Believe in the expansion

|

The Delta variant has become the predominant strain of COVID-19 in much of the world. In response, we're seeing a return to lockdowns and other socially restrictive measures. The resulting negative impact on the global economy is apparent. However, Morgan Stanley believes this will only moderate expected growth rates, with the expansion continuing. Three key reasons the expansion will continue, despite Delta:

|

|

US Economic data is strong

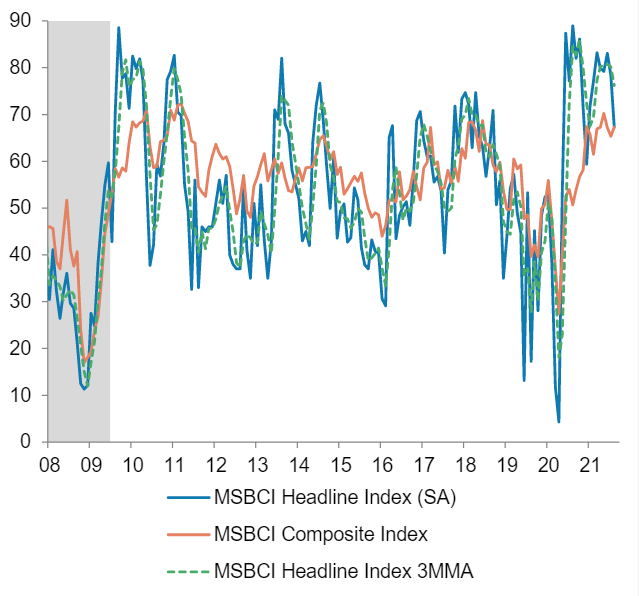

Focusing on recent US economic data, which has garnered the most attention, reported GDP growth has been lower than expected. However, it is important to note the source of this miss, which is primarily due to inventory de-stocking and ongoing supply-chain issues. Inventory represents economic activity created in a previous period, so lowering inventory levels does not contribute to economic activity today. Accordingly, inventory de-stocking and supplier bottlenecks hold back economic activity. Conversely, consumption and business investment are in line with Morgan Stanley’s estimates, and these are the key drivers of private domestic growth (see US Economics: How We Are Tracking, 30 July 2021). We believe it is just a matter of time for day-to-day business activity to return to normal and the expansion to continue. Exhibit 1 – Morgan Stanley Business Conditions Index

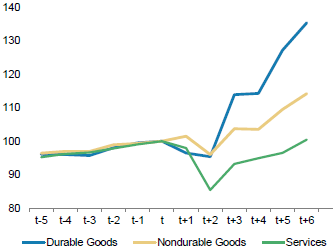

Source: Morgan Stanley Research. Note: +50 = Expanding. Looking at employment, Morgan Stanley's Business Conditions Index (see Exhibit 1) shows business sentiment moderating but remaining at an elevated level in July. More notable is the sub-index measures for hiring and capital expenditure. The hiring sub-index, which measures the pace of hiring, has surged over the past three months to 71 - the highest ever reading. While the Capital Expenditure Plan sub-index, which gauges business investment intentions, rose to 68 - just 3 points below this cycle's high in June 2021 (see US Economics: Business Conditions – A Record Pace of Hiring, 12 August 2021). In another sign that labour activity is increasingly contributing to the momentum in the economy, working-from-home trends seem to be reversing. Before COVID-19, Morgan Stanley's AlphaWise US Consumer Pulse survey showed that about 30% of employed adults reported spending some of the working week at home. In January 2021, this had increased to 53%. As of July 9, this had fallen back to 38%. This has supported a rebound in spending categories like public transport as well as laundry and dry cleaning and is consistent with our forecasts that consumer spending will shift back towards services and away from goods retailing (see US Economics: Back to Work, 23 July 2021). Exhibit 2 – Personal Consumption Expenditure Index

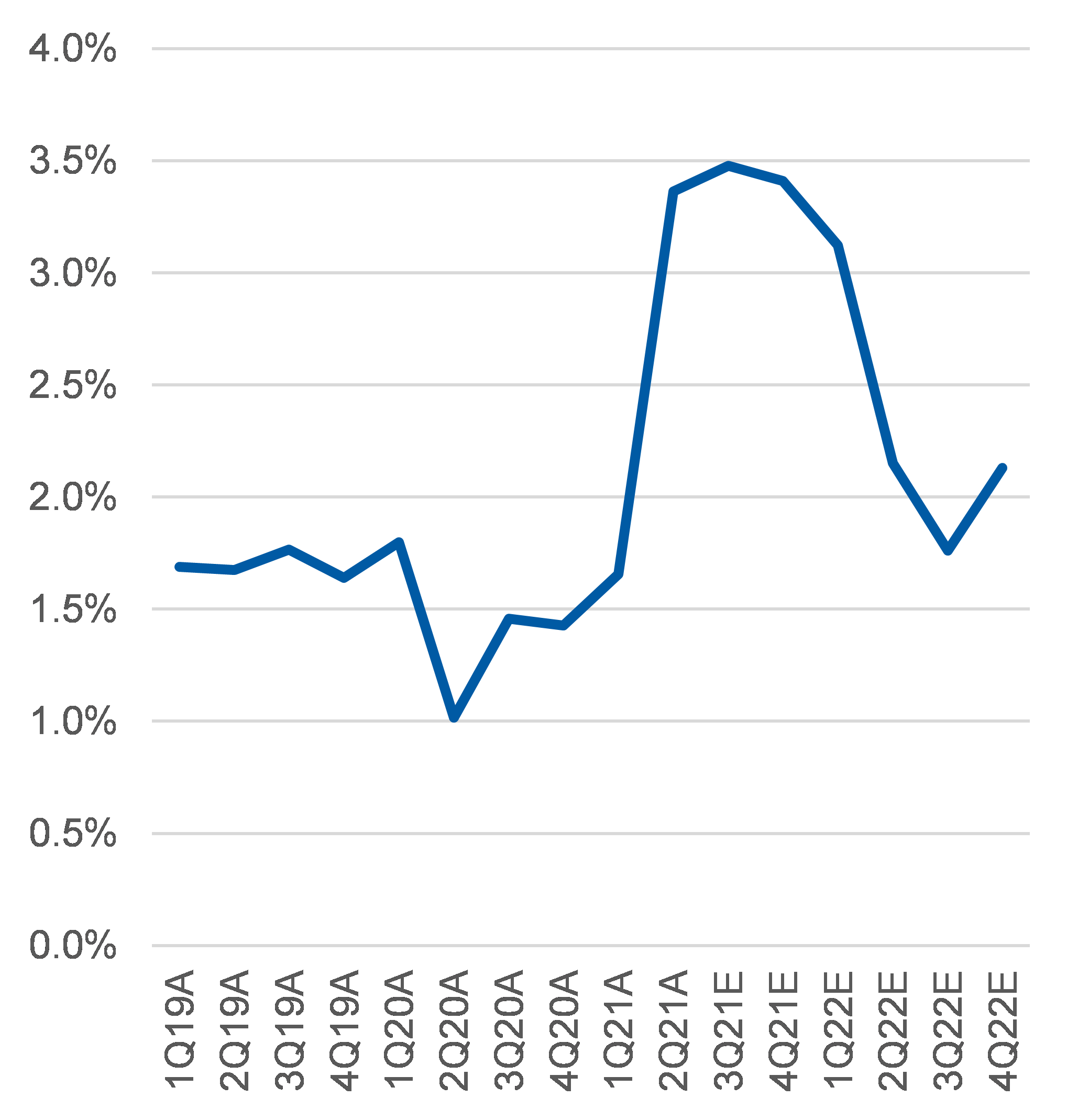

Source: Bureau of Economic Analysis. Morgan Stanley Research. T = 4Q19 This increase in activity is leading to inflation coming in slightly stronger than Morgan Stanley had anticipated. In July, the modest upward pressure we saw in the producer price index (PPI) offset the cooling in the consumer price index (CPI). However, the net impact on our estimate for July's core personal consumption expenditure (PCE) was to only increase it from 3.5% to 3.6%. Core PCE is the preferred inflation measure used by the US Federal Reserve in determining its monetary policy settings. Growth at 3.6% versus last year remains consistent with our expectation for elevated near-term inflation. Last year's recessionary conditions will distort prior-year comparisons. Morgan Stanley continues to expect Core PCE to moderate in 2022 but remain above the US Fed's 2% inflation target (see US Economics: PPI, 12 August 2021). Exhibit 3 – Core PCE Inflation

Source: Morgan Stanley Research estimates The Build Back Better legislation is comingThe US Senate has passed a bipartisan US$1 trillion infrastructure package, which was around US$550 billion above baseline spending. While a political victory for President Biden, who has sought to govern with bipartisan support, the path through the House of Representatives remains uncertain. President Biden’s Build Back Better legislation is comprised of two sections. The second component, which is focused more on social policies like free community college, healthcare subsidies, and childcare tax credits, amounts to around US$3.5 trillion and is being used by House Democrats as a condition for their support of the initial US$1 trillion infrastructure package. Further complicating the process will be the negotiations as to how the spending will be funded. However, Morgan Stanley’s base case remains that a bipartisan path remains open for the entire Build Back Better legislation to be passed. This would provide a material, deficit-funded spending boost to the US and global economy (see Public Policy Brief: Infrastructure Week...What You Need to Know, 3 August 2021). The US can carry its deficit and debtsAs noted by Morgan Stanley’s global macroeconomics team (Global and US Economics: Debt Sustainability: r-g Is Key, 14 July 2021), managing the aftermath of debt build-ups is key to understanding long term consequences for the US economy as well as other economies more broadly. Morgan Stanley reviewed 76 instances over the past 100 years where economies experienced a comparable build-up in public debt and found the best outcome occurred when real GDP growth was greater than real interest rates. We also found that the best results were tied to extended periods of looser monetary and fiscal policies - leading to faster economic growth and a quicker return to full employment. Once the economy was on a self-sustaining path, policymakers could adjust policies back towards tighter conditions. Inflation is the main risk for policymakers, but it appears this is well understood and contained for now. However, the risk to our expansionary scenario comes from two sources: the Delta strain and China/US tensions.

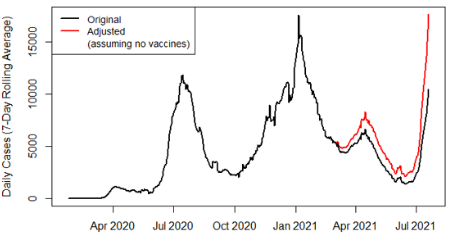

The current COVID vaccines remain effective against severe disease, hospitalisation and death. However, additional variants might emerge that prove resistant to these currently available vaccines, in turn forcing more severe lockdowns and impacting economic activity. It is important to note Morgan Stanley believes the rising case count obscures the reality that vaccinations are working to control the virus. Our US work points to significantly higher infections if the rollout of vaccines had not occurred. (see Biotechnology: COVID-19: Putting Delta in Perspective, 27 July 2021). Exhibit 4 – Adjusted Covid-19 case numbers assuming no vaccines – Florida example

Source: Morgan Stanley Research. Data.cdc.gov. Morgan Stanley recently hosted a panel discussion with US/China relationship experts. They identified potential catalysts that might bring trade tensions between the US and China back into focus (see Podcast | Thoughts on the Market: Michael Zezas: The Return of US-China Trade Tensions?, 11 August 2021). These included:

The bottom line

While we acknowledge the impact on economic activity from the rise of the COVID-19 Delta variant, underlying activity remains robust, while the desire for a return to "normal" remains as strong as ever. In addition, the US Build Back Better legislation remains on track. This legislation, in particular, should provide a significant economic boost. We continue to expect equity markets to take a gradual path to generally higher levels in 12 months. We continue to favour the Quality factor and, to a lesser extent, the Value factor and prefer International over Australian equities. Fixed-income allocations remain tilted towards credit for improved yield at the expense of duration. Cash currently remains our least favoured asset class. Learn morePlease click 'Contact' if you would like a copy of the full report. |

|

4 topics