Brace yourself: Why a 6% interest rate in America (still) can't be ruled out

It was December 2020 when the US Federal Reserve first told us what conditions it would take for the interest rate in the world's largest economy to begin rising again.

"...the Federal Reserve will continue to increase its holdings of Treasury securities ... until substantial further progress has been made toward the Committee's maximum employment and price stability goals..."

In its November 2021 meeting, it then flagged inflation was finally above the 2% target for the first time in many years and that it would remain there for "some time". Back then, the Federal Reserve's famous dot plot showed the decision-making committee being split evenly between rate hikes in 2022 and no rate hikes in 2022.

Fast forward a year later, and "some time" has turned out to be the understatement of the century. US inflation is now nearly four times the Federal Reserve's target - and it's remained above target since March 2021. Oh - and that same central bank has hiked rates by 75 basis points four times... in a row.

And you can bet your house they are not done yet.

In this wire, I'll take you through the story of how we got here, the changes that were made in light of the latest meeting's commentary, and answer a question that every investor needs to consider... even if it seemed impossible just a few months ago.

Could the Federal Reserve's end game actually begin with a 6?

We've seen this rodeo before

As early as April this year, some strategists on Wall Street were already concerned that the Federal Reserve may need to hike rates well beyond what markets were expecting.

Deutsche Bank's economics team, led by David Folkerts-Landau, wrote back then that a Fed funds rate range (their version of our cash rate) of between 5 and 6% would be "sufficient" enough to bring inflation down to target.

"We assume conservatively that a Fed funds rate moving well into the 5% to 6% range will be sufficient to do the job this time."

But a 5% Fed funds rate is also widely seen as more than enough to trigger a deep US recession. In technical terms, the US is already in a recession.

That note attracted more than a few eyeballs and headlines. And as wild as it seemed back then, more people are starting to sit up and take notice.

Former Treasury Secretary and Bloomberg contributor Larry Summers said a 6% terminal rate "would not surprise" him anymore. And the big behemoths of Wall Street are inching towards moves in that direction as well.

Jerome Lander, CIO at WealthLander, believes a 6-handle is possible but unlikely. But that doesn't mean all the bad news is done and dusted.

"Inflation isn’t likely to disappear as an issue in coming years, and in fact, volatile inflationary outcomes are much more likely than in years past," Lander said.

What do the professionals say?

After last week's Federal Reserve meeting, the upward shift in terminal rate expectations was palpable. Goldman Sachs was the quickest out of the blocks. From there, the moves just cascaded.

- Goldman Sachs: 5% by March 2023

- Barclays: 5-5.25%, timeline not specified

- Morgan Stanley Investment Management: Market pricing of 5-5.25% peak is "OK", but it's the yield curve inversion we should be more worried about

- TD Securities: 5.25-5.5%, sees 50 basis points hike in December

- Bank of America: 5-5.25%, sees 50 basis points hike in December

- BNP Paribas: 5.25%, sees a fifth 75 basis points hike next month

- Citi: 5.25-5.5%, but cuts may be on the way late next year

- Nomura: 5.5-5.75%, expects 50 basis points hike in December

All these moves were made after last week's Fed meeting and press conference alone. And even after last night's inflation print handily beat expectations, most research houses still haven't budged on their higher terminal rate calls.

What do the traders say?

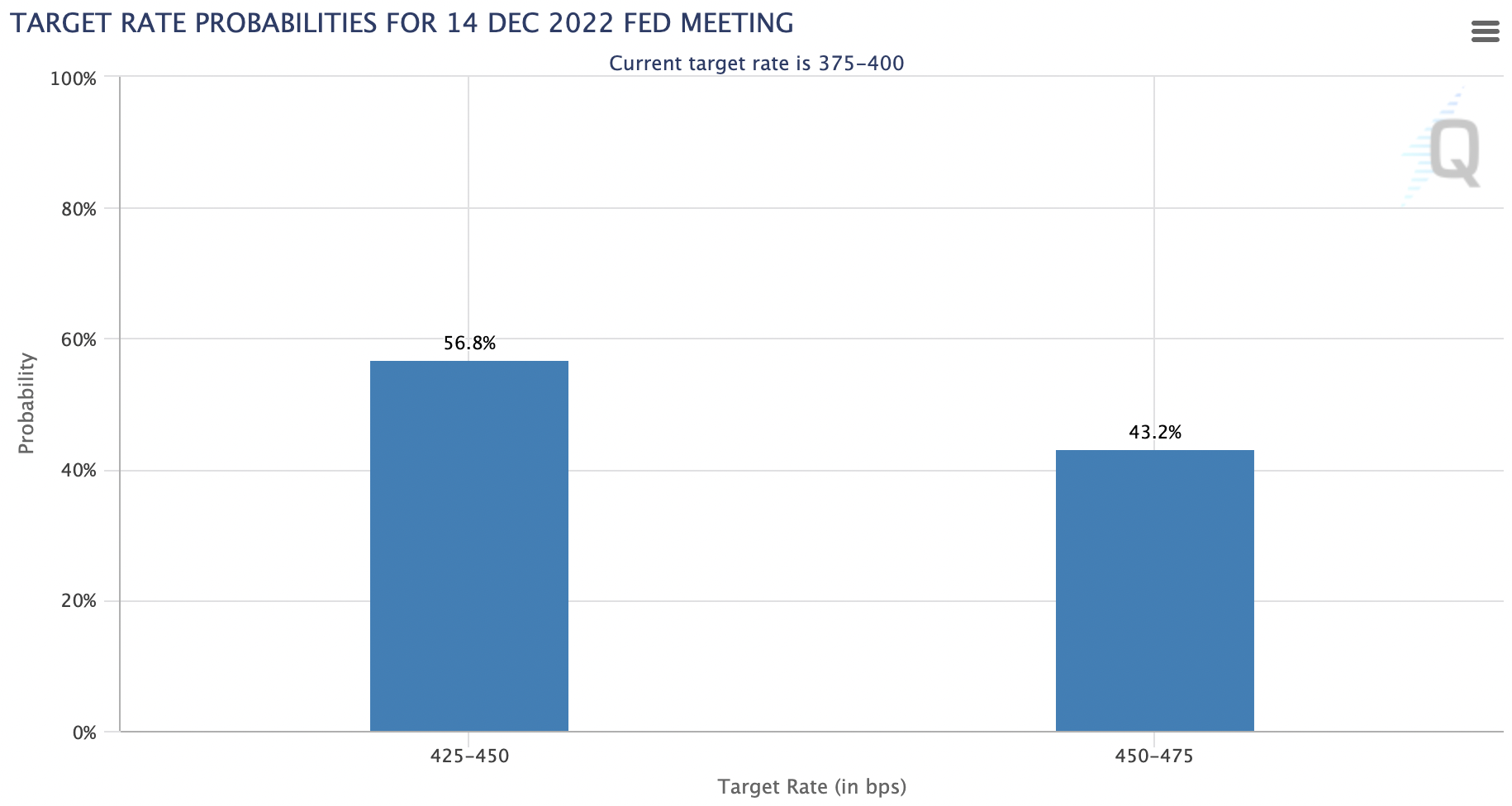

At the beginning of this week, the CME Group's FedWatch tool showed rates traders slightly biased towards a 50 basis point hike at the next Federal Reserve meeting - but not by much.

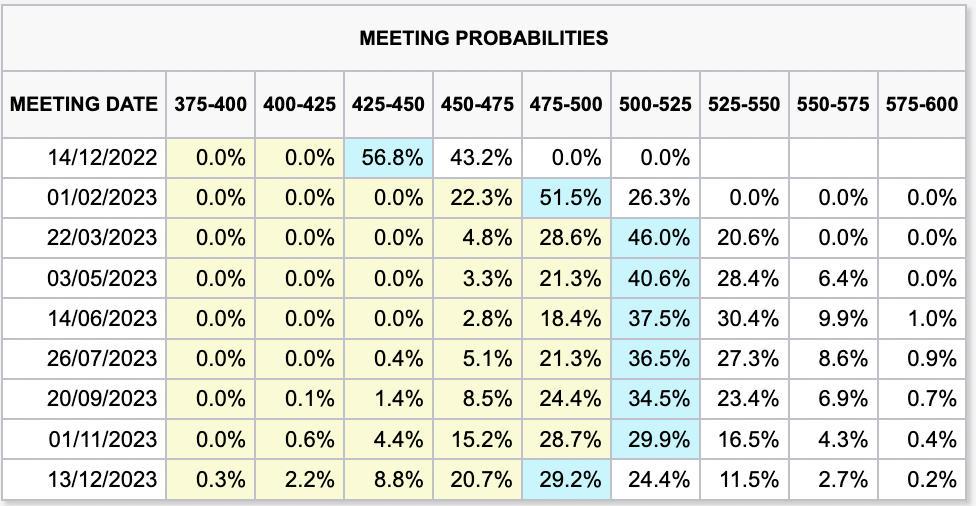

The CME Group also provides a tool for investors to visualise where other investors believe the Federal Reserve's terminal rate will be. It's called the "meeting probabilities" table and at the beginning of the week, it looked like a big cluster was developing between 5% and 5.5%.

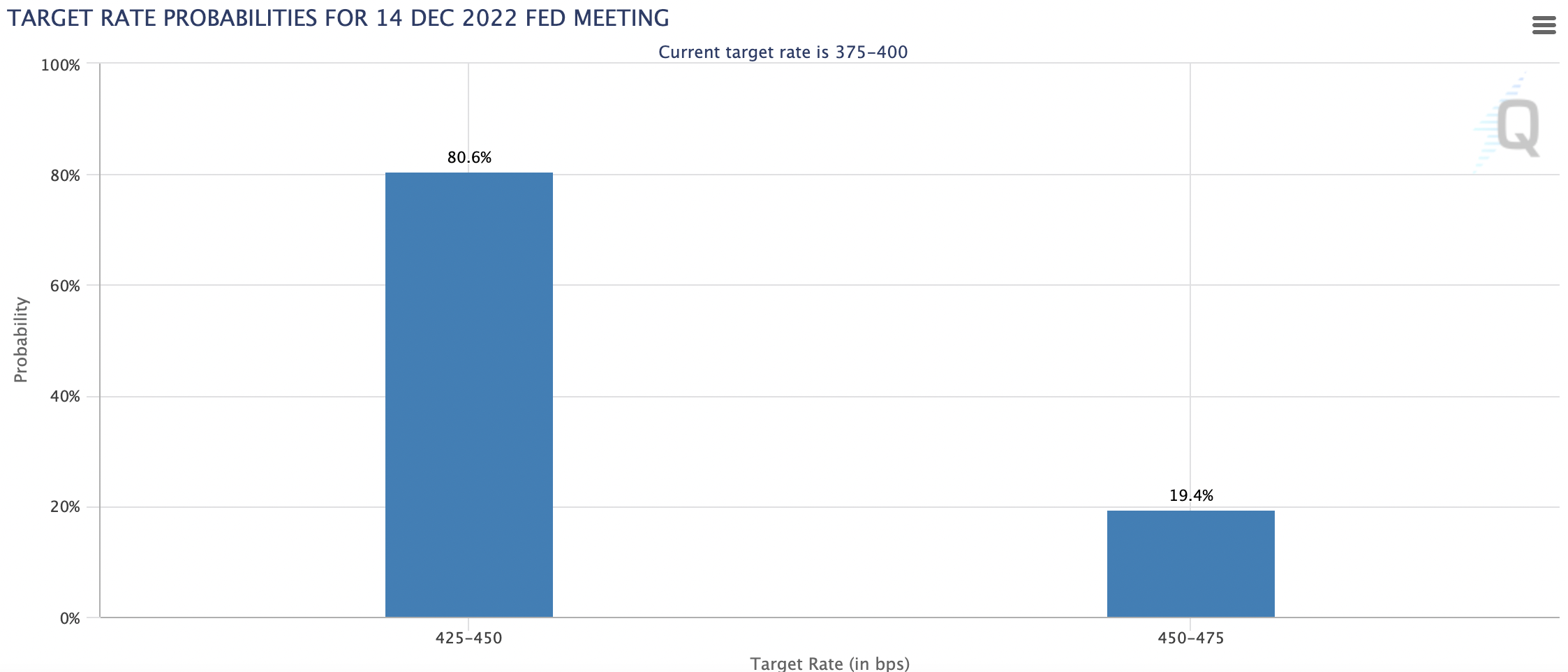

After last night's inflation report, the bets for a step down from 75 basis points to 50 basis points has increased dramatically.

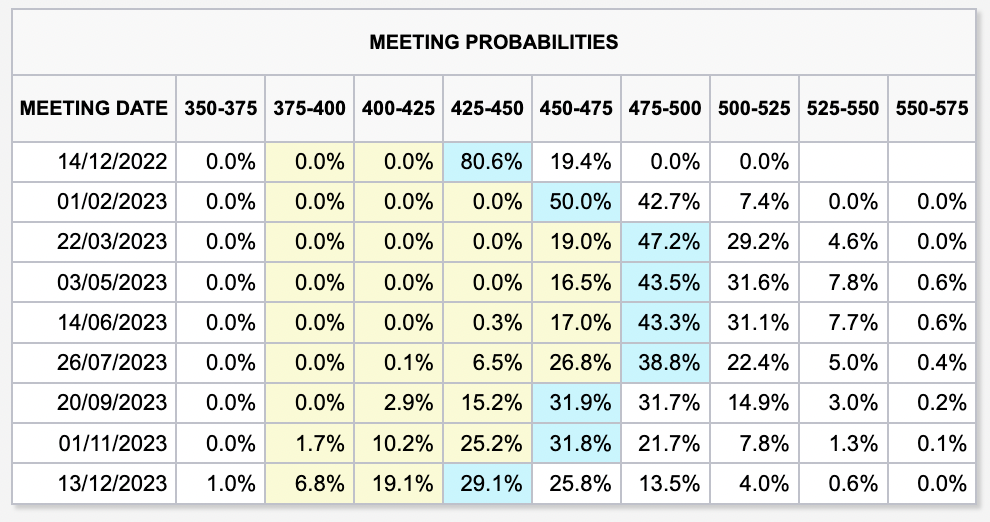

Even more interestingly, the "575-600" column from Monday's probabilities chart has now been completely erased as traders move their bets into the "500-525" column. Talk about a growing consensus!

The bull and bear cases for a 6% interest rate

Oreana CIO Isaac Poole has been one of those arguing for an extended pause, arguing the Federal Reserve needs to stop hiking for a moment before it goes too hard, too fast.

"But if the Fed hikes too far, too quickly, we expect the Fed Funds rate will be either below its current level (a short shallow recession), or a long way below its current level (a painful, non-linear recession)."

AMP chief economist Shane Oliver feels similarly. In a sit-down interview with Livewire co-founder James Marlay, he believes the Fed's end-game will be far lower than even what Wall Street's brightest are expecting.

"So I reckon we're currently 3.25% for the Fed funds rate at the top end of their range. Yes, we've got some more upside there, probably up to around four and a half per cent."

He added that the Reserve Bank is more "rational" and "level-headed" than its overseas counterparts, including the Federal Reserve. But Oliver and Poole are definitely now in the minority, as the consensus believes we're either a long way from the peak or the mistake has already been made.

Jamieson Coote Bonds CIO Charlie Jamieson has not published a theory for the Federal Reserve's end game. But he did recently tell our Chris Conway that he finds the timing of the Fed's peak rate "plausible" - but he believes the bigger issue is more entrenched.

"Obviously, it's still absolutely critical, but we are transitioning across to more of a liquidity and credit issue, as people are being asked to refinance their existing obligations at these catastrophically high-interest rates versus what they've been used to."

And while Lander argued a hard landing is more likely now than an uber-high terminal rate, he continues to warn of a market risk we haven't seen on paper yet - a hard landing.

"A higher terminal rate would hence likely require another inflation shock," Lander said. "In the absence of this, a hard economic landing is more likely than an inflation surprise in the short term – and will ultimately be just as disturbing to risk assets," he added.

In short, the answers are unclear, and the moves of every central bank around the world will continue to be dependent on the data. But even after today's inflation report, it's still tenuous at best to believe that the Federal Reserve will be able to take its foot off the gas pedal.

A six-handle was a hard scenario to imagine - and arguably, it still is. But you'll have to imagine how you will allocate assets in it, given the first brutal mistake has, in all likelihood, created many more.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

2 topics

6 contributors mentioned