BNPL & Gold are on everyone's mind: this week in capital markets

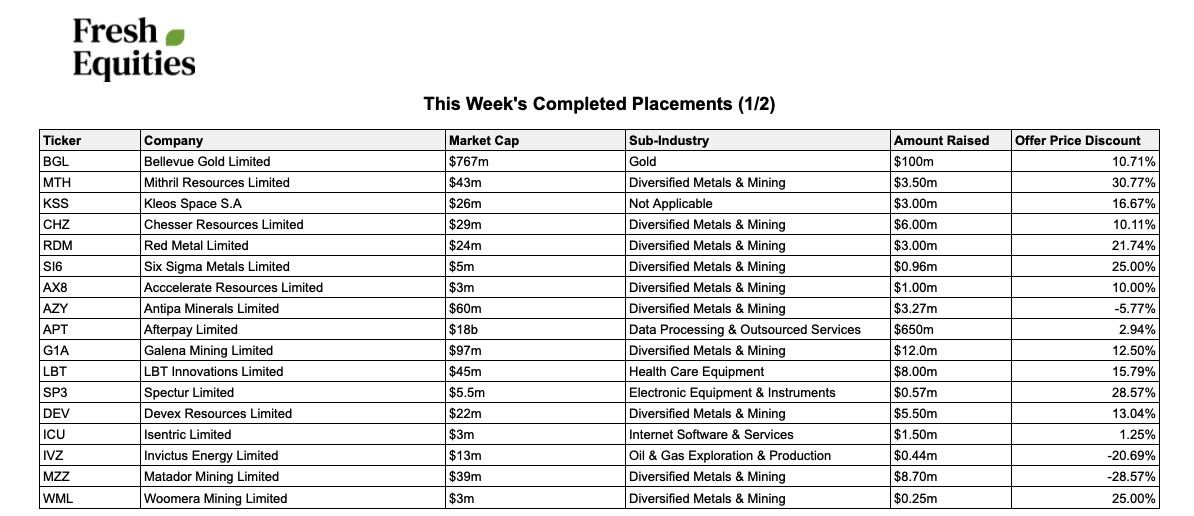

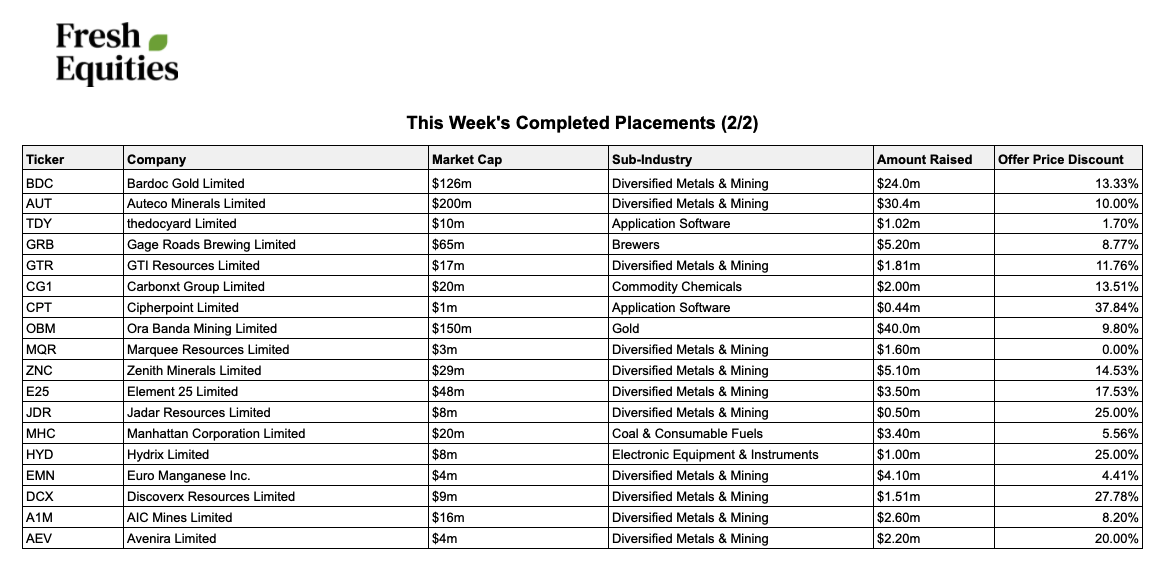

It was a big week. A whopping 35 placements were closed, and a tad over $938m of fresh funds made its way through markets.

There were two things on every investor and banker's mind this week - 'buy now pay later' (BNPL) and gold.

"Give me some gold stocks" said the investor!

As gold shoots past US$1,800/Oz everyone from explorers to producers are looking to capitalise and chase fresh funding. We've seen more than one deal where the mention of a Gold asset - whether it was proven or not - was enough to attract interest.

The rush started with Bardoc Gold on Monday, who set out to collect $24m. There was a heavy emphasis placed on institutions, which makes sense for a company heading into the final stretch of a DFS (definitive feasibility study) and then production. Both of which will require deep-pocketed supporters. It took them only a day to firm up commitments, and judging by the number of investors disappointed with their allocation, we suspect it was well received.

Bellevue Gold was another good example this week. Bellevue has a multi-million ounce Gold deposit in WA and was looking for $100m to fund ongoing discovery and feasibility studies. The deal was open and closed as quickly as you'd expect, with a reported book "multiple times covered over the Placement amount". Existing shareholders who didn't get a look in via the placement will be given the opportunity to apply for up to $30k in a $20m follow-on SPP. This will be set at the same price as the placement (no fixed VWAP discount), so for sake of retail holders, let's hope the gold rush continues!

There's lots of money and interest flowing into the gold sector. COVID-19 has fuelled a rally in the Gold price which has in turn helped buoy the industry. Although the virus hasn't impacted operations on the ground, the majority of exploration/development work is in the relatively COVID-free areas of WA, NSW and regional VIC.

There's still lots of love for BNPL

The new breed of finance companies that allow consumers to pay for goods in instalments, is now drawing almost as much intrigue as the gold sector. BNPL has supported the market in recent weeks, and it's poster-child Afterpay has the credentials to prove it as a newly minted member of the ASX 20.

Speaking of Afterpay...they rattled the tin this week to capitalise on what has been nothing less than an extraordinary run since their March lows. $660m was sought from funds and the like via a placement with the final price to be determined by a book-build. A further $250m founder sell-down was to be included as part of the placement round. Investors were told that the bookbuild range was $61.75 - $66.00 but only instos were given the chance to pick a price. By lunchtime the book was covered at $62.50, and a further update released at 3pm signalled the book was "covered through range". $66 or a 2.9% discount to the trading halt price was the final number. Maybe too skinny a discount given the dilution and market impact of a founder sell down?

Afterpay's much smaller sibling, Sezzle, also made a cash call this week. It wasn't an easy deal to price, Sezzle stock had jumped 41% before announcing their trading halt. This surely threw a spanner in the works for the brokers piecing together the raise. A book-build was chosen to price the deal (perhaps because of the unexpected last minute price bump), and bids were taken from a floor price of $5. The company was out seeking $79m via a placement with a further $7.2m to come from an SPP.

The BNPL sector has seen its own fierce bull market in recent months. Since the March lows every player in the space has skyrocketed in value - Afterpay (up ~745%), Zip (up ~448%), Splitit (up ~600%) and Sezzle (up ~1000%). This sector may well become the world's new form of credit, but it may also be growing in price just a little bit too quickly.

With all this attention, we suspect most investors are wondering if the sector is a good buy now, or maybe later?

Never miss an update

Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

4 topics

35 stocks mentioned