Black Boxes are not great investments

Ellerston Capital

A recent visit by the Investor Relations manager of a well-known global diversified investment bank served as a reminder of why, in our opinion, investors should always be cautious of investing in such financial conglomerates, particularly where a large portion of the business is an investment bank.

Complexity

The business model of a simple bank that only takes deposits and then lends these out is relatively easy to understand. Other types of business often found alongside banking, e.g. wealth and asset management, insurance, and investment banking are different business models. Investment banks are particularly complex, combining a number of different business models such as people-based advisory businesses, and trading and lending businesses that require large balance sheets.

The result of combining these businesses is a cocktail of complexity otherwise known as a “black box”. Consolidated accounts combine and present these businesses, viewing them in their entirety and requiring only limited disclosure of additional and partially helpful information. Management has considerable influence on the presentation of their business and the level of disclosure.

Investors are left to try and discern the reality of these businesses from the limited information that is intended to highlight the good and hide the bad. In reality, a detailed analysis is simply difficult and unlikely to yield that much meaningful insight, least of all any pertinent warning signs.

Diversification equals “diworsification”

A regular justification for combining these businesses is that they diversify the different risks inherent in them. History has demonstrated that when things get bad in one area, rather than providing stability, things often get bad in other areas. Panic in one area quickly spreads to another, previously uncorrelated risks then suddenly become correlated.

The financial conglomerate structure facilitates the risk of other such misalignments. For instance: savers’ deposits being put at risk by subsidising the risk-taking of traders (low-cost source of capital); and, wealth management clients being sold the consequences of investment bankers paid for advice to corporate clients, such as the debt and/or equity of M&A deals (more often than not poor outcomes for shareholders). And let’s not forget that taxpayers ultimately pick up the bill in the event the Government rides to the rescue when shareholders are wiped out!

Misalignment of Interests

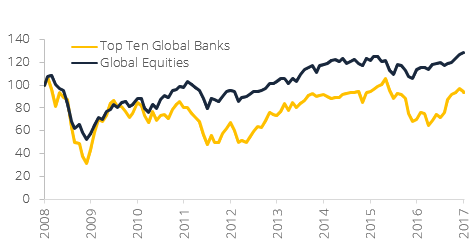

If we return to our recent company management meeting, the other area of concern is what would appear to be a preponderance of staff finishing first ahead of shareholders. Consider some statistics that came out in the meeting: over the last six years the senior management (circa ten people) have together been paid over AUD 500m in salaries and bonuses. On the other hand, shareholders have seen a close to zero return on their investment (Chart 1). Clearly an inadequate return in the face of the inherent risks, this appears to indicate a gross misalignment of interests between stakeholders.

Examination of the highly complex remuneration policy, in this case, suggests that the stated goals for the divisional leaders were inconsistent with those applied at the Group level such as return on equity targets (not once achieved) and cost income ratios (also way off being achieved).

Given that employee costs are by far the largest in this business model (65% in this case), this alone may suggest that the business is being run for the employees ahead of shareholders.

As for the Board of Directors, who have signed off on the remuneration policies, one wonders whether they are good value at close to an AUD 500k basic annual fee, or AUD 42k per meeting (with other fees doubling these payments. At that sort of price, they really do need to be special people who can understand and analyse the complex businesses that they oversee none more so than the non-executive Chairman who alone commands almost AUD 10m per year!

Figure 1 – Top ten global banks and global equities

Source: Bloomberg

Avoid “black boxes”

From an investment perspective, we believe “black boxes”, such as many of the financial conglomerates we observe, should be treated as such. Don’t delude yourself that you understand the inner workings or the inherent risks when it is likely management’s understanding is not that much more enlightened. Recognise that shareholders’ interests are likely not aligned with the management you entrust your capital with.

Investment banks are cyclical, making lots of money for their employees when the economic cycle is driving markets up, and when a part of a broader conglomerate often returning shareholders only a few crumbs. When times are bad, shareholders are often asked to stump up more cash (if not being wiped out completely). In our opinion, investing here offers little more than beta, fine if everything is going up, a recipe for capital impairment when the cycle turns.

And if you must invest, it is best to avoid the conglomerates altogether and focus more on the standalone Investment banks such as Goldman Sachs who have notably delivered much better returns (beta) of late. It appears that “Long-term greedy” (the famous Goldman Sachs motto) is indeed better for shareholders.

Article originally published on Morphic Asset Management blog.

4 topics

Chad co-founded Morphic Asset Management in 2012. As a stock picker Chad is also a generalist but has strong regional knowledge of Europe and the Americas. He has also been awarded the CFA Charter.

Expertise

Chad co-founded Morphic Asset Management in 2012. As a stock picker Chad is also a generalist but has strong regional knowledge of Europe and the Americas. He has also been awarded the CFA Charter.