BlackRock: Stocks will head lower - why you need to get used to it

Global equity prices are heading south, bond yields are heading north, and the era of free money is making way for the era of the trade-off. That's the new, and far more bearish outlook, from the BlackRock Investment Institute. They argue that the last forty years were a time of moderation in markets. Inflation was low and the biggest problem was keeping economic growth steady, especially as China became more of a force to be reckoned with.

Now, we're entering what BII APAC chief investment strategist Ben Powell an era of 'scarce supply' - where the easy stimulus will be harder to justify and COVID-19 has created an environment where growth at all costs simply won't cut it.

This, in his opinion, is going to create a fertile environment for a deep recession and an environment where nimble investing will win out. Recently, I interviewed Ben and sought his views on this overarching theme. We'll dig deeper into the kinds of assets he's most bullish on, the ones he is most bearish on, and most importantly - what happens now.

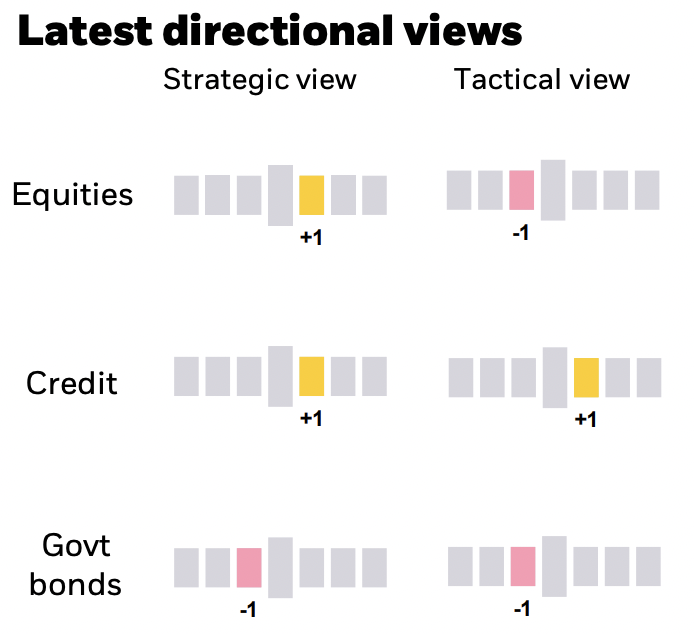

Asset allocation at a glance: BlackRock Investment Institute

What just ended: The Great Moderation

The core thesis of Powell's argument is the fact we've reached the end of a long and prosperous period in markets. From the globalisation of labour and production to China's entry into the World Trade Organisation, to the rapid innovation seen in big tech, the era was defined by restricting or stimulating growth through central bank activity. It wasn't an easy job, Powell says, but it was easier than the one they face now.

"Supply just wasn't a problem," Powell said. "Inflation continued to be a dog that didn't bark. For central bankers, this meant they didn't need to worry so much about inflation."

That all changed when this headline appeared in January 2020:

How times have changed. But just because COVID-19 is receding into the rear-view mirror in some nations does not take away the structural challenges which remain in the global economy. And it's these challenges that explain why markets are so "naturally" nervous.

"We would suggest it's quite natural that markets are quite volatile. We think they are accurately reflecting the more volatile, less certain macroeconomic backdrop that we're all seeing every day," Powell said.

Welcome to the new regime

When inflation is running at up to five times central bank targets, all focus is on reining those steep price increases in. But for every move to cool inflation, there is always a risk that economic activity will stumble and fall. And that, in Powell's view, is the big trade-off policymakers have yet to reconcile.

"I think central banks are likely to hike into a recession that they cause," Powell said. "This is deliberate policy to bring demand down. Central bankers are fully aware of the consequences of bringing demand down. That will be slower growth and higher unemployment. I think there is a risk they will overdo it," he added.

"This slowdown and growth is deliberate, and therefore is very likely to happen."

Sorry if you were hoping for an optimist's take.

Down, down, prices are down (in equities)

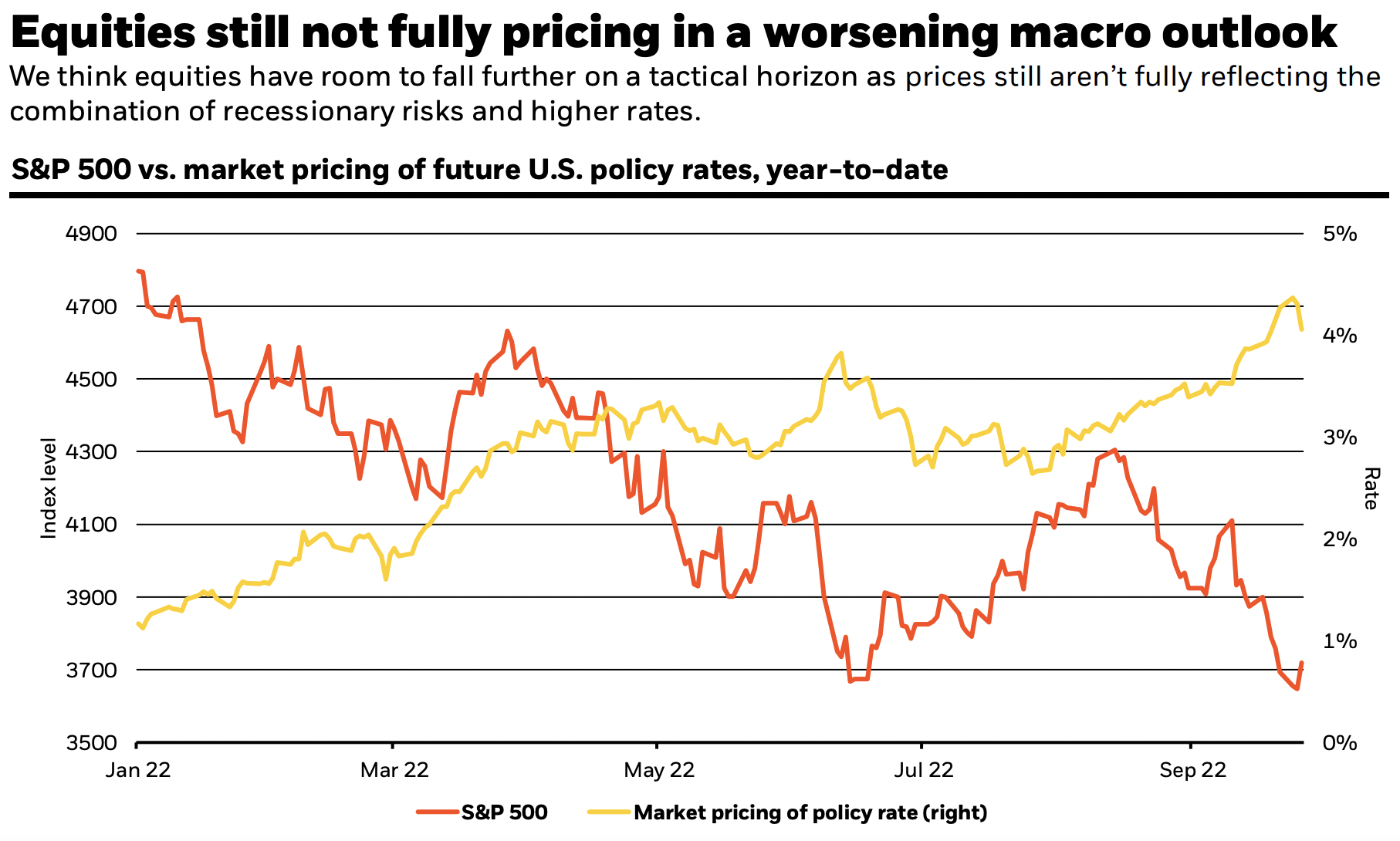

Given the scene we've set, you won't (or at least should not) be surprised when Powell told me he's underweight on equities across the globe and across the board.

"We're actively underweight the US and Europe," Powell said. "I think we're at an interesting crossroads where the "bear driver" is going to move from the financial system."

But even central banks will not have the same kind of power in the next leg of the market's decline. Powell argues that the next shoe to drop will be corporate earnings, given financials never live in a vacuum. He argues rising rates will have an effect on balance sheets over the next three to six months - making the looming US earnings season (kicking off October 15th) doubly vital.

"In aggregate, we think that might be the opportunity that companies can take to update the market. There could be a downdraft in particular for 2023 earnings forecasts," Powell said.

On the emerging markets front, not all regions are created equal and that's particularly true for EM equities. Unlike other money managers who have considered Chinese equities to be a challenge (or at worst, uninvestable), the BlackRock team is actually more constructive than most. They have a neutral rating on both Japan and China - a call which Powell admitted could be arguably seen as "unsatisfactory".

"We are neutral, which I know can be somewhat unsatisfactory. But it feels to us, that this is the right call," Powell told me. "But the market has somewhat noticed and that's why we've moved to this record-low valuation. So being outright cautious feels somewhat bold but equally given the uncertainty, it's hard to have a strongly positive view as well."

Do bonds offer a value trap?

If you thought it was a nasty year in equities, spare a thought for fixed-income investors. The rush in outflows from global bond funds is, by recent standards, unprecedented. But after a decade where bonds have been out of favour, does the BlackRock team feel that present yields are finally going to pique their interest?

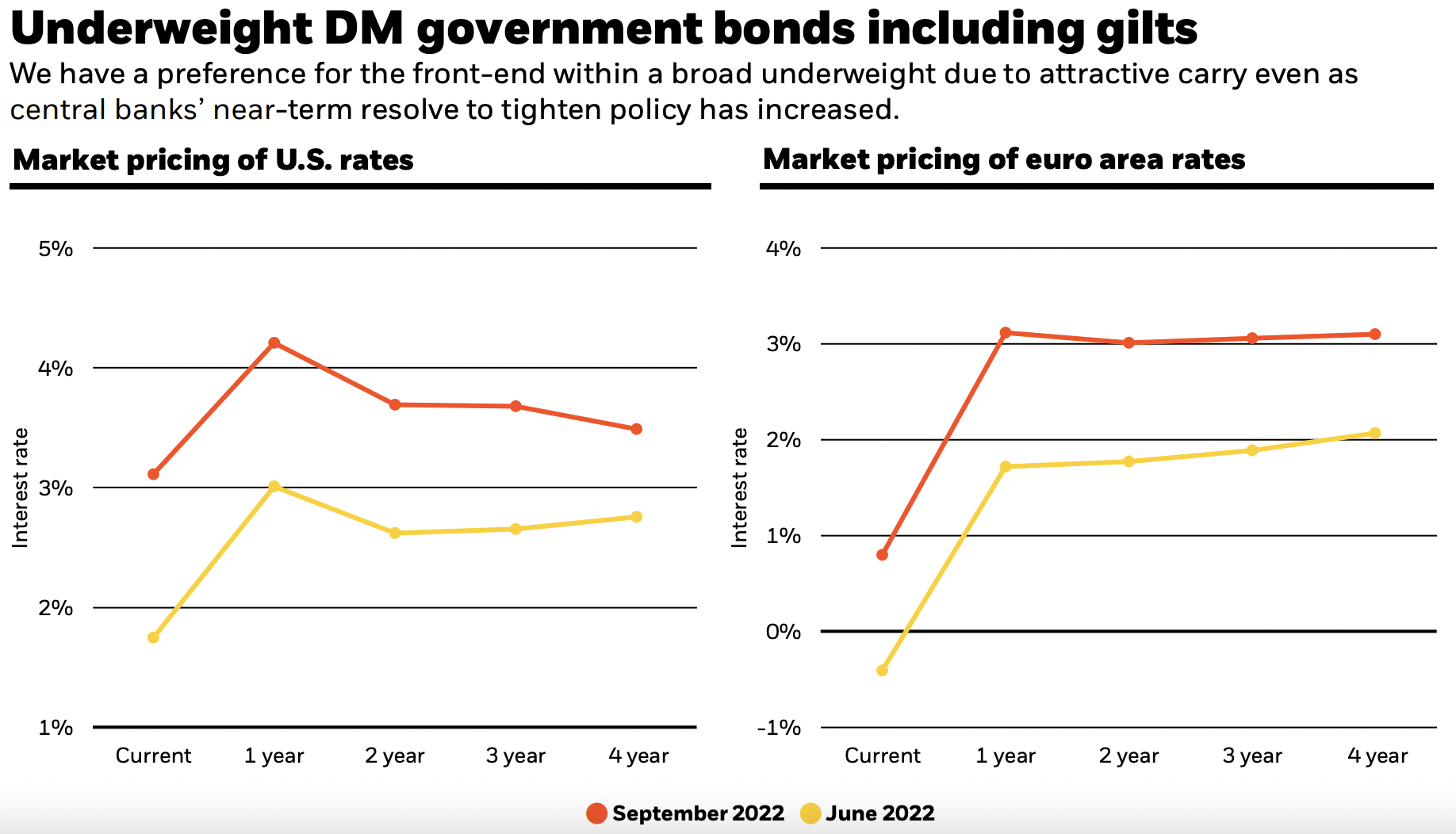

"We're still underweight. We were maximally underweight because we were very nervous about potential asymmetric price risk," Powell told me. "12 months ago, yields were extremely low. And it seemed to us that yields were likely to go higher rather than lower," he added. And so they did - the US 10-year yield has nearly trebled in the last year from its December 2021 lows.

But the real secret to this sauce is that the underweight call is directly related to where yields can still go even in the short-term - higher.

"Our view from here would still be that yields can move a little bit higher. Maybe we've seen the big move, but we still think, given that we think inflation is going to persist for years to come and is likely to set a level higher than we've all got used to over the last three or four decades," Powell said.

So when will the long nightmare end?

The end to a global recession call would likely depend on a suite of issues being resolved. Powell was quick to point out that the recovery is not BlackRock's core view yet, but that there were at least two signposts worth watching to see if there would be an easing of pressures.

"I think progress around the loosening of COVID-19 restrictions (in China), creating an uptick in confidence leading to a more buoyant situation from the current very low levels of economic activity - I think this would be a significant positive," Powell said.

"Second would be a clearer recognition from central banks. We haven't seen the damage flow through which is no surprise because monetary policy has a time lag. But for us to become more constructive, we would need to see recognition from the Fed in particular that there is a trade-off," Powell said. He added that this will come in the form of an understanding of the downside risks to growth and unemployment, rather than its total focus on inflation.

2 topics