Can equities have a soft landing while the economy goes into recession?

Buried deep inside an otherwise vanilla edition of the Federal Reserve meeting minutes is a line that caught a few people's attention.

"Given their assessment of the potential economic effects of the recent banking sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years."

The shutdown of three regional banks has caused economists at the world's most consequential central bank to predict the end of Powell's soft landing dream.

It's for this reason that some Board members argued for a pause. And had it not been for the banking crisis, other Board members were arguing the central bank would have to hike rates by another 50 basis points.

The interest rate in the US is already the highest since 2007. Following the latest stateside inflation print of 5.6% (core), there is likely at least one more hike in the pipeline. So how did equity markets react to such a small but important change?

As of writing, the S&P 500 forward P/E ratio is sitting at around 18. That's above the historical average of 15 and well above recessionary levels. The same could be said about the credit market, according to KKR's Jeremiah Lane.

So it all begs the question - Can you have a soft landing in the equities market and a hard landing in the economy? This wire will attempt to answer that little thought experiment.

Mixed signals

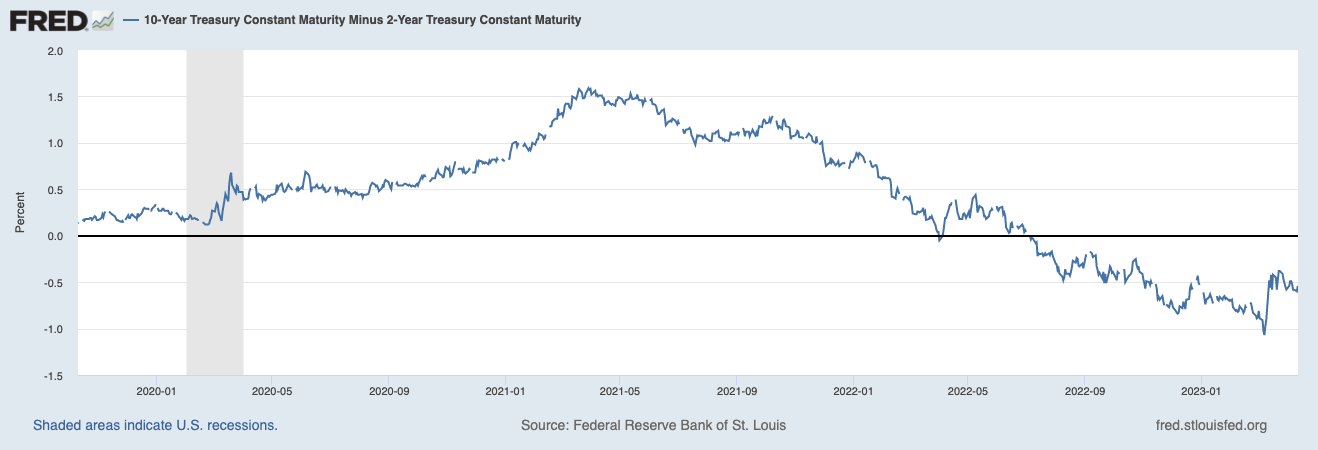

Ask an equities person where they think the economy is going and you'll get a very different answer to someone who works in the bond market. The bond market usually points to the 2s/10s curve which has now been inverted for nine months and counting. Historically, the 2s/10s curve has a strong track record of predicting a recession.

.png)

For equities investors, they point to strong labour markets, the wider disinflation trend, and most importantly, resilient corporate earnings. Balance sheets for most major companies remain in a good place (an argument reinforced by corporate credit investors). But that argument will really be tested starting tonight when the US Big Banks hand down their latest quarterly earnings.

As of last Friday, FactSet's count of companies guiding for negative EPS growth is 106, the most since Q3 2019. The estimated general earnings decline is also likely to be the biggest since the beginning of the COVID-19 pandemic.

The UBS economics team argue one level further, saying a normal recession is not priced into any asset class... except one.

"The common signal across all assets suggests markets are pricing in just below trend growth, still far from recession. Oil is the only asset pricing in a less benign global outlook."

The insights of Livewire's mind hive

Livewire contributor and WealthLander CIO Jerome Lander argues both the bears and bulls will be wrong. Lander believes the equity market is not priced for a recession because it's simply acting like a casino.

"Central banks are first likely to cause a market accident or hard landing particularly given the nature of market participants and speculation in today’s equity market, yet ultimately will be forced into a path of financial repression."

He goes on to add that equities will eventually present a buying opportunity for this reason. But due to the nature of the market, you have to be in it to win it first.

Incidentally, that "financial repression" theme has already been brought up by Chris Watling of Longview Economics. In a recent client webinar, Watling argued the push for growth was engineered by central banks.

"We've had 12+ years of financial repression where central banks have bullied investors into risky assets and pushed them out of income yielding assets."

Watling, normally a bull, has been shifting his asset allocation model heavily in favour of government bonds in recent months.

Alastair's views

So will the disconnect actually last this time? It's not conventional, but it may be different this time, argues Wheelhouse Partners Managing Director Alastair MacLeod.

"Long term economics and markets are correlated by the linkage with corporate profits, but in the shorter term, there can and usually is a disconnect," MacLeod told me.

"But this seems to have been one of the most well telegraphed recessions we’ve seen. Our sense is that many investors are waiting for a pullback, waiting for an opportunity to deploy capital. With everyone positioned defensively and ready to jump back in, the pullback might be a lot shallower than people expect," he added.

The disconnect is simply to do with how markets function. Investors are always forward-looking. You can also visualise that disconnect by just simply looking at the risk-free yields now available in bonds (which are now very competitive, in comparison to equities in many developed markets). But MacLeod also argues this time may be different.

"We believe the bigger risk to investors may be an extended period of low returns, perhaps flat in real terms. That scenario could be far more damaging to wealth creation than a short shallow pullback which then recovers in due course," he noted, adding this could also occur even if the economy experiences a soft landing against the Fed's own estimates.

2 topics

3 contributors mentioned