BlackRock's Rick Rieder on the "Category 5 hurricane" coming, and where his team is investing

When they write the list of legendary fixed income investors and fund managers, it will include such names as Bill Gross, Mohamed el-Erian, Jeffrey Gundlach, and - the man who is the subject of this wire - Rick Rieder.

Rick is BlackRock's Chief Investment Officer of Global Fixed Income, head of the global asset allocation team, and chairman of the firm's Investment Council. He also serves on the Alphabet/Google Investment Advisory Committee and the UBS Research Advisory Board. In a past life, he worked at Lehman Brothers and served as Vice-Chairman of the US Treasury’s Borrowing Committee and on the NY Fed’s Investor Advisory Committee on Financial Markets.

Recently, Rick addressed the Lonsec Symposium alongside Lukasz de Pourbaix, CIO of Lonsec Investment Solutions on the paradigm shifts we are seeing in the investment landscape as a direct result of rampant inflation around the world.

Rick's thesis

Recently, the Federal Reserve appeased market expectations and hiked its key rate by 50 basis points. Incidentally, Rick was left surprised by the decision and in particular, Powell's return to a relatively dovish stance.

With this in mind, Rick's big idea revolves around the occurrence of Category 5 hurricanes in the south-eastern United States - which happen approximately once every 30 years. He says markets are now in a period of similar turbulence. Further, the key uncertainties can be summarised into five categories. This wire will look at those five categories and how those factors are influencing his asset allocation strategy.

The hurricane: rampant inflation

Coming off the fastest and deepest recession in US history, central banks and governments around the world pumped out trillions in stimulus payments. Fast forward to now and those same policy settings have caught the same officials completely off guard on the inflation those payments caused.

The bad news for central bankers is that there is every reason for high inflation to persist. The good news is that some of the factors which have pushed inflation to astronomical levels are starting to peak.

"If you take the output gap against GDP then you look at where Treasuries are related to inflation, what that tells you is the Federal Reserve is so far behind ," Rick said to the symposium. "It's created an incredibly rare situation of shocked inflation and a Fed that's gotta deal with that quickly."

Rick has a point - this "incredibly rare" situation he refers to has not happened for more than 40 years.

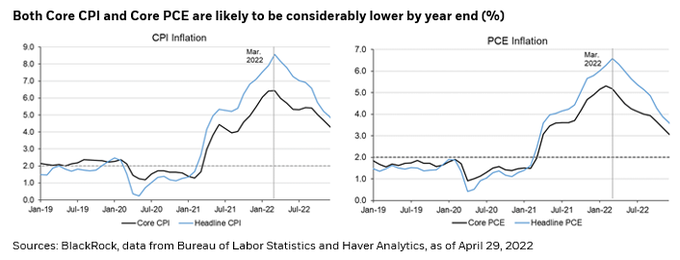

Inflation is also being spurred on by the lockdowns in China which are having a drastic effect on global supply chains. We have all seen the pictures online of ships literally at a standstill outside Shanghai waiting for the ports to reopen. Even in spite of this, Rick says there is some good news - as this chart shows below:

While China may still have its ports closed, the backlog in the United States is starting to look far better at such ports as Los Angeles and San Francisco. He also points to two key commodities - copper and crude oil - for his reasoning as to why there is some inflationary pressure coming off.

"It has gone from 100% year on year change to virtually nothing," Rick points out. On the oil side, Rick looks at the rig count and inventories.

"You're getting more production for oil and gas, and that will ultimately bring down prices," Rick says. "You're starting to see inventories build and real imports are starting to build," Rick notes - with a caveat that his reference is to the United States' specific supply.

"We think inflation is peaking and coming down," Rick declares but notes prints are still "sticky high".

The hurricane: China's ongoing COVID-19 lockdowns

Now to something Rick himself says he has never seen before - namely, the collapse in passenger and shipping volumes to near-zero as the world's most populated country aims to eliminate COVID-19. This policy evolution, he thinks, is a really big deal for the global economy given its impact on prices and on growth.

To showcase how big a deal Rick believes this is, he points to Apple. From smartphone to computer and semiconductor manufacturing, Rick says the impact is nothing short of enormous. He has a point - while the IT giant has largely dodged supply chain constraints throughout the pandemic, its CFO Luca Maestri acknowledged on its recent earnings call that iPhone and Mac products were struggling with supply chain issues.

“We expect the constraints to be in the range of US$4 billion to US$8 billion dollars and will also have an impact on customer demand in China,” Maestri noted.

That's not good news for investors who have been used year after year to new products, small innovations, and perhaps most importantly, extreme profitability due to its manufacturing network in China. And with no end in sight, it looks like the price pressures will be around for as long as Beijing sees fit to meet its goals.

The hurricane: the Ukraine/Russia war

If you thought Rick's comments on China were eye-opening, get ready for this revelation. Blackrock's base case for the war in Ukraine is that it will go on for an extended period of time. He says he can't see any "closure" on the horizon - and the best place to find out the impact of that is in the price of wheat.

"Wheat prices have spiked over 50%, and are still up over 30% since the Russian invasion," Rick notes while saying this spike does not factor in the impact increased fertiliser prices would have had on the supply chain and the general scarcity of food.

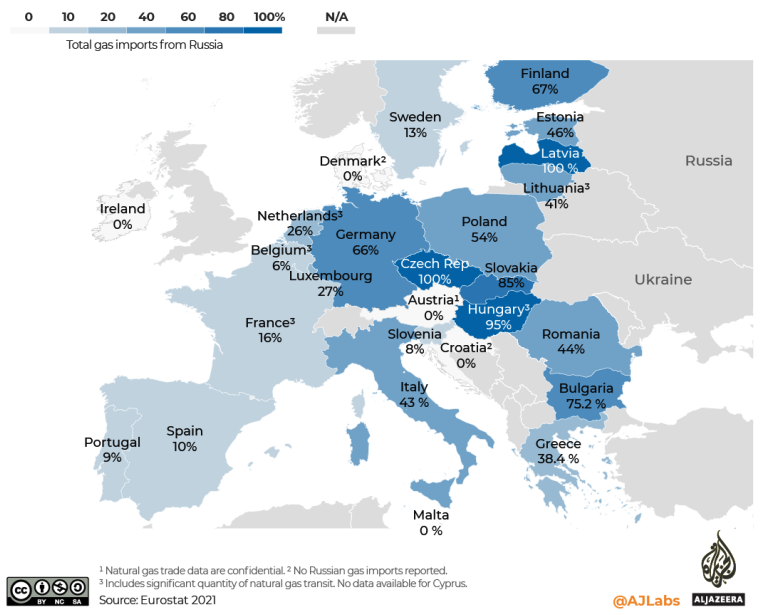

Of course, this is far from Europe's only problem. The continent must come to terms with its incredible reliance on oil and natural gas exports from Russia. The continent is "in a very difficult position", Rick thinks.

"If you take out the share of natural gas that is required in the UK from Russia, this would be a really big deal," Rick adds. Last week, the Kremlin put a stop to LNG deliveries to Poland and Bulgaria while threatening to do the same to other countries over their support for Ukraine. And from this chart, you can tell it's still quite the scramble.

The hurricane: yield curve inversions

"I don't believe we're going into a recession."

While this is another US-centric comment, Rick does not believe the world's largest economy is heading into a recession. Why? Firstly, don't treat the yield curve inversion of early April 2022 as gospel.

"I would argue it's the best indicator but it's not always an accurate indicator," Rick says. He also says the war and the negative impact on consumer confidence from the conflict demonstrate the probability of a recession will remain much larger (and unavoidable) in Europe than in the US.

Rick's second reason is the continuing jobless claims situation in the United States. Of late, the data has been undeniably strong with initial claims bottoming out at 50+ year lows. Remember - in April 2020, six million people were filing jobless claims in the US at one point. In the case of continuing jobless claims, the figure has plunged as well.

The only snag in this story? The incredibly tight labour market has led to a huge increase in job openings. The American job market now has two jobs for every unemployed person. That is - to put it mildly - insane.

A bumper crop for job openings has also fueled a boom in the quits rate. The figure is viewed by policymakers and economists as a measure of job market confidence. The higher the quits rate, the more rampant wage inflation will likely be as companies scramble for workers.

His final reason is the one that shocked me the most - for all the debt that US households have, they can now pay that entire amount off with just cash on hand. This is, of course, an aggregated figure and cannot possibly drill into every single household's specific situation. However, that's still a remarkable thing to say out lout.

The hurricane: will the Federal Reserve get its soft landing?

Rick says the key priority for global central banks is the need to not entrench high inflationary expectations.

"Interest rates don't usually peak until the end of a hiking cycle," Rick notes with the caveat that we have only just started this series of rate rises. At this moment, Rick says he would rather not look at interest rates but rather at liquidity. He says this is the bigger risk and that investors do underappreciate how the balance sheet runoff will be carried out - in what size and in what pace.

Where Rick's team is investing

For equity investors, it's all about protecting your downside. He believes equities in general are still not cheap enough to buy. If you have to buy, manage any near-term stresses and pick structurally strong sectors and stocks.

Outside of listed markets, he says it's time to put some "quality carry" into your portfolio. Given the beginning of 2022 has seen the worst drawdown for investors since the mid-1970s, fundamentals will become more important - or as he put it, find stocks that are "liquid, income-generating and stable".

Conclusion

Long story short, this time is different. The five categories of market uncertainty that Rick has discussed at length are not going away anytime soon. While he doesn't see a recession in the immediate for the US, it doesn't mean that there are no problems elsewhere. Inflation is still extremely strong and the impacts are still being felt around the world.

If Rick's hurricane lands, then turbulence could be an understatement for the next few months in investing.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed income fund managers (yes, I have a standing request to have Rick do an interview with us!)

If you have questions of your own or other guests you think we should chat to, flick us an email: content@livewiremarkets.com

3 topics