Big value in small caps

The correction in US tech stocks (from extreme expensive valuations) appears to have served as a market wake-up call to the opportunity in small caps.

The Nasdaq 100 ETF QQQ slipped almost -10% in July, while US small cap ETFs IJR and IWM surged just over 10%.

Part of this is an unwind of the long mag-7 vs short small caps trade, but also a reflection of emerging economic trends, (geo)politics), and I think most importantly of all — a clear appetite from speculators for something new (e.g. recent surge in small cap call option buying).

But the big question for small caps is how far does this rotation trade have to run? Is it just a short-covering snap-back, or is there a genuine bull case?

With my approach I always want to start by asking what’s the valuation picture?

(you don’t end there, but you start there, because it tells you a lot about what the market is thinking, the potential upside, and key pressure points)

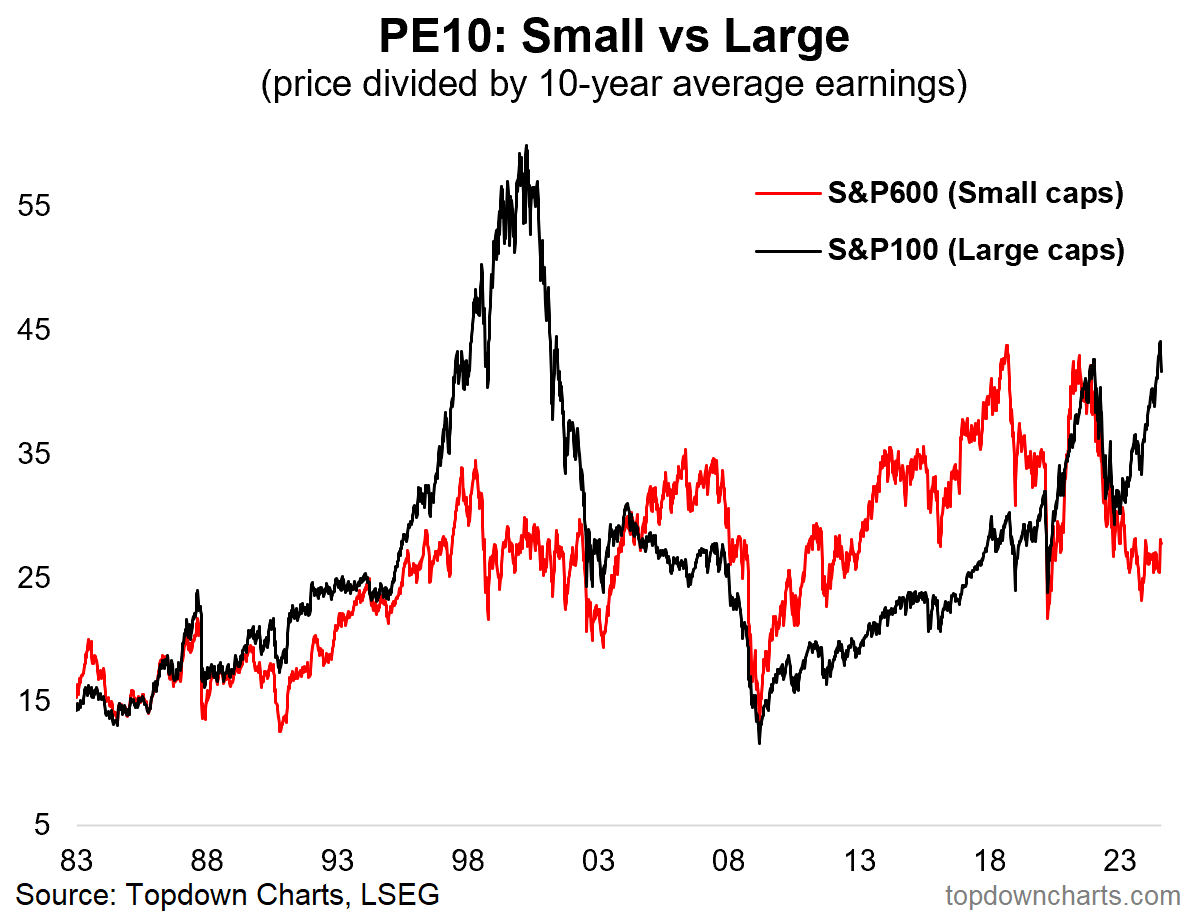

As things currently stand, the PE10 ratio for US small caps is slightly below the average of the past 20-years, still round the bottom end of the range of the past 10-years, and trading at a 30-40% discount vs Large Caps (which themselves are extended vs history).

Indeed, one glance at the chart below and it tells you the pressure point is in large caps (they’ve already discounted a perfect future), and the opportunity is in small caps (ample room for catch-up, scope for upside re-rating).

So while the tactical outlook does seem to be coming together for small caps (and it’s certainly front of mind given the sharp moves), it’s important to keep the strategic outlook in mind — which is informed by the chart below...

Namely: room to run.

Key point: Small Cap stocks are cheap and have ample room to run.

5 topics