Bullwhip effect: Why big tech earnings (and share prices) will snap back

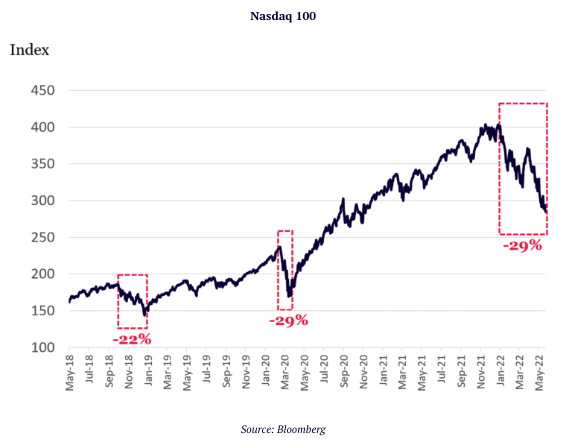

Since their 2021 peaks, the share prices of the world’s largest technology companies have recorded breathtaking declines. These once high-flying stocks have seen their value slashed by at least one quarter. Many have posted even steeper drops, including Amazon (down by more than 40%), Meta (down by 50%) and, of course, China’s Alibaba (down by more than 70%).

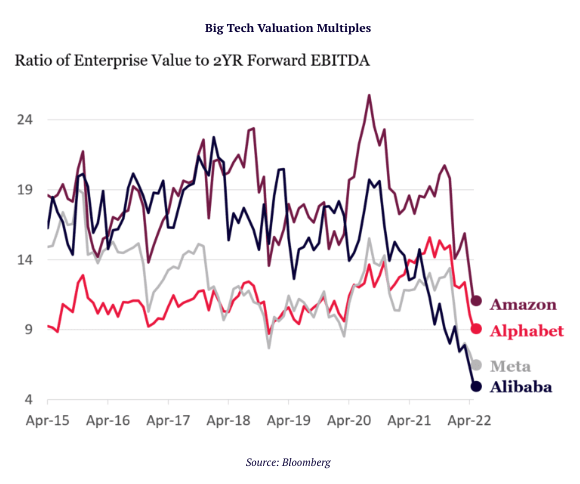

The tech leaders have been hit by a triple whammy: weak profit growth at a time when interest rates are rising and valuation multiples are collapsing. Their share prices have been collateral damage.

Many investors, understandably, are thinking about throwing in the towel and offloading these stocks.

But the good news is the pain is very likely only temporary. The massive investments big tech companies have been making will eventually pay off in a huge way, profit growth will resume, and stock prices will follow.

Today’s weak profit growth is not a good reason to sell high-probability long-term winning tech businesses. Today actually represents an extraordinary buying opportunity.

Big tech’s covid ‘Bullwhip’ effect

Investors were spooked when big tech reported their financial results for the most recent quarter. One thing became clear: profit growth has weakened dramatically.

For years big tech has rolled out strong profits and investors assumed they were long-term structural growers. Investors are wondering what had gone wrong.

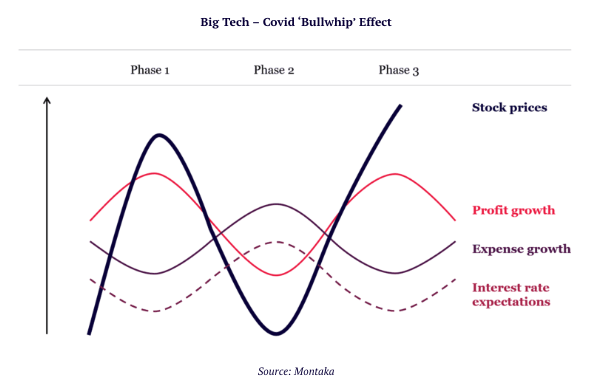

But if we zoom out, what we are seeing today in big tech’s earnings trajectory is less scary than at first sight. The mega techs are simply in the second of a logical three-phase ‘bullwhip’ effect following the onset of Covid.

The bullwhip effect is a term typically used to describe temporary supply chain disruptions that happen with demand changes unexpectedly. We have borrowed the concept and applied it to explain the current temporary ‘disruptions’ to big tech’s profits and stock prices.

Here is how it is playing out.

Phase 1. Big tech wins big from Covid-stimulus demand

When Covid hit two years ago, central banks and governments jumped in and launched unprecedented stimulus to protect economies. That stimulus triggered a ‘pull-forward’ in demand. Consumers flushed with stimulus payments and stuck at home spent big, often with digital businesses whose operations were largely unaffected by the lockdowns at the time.

Big tech’s revenues accelerated well above expenses for these businesses and profits exploded. At the same time, interest rates were forced to near-zero in support of the economic recovery. Valuation multiples increased, as did stock prices.

But this initial phase was accompanied by another important dynamic: the world’s leading tech companies massively accelerated their investments into very large, long-term growth opportunities. That includes Meta’s investment in virtual and augmented reality, Alphabet’s investment in new AI applications, and Microsoft and Amazon’s growth in cloud and distributed computing. R&D and capital expenditure budgets grew by as much as 60 percent in a single year. Hiring of engineers surged.

Phase 2 – Demand normalizes, but big spending continues

Big tech’s huge investment spree was logical. After all, stock prices were high, profits were strong and there is enormous value in unlocking these large long-term growth options, such as AI and cloud, more quickly.

But this resulted in Phase 2 of the bullwhip effect that we are experiencing today.

While that ‘pulled forward’ growth in demand during Covid has now normalized, the big tech companies still spending massive sums on those investments. That has seen the levels of profit growth achieved in Phase 1 evaporate.

At the same time, inflation is exacerbating weak profitability and causing interest rates to rise and valuation multiples to fall. Stock prices have followed, creating a very painful period for investors.

Phase 3 – Big tech profits from huge investments

But one silver lining – almost completely overlooked today – is that today’s large tech leaders are much closer to profiting from those massive growth opportunities they are investing in, than if they had they not accelerated their investments in Phase 1.

Artificial Intelligence (AI) is one area that is improving at a startling rate and is set to transform almost every industry, function and geography. Alphabet, Amazon, Meta, Microsoft, Alibaba and Tencent are all likely to be big long-term winners from AI because they are providing the tools and data storage needed for people to build and operate AI technologies.

We will eventually move to Phase 3 where big tech’s investment spending will normalize and align with demand growth. That will see profit growth will reaccelerate. At the same time, interest rates will stop rising and valuation multiples stop falling. And stock prices will resume their appreciation.

Indeed, we believe the stock prices of those businesses that continued investing through Phase 2 will likely experience much faster appreciation than those that did not. In recent days, for example, Alphabet announced the creation of the world’s largest and most capable AI-based language model, PaLM, and text-to-image generator, Imagen. These extraordinary advancements, with many more to come, have long-term value well beyond the short-term business cycle pressures we are observing today.

An extraordinary buying opportunity

There is no doubt that investors have had a tough ride in big tech stocks during the recent correction.

But over the lifetime of any great long-term investment, there are going to be many periods when short-term drivers of business value create cyclical oscillations. For investments in listed companies, this will certainly result in short-term stock price volatility.

As we described recently, drawdowns in big winners are normal and even if one knew for certain the best stocks to own, these too would result in major volatility over the life of the investments. (See “Even God would get fired as an Active Investor” by Wesley Gray, 2016).

Likewise, the tech sell-off is normal and can is simply the logical consequence of the Covid period we just experienced. (Of course, this is easy to say in hindsight).

The good news is that the next phase of the bullwhip effect will likely result in stock prices resuming their appreciation.

That means that investors with positions in big tech should hold tight. And for those who don’t own them, today likely represents an extraordinary buying opportunity for any long-term focused investor in stocks such as Amazon, Microsoft, Alphabet, Meta, Alibaba and Salesforce.

Note: Montaka is invested in Amazon, Microsoft, Alphabet, Meta, Alibaba and Salesforce.

Compound your wealth over the long-term

Montaka Global Investments provides investors with the opportunity to compound wealth over the long term through disciplined global investment strategies and a sophisticated approach to risk management. Get in touch with us through the 'CONTACT' button below.

4 topics

4 stocks mentioned