Beware the Ides of March! What to expect from ASX stocks this month

Summer’s over, earnings season is done, and March has arrived! Whilst I personally will enjoy a breather after a monster February earnings blast, investors should note that the third month of the year can often deliver significant volatility.

What is seasonal analysis?

Seasonal analysis investigates the tendency of asset prices to move in consistent patterns at certain times of the year. It is a form of quantitative analysis that can complement fundamental and technical methods.

Seasonality is particularly evident in the movement of commodities and stock indices. Seasonality in commodities is easy enough to understand, the weather plays a major role in determining demand and supply throughout the year. Stock indices also exhibit seasonal trends, mainly based on the regular timing of earnings and dividends.

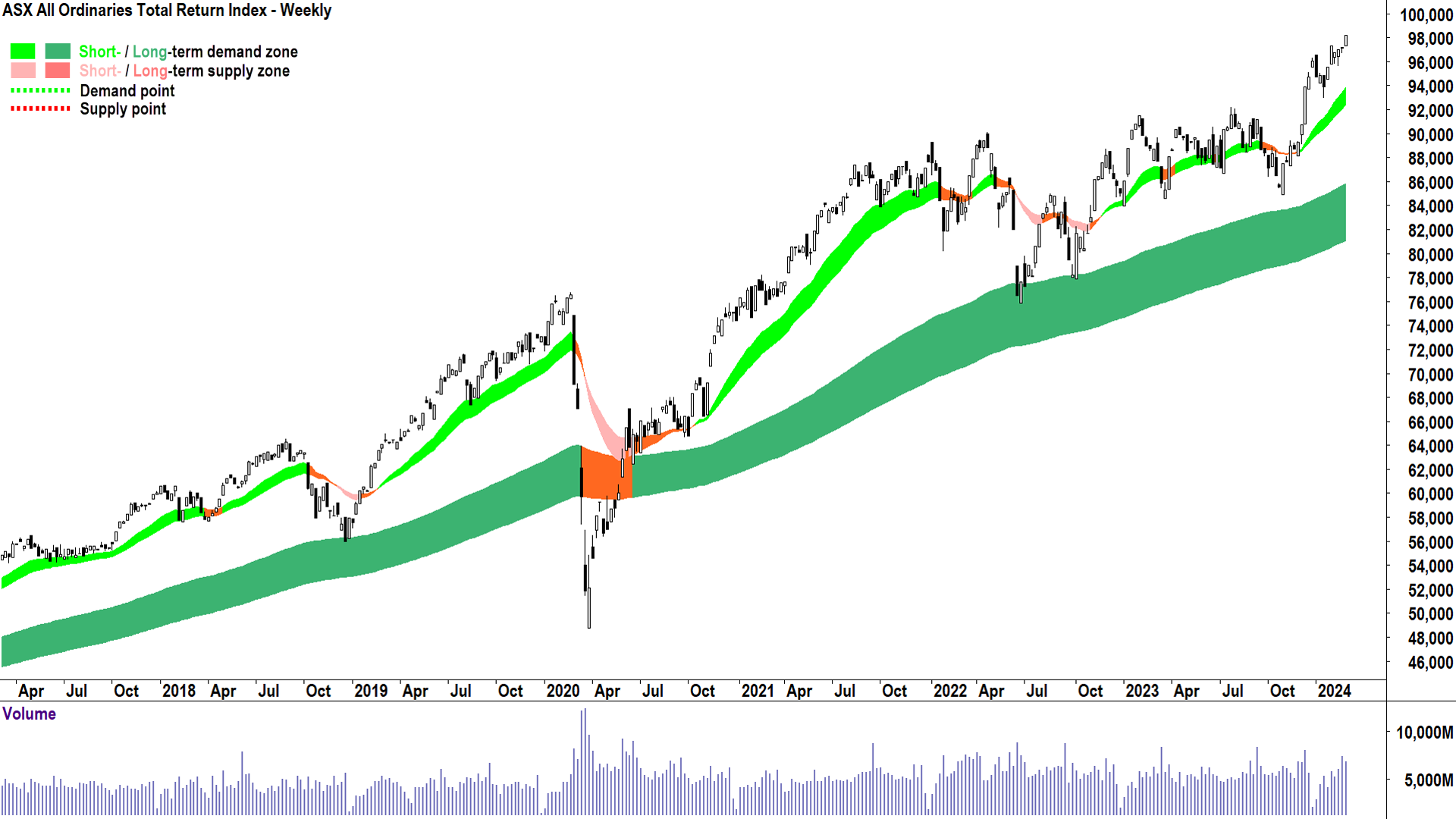

For stock indices, it’s important to conduct seasonal analysis using total return measures, that is, those that add back dividends. This ensures one is getting the full picture when it comes to performance. On the ASX, the key total return index is the All Ordinaries Total Return Index (AOTRI).

ASX seasonal observations

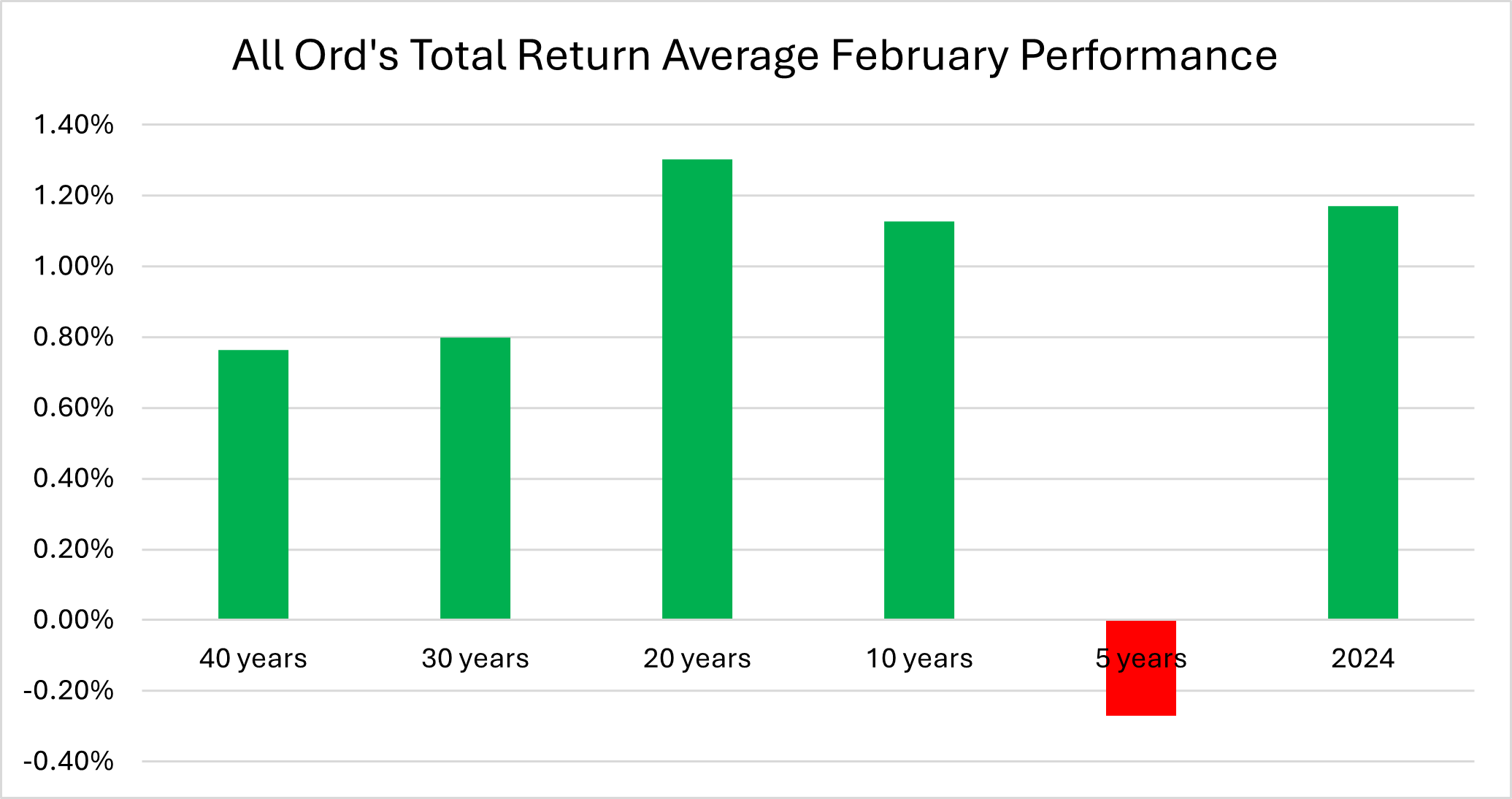

The AOTRI closed at an all-time high of 98227.8 on February 29, a 1.17% gain for the month. This is fairly typical of the average February performance over longer-term lookback periods, but far better than the -0.27% performance over the last five years.

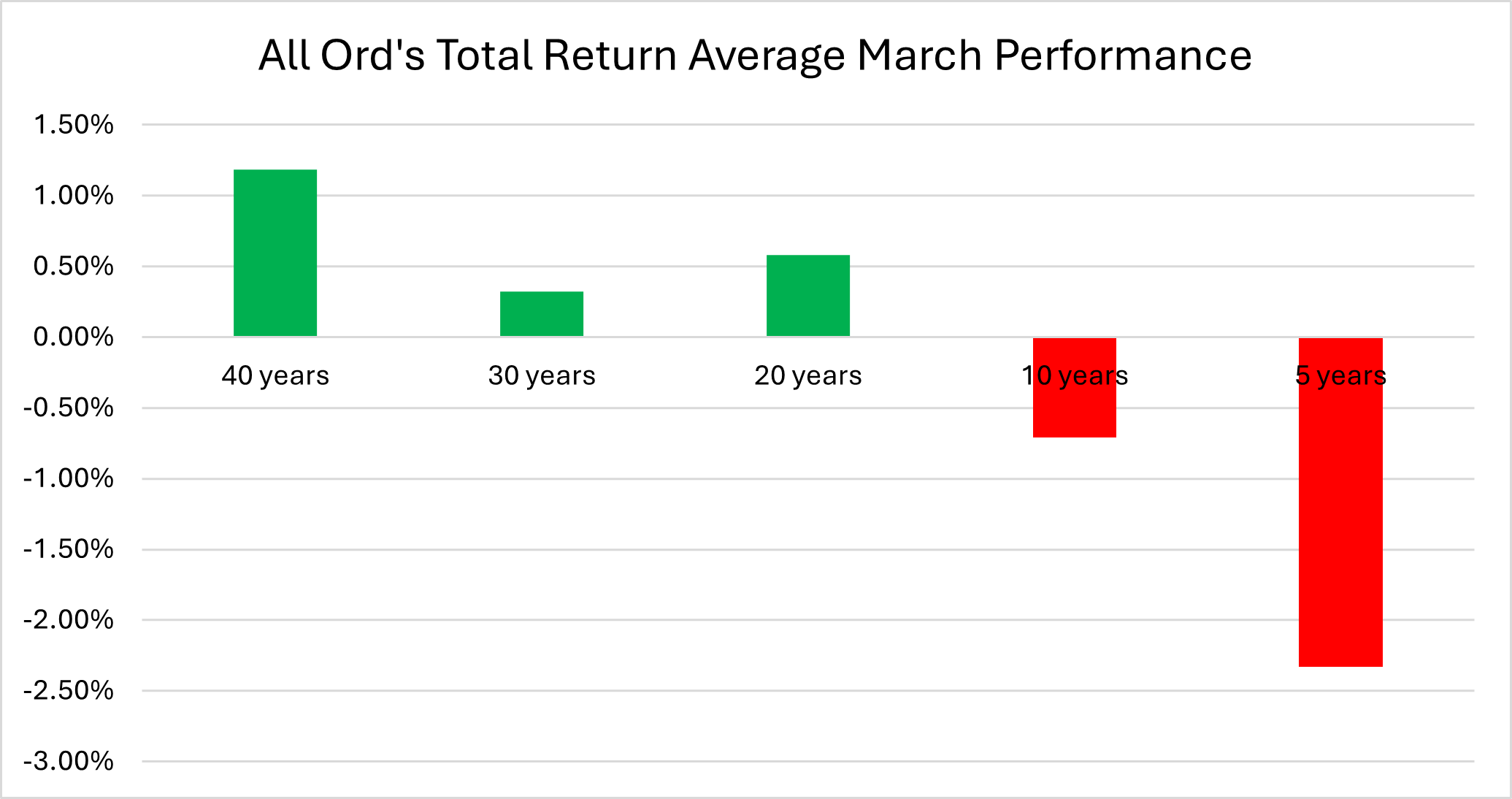

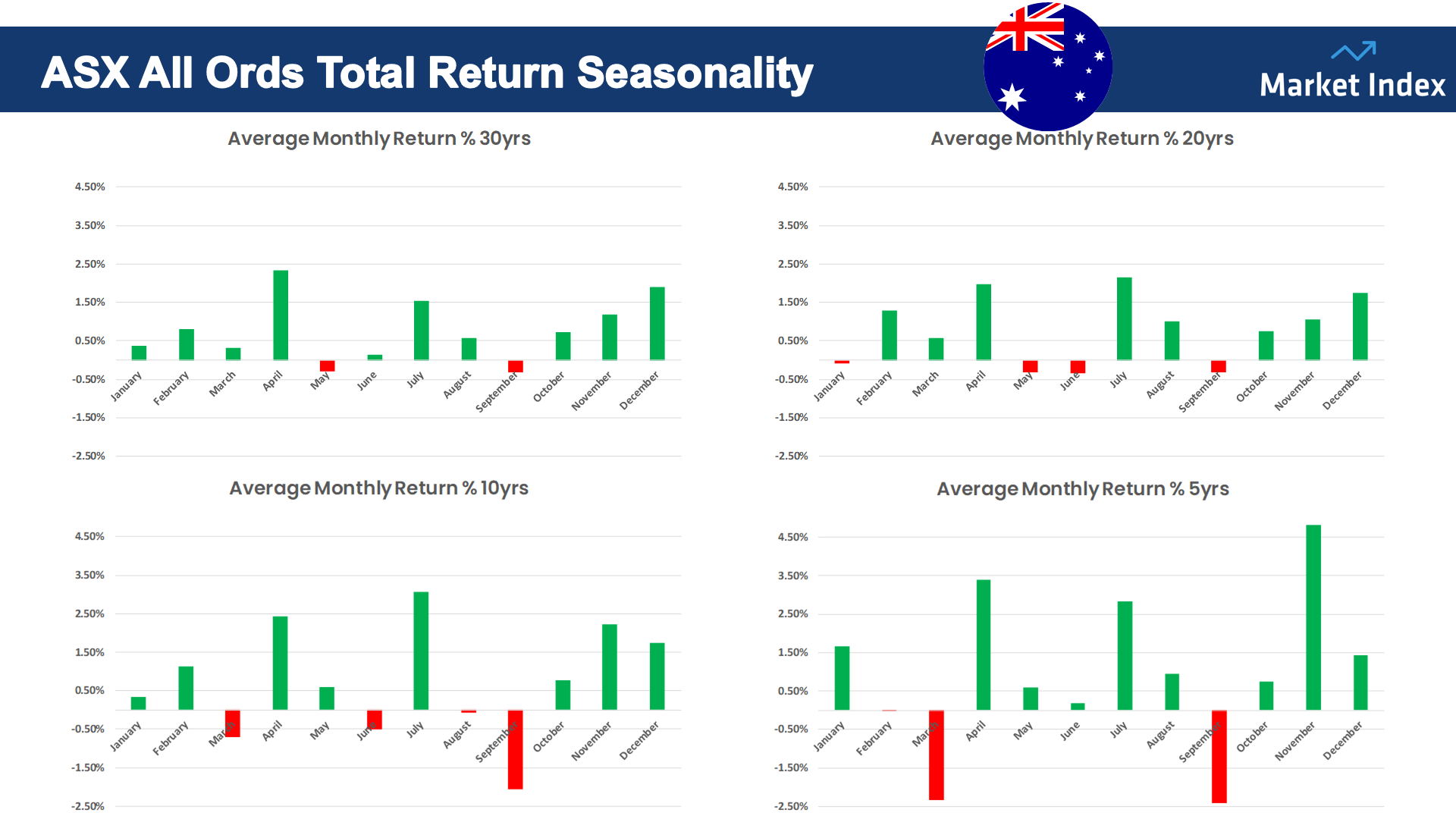

What can we expect in March? I have good news and bad news. The good news is over the long term, March is also typically a positive month for Aussie stocks. The bad news is, over the last 10 years, on average it has been a negative month – this is particularly so over the last five years.

The five-year performance of -2.33% is concerning, but it is a small sample size. Over 10 years, the typical March decline is -0.71%, over 20 years it’s +0.58%, over 30 years it’s 0.32%, and over 40 years it's a very respectable 1.18%.

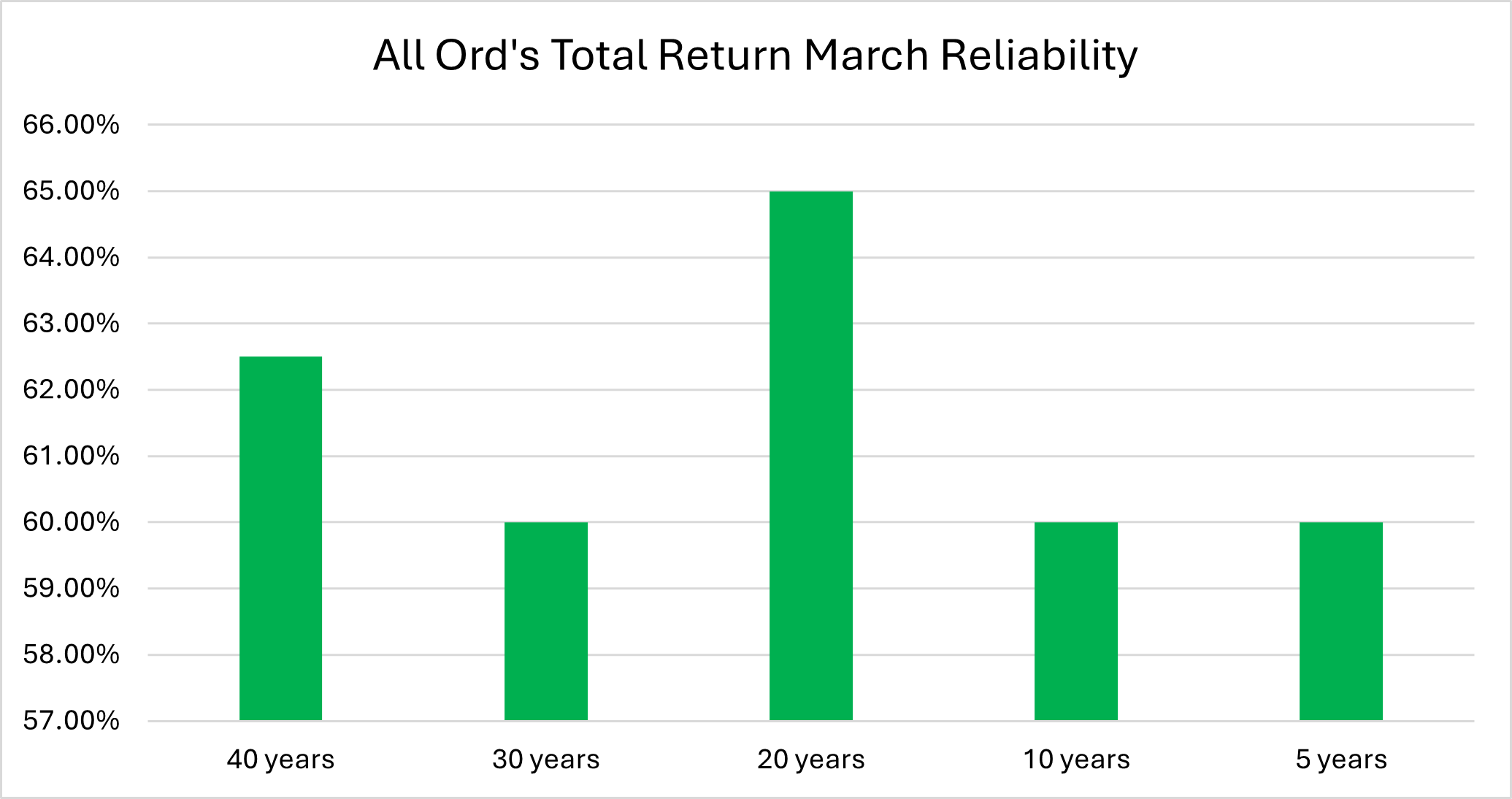

In terms of reliability, March delivers a gain of any amount between 60% and 65% of the time depending on the lookback period. This is roughly an average reliability among the months (note that April and July are the two most reliable months for delivering a gain).

How goes October-February, so goes March

Another thing to consider when conducting monthly seasonal analysis is whether there are any mitigating factors for a month’s performance. For example, does the performance heading into March have an impact on its performance?

In my last article on seasonality in the Australian stock market, I noted that performance in January tends to run somewhat counter to the performance in December. Interestingly, March tends to follow the recent trend, not counter it. This is good news for us this year because the trend in AOTRI performance heading into this month is a strong one.

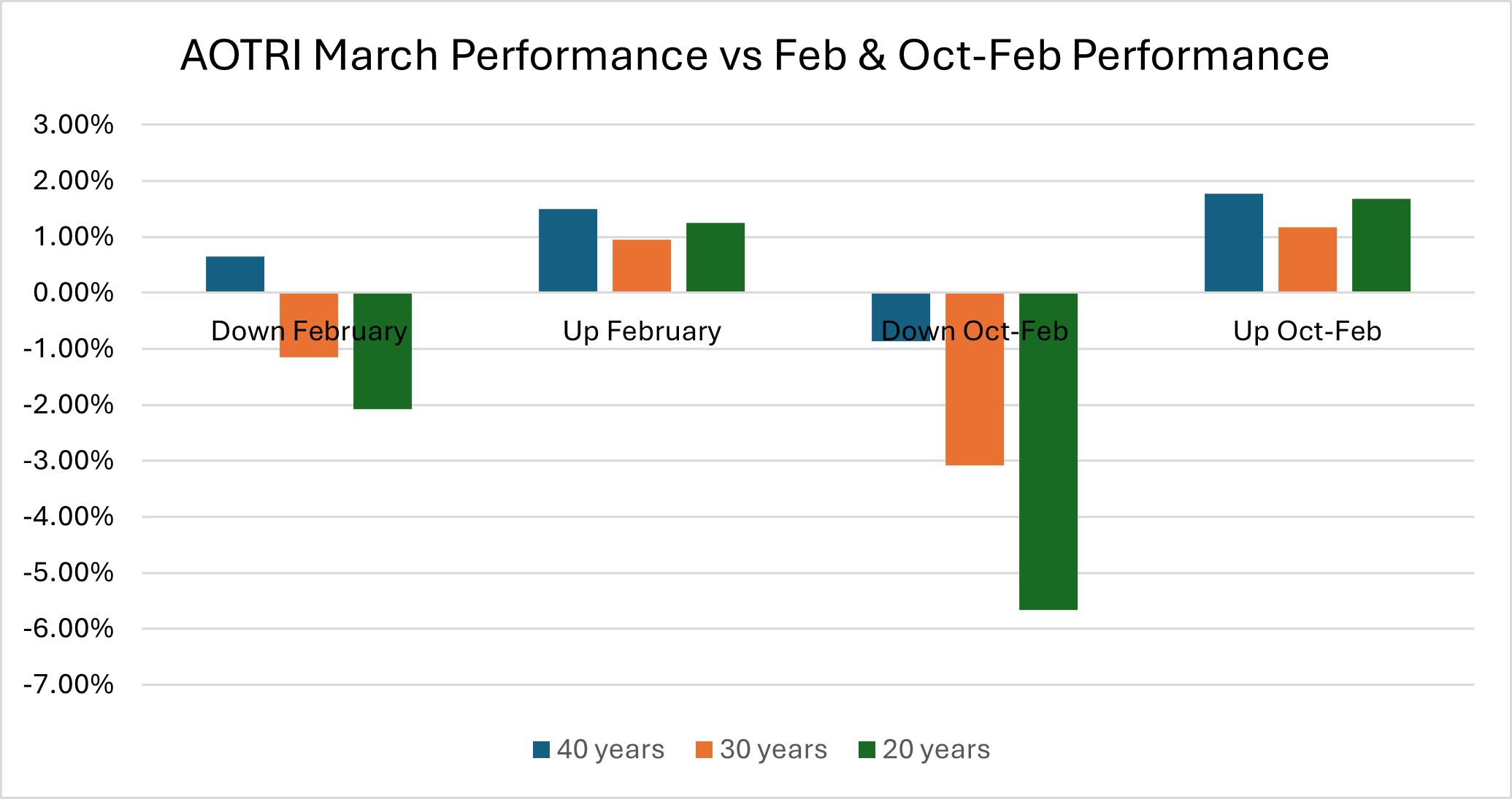

Note, I have deliberately excluded shorter 10- and five-year lookback periods here because the outlier decline of -20.94% in Mach 2020 triggered by the outbreak of the COVID-19 pandemic completely skews the small datasets over these periods.

That’s what the table above shows over longer lookback periods. The data suggests that a down March usually follows a down February, and an up March usually follows an up February.

When we consider the seasonally strongest period of the year between October and February, the trend in March is even more pronounced. A strong performance during October-February usually results in a March gain, and vice-versa.

The good news for investors is that this year we have enjoyed both a strong February and a strong October-February period.

Lessons from seasonality

I always end my seasonal analysis articles with a reminder that this form of analysis just provides us with information to help understand what could occur. My analysis and experience suggest seasonality in the Australian stock market is very real, but I also know that the future is unknown!

Just because something has tended to occur in the past doesn’t guarantee it will occur again in the future. Seasonal analysis, therefore, is merely a useful roadmap for what might happen. On this note, I’ll leave you with the typical seasonal roadmap for a typical year on the Aussie market.

This article first appeared on Market Index on March 1 2024.

4 topics