Biden’s Build Back Better legislation

During his 2020 election campaign, President Biden made commitments to relieve the economic hardship being experienced by a rising percentage of the US population, as well as fast-tracking decarbonisation of the economy to meet the challenge of global warming.

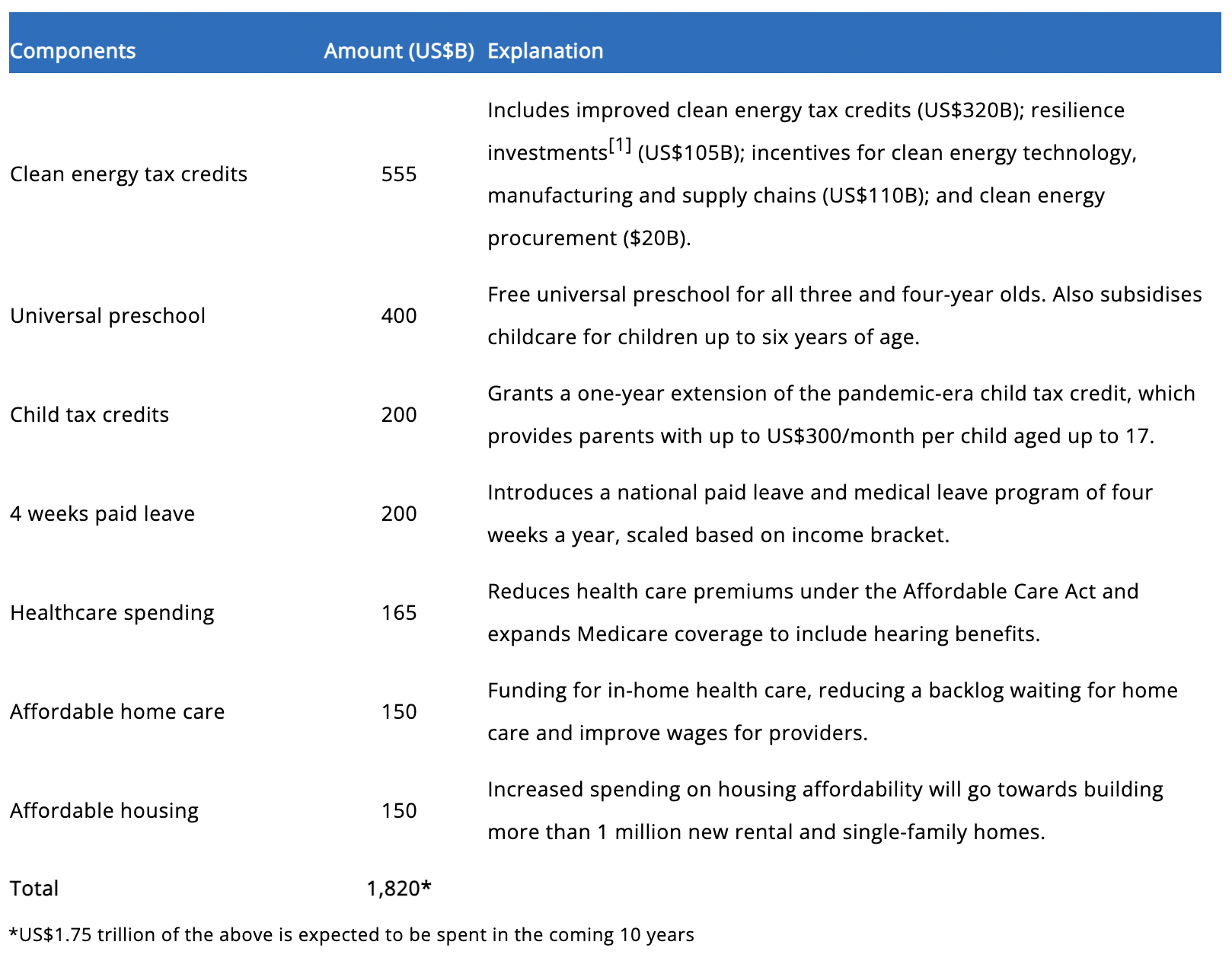

To meet these challenges Biden signed off on the bipartisan US$1.2 trillion infrastructure plan in November 2021, and is now pushing to have components of the proposed US$1.75 trillion Build Back Better (BBB) legislation passed through congress. So, what is included in the BBB legislation and what does it mean for infrastructure investment?

The BBB legislation in summary

Difficulties in adoption

The BBB legislation was proposed under the auspice of the Budget Reconciliation process and so only needed a simple majority in each of the houses of congress. The Democrats have a majority in both, but moderate Democrat Senators Minchin (WV) and Sinema (AZ) have objected to the passing of BBB based on its potential to expand the federal deficit – estimated by some as large as US$2.8 trillion over 10 years[2] – as well as potentially exacerbating already high inflation levels (7% annualised as at end of December 2021).

Biden has discussed breaking up the BBB package and passing elements that the moderate Democrats are less sensitive about. Minchin has communicated his support for the US$555 billion component focused on decarbonisation, so Biden may push this through Congress separately. Alternatively, Biden may remove components of the legislation such as the child tax credits.

Opportunity for infrastructure investors?

Of the above components, the first bucket supporting the energy transition offers the most visible investment potential for companies in 4D’s investment universe.

Electric transmission and distribution utilities

The legislation expands tax credits for currently used technologies like wind, solar and batteries, which will reduce the cost of these technologies. This reduced cost is passed through to customer bills, which allows utilities to increase their investment budgets while maintaining affordability. As a result, utilities can grow their Regulated Asset Base (RAB) faster, enhancing earnings growth and assumably shareholder returns.

Subsidies are also being proposed for technologies not readily adopted, such as green/blue hydrogen; carbon capture utilisation and storage (CCUS); and nuclear generation. The subsidies improve the economics of these technologies to the point that they become competitive relative to fossil fuel sources, and incrementally support the decarbonisation process. This expands the investment opportunity set for utilities. Utilities likely to benefit most are those considered leaders in new technology deployment, such as NextEra Energy (NEE-US), American Electric Power (AEP-US), and Exelon Corp (EXC-US).

Contracted generation

Contracted generation companies focused on renewables, or those that have no carbon fuel sources, will directly benefit from increased tax credits on existing technologies and subsidies applied to technologies like batteries. However, the renewable developers could face increasing competition for new projects from the vertically integrated utilities that own regulated generation, which actually could have better development economics as they utilise the ‘direct pay’ feature of the BBB legislation allowing for cash recovery of tax benefits even where there is no tax liability. Contracted generation companies likely to benefit include NextEra Energy Partners LP (NEP-US), and Clearway Energy (CWEN-US).

Gas distribution utilities and midstream oil/gas sector

The BBB legislation supports the useful life of the gas operators and should see the gradual removal of the valuation discount applied to the oil/gas sector. In recent years, there have been increasing concerns about the longevity of gas infrastructure’s business model in light of the decarbonisation movement, and whether gas has a role in a net-zero future. Technologies such as renewable natural gas (RNG), hydrogen and CCUS all have the potential to extend the useful life of a gas distribution network, as the pipe in the ground is utilised to transport low/no carbon commodities rather than traditional natural gas. The midstream sector’s assets become central to the future hydrogen and CCUS markets, as existing pipelines connect the end users and facilitators of these new technologies. With the BBB tax credits/subsidies combined with governmental support for manufacturing/procurement, opportunities for gas players to adopt these technologies is becoming more economic and the likelihood of their adoption in the future more tangible. Specific gas utilities likely to benefit include Sempra Energy (SRE-US) and Northwest Natural Gas (NWN-US), and in the midstream space Enbridge Energy (ENB-CN) and Kinder Morgan (KMI-US) are looking to participate.

Transportation – rail and toll roads

The BBB legislation, in conjunction with the infrastructure plan supports economic growth and manufacturing activity in the US. This growth is likely to support earnings of transportation sectors such as rail, whose operational activity and earnings are linked to US economic growth.

Interested in infrastructure investing?

4D manages a diversified portfolio of stocks across the utility and transport sectors. 4D Infrastructure is a Bennelong Funds Management boutique that invests in listed infrastructure companies across all four corners of the globe. For more insights on global infrastructure, visit 4D’s website.

[1] Addressing extreme weather, legacy pollution in communities, and a Civilian Climate Corps – represents jobs to enhance conservation of the environment

[2] Committee for a Responsible Budget – “A Permanent Build Back Better Act Could Cost $4.8 Trillion”; 30 November 2021

5 topics