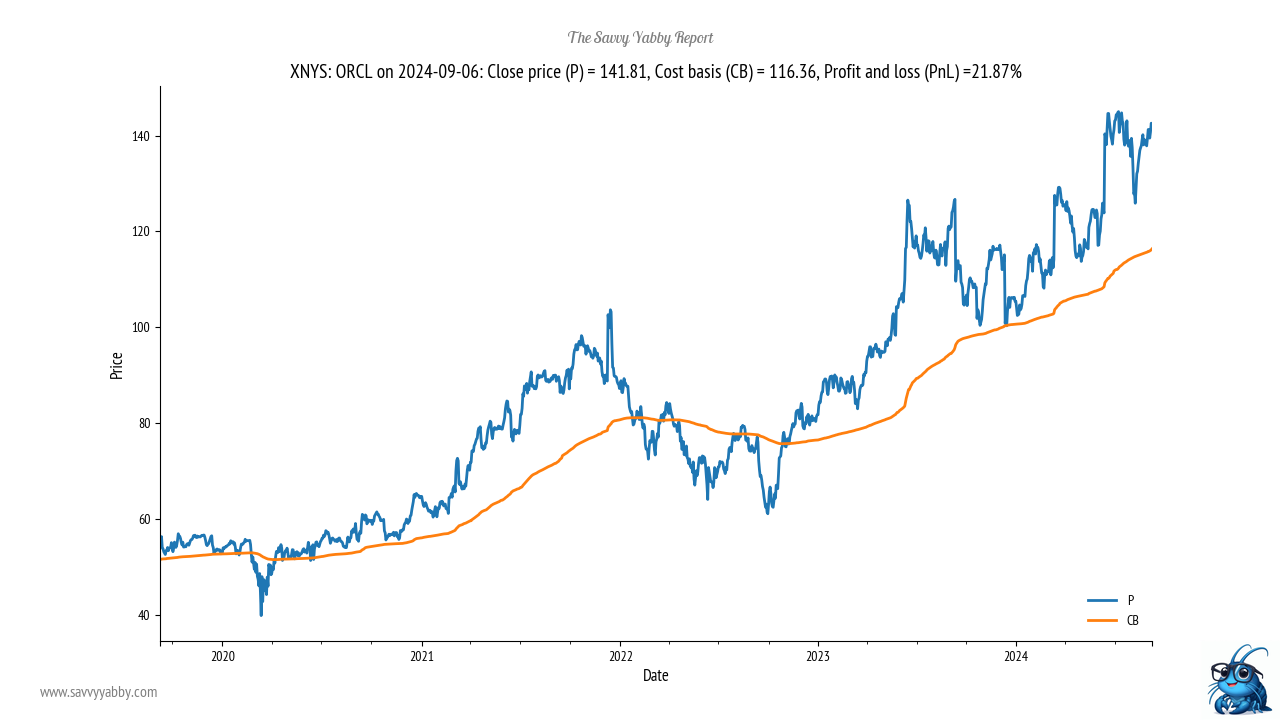

Just look at what went wrong. Oracle (NASDAQ: ORCL) is doing well!

Only fools like me bought that stock.

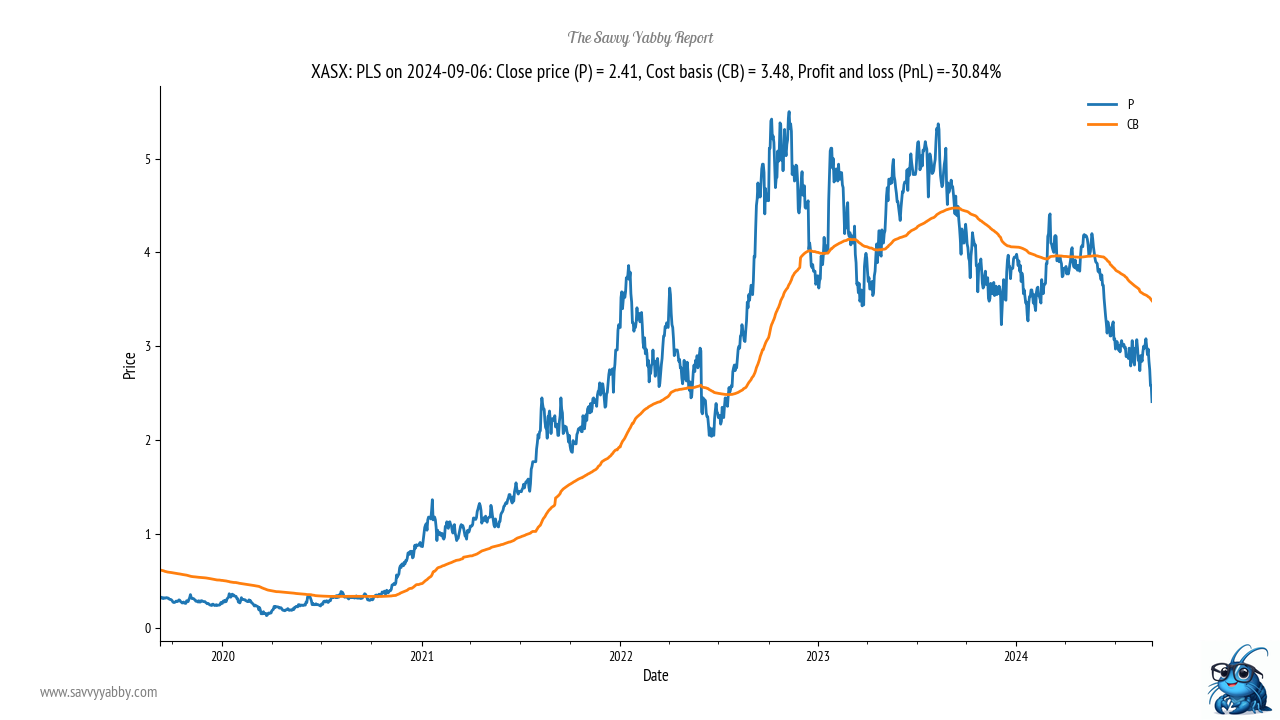

In the meantime, the minerals industry has 43 colours of custard.

Markets change the whole time, and so it is a mistake to be too fixated on one idea.

Are we approaching a bear market?

I don't think so.

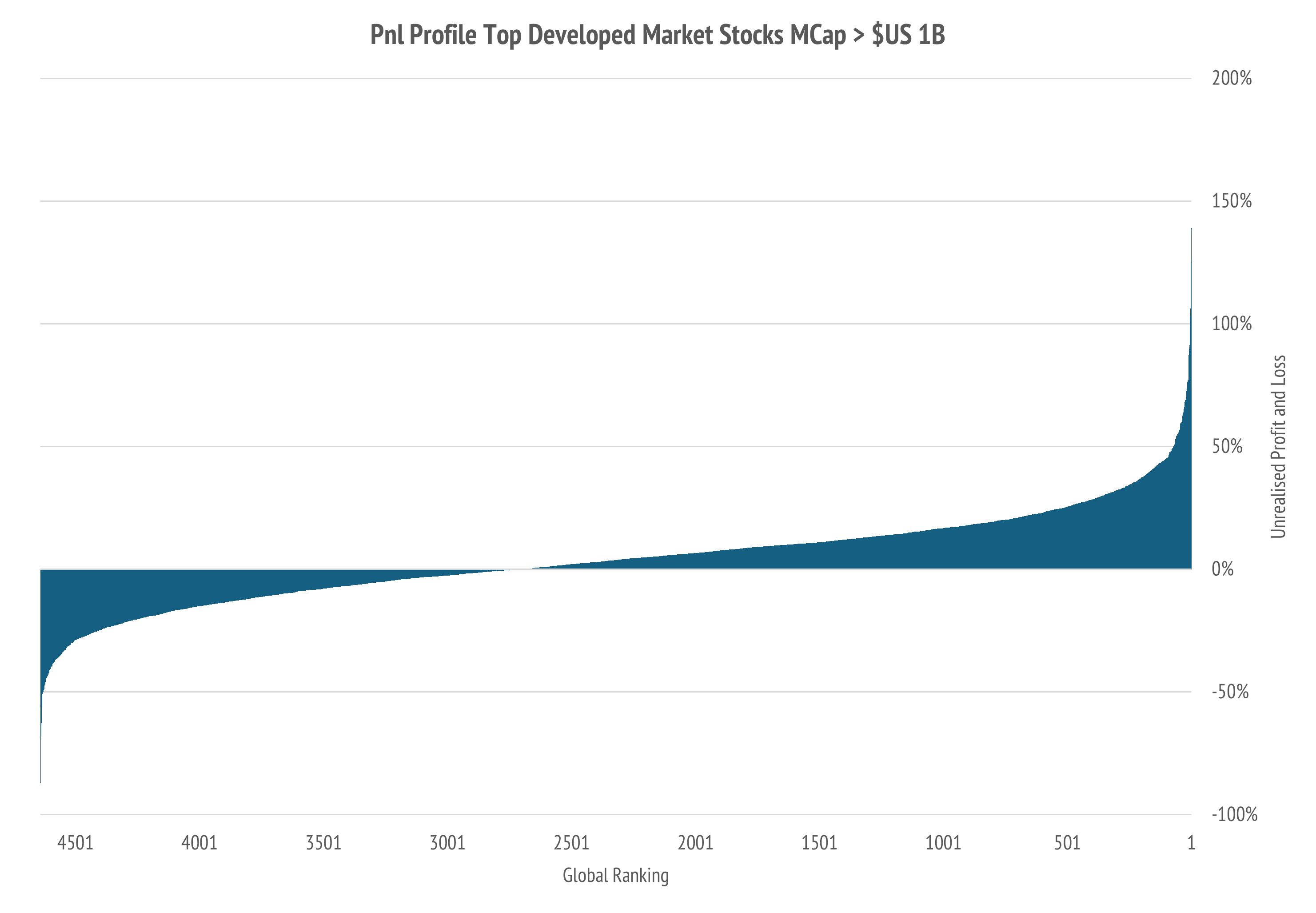

However, this is not an idle question for me as I have a well-developed methodology for calling the beginning and end of bull markets and bear markets. This involves estimating the average investor's unrealised profit and loss in their holdings. The technique has been described in detail here, and I now run a newsletter devoted to it.

Last Friday I ran a global developed market screen against all 4,600 publicly listed companies with market capitalisation greater than US $1 billion. You can see the results below.

This chart shows all 4,600 stocks' estimated investor profit and loss in rank order. Positive values are good. Around 2,600 of 4,600 stocks are in bullish territory.

The breadth is good with winners outweighing losers in number and magnitude.

Why all the sour faces then?

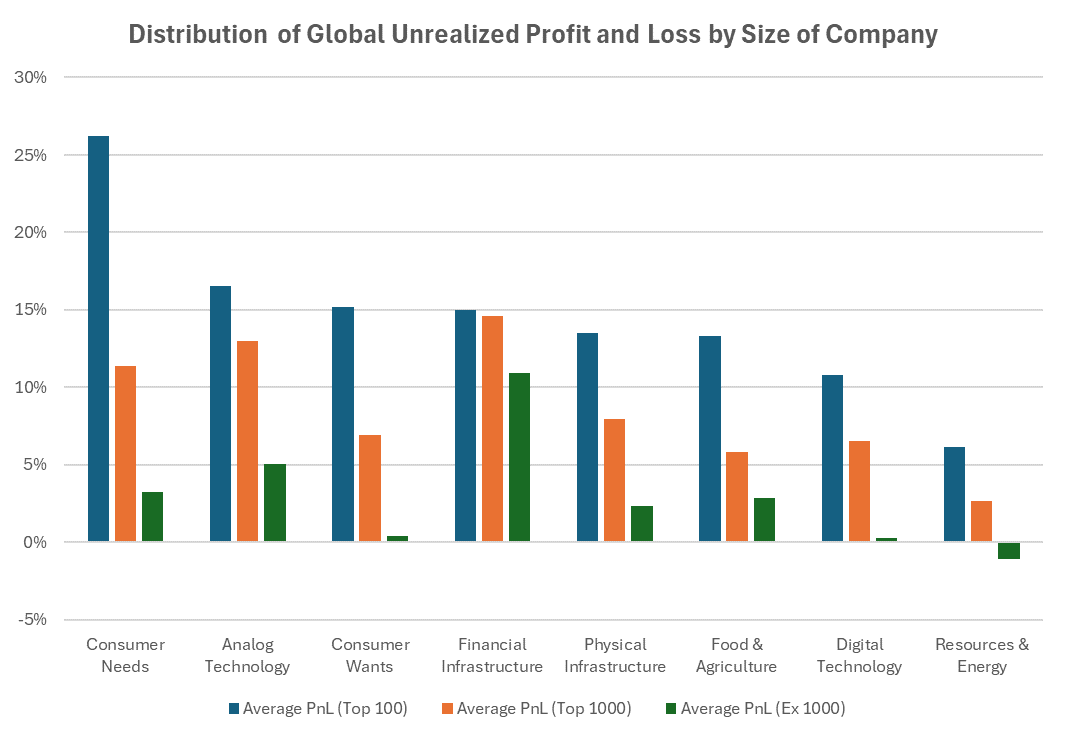

For more colour, we can look at the distribution of profit and loss by sector.

The media headlines generally dwell on what "everybody knows to be true". This is because Mr. Everybody does not get out much and does not seem to have a clue.

Note that there are six of our eight market sectors that are firmly in bull territory, especially in the area of large-cap stocks.

The standout is Consumer Needs, which includes healthcare.

Here are some healthcare names that look to be all kinds of fine.

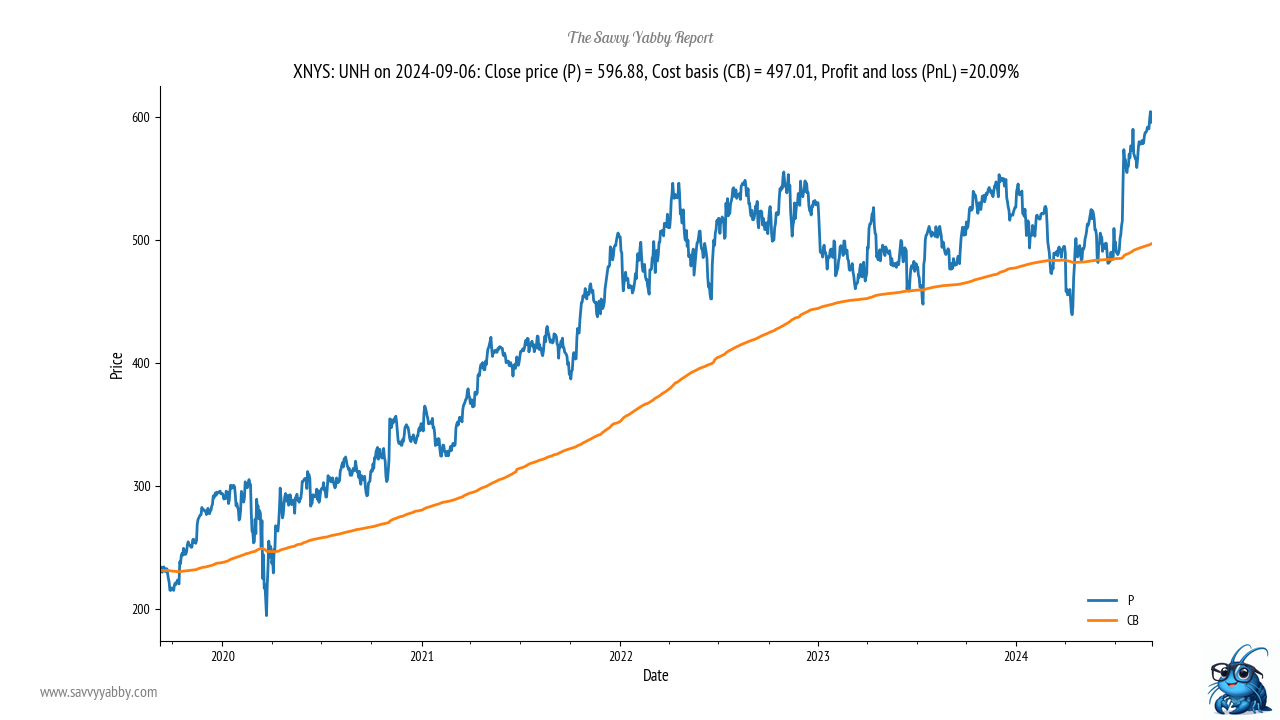

United Health (NYSE: UNH) is a US-managed care firm that just made new highs.

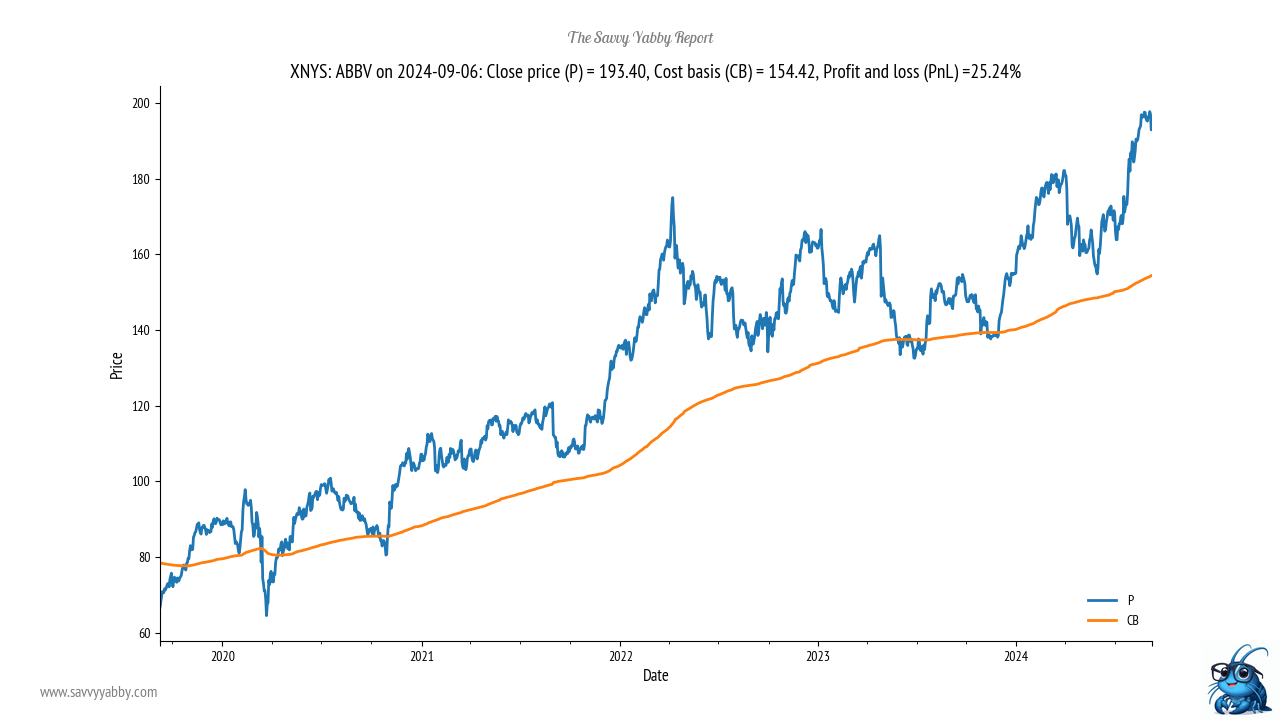

Pharma group AbbVie (NYSE: ABBV) is another.

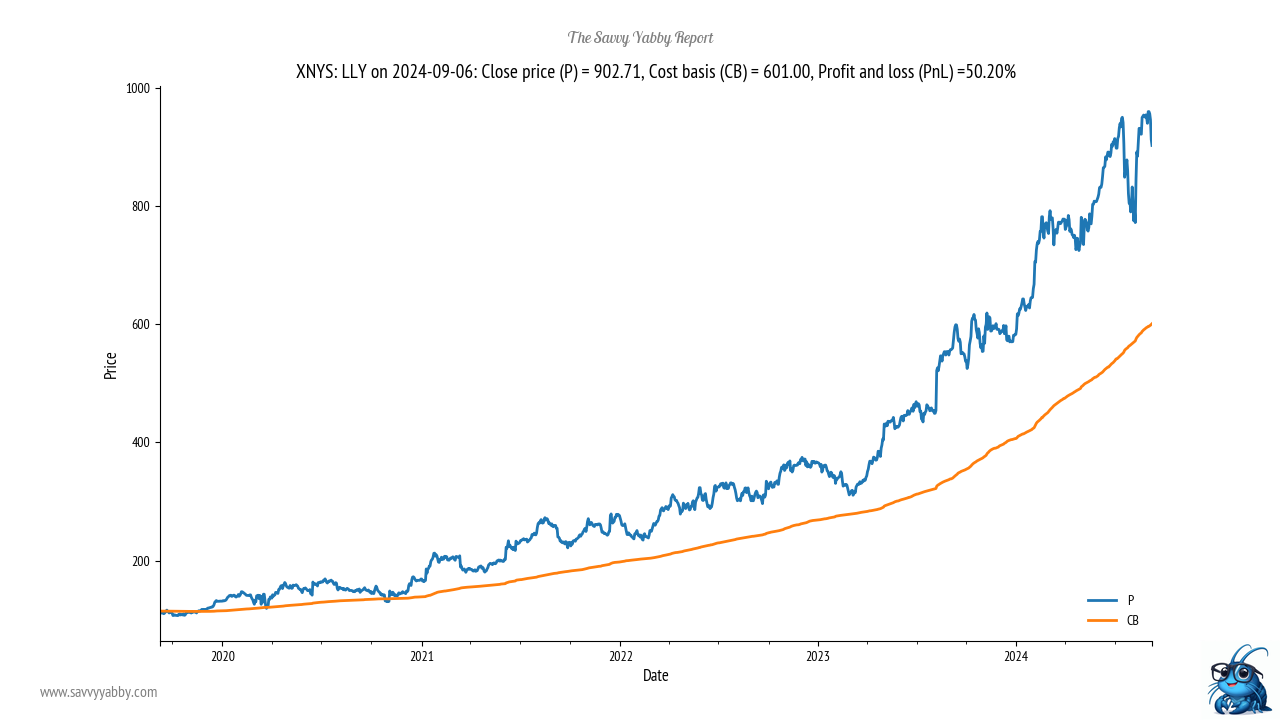

That is before we consider the obesity drug duo Eli Lilly (NYSE: LLY).

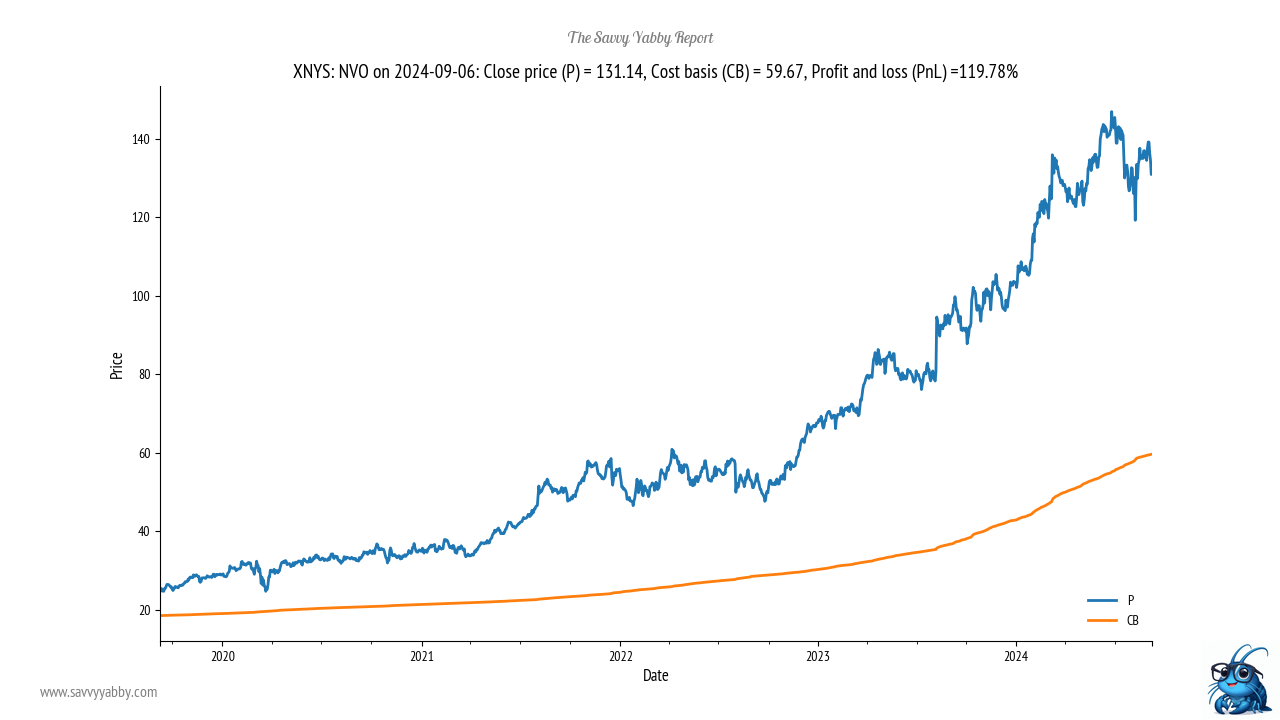

And the Danish Dominator Novo Nordisk (NASDAQ: NVO).

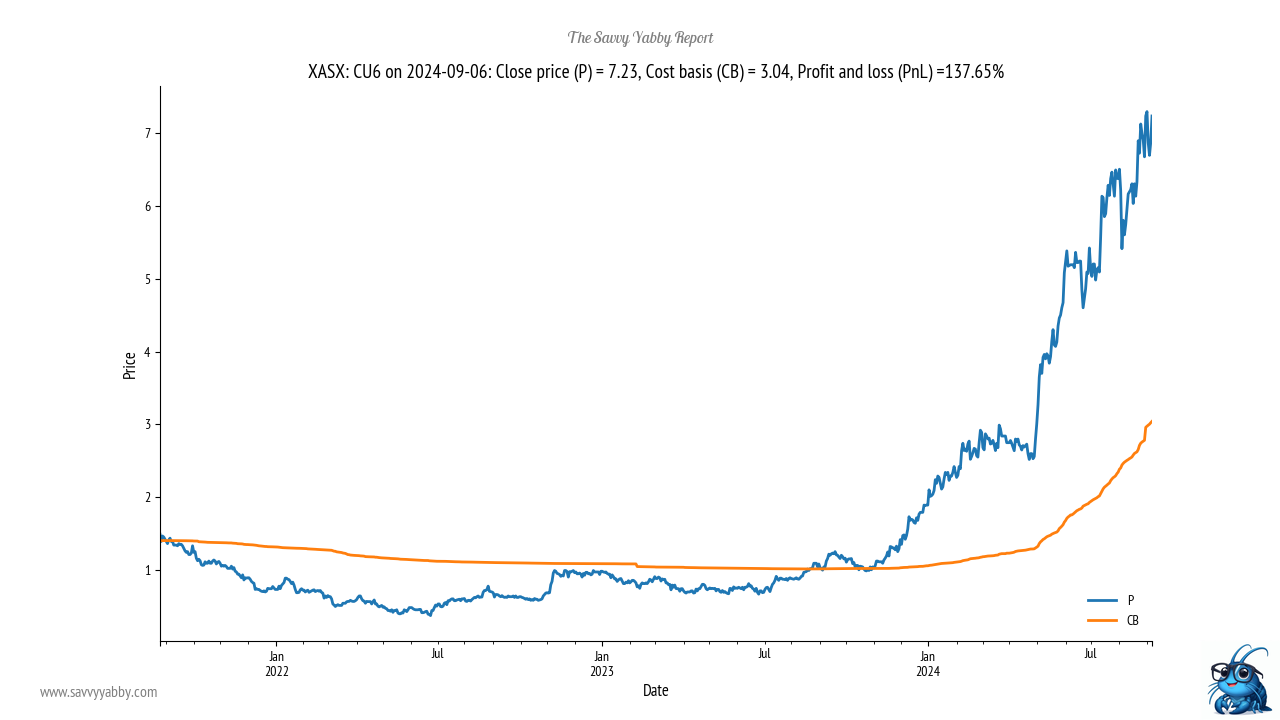

Then you have Australian oncology plays like Clarity Pharmaceuticals (ASX: CU6).

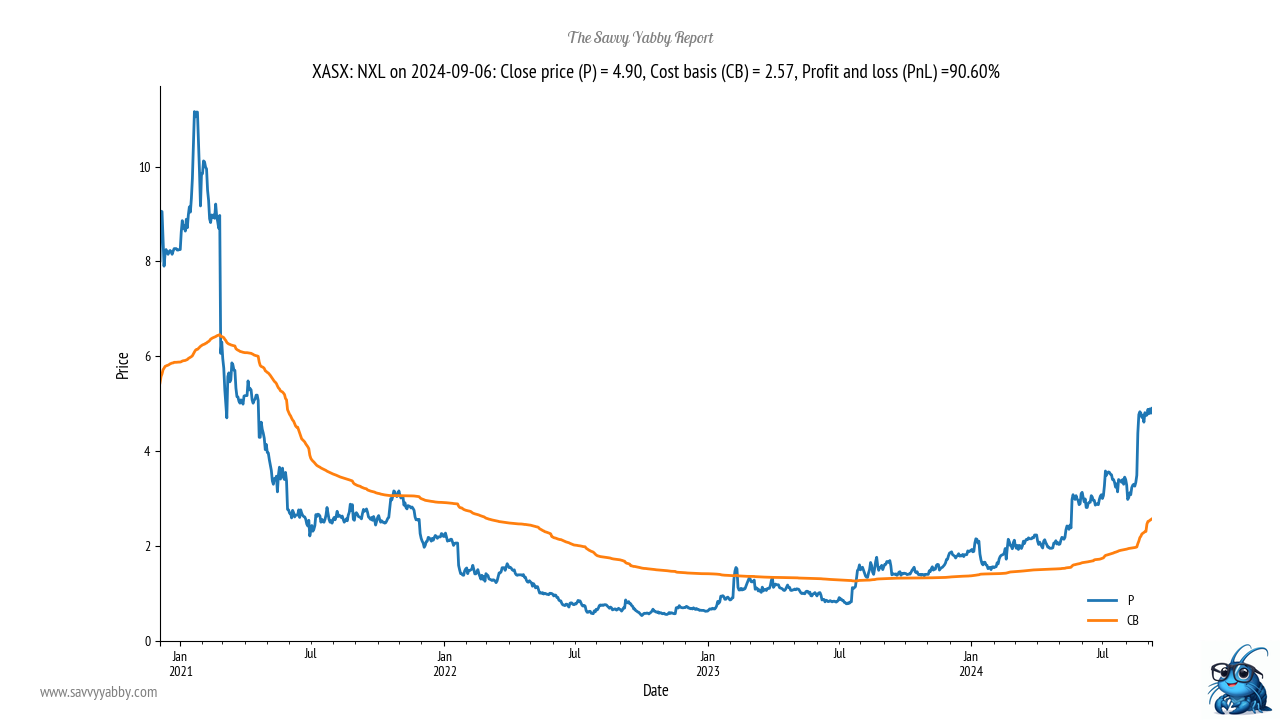

Even if you look in technology, everything is all wrong. Look at Nuix ASX: NXL.

Why was Mr Everybody not told?

Mr. Everybody knows diddly squat.

Mr. Everybody is the ultimate broken clock.

Right twice each market cycle, but who knows when.

In my view, global markets are now firmly into a classic sector and market rotation.

Look at the fundamentals, and see where they are fading, and where they are improving. If you are lazy, use market technical indicators to help you find where to look for that story. If you are both lazy, and generous, then pay me to do it for you.

The market is not stupid, but it is mute. It does not talk in any normal way.

You have to be alert to the signs and go dig.

Looks to me like healthcare is the new leader.

There will be others, but that much looks plain already.

Happy investing!

Photo by Hans-Jurgen Mager on Unsplash

5 topics

8 stocks mentioned