Buying property during a recession? Not as crazy as it sounds

Livewire Markets

COVID-19 has well and truly slashed Australia’s residential property market. What was a consistent market, moving 10% either upwards or downwards for the past three years has been blindsided by an unforeseeable global pandemic. With clearance rates at an all time high, employment down 20% and mortgage stress looming, where does the residential property market sit now?

I reached out to some of Australia’s best-known experts in the field for their thoughts on the current state of play. In this three part collection, these contributors will state their case for the property market.

Responses come from:

- Shane Oliver of AMP Capital

- Doron Peleg from Riskwise Property Research

- Pete Wargent of AllenWargent Property Advisory

It's not as bad as it looks

Shane Oliver, AMP Capital

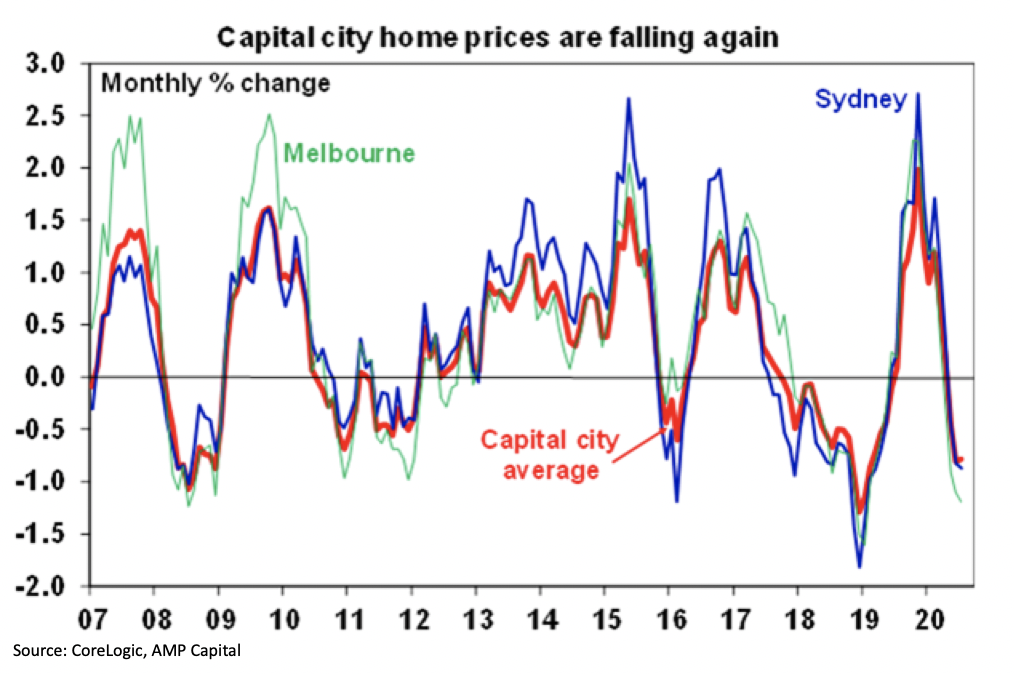

The coronavirus hit to the economy put an end to the 10% rebound in average capital city home prices seen between June last year and April this year and prices have since fallen as sales have weakened. But the hit to jobs and incomes has been offset by government income support measures and bank mortgage payment holidays which in turn has headed off a bigger hit to the property market. As a result, average capital city prices have fallen only about 2% from their April high. This also masks a huge divergence with prices down around 4% in Melbourne, down about 2% in Sydney and Perth, little changed in Adelaide and Brisbane but still trending up in Canberra and Hobart. And regional prices have generally held up ok.

We have also seen divergence in cities with working from home seeing reduced demand for inner city property and apartments relative to suburban houses particularly in areas where there is potential for new housing which can benefit from government new home building grants.

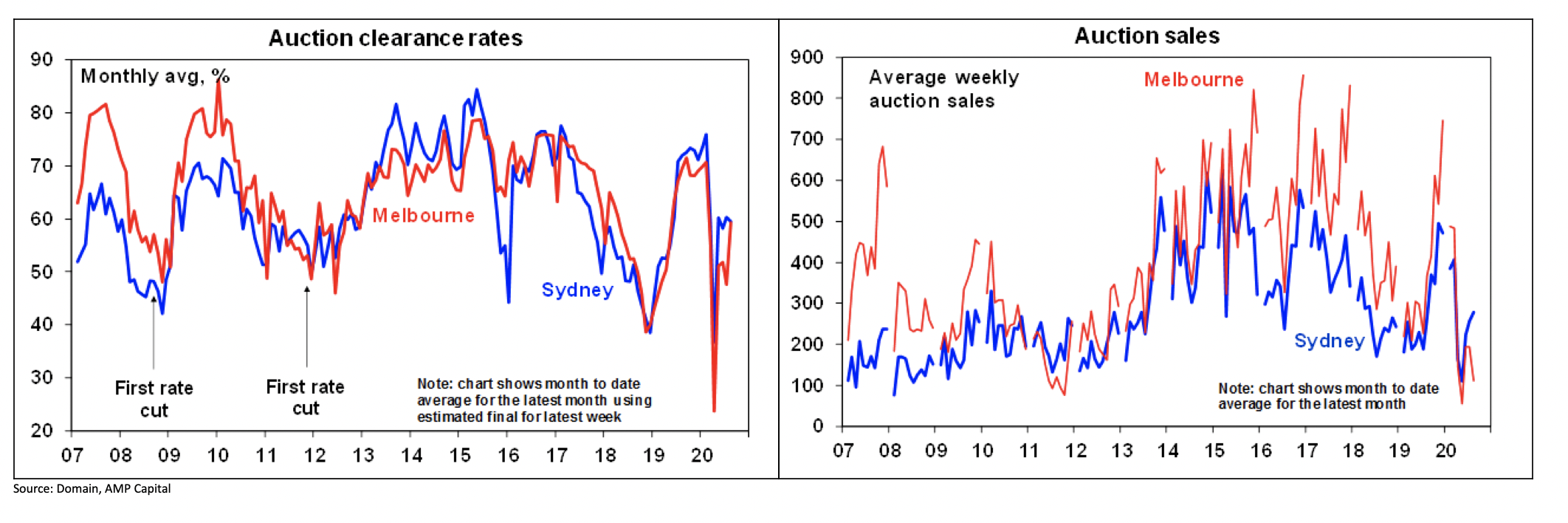

Auction clearance rates are up from their April shutdown lows but sales volumes remain very soft particularly in Melbourne which has been hit by the move to a Stage 4 lockdown in August.

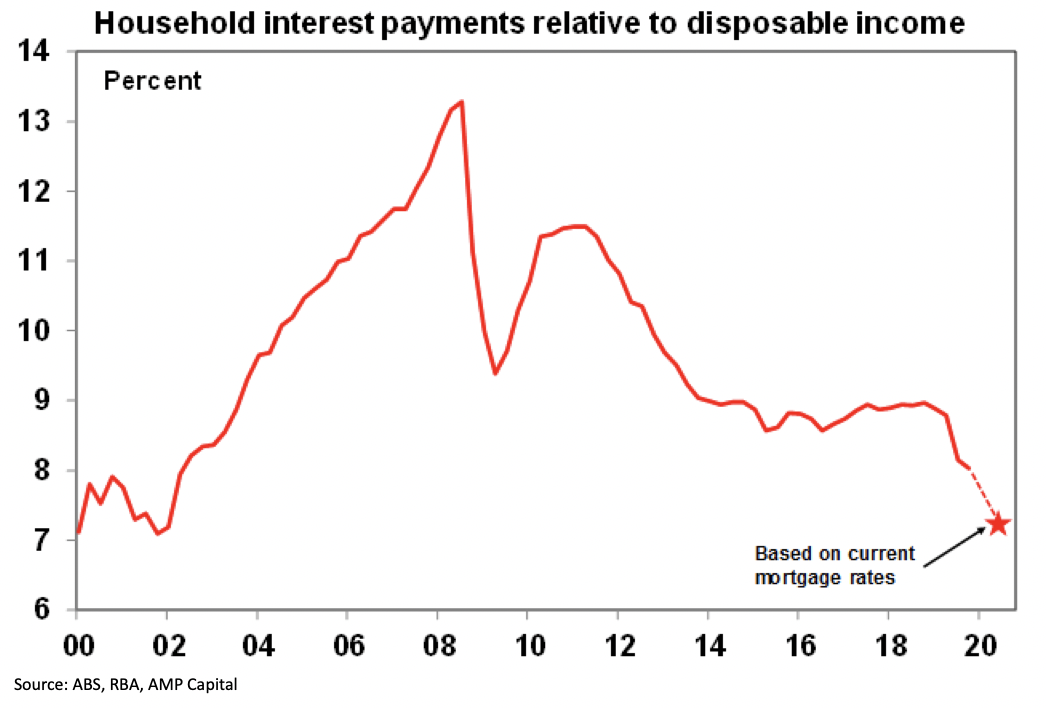

Mortgage stress has been kept down by the collapse in mortgage rates to record lows with debt interest payments falling to levels last seen 20 years ago and bank payment holidays which have allowed payments on nearly 500,000 mortgages to be deferred.

Now is the time to capitalise

Doron Peleg, Riskwise Property Research

In November 2019, we projected the housing market would reach new peaks by the end of 2020, meaning it would be back to ‘square one’ for housing affordability.

Our research also suggested this could spark the reintroduction of macroprudential measures by APRA if ‘speculation’ by investors rises and increases the risk to the financial stability.

At the end of last year we were expecting new peaks in both Sydney and Melbourne with additional peaks thereafter until the market reached a new tipping point. We projected strong price increases across a large number of areas in Sydney and Melbourne in the short term, and particularly the long term, thanks to a good (while a somewhat deteriorating) employment market and strong population growth, particularly in Melbourne. The RBA’s interest rate cuts, some loosening of credit restrictions, significant improvement in buyer confidence and increased auction clearance rates provided very strong indications regarding these markets.

Buyer sentiment in relation to housing measures had also noticeably improved and the Westpac-Melbourne Institute’s House Price Expectations and Time to Buy a Dwelling Indices showed a consistent trend. Auction clearance rates had also recovered and were largely above 70 per cent in Sydney and Melbourne. In addition, the population of both the capital cities was continuing to climb, putting more pressure on the housing market.

Yet, since COVID-19, there had been a marked impact on the housing market throughout the country, with increased volatility in Sydney and Melbourne, especially now there is a second wave of the pandemic.

However, this leaves homebuyers in a solid position to leverage on the current market conditions. Home buyers with long-term holding strategies are well positioned to negotiate aggressively to purchase high-quality houses that usually enjoy very strong demand.

Despite credit restrictions by APRA, scrutinising of loan applications as a result of the Royal Commission and material price reductions until the election results in May 2019, houses in the major capital cities simply enjoy strong demand and, due to their chronic undersupply, particularly in the inner and middle rings of Sydney and Melbourne, deliver solid medium and long-term capital growth, which puts homebuyers, and especially first homebuyers, in an enviable position.

The housing market all depends on COVID-19

Pete Wargent, AllenWargent Property Advisory

With mortgage rates falling to the lowest level on record in 2020 and there being relatively few forced sellers thanks to a combination of government stimulus measures and mortgage holidays, stock market levels have been low and housing prices have generally held up relatively robustly.

In some suburban, coastal, and hinterland areas, competition for detached homes has even driven some capital growth through Australia’s first recession in three decades.

Smaller units not suitable for families have typically not fared so well, with much of the price weakness associated with COVID-19 being experienced in inner-city apartments (and to some extent in the upper quartile of Melbourne’s shuttered housing market).

The fallout to the housing market has largely been felt in terms of lower transaction volumes, a sharp decline in the construction pipeline and building activity, and in weakened CBD rental markets, where vacancy rates are high and investor sentiment is low.

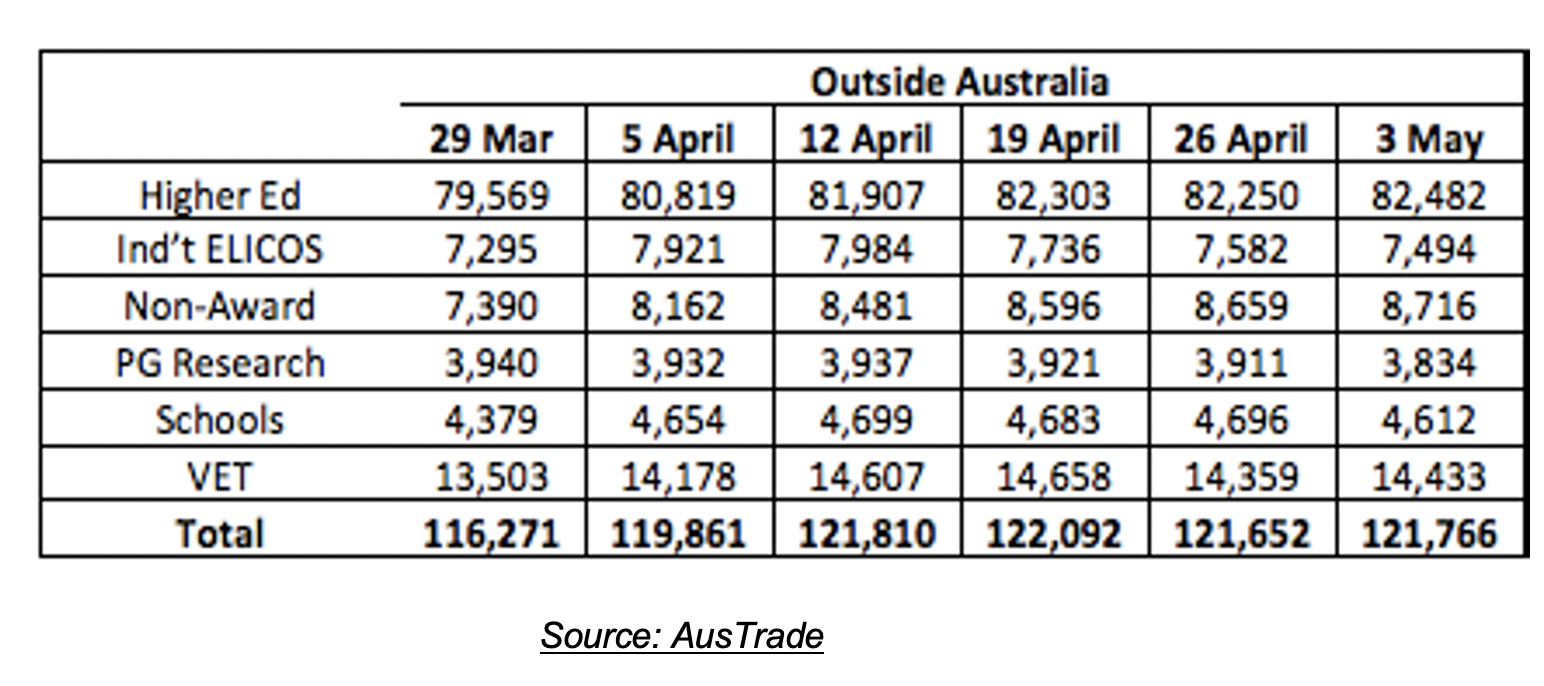

About 121,000 or some 20 per cent of student visa holders remained offshore as of May of this year, leading in turn to a surge of inner-city apartment vacancies.

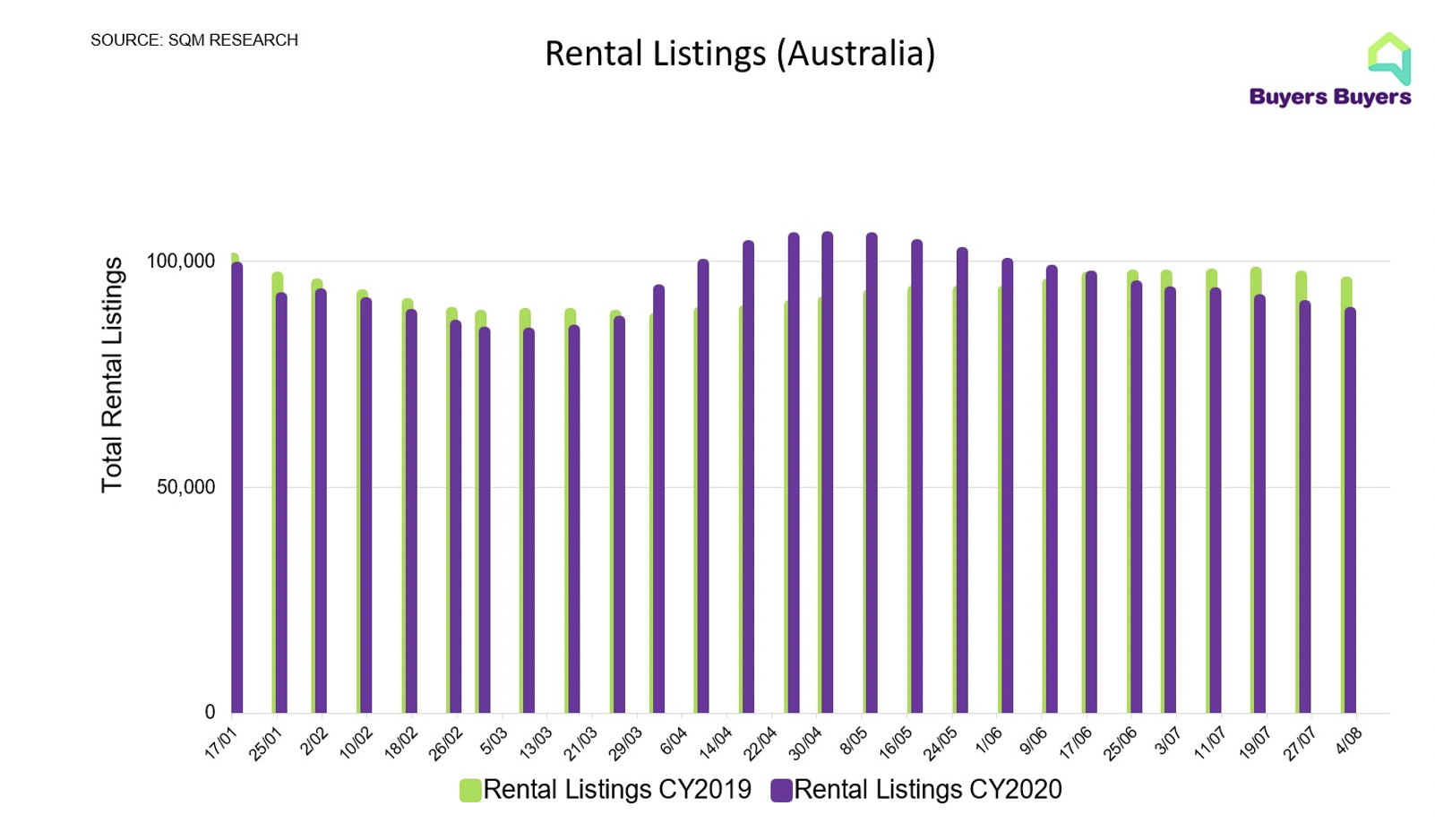

Interestingly, however, analysis by Louis Christopher of SQM Research has highlighted a significant trend reversal in total rental vacancies over the past quarter, to the extent that by August 2020 total rental vacancies in the residential market were some 7 per cent lower than a year earlier.

This may in part be due to unusual Airbnb trends, fewer investors in the market, and a function of softening rents encouraging more tenants to sign leases.

Moreover, there’s been a clear outward or decentralising shift in housing demand away from the inner cities of the major capitals as cautious Australians seek to avoid density, and this dynamic suggests that many coastal areas and regional centres of Australia may in turn be heading for rental shortages.

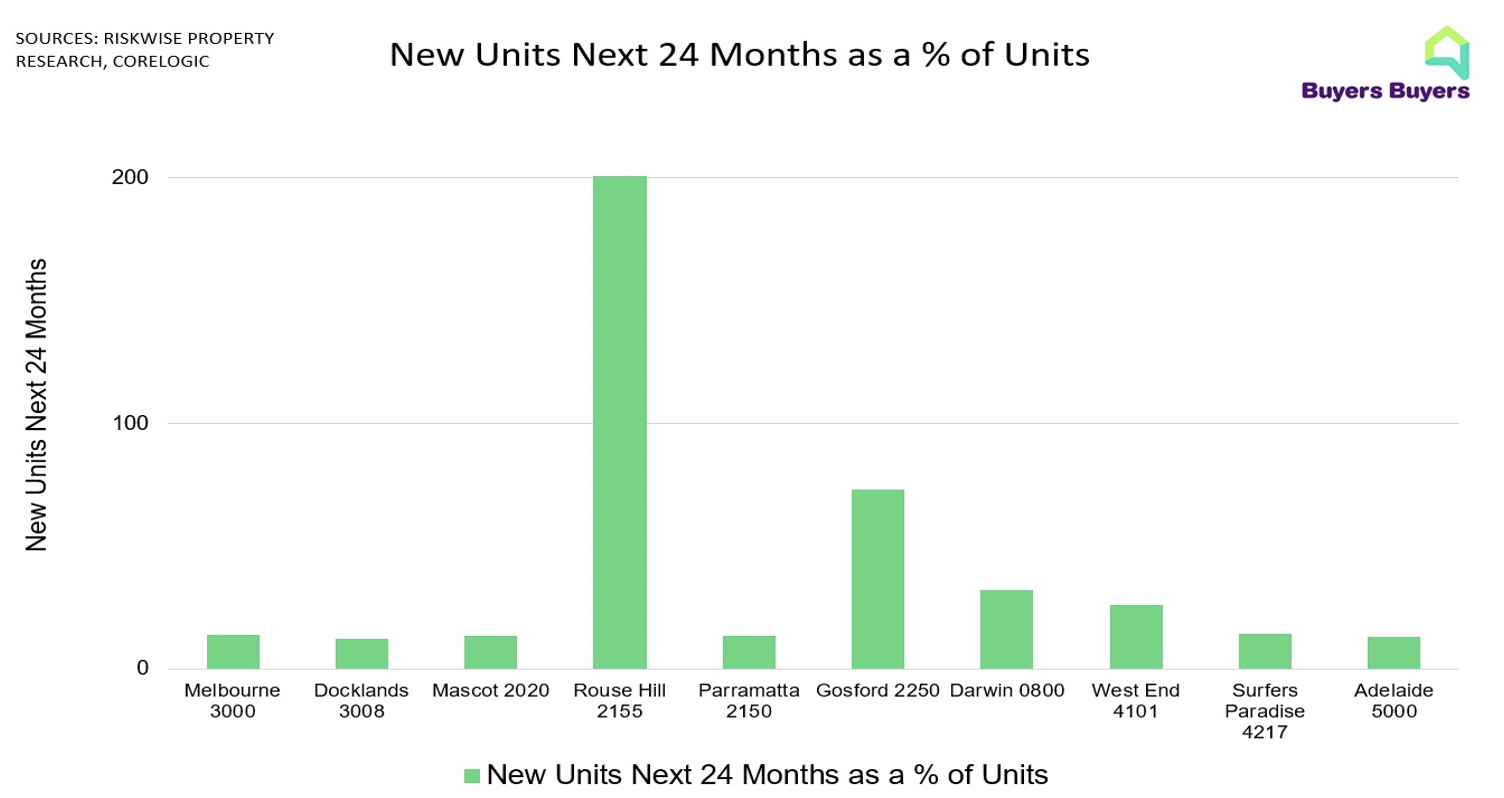

The inner cities are another matter entirely, with RiskWise Property Research’s latest unit oversupply report suggesting that Melbourne CBD and Docklands are at the forefront of the unit oversupply risk.

RiskWise highlights the pipeline which is set to add to an already high level of units in some inner-city areas, with lower demand by young renters who may simply end or not renew their rental agreements in turn increasing vacancy rates further.

Some parts of New South Wales also appear poised to experience a significant uplift in unit stock, at a time when demand for new units has been very patchy.

A good deal hinges on the successful containment or otherwise of COVID-19, with Melbourne’s stage 4 restrictions inevitably curtailing market activity, and prices have softened accordingly in the Victorian capital, although far from precipitously to date.

Never miss an update

Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

2 topics

2 contributors mentioned

Bella is a Content Editor at Livewire Markets.

Expertise

Bella is a Content Editor at Livewire Markets.