BOE leaves rates steady at 5.25%, British Construction PMI rises to 53.0

Let’s hop straight into five of the biggest developments this week.

1. RBA leaves the cash rate unchanged at 4.35%

On Tuesday the Reserve Bank of Australia left the cash rate steady at 4.35%. Within the Rate statement, they mentioned that they expect the future path for interest rates to be lower and that it is unlikely that they will be raising rates further from here. Markets viewed this very dovishly and bought Australian equities in response.

2. BOE leaves rates steady at 5.25%

The Bank of England’s Monetary Policy Committee (MPC) set its monetary policy at 5.25% with an aim of meeting its 2% inflation target, however, they are attempting to do it in a way that sustains growth and employment. This stance is similar to other central banks and provides room to reduce rates if necessary.

3. British Construction PMI rises to 53.0

Business activity growth gained momentum across the UK construction sector in April, largely due to solid rates of expansion in the commercial and civil engineering segments. Near-term prospects remained relatively positive, as new work increased for the third month running amid reports of a boost to sales from improving domestic economic conditions. This demonstrates that although rates are high, economic activity continues to move forward.

4. US Crude Oil Inventories decline -1.4M barrels

U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ending May 3, 2024, which was 307 thousand barrels per day more than the previous week’s average. This shows that oil demand in the US continues to be robust as they head into the summer months.

5. US unemployment claims rise by 231K

In the week ending May 4, the advance figure for seasonally adjusted initial claims was 231K, an increase of 22K from the previous week's revised level. Market participants viewed this positively for the market as it seems to have shown that higher interest rates are working to cool the labour market.

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Over the week, we have seen a continued move higher in the majority of commodities. Cocoa has rebounded after a period of aggressive selling, while Natural Gas has rebounded due to an increase in demand. Silver continues to make new highs off the back of numerous factors associated with inflation, interest rates, and a lack of physical supplies available. The VIX has sold off approximately 5% as equities rebounded aggressively as the US Federal Reserve subdued fears of further rate hikes. Outside of this, we have seen a broad rally in most commodities which demonstrates that future PPI readings may beat expectations.

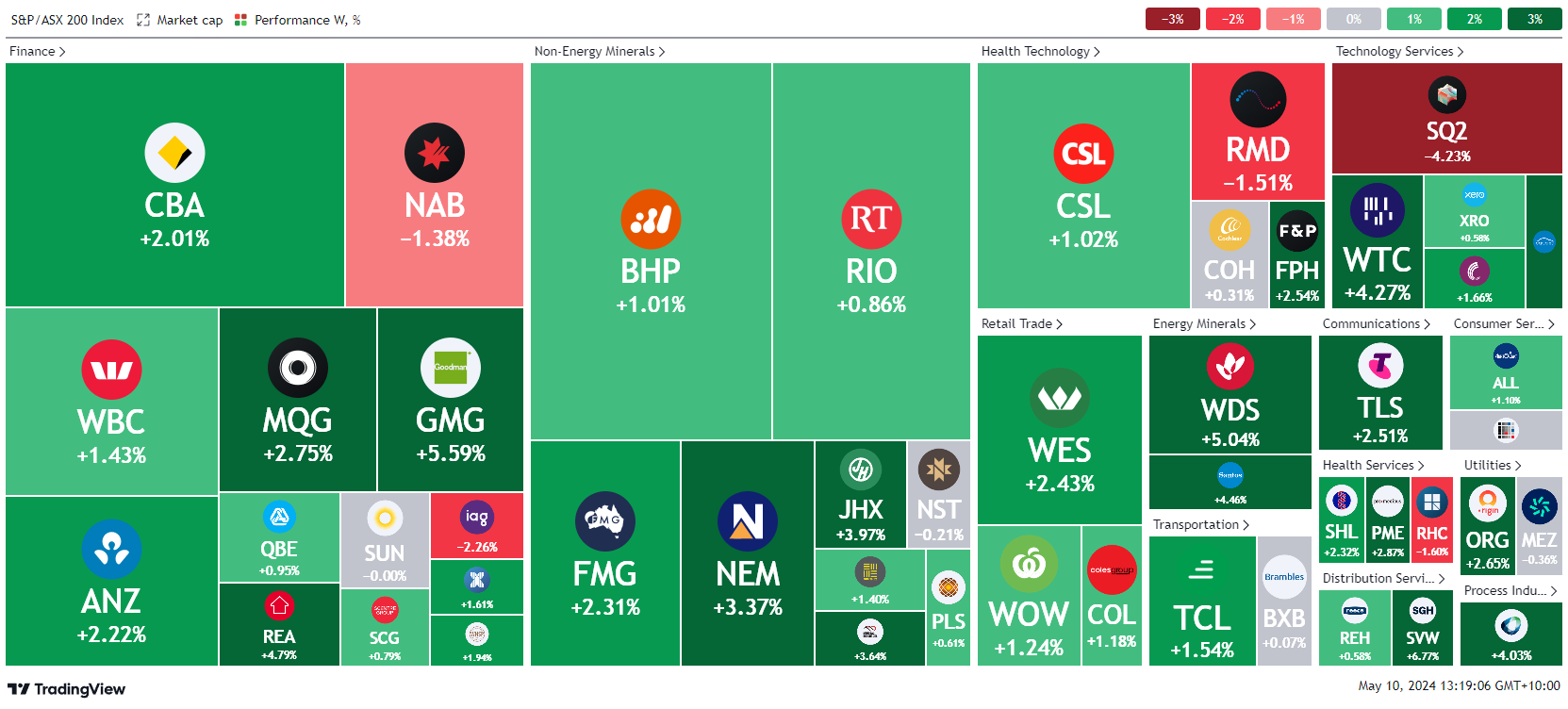

Here is the week's heatmap for the largest companies in the ASX.

After a brutal two weeks, the ASX has managed to rebound well this week, led higher by financials, with CBA, MQG, ANZ, and NAB all storming higher by over >1.8%. NAB was the weakest bank as they reported their results which missed expectations. The Materials sector also rebounded after a weak showing over the last two weeks, this was led higher by the underlying commodity prices, as the Chinese commodity market reopened after its holiday. In general, the market was green all over, as most sectors contributed to this week's performance.

5 topics

4 stocks mentioned