BHP, RIO, FMG, MIN, PLS…Big brokers tip ASX mining stocks tariff collateral damage is unavoidable

It’s been a tough couple of weeks for markets, for investors, and take a minute to consider us exhausted financial journalists! The uncertainty created by President Trump’s trade policies have caused fund managers to recalibrate their views of global trade, global economic growth, and importantly, for ASX mining stocks – the demand for key commodities like Iron Ore, Crude oil, Coking Coal, Lithium, and Copper among others.

Now that the dust has settled on President Trump’s April 2 Liberation Day “reciprocal” tariffs, his backflip a few days later where he paused many of them, and more recent exemptions on items like smartphones and laptops, let’s look at where the big brokers have settled on their ratings and target prices for the ASX’s most important mining companies.

What’s the consensus on how the looming trade war is going to impact our big miners? Are they a buy, hold, or sell, and at what price? Let’s start with iron ore producers, then we’ll look at base metals and lithium companies. Spoiler alert 🚨! It appears the big brokers are tipping substantial collateral damage from President Trump’s tariffs is inevitable.

Group 1: Iron Ore Stocks BHP, RIO, FMG, MIN, CIA

For all of the stocks covered, to obtain a Broker Consensus Rating, we assign a Rating Value of +1 to any broker rating better than HOLD/NEUTRAL/MARKETWEIGHT; a Rating Value of 0 for any broker rating equivalent to HOLD/NEUTRAL/MARKETWEIGHT; and a Rating Value of -1 to any broker rating worse than HOLD/NEUTRAL/MARKETWEIGHT.

We then take the average of all Rating Values and assign a Broker Consensus Rating of BUY to values +0.5 or above; a Broker Consensus Rating of HOLD for values between -0.5 and +0.5; and a Broker Consensus Rating of SELL for values -0.5 or below.

The Broker Consensus Target is simply the average of the target prices we have on file for each broker. Typically, brokers define their target price as a 12-month forecast, and each target price is based on a broker’s fundamental valuation assumptions. We have only assessed broker ratings and target prices within the last 3 months to account for recent relevance.

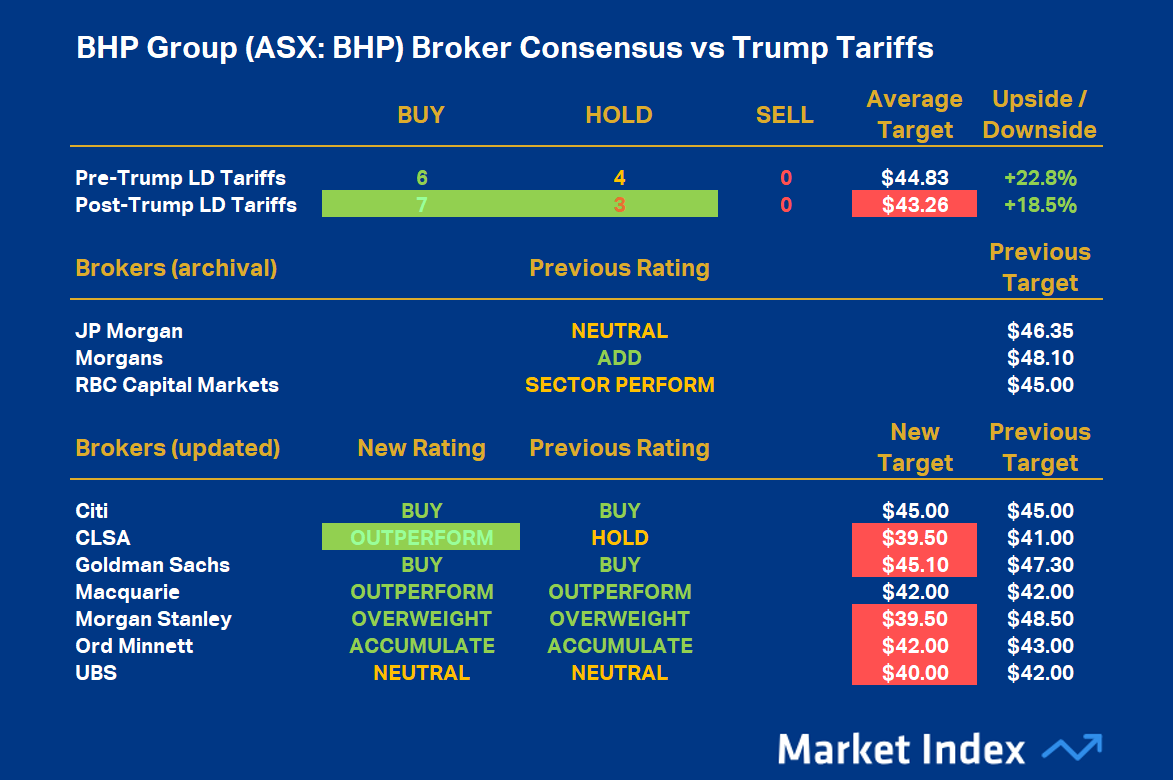

BHP Group (ASX: BHP)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

BHP’s average Rating Value is +0.70, resulting in a Broker Consensus Rating of BUY. This is up modestly from its prior average Rating Value of +0.60 and Broker Consensus Rating of BUY.

BHP’s Broker Consensus Target is $43.26 (down 3.5% from $44.83 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 18.5% undervalued based upon the closing price on Tuesday, 15 April of $36.50.

Note however, if we only consider broker updates received since 2 April, BHP’s average Rating Value rises to +0.85 – arguably a strong BUY – but its Broker Consensus Target falls to $41.87 (+14.7% undervalued).

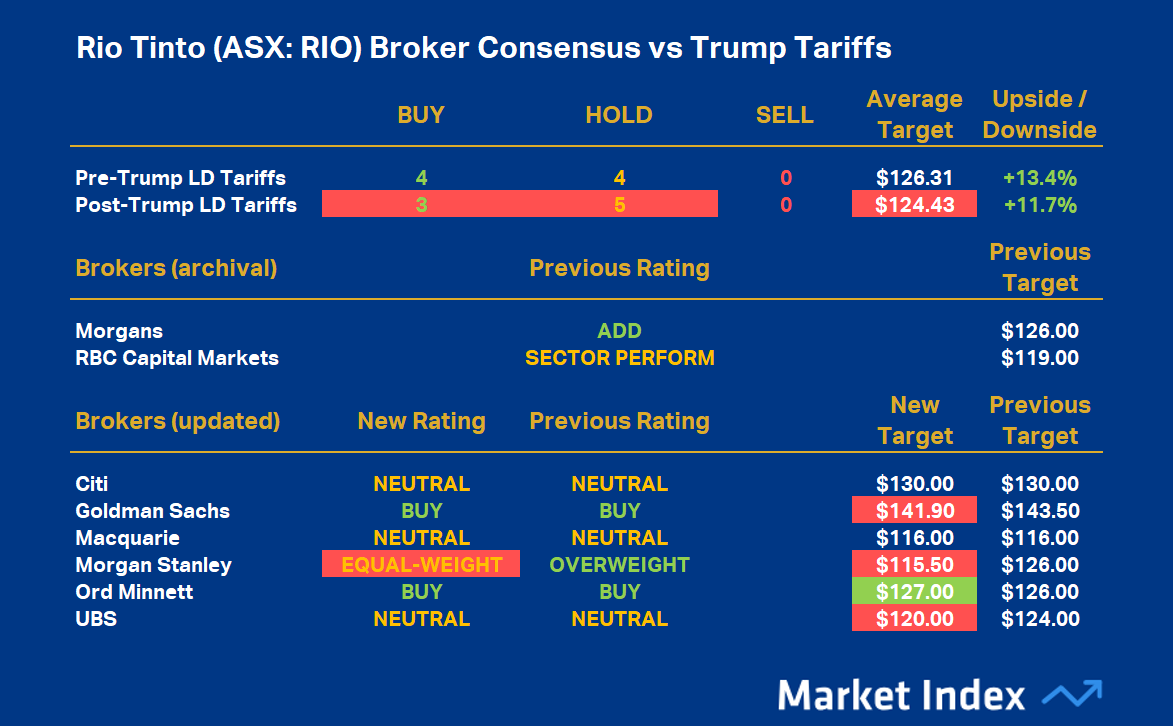

Rio Tinto (ASX: RIO)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

RIO’s average Rating Value is +0.38, resulting in a Broker Consensus Rating of HOLD. This is effectively a consensus downgrade from its prior average Rating Value +0.50 and Broker Consensus Rating of BUY.

RIO’s Broker Consensus Target is $124.43 (down just 1.5% from $126.31 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 11.7% undervalued based upon the closing price on Tuesday, 15 April of $111.40.

Note however, if we only consider broker updates received since 2 April, RIO’s average Rating Value falls to +0.33 (still a Broker Consensus Rating of HOLD) but its Broker Consensus Target rises to $125.06 (+12.3% undervalued).

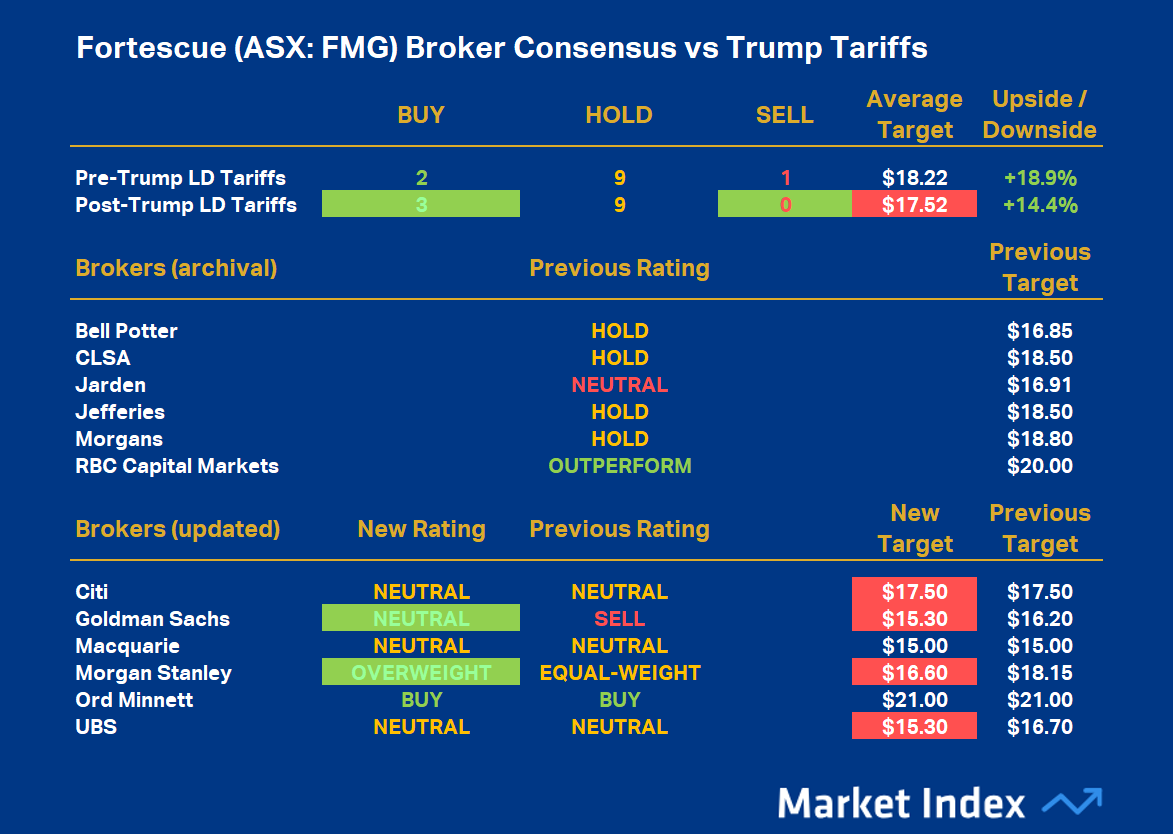

Fortescue (ASX: FMG)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

FMG’s average Rating Value is +0.25, resulting in a Broker Consensus Rating of HOLD. This is up from its prior average Rating Value of +0.08 and Broker Consensus Rating of HOLD.

FMG’s Broker Consensus Target is $17.52 (down 3.8% from $18.22 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 14.4% undervalued based upon the closing price on Tuesday, 15 April of $15.32.

Note however, if we only consider broker updates received since 2 April, FMG’s average Rating Value rises to +0.33 (still a Broker Consensus Rating of HOLD) but its Broker Consensus Target falls to $16.78 (+9.5% undervalued).

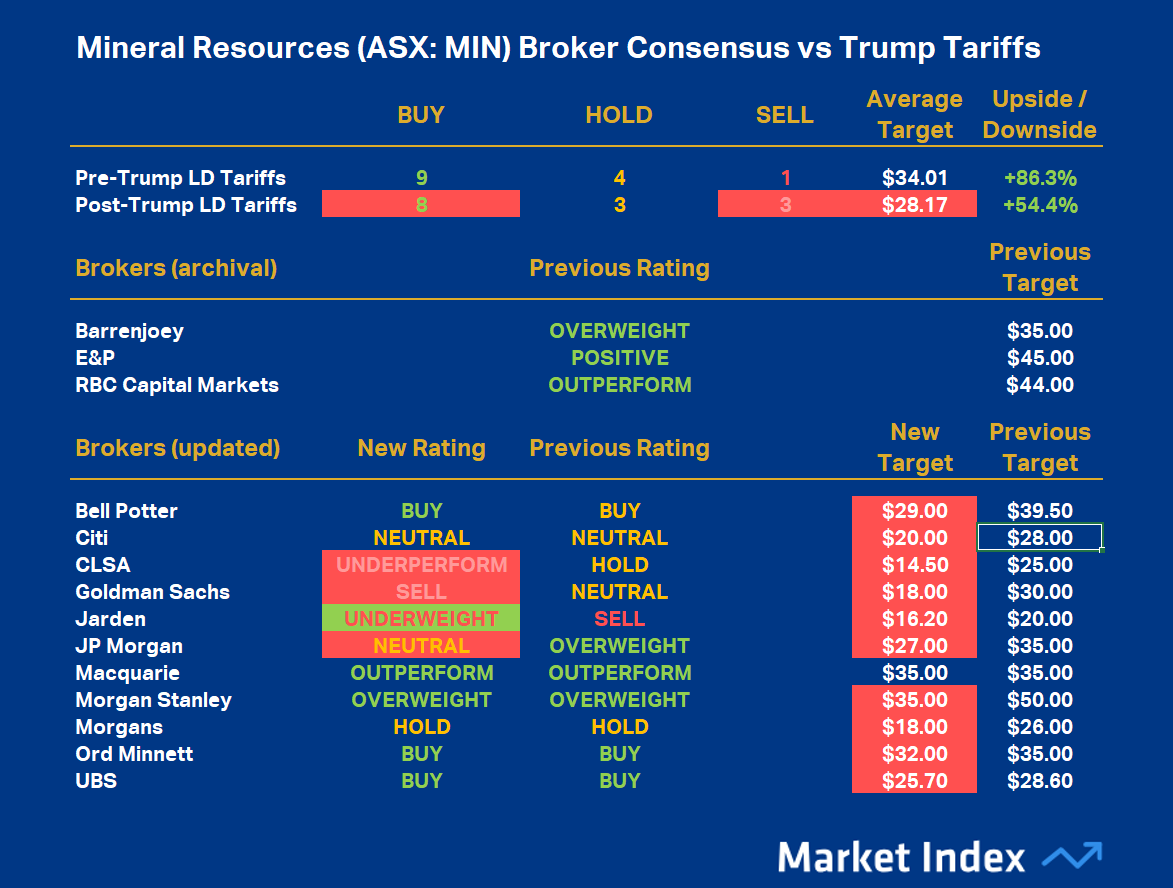

Mineral Resources (ASX: MIN)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

MIN’s average Rating Value is +0.36, resulting in a Broker Consensus Rating of HOLD. This is effectively a consensus downgrade from its prior average Rating Value +0.57 and Broker Consensus Rating of BUY.

MIN’s Broker Consensus Target is $28.17 (down 17.2% from $34.01 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 54.4% undervalued based upon the closing price on Tuesday, 15 April of $18.25.

Note however, if we only consider broker updates received since 2 April, MIN’s average Rating Value falls to +0.18 (still a Broker Consensus Rating of HOLD) and its Broker Consensus Target falls to $24.58 (+27.7% undervalued).

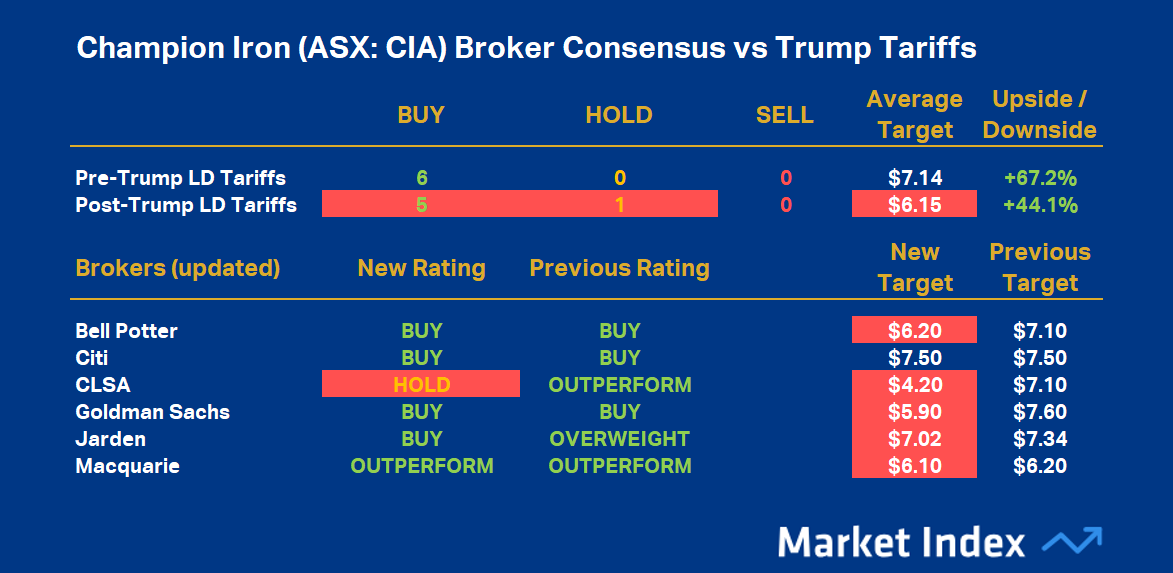

Champion Iron (ASX: CIA)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

CIA’s average Rating Value is +0.83, resulting in a Broker Consensus Rating of BUY. This is down from its prior average Rating Value of +1.00 and Broker Consensus Rating of BUY.

CIA’s Broker Consensus Target is $6.15 (down 13.8% from $7.14 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 44.1% undervalued based upon the closing price on Tuesday, 15 April of $4.27.

Group 2: Base Metals & Lithium: IGO, LTR, PLS, S32, SFR

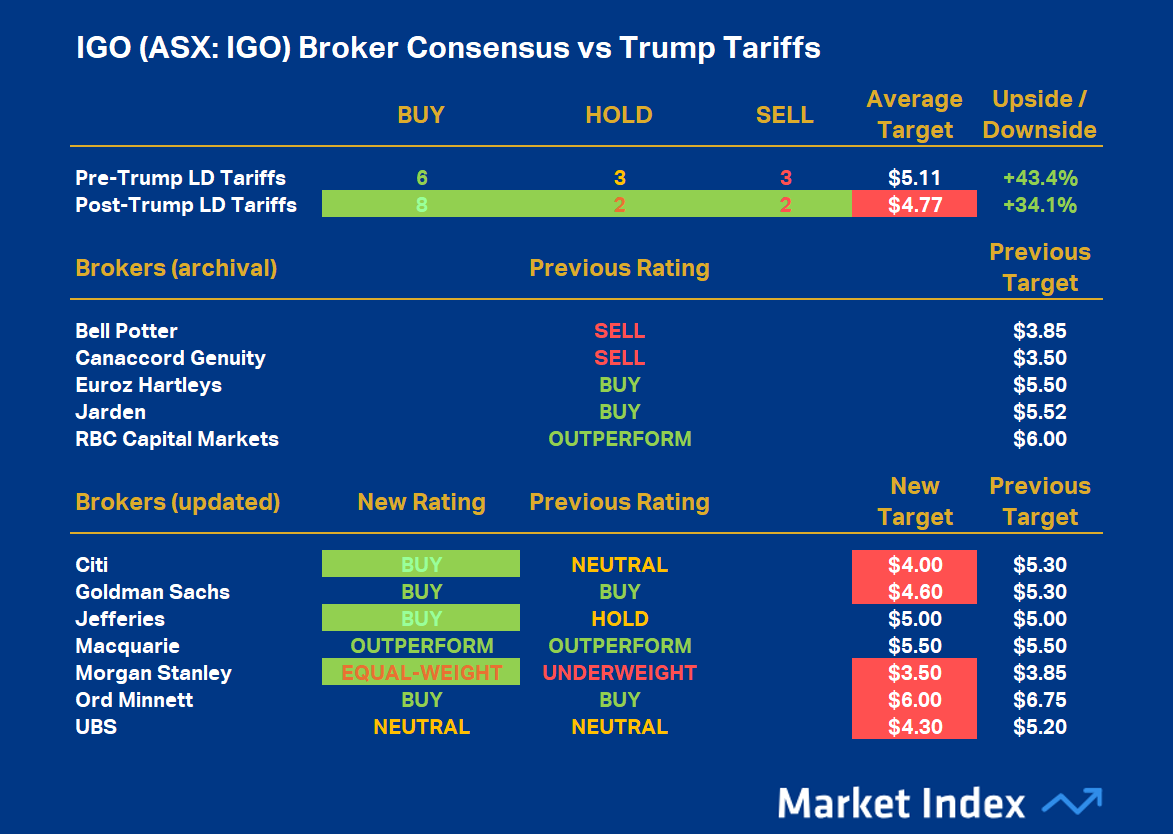

IGO (ASX: IGO)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

IGO’s average Rating Value is +0.50, resulting in a Broker Consensus Rating of BUY. This is effectively a consensus upgrade from its prior average Rating Value +0.25 and Broker Consensus Rating of HOLD.

IGO’s Broker Consensus Target is $4.77 (down 6.5% from $5.11 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 34.1% undervalued based upon the closing price on Tuesday, 15 April of $3.56.

Note however, if we only consider broker updates received since 2 April, IGO’s average Rating Value rises to +0.71 (still a Broker Consensus Rating of BUY) but its Broker Consensus Target falls to $4.70 (+32.0% undervalued).

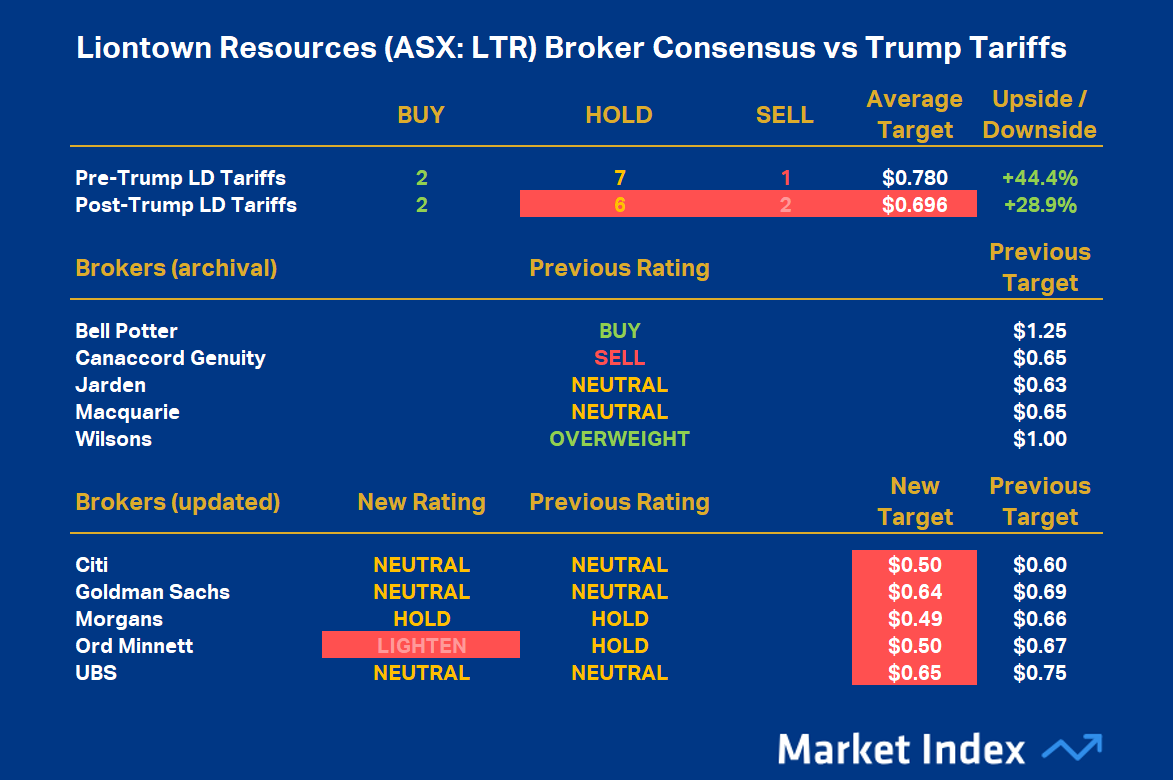

Liontown Resources (ASX: LTR)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

LTR’s average Rating Value is 0.00, resulting in a Broker Consensus Rating of HOLD. This is down from its prior average Rating Value +0.10 and Broker Consensus Rating of HOLD.

LTR’s Broker Consensus Target is $0.696 (down 10.8% from $0.780 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 28.9% undervalued based upon the closing price on Tuesday, 15 April of $0.540.

Note however, if we only consider broker updates received since 2 April, LTR’s average Rating Value falls to -0.20 (still a Broker Consensus Rating of HOLD) and its Broker Consensus Target falls to $0.556 (+3.0% undervalued).

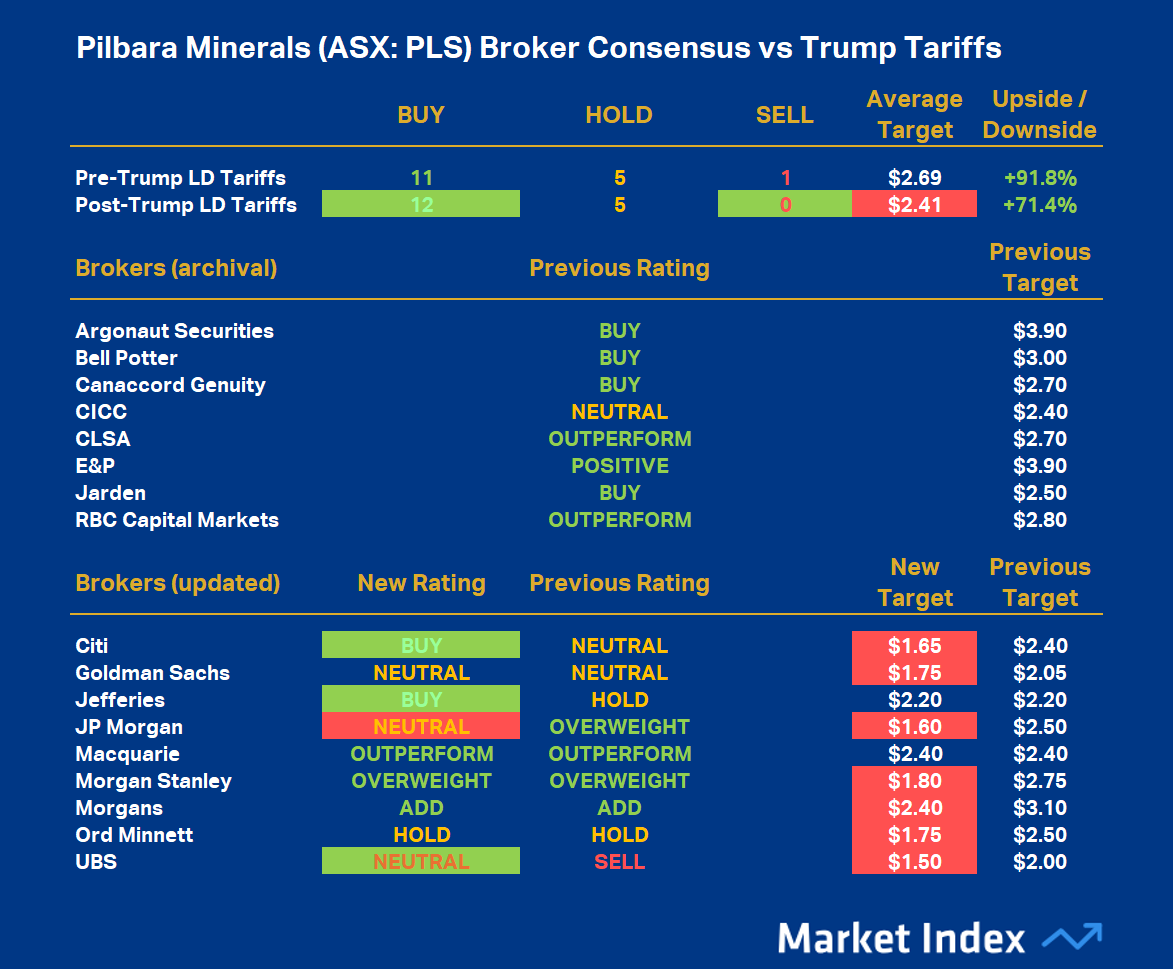

Pilbara Minerals (ASX: PLS)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

PLS’s average Rating Value is +0.71, resulting in a Broker Consensus Rating of BUY. This is up from its prior average Rating Value of +0.59 and Broker Consensus Rating of BUY.

PLS’s Broker Consensus Target is $2.41 (down 10.6% from $2.69 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 71.4% undervalued based upon the closing price on Tuesday, 15 April of $1.405.

Note however, if we only consider broker updates received since 2 April, PLS’s average Rating Value falls to +0.56 (still a Broker Consensus Rating of BUY) and its Broker Consensus Target falls to $1.894 (+34.8% undervalued).

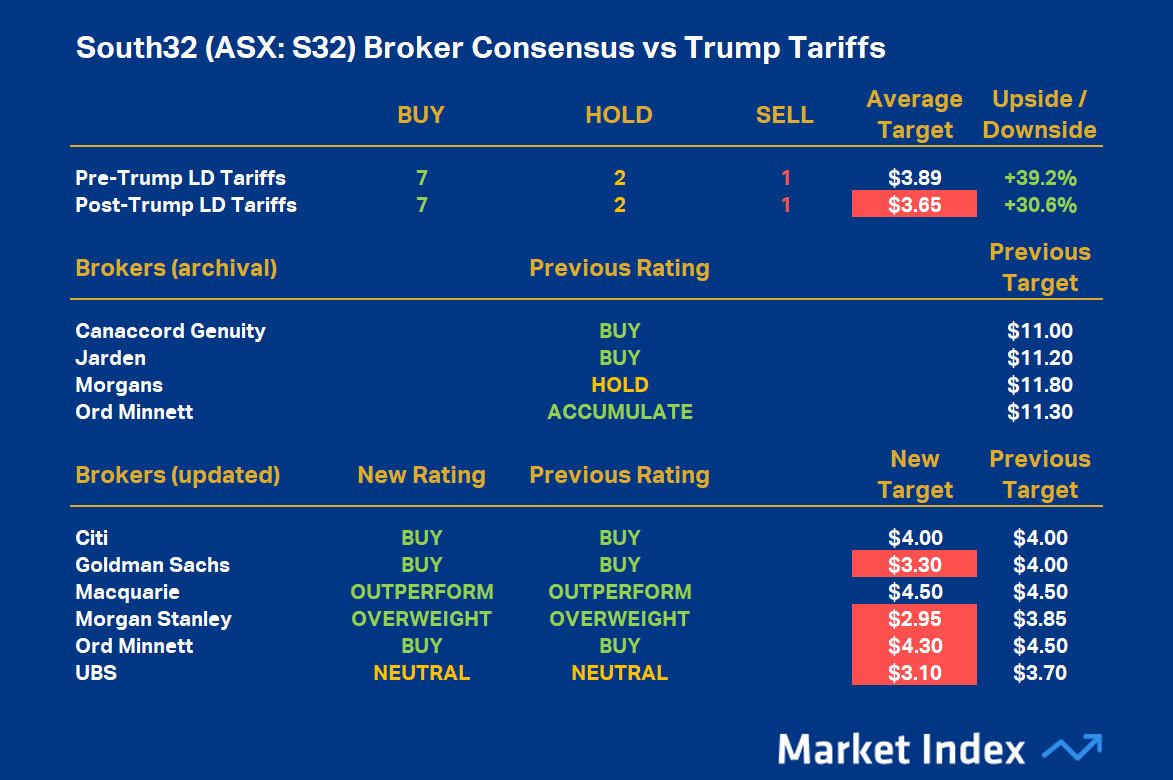

South32 (ASX: S32)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

S32’s average Rating Value is +0.30, resulting in a Broker Consensus Rating of BUY. This is unchanged from its prior average Rating Value of +0.60 and Broker Consensus Rating of BUY.

S32’s Broker Consensus Target is $3.65 (down 6.2% from $3.89 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 30.6% undervalued based upon the closing price on Tuesday, 15 April of $2.79.

Note however, if we only consider broker updates received since 2 April, S32’s average Rating Value rises to +0.83 (still a Broker Consensus Rating of BUY) and its Broker Consensus Target rises to $3.69 (+32.3% undervalued).

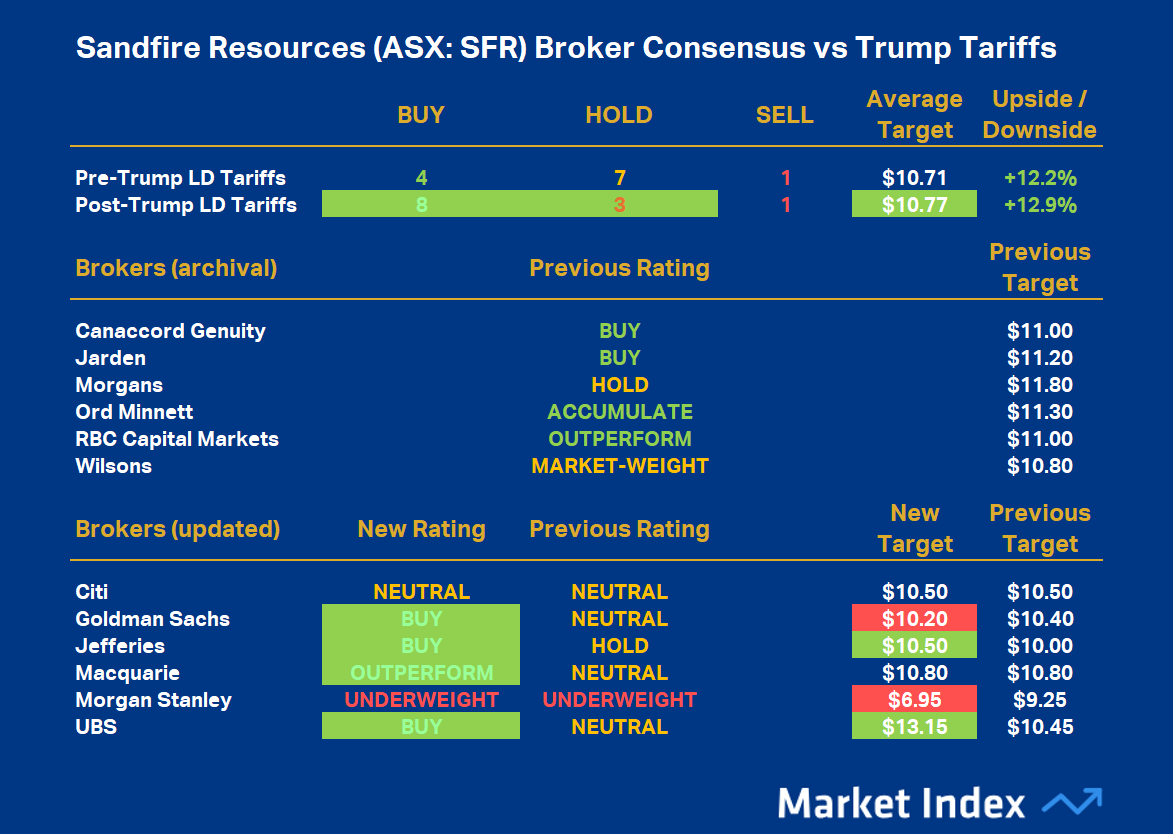

Sandfire Resources (ASX: SFR)

%20Broker%20Consensus%20vs%20Trump%20Tariffs.png)

SFR’s average Rating Value is +0.58, resulting in a Broker Consensus Rating of BUY. This is effectively a consensus upgrade from its prior average Rating Value +0.25 and Broker Consensus Rating of HOLD.

SFR’s Broker Consensus Target is $10.77 (up 0.5% from $10.71 prior to President Trump’s Liberation Day speech). This suggests brokers collectively believe the stock is around 12.9% undervalued based upon the closing price on Tuesday, 15 April of $9.54.

Note however, if we only consider broker updates received since 2 April, SFR’s average Rating Value falls to +0.50 (still a Broker Consensus Rating of BUY) and its Broker Consensus Target falls to $10.35 (+8.5% undervalued).

Conclusions

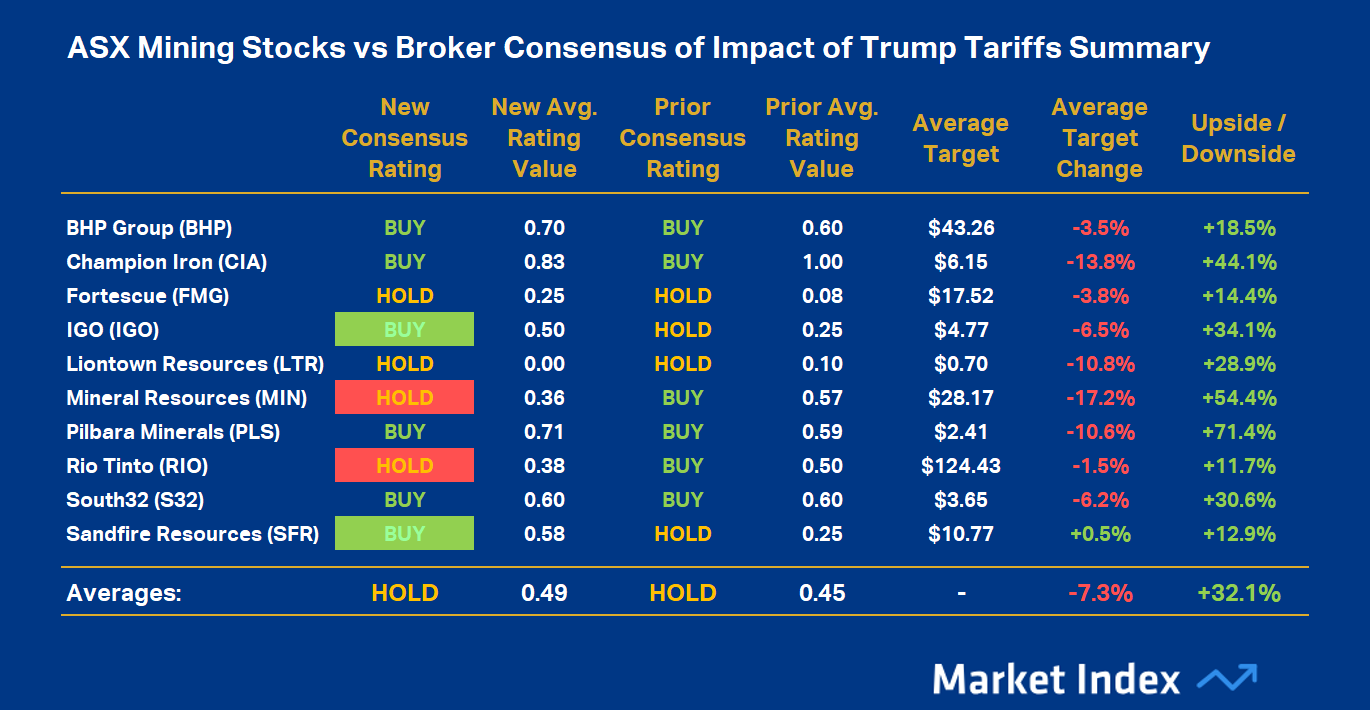

The big brokers have done the analysis, they’ve tweaked their valuation models, and through their new ratings and target prices, we can get a better idea of the likely impact of President Trump’s tariffs on ASX mining stocks.

Generally, the big brokers consider the impact of President Trump's tariffs is likely to be negative, with target prices across the 10 major mining stocks covered here falling by around 7.3% on average. But this doesn’t mean the brokers aren’t seeing substantial value in our biggest miners.

If we look at the impact on average Rating Value, it actually increased by 8% (from 0.45 to 0.49) – the equivalent of a HOLD – but a whisker away from a BUY (i.e., 0.50 and higher). Confirming this “nearly a buy” thesis, it's clear from the average Upside/Downside to Broker Consensus Target of 32.1% that the big brokers generally feel our biggest ASX mining stocks are substantially undervalued.

It's also worth highlighting specific winners, IGO and SFR – which each saw its Broker Consensus Rating upgraded to BUY from HOLD. SFR was also the only major ASX mining stock to see its Broker Consensus Target grow, albeit modestly.

Losers? RIO, saw a Broker Consensus Rating downgrade to HOLD from BUY, but it also experienced the smallest Broker Consensus Target decrease (-1.5%). The clear biggest loser must therefore be MIN. It also suffered a Broker Consensus Rating downgrade to HOLD from BUY, but it experienced the biggest Broker Consensus Target decline of -17.2%.

If there is a silver lining for MIN, and many other of the big losers, it's that their share prices have been pummelled so much, they’re now showing a large upside to their Broker Consensus Target.

Stay tuned 📢! Tomorrow we’ll investigate how the major ASX Energy stocks have fared in the wake of President Trump’s Liberation Day tariffs, so the likes of Woodside Energy (ASX: WDS), Santos (ASX: STO), Beach Energy (ASX: BPT), Karoon Energy (ASX: KAR), Ampol (ASX: ALD), Viva Energy (ASX: VEA), Whitehaven Coal (ASX: WHC), and Coronado Global Resources (ASX: CRN).

This article first appeared on Market Index on Wednesday 16 April 2025.

5 topics

10 stocks mentioned