Beating home bias with US-listed companies

Home bias is an understandable phenomenon as investors are often told to “stick to what they know”, and Australian investors have taken this sentiment to heart as directly held domestic shares are still the mainstay of many portfolios. Though some would consider this approach tried and true, it has a few distinct downfalls which may prevent portfolios from performing to their upmost potential. Hence, to help beat home bias, investors could look to international markets – notably the US, which is the stomping ground for the world’s largest companies.

Too close for comfort

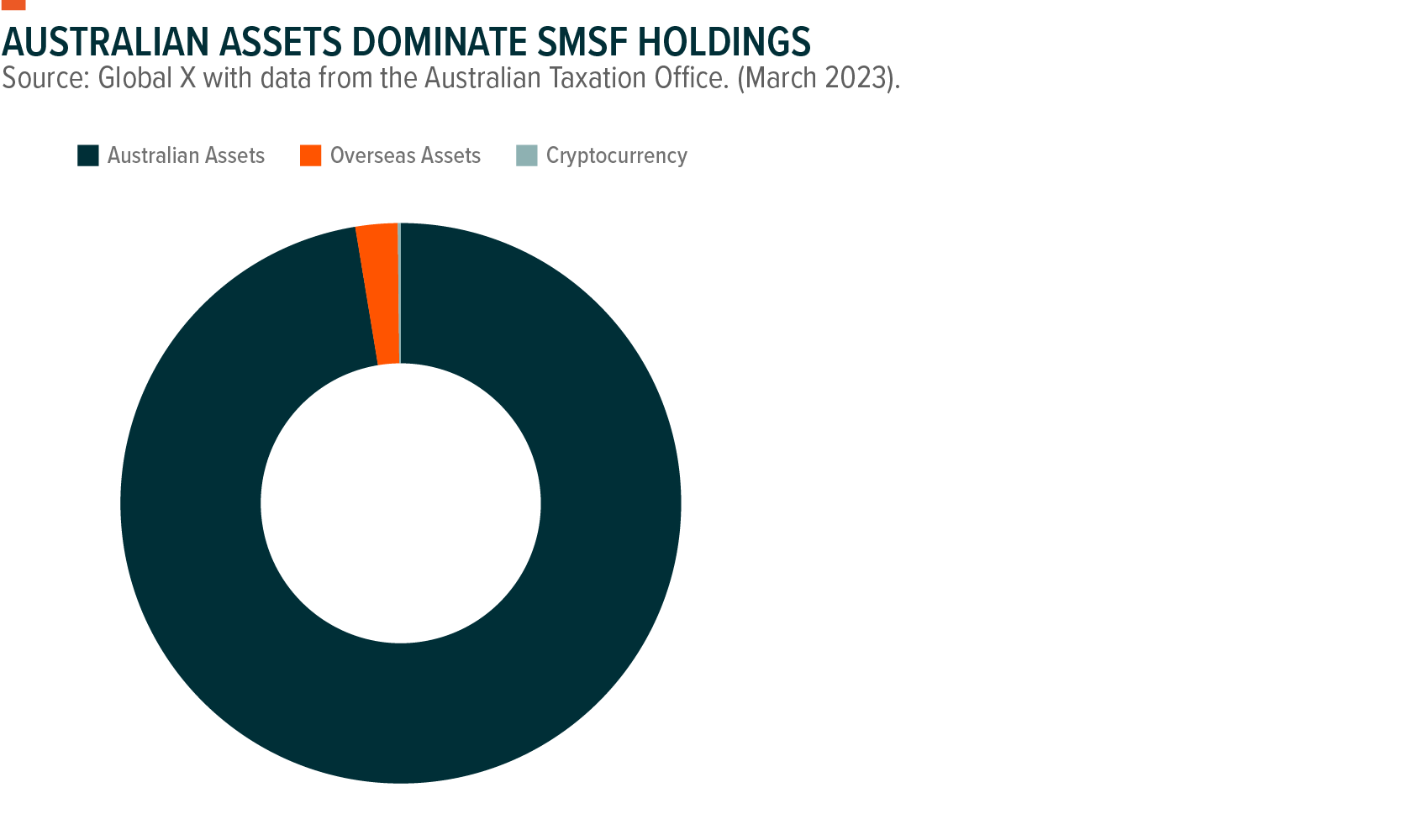

According to the 2023 ASX Investor Study, 58% of local investors have directly held Australian shares in their portfolio, making them the most popular option in the country. Meanwhile, only 16% directly hold international shares.(1) From a self-managed super fund (SMSF) perspective, Australian assets make up more than 97% of total holdings and overseas assets are around 2.4%.(2) This is shown in the below chart.

Besides being more aware of the companies listed in Australia, local investors have generally been attracted to domestically listed shares because of franking credits. Franking credits generally increase tax efficiencies as they avoid tax being paid twice; once by the company on profits generated and once by the investor through any dividends collected. Currency risk may also be a consideration for local investors as the US dollar is comparatively stronger than the Australian dollar.

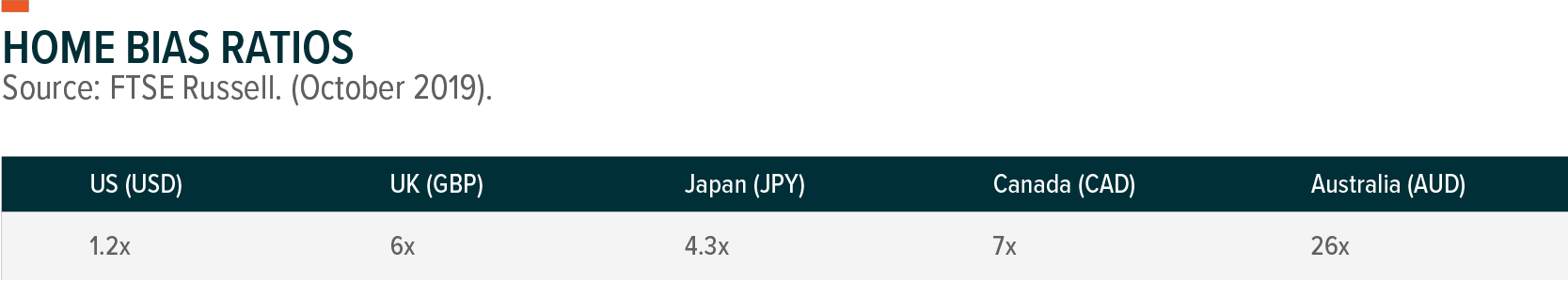

Australians are not alone in favouring local equities. A study conducted by FTSE Russell indicates home bias is prevalent in other established markets such as the US, UK, Japan, and Canada.(3) The study found the US was the only market where home-biased investors would have been at an advantage given its significant growth. Meanwhile, home bias had an adverse effect in the other regions, including Australia which has the highest home bias ratio of any country in the study, as shown in the table below.(4)

Going out to capture growth

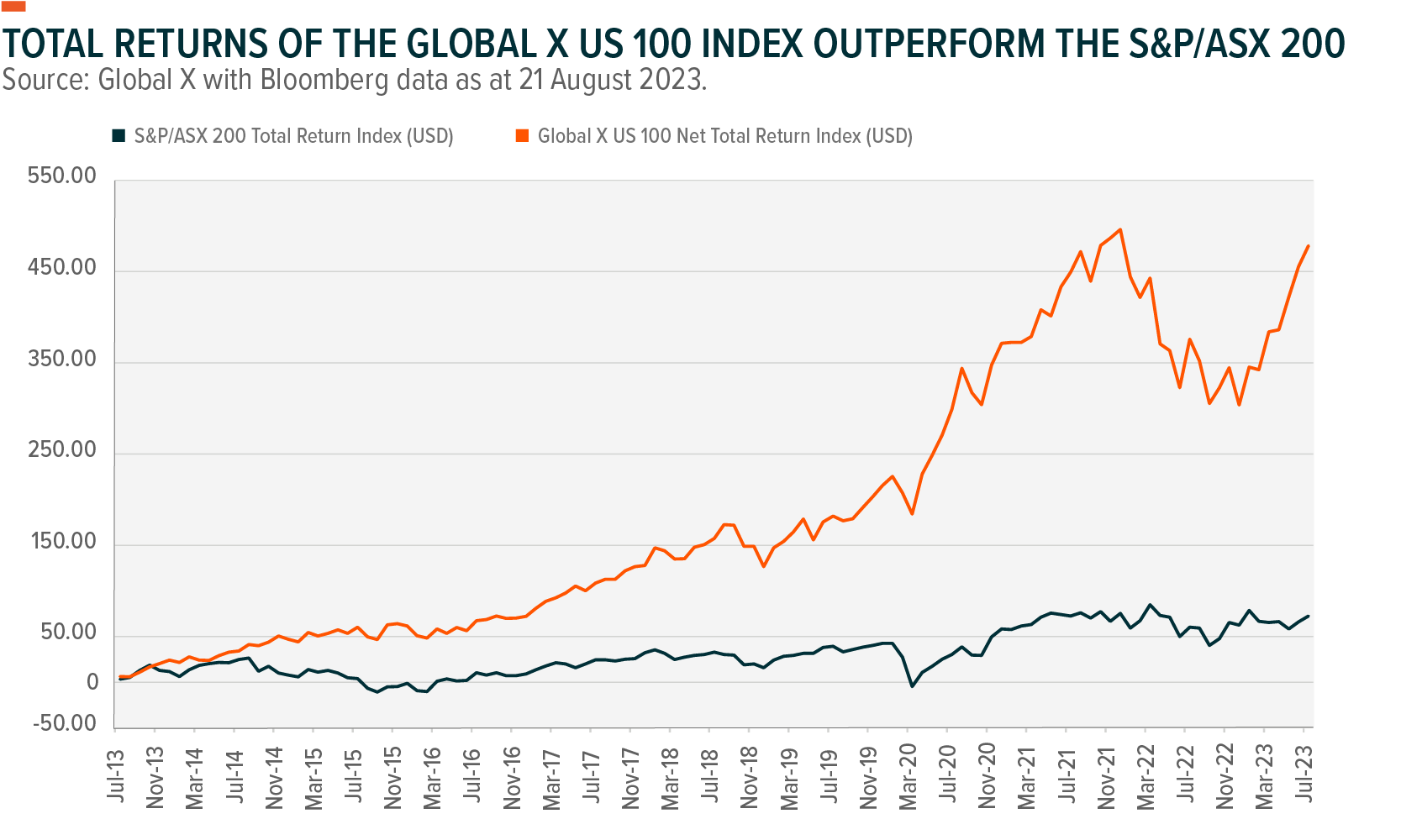

Australia’s market size is a key factor compounding the effects of home bias. It represents only 2% of the global market, while the US makes up around 60%. This can be detrimental to portfolio performance as Australian investors are not capturing the potential growth and returns of larger markets. The below chart highlights how the Global X US 100 Index, a tech-heavy index featuring some of the world’s most innovative companies, has significantly outperformed the S&P/ASX 200 over the past 20 years. In context, US$100 invested in the Global X US 100 Index five years ago would be worth just over US$213, while AU$100 invested in the S&P/ASX 200 would be worth just shy of AU$140.(5)

In addition to overall size, sector weightings in each market play a notable role in performance. This is where the top 100 US-listed companies can offer genuine diversification from the S&P/ASX 200.

Financials and materials combine to make up more than 50% of the S&P/ASX 200. Nine out of the top ten companies fall into these sectors.(6) These blue-chip stocks, seen as the cornerstones of the Australian economy, are generally characterised by their consistent performance, dividend distributions and value. However, the growth potential of these industries is often reduced, given their limited ability to innovate in line with broader megatrends.

Conversely, information technology (IT) is one of the smallest sectors in the Australian market, making up approximately 2.5%.(7) This indicates that Australian portfolios are likely underweight in this sector and may miss out on its potential growth and returns. Meanwhile, IT represents almost half of the 100 companies found in the Global X US 100 Index. The US IT sector is a hub for innovation, boasting some of the largest companies in the world, including Apple, Amazon, Google, Microsoft, and Tesla. The sector has been a driver for growth in recent years. This trend is set to continue as these companies are at the fore of structural shifts in society, including digitalisation, battery technology and artificial intelligence.

Say bye to home bias

Although investing in local equities has its merits for Australian portfolios, having home bias can ultimately limit overall performance and returns. Looking to international markets, like the US, offers geographic and sector diversification, which can help add a growth tilt to core portfolio holdings. Hence, accessing these leading companies via an ETF like the Global X US 100 ETF (ASX: N100) may be an effective option for Australian investors looking to beat their home bias.

1 stock mentioned

1 fund mentioned