Bucking bulls, Bond and a boost for the ASX: Shane Oliver's 2021 watchlist

Livewire Markets

With 2021 just around the corner, vaccine distribution looking promising and a US election put to bed, the bulls of the market are bucking, with little concern of any downside.

But is this optimism premature?

According to AMP's Chief Economist Shane Oliver, while there's good reason to be a bull, investors must be wary of market uncertainties.

In the interview below, Shane reveals his outlook for markets in 2021, detailing the key macro drivers for global equities, the importance of the rotation from growth into value stocks and the relevance of a vaccine for the Australian housing market.

Shane also discloses the most important lesson he learnt from a year that nobody expected.

Image: Shane Oliver, Head of Investment Strategy and Chief Economist, AMP Capital

2020 was a dramatic year for markets worldwide. What would be the biggest lesson you’ve learnt?

2020 is a year that many will be pleased to see the end of. But it also contained many useful lessons. For example: that lockdowns and social distancing can work in controlling viruses; that working from home can be productive, save time, good for the environment and contribute to a more balanced life; that the disruption from online retailing has a lot further to go; that there is more to life than working; that humanity working together can make great strides rapidly when under threat (thinking of the vaccines); and that a good institutional framework based around respect for experts and sensible citizens can make a big difference when dealing with a pandemic (thinking of the health response in Australia and New Zealand).

But the main lesson to me is that a rapid, large, comprehensive and well-targeted economic policy response can protect an economy from a significant shock and enable it to rebound quickly when the threat abates. The pandemic was clearly a big shock that surprised everyone but it was the economic policy response to it that really contained lessons for the future in terms of economic policy.

Smart economic policymakers and governments realised very early on that while the hit to the economy from the pandemic and associated lockdowns would be huge, recovery would be fastest if businesses, jobs and incomes were protected.

And this is exactly what we saw in Australia where a combination of massive fiscal stimulus, ultra-easy monetary policy and debt payment holidays minimised the economic fall-out such that, when it was safe to reopen, the economy could rebound which it has.

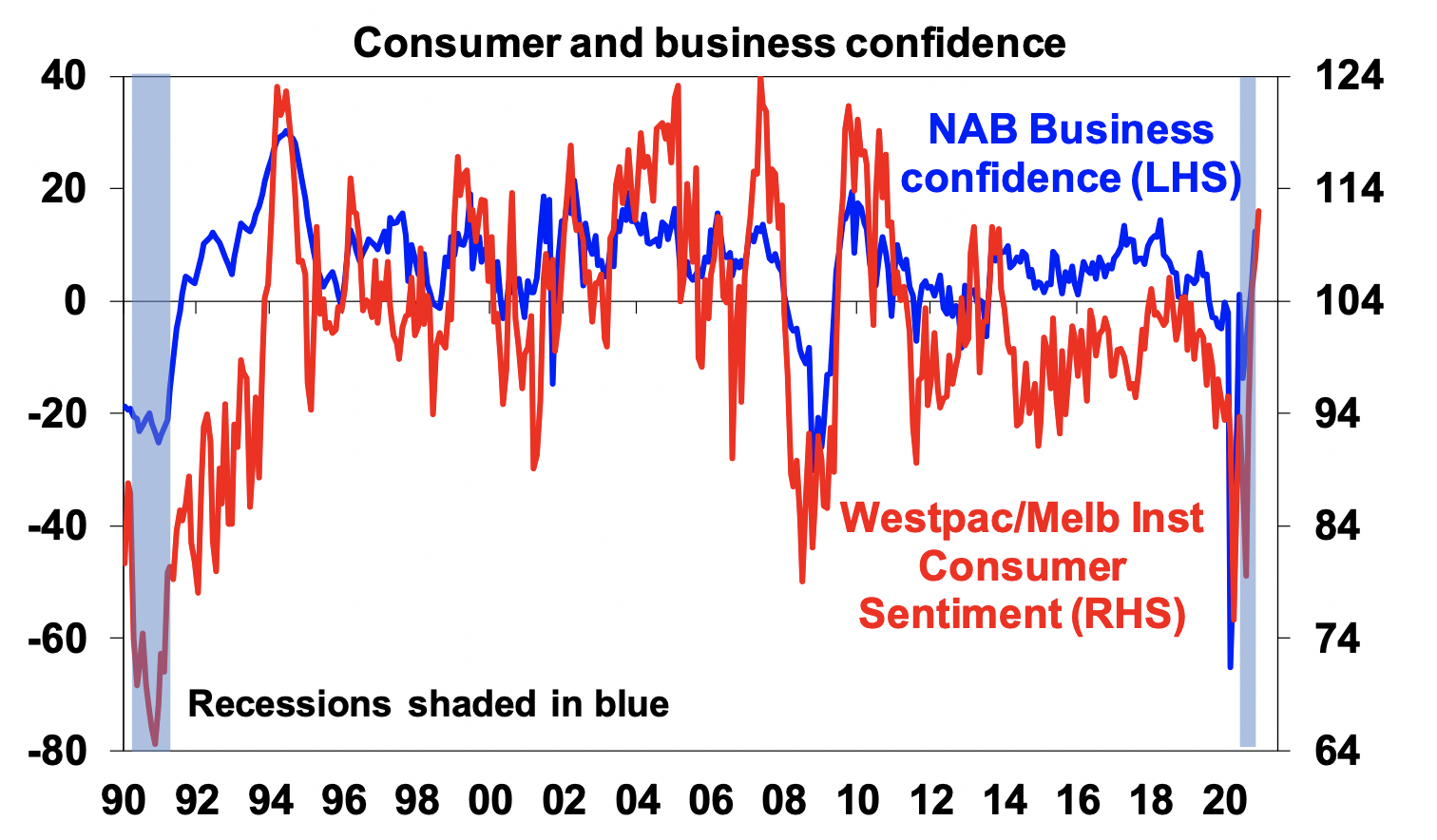

While there was much scepticism and fear of a deep and lasting depression back in March and April, the rebound in economic conditions in Australia has been much stronger than expected thanks to this economic policy response. Consumer and business confidence have rebounded to be above pre-coronavirus levels, retail sales are way above year-ago levels, 75 per cent or so of lost jobs have been reinstated and GDP is expected to have recovered pre-coronavirus levels by mid-2021.

Source: Westpac/MI, NAB, AMP Capital

From this has flowed the faster than expected rebound in investment markets.

While future economic shocks will always be different the lesson of 2020 is that when there is a clear and significant threat to the level of economic activity the key is to go early and go hard with economic policy support measures.

2020 is finishing off with three potential COVID-19 vaccines. Do you anticipate a rapid and seamless global recovery or should investors be wary of volatility?

While many uncertainties remain the news on the vaccine front has been good. As Auric Goldfinger said of meeting James Bond “Once is happenstance. Twice is coincidence. The third time is enemy action.” Having now at least three vaccines with high levels of effectiveness adds to confidence that others will be too and that based on current production plans and those who have already been exposed to the virus there is a good chance of reaching herd immunity globally by end 2021 or early 2022. This, in turn, should allow a more confident reopening of the global economy over the year ahead which when combined with massive policy stimulus - much of which is still sitting around in the form very high household saving rates reflecting pent up demand - should result in a strong rebound in global and Australian economic activity over the year ahead.

This does not mean that we won’t see volatility with a few decent corrections along the way - just think of those seen in 2010 after the initial recovery in share markets from the GFC low in March 2009. Shares have had a big run-up since early November but coronavirus is still causing havoc in many countries which leaves them vulnerable to a correction. But the combination of reopening through 2021, massive stimulus and low rates should underpin solid share market returns through the year ahead as a whole.

How important is the rotation from growth into value stocks? Is this a structural shift moving into 2021 and how much importance should investors be placing on this?

The shift we are now starting to see from growth stocks in favour of value stocks is a big deal. Growth has outperformed value for a decade or so now thanks to a combination of ever falling interest rates, rapid growth in tech stocks with “winner takes all apps” that has resulted in a degree of monopoly power and one crisis after another providing an added push in favour of growth stocks. However, this looks to be turning as the focus shifts from stocks that benefit from the pandemic (namely tech and health care) to stocks that benefit from reopening and recovery, interest rates approach their lows, wide-scale market penetration limits the future growth of big tech stocks, the seeming monopoly power of tech stocks makes them vulnerable to increased regulation and relative valuations have been pushed to extremes.

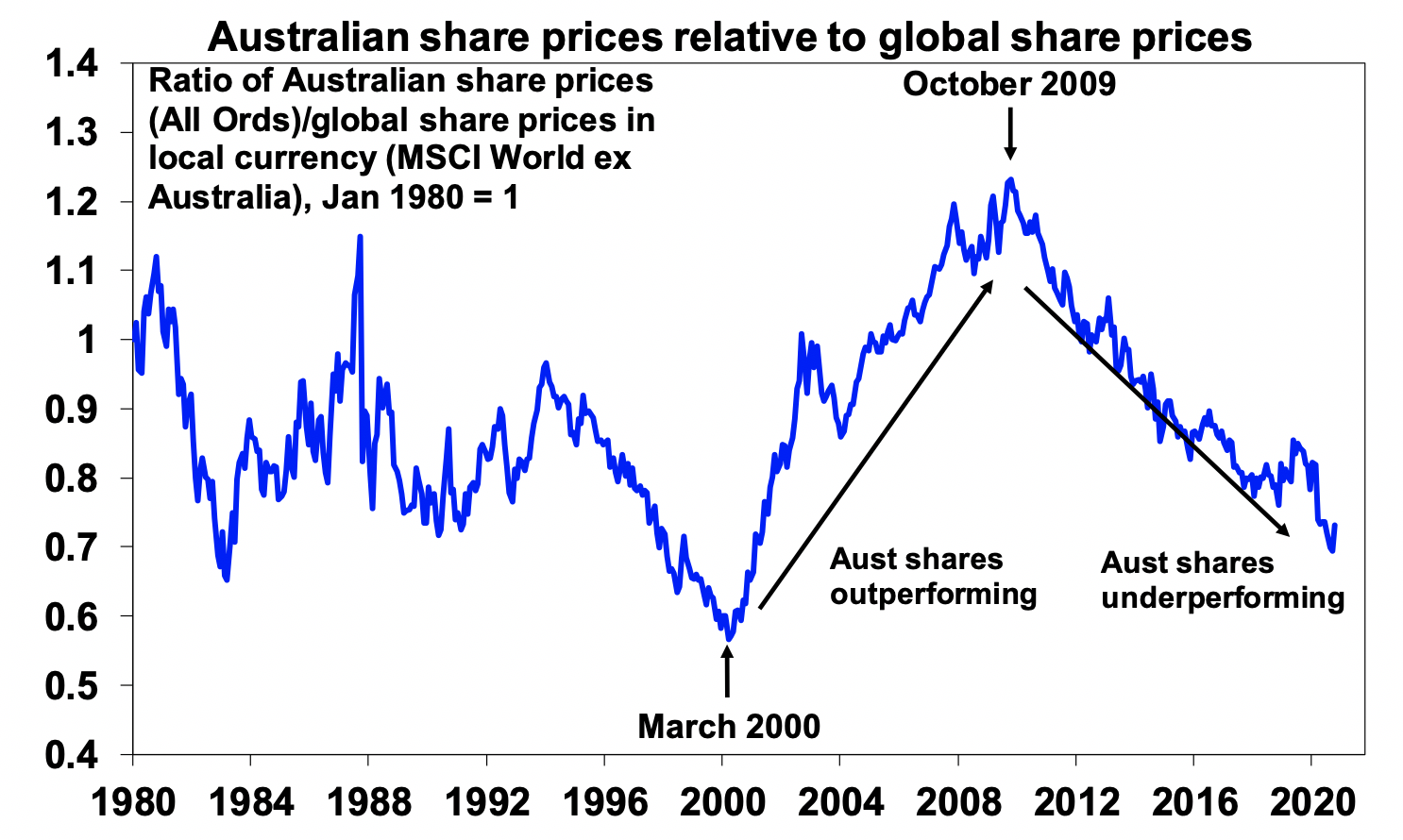

Once it turns, value could outperform growth for several years to come. Given the greater exposure of the Australian share market to cyclical value stocks (like resources, industrials and even financials) compared to the US share market which is relatively more exposed to growth stocks (like technology and healthcare), it may mean that the relative underperformance of the Australian share market compared to global shares (which are more than 50% US shares) since 2009 could have run its course. So don’t give up on the Australian share market.

Source: Thomson Reuters, AMP Capital

How important is a vaccine for the Australian housing market and how should investors be approaching this?

In the short term, a vaccine is not very important for the Australian housing market but for the medium to long term it (or an alternative long-term medical solution to coronavirus) is critical. The last few months have shown that the combination of low rates, government home buyer incentives, income support measures, bank payment holidays and reopening have swamped the negative impact of high unemployment, weak rental markets and the hit to immigration. So the housing market has started to recover from a dip around mid-year with houses in outer suburbs, several cities and regional centres seeing prices pushed to new highs helped by a desire to “escape from the city”.

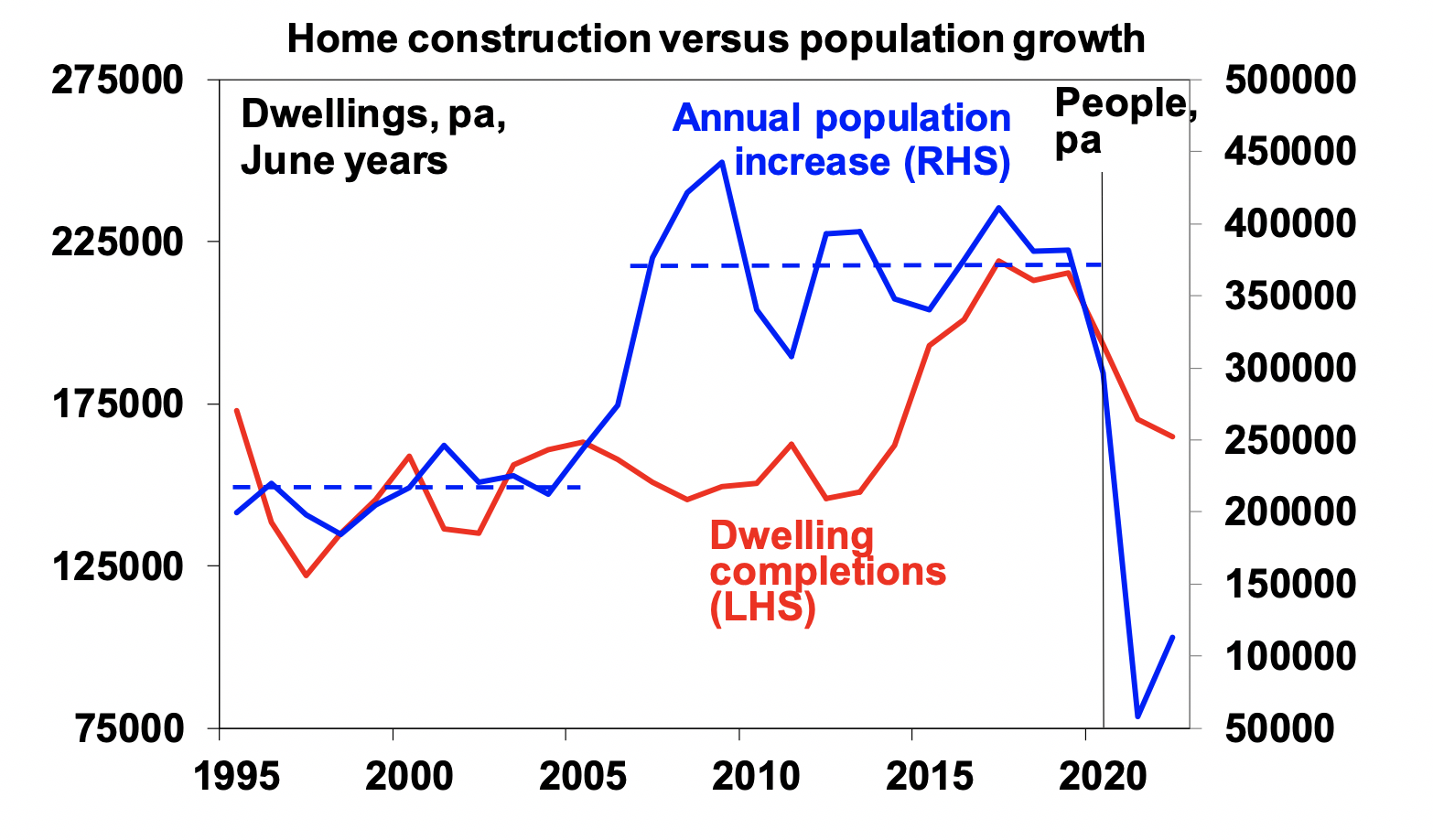

But it's hard to see the hit to immigration having no impact. While interest rates drive the short term cycle in house prices, population growth relative to the supply of housing dominates over the medium to long term. The reality is that the last 15 years have been characterised by a chronic shortage of housing in Australia as immigration surged with the result that prices never fell back to earth in the face of ever-lower interest rates.

Source: ABS, AMP Capital

Now might be different. Immigration has collapsed and population growth has plunged to its lower since 1917. Demand for housing is likely to be around 300,000 dwellings lower than otherwise would have been the case out to mid-2022. This is likely to take the market from undersupplied to oversupplied and is likely to weigh on prices in Sydney and Melbourne particularly but mainly for inner-city areas and units. A quick return to normal levels of immigration helped by a vaccine allowing the reopening of international borders will minimise the impact. But a failure of the vaccines to allow more normal travel or permanently lower immigration could see a more lasting impact on home prices. Of course, more affordable housing would be good news for many.

What is your outlook for 2021 and what should investors be keeping an eye on?

2021 is likely to see a continuing macroeconomic recovery helped by a combination of massive policy stimulus and vaccines. This along with continuing low inflation and hence low-interest rates will likely see solid returns from share markets, albeit with bouts of volatility but poor returns from bonds and cash.

The main things to keep an eye on in 2021 are as follows:

- Coronavirus and vaccines – problems here could result in ongoing waves of new coronavirus cases & slower recovery than we are assuming.

- US politics – a Democrat victory in Georgia’s January 5 US senate elections would risk more of a leftward tilt under Biden, although conservative Democrat senators will limit this. Trump could also try to throw a spanner in the works.

- China tensions – we expect a shift to a diplomatic approach here but there is a risk of misjudgement which could threaten Australia’s longer-term economic growth rate.

- Inflation – we are assuming it remains weak but if it rebounds faster than expected it will mean faster increases in bond yields and downward pressure on asset valuations.

- The hit to immigration in Australia – it’s hard to see 700,000 fewer immigrants out to mid-2023 having no impact on inner-city Sydney and Melbourne property prices.

Who will be the winners of 2021, and who will be the losers?

Basically, the big winners of 2020 will be the relative losers of 2021. With a more durable reopening and recovery coming into sight the focus has already shifted towards those investments that will be the key beneficiaries of reopening.

This includes non-US shares including the more cyclical Australian share market over the US share market, cyclical or value shares over growth shares, small caps over large caps and commodity currencies like the Australian dollar over safe-haven currencies like the US dollar. We expect the $AU to rise to around $US0.80 over the year ahead.

3 topics

1 contributor mentioned

Bella is a Content Editor at Livewire Markets.

Expertise

Bella is a Content Editor at Livewire Markets.