Big discounts on offer for LIC investors

Value investors have long searched for the opportunity to ‘buy a dollar for 80 cents’, but for investors in Listed Investment Companies (LICs) this is not just an analogy. LICs’ share prices can depart from the value of the underlying assets, allowing savvy investors to pick up assets at a discount. Right now, Daryl Wilson, CEO and Portfolio Manager at Affluence Funds Management, says there is a group of LICs trading at unusually large discounts, managed by high quality boutique fund managers with long track records of outperformance. Many of these managers are Livewire contributors whose names would be familiar to regular readers.

In this Q&A, Daryl explains how the LIC sector operates and the opportunity on offer right now for long term investors. He also shares three LICs that should perform well if markets remain volatile, and five that are ideal if we have a rapid recovery.

What is it that draws you to LICs as an investment opportunity?

We didn’t start out looking to invest in LICs. Our first project, which started back in 2014, was to undertake a thorough review of all the managed funds available in Australia. We aimed to construct an all-weather fund portfolio, comprised of some of the best investment managers in Australia across all asset classes. The result of that work was our Affluence Investment Fund.

As part of doing that research, we started looking in more detail at LICs. At that same time, my colleague Greg Lander joined Affluence, and he took charge of the LIC project. When we started looking at LICs in detail, we discovered three things that excited us.

Firstly, the overall quality of LIC managers, compared to unlisted managed funds, is much better. Less than 10% of managed funds can beat an appropriate benchmark by 1% or more over the long term. We feel the percentage of LIC managers who can do so is much higher. This surprises a lot of people, but to launch and raise capital for an LIC, a manager needs to have a demonstrated track record of delivering results.

Secondly, the LIC market is surprisingly diverse, even more so now, than back in 2014 when we started. Our current portfolio includes over 30 LICs and LITs, diversified by manager, investment style, asset class, market cap and geography.

Finally, the attribute that excites us the most is that the market sets prices for LICs. This is where LICs differ from traditional managed funds and ETFs, which are priced based on the underlying net tangible asset value (or NTA) of the fund. We’ve seen LICs trade at 30-40% premiums to their NTA, and at 30-40% discounts. If you can be in a position to buy LICs when they are trading at unnaturally large discounts to NTA, and sell them over time at a much lower discount, or even a premium, you can add exceptional value.

Those three features, investing with higher quality managers, having a diversified portfolio, and looking to take advantage of higher than average discounts, are the key principles behind our Affluence LIC Fund.

Why is it advantageous to invest in LICs at a discount? Please share any research or relevant charts.

The best way to explain that is to look at an example. Assume an LIC that invests in ASX listed stocks has an NTA of $1.00 per share. That is, if you added up the value of all the stocks it owns and divided it by the number of shares in the LIC, the resulting value is $1.00 per share. If that LIC was trading at a 20% discount to the NTA, that means you could buy a share in the LIC for 80 cents, and get exposure to $1.00 worth of stocks. There are several potentially positive impacts from such a situation.

Firstly, over the long term, stocks tend to go up. And for every 80 cent share of the LIC you own, you have $1.00 of ASX listed stocks working for you. So if those underlying stocks pay the LIC a dividend of 4%, that’s a 5% return based on your buy price. And if the $1.00 of stocks delivers a total return of 8% per annum, that’s an 8 cent return. But because you only paid 80 cents for the LIC, it’s a 10% return for you. Now, of course, LICs have costs and fees to the manager. But compared to an unlisted managed fund doing the same thing, you can do better over time from an LIC if you buy well.

Finally, if that same LIC that you bought at a 20% discount trades at only a 10% discount sometime in the future, then you could sell it and pocket some extra returns from the “narrowing” of the discount. Typically, these discounts can take a very long time to change. But even if it takes five years for a discount to narrow by 10%, then you’ve added an extra 2% per annum to your returns. If the average market return is 8% per annum, and you can add another 2% on top, that makes a huge difference over the long term.

Of course, there is a risk that some of those same factors go against you. LIC portfolios can lose value, markets can fall, discounts can increase, and managers can underperform. That’s why it’s essential to do your homework and to be able to put together a properly diversified portfolio, rather than just picking a few and sticking with them.

Can above market returns be achieved for LIC shareholders, even without a narrowing of the NTA discount?

They can, but it is quite hard to do. Our work indicates the best chance of outsized returns comes not from the largest LICs, but from holding mid-small sized LICs, run by boutique managers applying a differentiated investment strategy. Some examples of LIC managers with exceptional long term track records include Ophir Asset Management, VGI Partners, Thorney Investments, ECP Asset Management, MFF Capital, Ryder Capital and WAM Capital. They are not necessarily household names, and only two of their LICs are in the ten by market capitalisation.

Many of the largest LICs either track the market indices fairly closely or have delivered lower than market returns after fees and costs. If you’re looking for returns that closely match the index, and to keep fees and expenses low, you may be better to consider buying an index fund or ETF, rather than the biggest, most boring LICs.

For the Affluence LIC Fund, we don’t require the whole sector to improve to make money. We can be very quick to take a position in an LIC at an attractive discount. If the discount improves quickly, we can take our profit and move on to the next opportunity. In our opinion, buying individual LICs and holding them forever is not necessarily ideal, given the ever-changing discounts. As an example, thousands of investors purchased debt LITs in the past three years at NTA. They are probably now questioning the strategy of buying LICs/LITs at par in an IPO, given most are currently trading at 10%+ discounts.

How big are LIC discounts now compared to historical averages?

It’s hard to get perfect long-term historical data because the makeup of the sector has changed so much in the past few years. But we would say there are two themes at play right now.

For the larger, more index aware LICs such as AFIC, Argo and Milton, in terms of discounts and premiums, they are more expensive than average. That is not where the opportunity is.

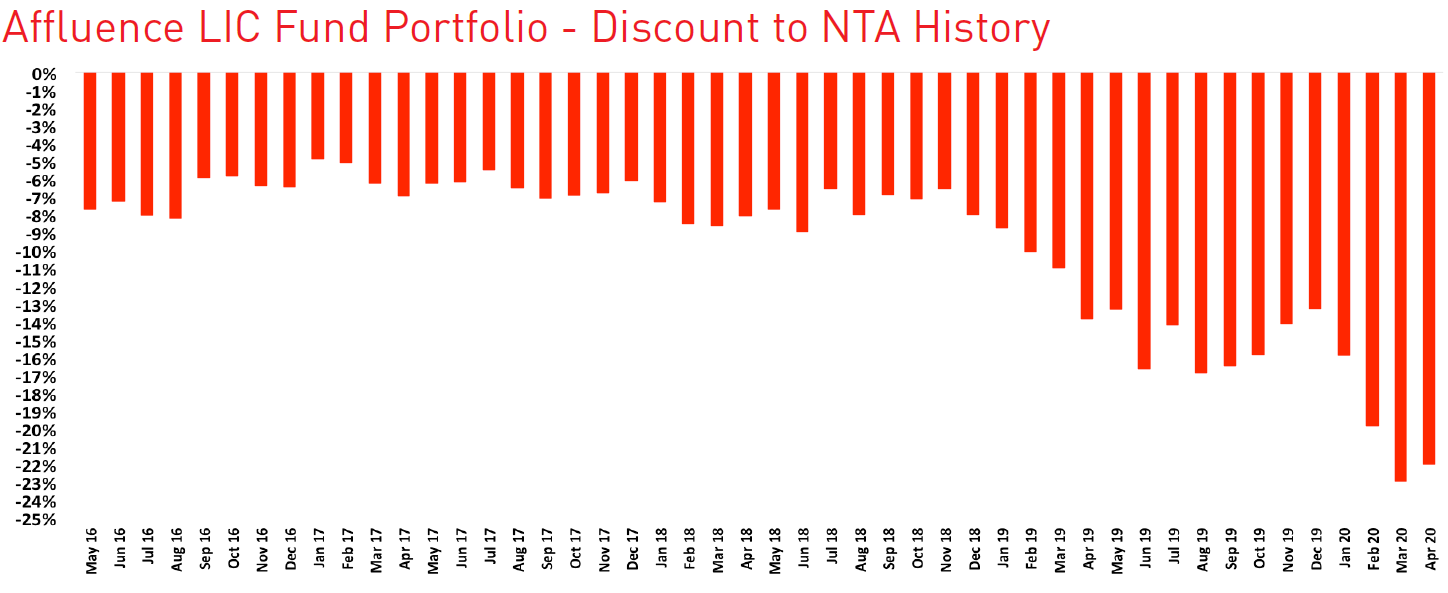

For almost all other LICs, including most that have been around less than ten years, discounts are much larger than usual. Many are at or near their historical extremes. We’ve measured the average discount to NTA for our LIC portfolio since the Affluence LIC Fund commenced in 2016. You can see the results in the graph below.

Between early 2016 and late 2018, discounts averaged 6-8%. Since then, they have expanded quite a lot. They went over 20% in March 2020 and remained at around 22% as at the end of April. It’s not a like for like comparison, because our LIC portfolio changes over time. Still, the results demonstrate that for the vast majority of LICs, discounts are approximately 15% greater than average.

This is why there’s such a great opportunity in LICs right now. The market falls mean overall equity valuations are 20-30% cheaper than they were in January of this year. And NTA discounts, for our portfolio at least, are around 15% greater than average.

Using history as a guide, what kind of returns can be expected from a discount of this level?

Well, that’s where we move from real data to guesswork! So, before I answer this, let me be clear that this is not a forecast. We’re just trying to see what might occur if we were to return to a more normal environment.

Perhaps the best way to answer the question is to anchor our thinking around what long term average returns have been, which is our starting point when analysing many investments.

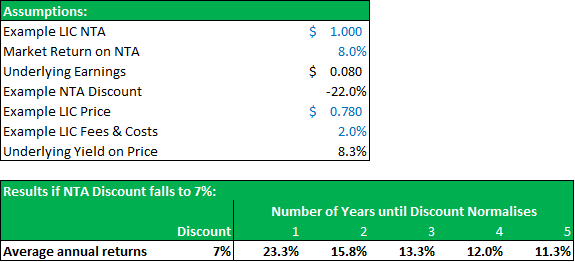

Our best guess right now is that the ASX 200 Index is not far from fair value, being down around 25% from where it was early in 2020. And long term returns from the ASX have averaged about 8% per annum, including dividends. Depending on the period you use, you can come up with higher numbers, but we will use 8% for this exercise. And let’s work with pre-tax numbers since every investor's tax situation is different. Then we need to make a couple more assumptions:

- LIC portfolios can deliver the same results as the ASX200 over the next few years (neither better nor worse).

- The average discount goes from the current 22%, towards the long-term average of 7%, a 15% improvement.

- Average fees and costs of LICs are 2% per annum.

If you plug those numbers into a spreadsheet, the expected returns you get will vary, depending on how long it takes for the NTA discount to recover, and how low the discount gets.

If discounts stay where they currently are, expected returns would be 8.3% per annum. That’s the long term average from the stock market, plus the “multiplier” benefit of buying the underlying portfolio at a 22% discount, less 2% per annum fees and costs. Then, depending on how far the discount falls, and how long it takes, returns can be quite a bit better from there. If the discount normalises within 12 months, total returns would be 23.3%, being the underlying 8.3%, plus an extra 15% from the discount narrowing. If that “normalisation” took five years to occur, you would get an average of 11.3% per annum, as the discount narrowing adds an average of 3% per year.

Of course, if discounts were to increase, LIC managers underperformed or markets delivered less than 8% per annum, results would be worse. But, as far as picking a good entry point, we believe this is as good an opportunity as we’ve seen in LICs for many years, probably since the period directly after the GFC around ten years ago.

Over what timeframe do you expect to see these discounts narrow?

It’s hard to say with any degree of certainty how long it will take, nor how low they can go. But we believe they will improve. Patience is required. It doesn’t tend to happen for all LICs, or at the same time. But no LIC manager with any integrity can watch these levels of discount persist for any length of time and do nothing about it.

Many of these LIC managers also run unlisted funds or ETFs, which are priced at NTA. They will likely come under increasing pressure from investors to convert the LICs to an alternative structure which offers an exit at NTA or wind them up. A few of these types of transactions have already occurred or are currently underway. And we are aware of several other LICs where significant pressure is being exerted.

There are also quite a few LIC investors who, like ourselves, are increasing their LIC holdings in anticipation of some consolidation or wind-up transactions in the sector. And if gentle encouragement doesn’t work, we will likely see a more forceful activist approach from many of these investors.

I note you had 3% of your portfolio in index puts at the end of March. Do you still own index puts?

We still have some put options against the portfolio, but not nearly as many as we had earlier this year.

Put options essentially make money for the Fund if markets fall. The cost of a put option is a bit like paying an insurance policy. A few different factors impact this cost, and they can be expensive, so we don’t use options all the time. It’s more likely we will use them when we feel markets are overvalued, and volatility is low. That makes them both cheap, and more likely to pay off.

In January this year, we felt the ASX 200 Index was around 20% above its long term fair value. As a result, we had put options covering a reasonable portion of the portfolio. In mid-February, we were relatively quick to recognise that there was a chance COVID-19 was going to create more havoc than was priced into markets. But that increased risk wasn’t yet reflected in the price of options. So, we bought quite a few more, and that paid off well over the next couple of months.

Those put options added 9.4% to the overall Fund returns between February and the end of March, which proved to be very valuable. We gave back 2.9% of that in April as equity markets rallied strongly. Despite that, the Affluence LIC Fund has its best month ever in April.

Do these reflect a bearish view on markets?

Actually, we’re not bearish right now, but volatility and uncertainty remain high. We expect to see volatility settle down over the next couple of months. With current valuations looking much more reasonable, it’s less likely we will hold a significant amount of put options once this happens.

Which type(s) of equity strategy do you think is best suited to today's market conditions?

It’s hard to say because we don’t know whether markets will go up, down or sideways in the short term. However, there is one point that I think is very important. For a long time, passive investment strategies have been the winners over most active managers. This has been driven by large cap momentum and lower costs. But if there’s ever a time when active managers can shine, this is it. We believe in the next few years the truly active managers will prove their worth. This bodes well for most LIC managers.

Of course, the opposite is also true. If active managers can’t do well in this market, where stock selection can make a huge difference to returns, they will come under considerable pressure from investors to give back the money, thereby eliminating the NTA discount.

Can you share two or three LICs that you'd expect to do relatively well if markets remain volatile?

Monash Investors Limited (MA1) has handled the last few months very well and is also going through a transition to an Exchange Traded Managed Fund so that investors can exit at NTA. It’s an excellent example of an event-driven holding for us, but one where the underlying manager has also performed very well.

VGI Partners (VG1 and VG8) is an excellent long short manager. They have navigated recent markets well and have an exceptional long term track record. Both LICs are currently trading at an attractive discount to NTA.

Australian Leaders Fund (ALF) is currently market neutral, and one that will probably do well if another correction comes along, having missed a chance in March to get some market exposure at much lower prices. Alternatively, a failure to perform before this year’s AGM is likely to result in further calls for it to be wound up following a long period of underperformance, and trading at more than a 20% discount to NTA.

Conversely, can you share two or three LICs that you'd expect to do well if we see a rapid return to normal?

NGE Capital (NGE) is a very small LIC with a big bet on the oil price, through a holding in Karoon Energy. If the economy recovers quickly, including the bigger global economies, NGE could do very well.

The Ophir High Conviction Fund (OPH) has been an exceptional long term performer in the mid-small cap space and has also handled downturns better than most other managers in their space.

Thorney Investments has two LICs, TOP and TEK, which can also do very well as the economy recovers, although the TEK share price has already rebounded a long way from its lows.

Finally, WAM Microcap (WMI) is the sweet spot for the Wilson Asset Management team. Unlike WAM Capital, which is trading at a substantial premium to NTA, WMI sells at around NTA. Stablemate WAM Leaders (WLE) may also do well if some of the larger cap fallen angels (I’m looking at you, big four banks) recover strongly.

Invest in LICs without the hard work

The Affluence LIC Fund invests exclusively in LICs and LITs on the ASX. The fund seeks to take advantage of inefficiencies, allowing investors to gain exposure without the need to research each security. To request additional information please email invest@affluencefunds.com.au or click the ‘CONTACT’ button below.

Affluence Funds publishes monthly member-only reports on opportunities in the LIC space. Register on our website to receive these reports to your inbox.

2 topics

17 stocks mentioned

3 contributors mentioned