Bulls outnumber bears 4-to-1

Amid a pandemic that’s set to surpass 4 million infections, sink the global economy into deep recession and saddle taxpayers with a generation’s worth of debt, most Livewire readers have one reaction: “Buy stocks”.

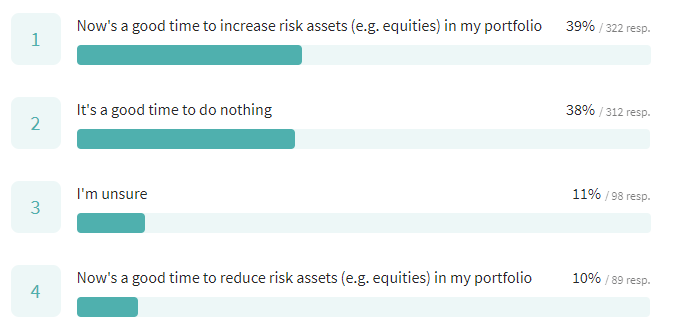

In our second reader survey for 2020, we took the opportunity to ask "How are you feeling about markets right now?”

The responses certainly surprised us; 39% of participants reckon it is a good time to increase risk assets, while notably, 10% felt it is a good time to reduce risk. Put another way, the bull-to-bear ratio is nearly 4-to-1, up from 3-to-1 when we ran our first survey in early March.

How are you feeling about markets right now?

The preliminary results on how 821 Livewire readers are feeling about the markets are as follows:

So why the bullish sentiment? One reason could be that our audience is taking a leaf from Sir John Templeton’s playbook as we pass through the peak of the bad news cycle; those disheartening days when death rates were soaring across Europe and America, prompting the US Surgeon General to warn of “our Pearl Harbour moment, our 9/11 moment”.

“The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” – Sir John Templeton

Expanding on that point, Marcus Padley wrote recently that in such moments investors need to think counter-intuitively about “getting ahead of the headlines not wallow in them”. He halved his cash weighting to 20% recently and it's falling further as he snaps up recovery stocks.

“The nervous Nellies will be telling you about how terrible it all is, how the coronavirus continues to hold society in its grip, but the stock market doesn't price stocks on what they are worth today, it prices stocks on what they will be worth in a month, a year or sometimes even further ahead.”

In his wire, Padley says the next headlines will be about the economy restarting, lockdowns ending, people getting back to work and before long sports, bars and restaurants getting back to business. Following that will be news that international holidays and cruises are permissible again. So watch out.

Signs of recovery... but are equities too expensive?

The stunning rebound in markets has left equity prices just 20% below their pre-pandemic highs and the valuation story is vastly different today than it was just a few weeks ago, as captured in this chart provided by Scott Haslem who is the Chief Investment Officer at Crestone Wealth Management.

Valuations have returned to near pre-virus highs

SOURCE: UBS, CRESTONE.

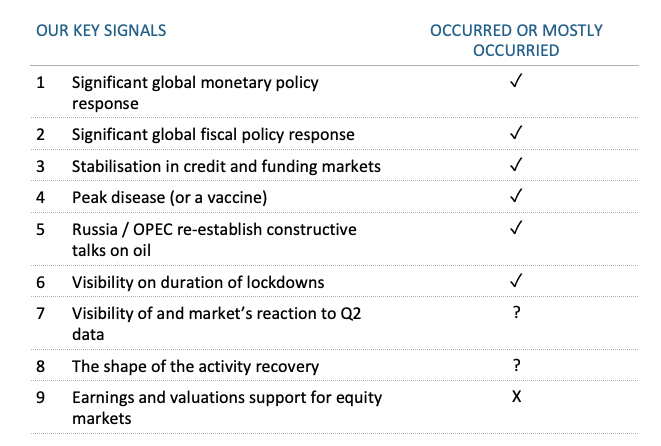

As the crisis was unfolding, Haslem and the team introduced a list of key signals they would be monitoring to help establish when risk appetite established a trough. Some of the remaining items may be achievable over the coming month or so, he reckons.

Blending all that together into a view, Haslem summarised it neatly as follows:

“Based on our signals, we remain both comfortable with our modest tactical overweight to equities (from mid-March) and cautious for now about moving more overweight, despite rising odds of a H2 2020 economic recovery. While not convinced markets will retest their prior lows (and are inclined to buy into any weakness), the recent rally has cautioned us about moving more overweight equities given relatively full valuations.”

Major asset classes investors are considering

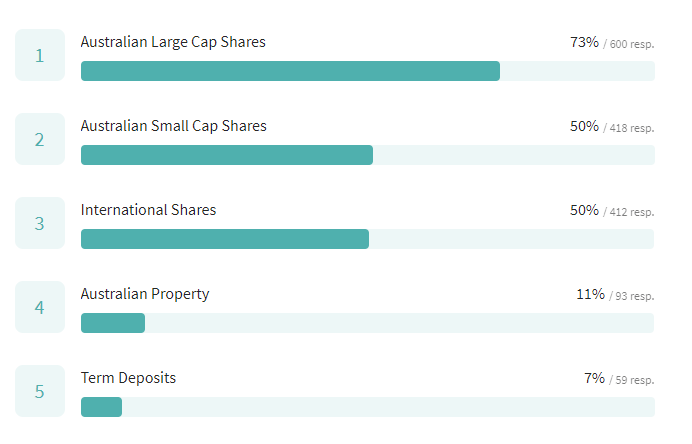

Putting aside for a moment the outlook, which will forever be the subject of rich debate, we also asked readers "Which major asset classes are you considering increasing exposure to over the next 12 months?"

Despite narratives from our contributors about boosting allocations to international shares to access the leading tech and consumer brands that are becoming more entrenched in our lives, most Livewire readers intend to stay at home. Over 70% of participants expect to accumulate more Aussie large-caps. Still, 1-in-2 are considering buying more domestic small caps and international shares. Only 11% are thinking about property.

The bear case

Still, among the experts who contribute to Livewire, there are a few lone, brave voices who reckon readers' optimism is misplaced. At the start of the month, we published a video with Jerome Lander who pitched a three-part argument about why the bulls are wrong:

- We haven't eradicated COVID-19,

- Valuations are at record levels against a poor economic backdrop, and

- We're coming to the end of a long-term debt cycle.

Be sure to check out Jerome calling out bull on this rally here.

So, how are you feeling about markets?

The survey is still running, so let us know how you are feeling about the market right now.

We are also asking participants to tell us about the investments they use to implement their strategy and alternative asset classes they're considering so that we can help shape more relevant ideas for readers. Once the survey closes, we will collate the data to create an essential guide that will inject fresh ideas to your investment process and if you participate will get first access to the results.

You can take part by clicking here.

4 topics

3 contributors mentioned