Bonds and Your Investing Health

OTG Capital

I’m often asked why I'm fixated on bonds rather than following the herd with shares and cash. I blame this fixation on my age and sentiment. I am also a control freak but mostly, I like bonds because they help keep my blood pressure within a healthy range.

As a one-time share day trader, I played and shorted US shares during the height of the GFC meltdown and can rightly boast a great annualised result but the side effects? - lack of sleep, no fingernails, frayed nervous system, and a very cranky wife.

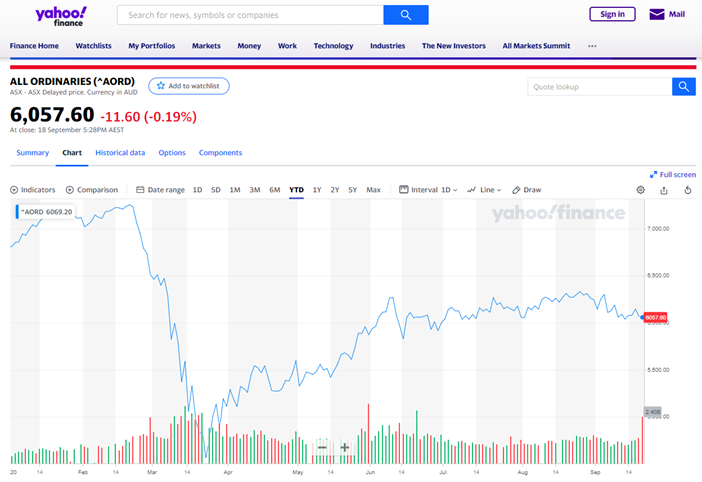

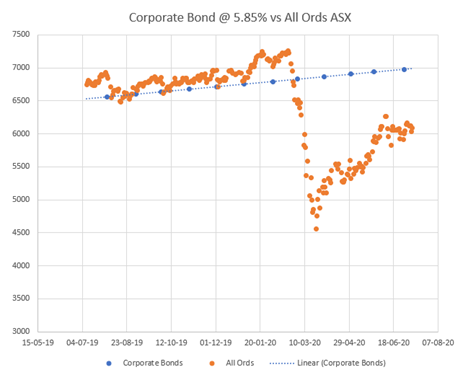

So, how is your blood pressure doing so far this year? 2020 has seen the All Ords start the year at 6810 and fluctuate from historic highs to historic lows back and historic in betweens in historically short time periods - (did I also mention it has been unprecedented?)

The corporate bond coupon rates over this same period of time have eased somewhat in line with the easing of the RBA cash rate (now only 25 basis points). However, in general, bond yields have remained consistent and stable since the beginning of 2020 as they were throughout most of 2019.

Shares Will Always Outperform Bonds!

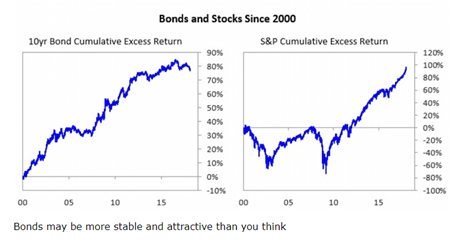

I admit it, of course I do!! Anyone can look at the statistics, they are compelling and tell the truth - over the long haul, shares have always outperformed bonds.

But the reason I like bonds is they suit my risk tolerance and they suit who I am as an investor – pure & simple. I’m not a total conservative with everything tied up in cash deposits. I understand my money needs to work hard to beat inflation and tax.

I’m just not comfortable following the masses into “blue chip” stocks that deliver the occasional big bang (A2 Milk, CSL and AfterPay are recent examples).

While not everybody jumped on these shares to make extraordinary profits, of those who did, how many investors fess up to their mistakes/duds?

It is consistently true shares deliver better returns than bonds and cash over a long period of time, but this only works if you buy and hold a reasonable basket and withstand the temptation to exit or panic buy poor choices.

(I also acknowledge many investors buy Australian blue-chip stocks purely for the franking credits – which is in fact a heavily subsidised government rebate – which performs similar to a bond.)

Stock Picking Ain’t Easy!

Stock picking is exceptionally difficult.

a "beginners guide" - wait until you see the Expert's Guide!!

a "beginners guide" - wait until you see the Expert's Guide!!Warren Buffet has regularly proved active hedge fund managers (the supposed experts), performed no better than someone with Indices ETFs. For mine, throwing my bets (and hard earn cash) to the wind when it comes to my retirement at this stage of my life is just not a viable plan.

There are five asset classes that investors can chose from yet, I am dismayed most people I meet at investor shows, discussions groups and industry days are focused on shares, cash and little else.

I don’t tend to count real estate in this mix if the item is the family home. For most, making money on where you live tends to be a nature of good fortune and happenstance rather than good management, if we are realistic.

Hence, my ongoing love affair with bonds (and I’m not referring to low yield, poorly performing government bonds). They provide me a relatively consistent way forward that is slightly higher on the risk profile than cash and term deposits.

Importantly for me they are nowhere near the risk profile of shares and they are relatively simple to understand, easy to invest in, and provide modest to strong returns without the drama and stress of the market volatility we are currently living through.

This pandemic still has a long way to run, and there is no vaccine on the foreseeable horizon. I contend forecasts of “snap backs” and “greenshoots” are premature. There are tips, tricks and traps to investing in bonds, but for mine, they are a steadier long-term investment.

what kind of ride suits you and your investments

what kind of ride suits you and your investmentsWhen you look at the comparative yield graphs – one delivers better than the other a lot of the time, but I know which one is easier to manage and traverse, and which one is better for my blood pressure.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

Ray Trevisan is a Fund Manager and Director of OTG Capital, a boutique wholesale investment fund specialising in asset backed securities. He has over 40 years of business and investing experience.

Ray Trevisan is a Fund Manager and Director of OTG Capital, a boutique wholesale investment fund specialising in asset backed securities. He has over 40 years of business and investing experience.