Can this ASX stalwart capitalise on the "drink at home" and "the return to pub"?

In proof that time really does fly when you're having fun, it has now been two years since Woolworths (ASX: WOW) spun off Endeavour Group (ASX: EDV). The fun, in this context, stems from Endeavour Group being the owner of hundreds of pubs and wineries in addition to the BWS and Dan Murphy's liquor retail chains.

In more recent times, the company has been the subject of a potential earnings downgrade after the Victorian government made sweeping changes to its gambling laws as well as the slot machines themselves. Already, the company's C-suite has said it will reduce gaming hours in its Victorian pubs and axe jobs.

Victoria's move is the most drastic change in a slew of gaming reforms that are taking place across much of the eastern seaboard. Between Victoria, New South Wales, and Tasmania, Morgan Stanley estimates that 50% of the company's gaming fleet could see a hit to earnings. It has an UNDERWEIGHT rating with a price target of just $5.80/share.

Alternatively, you can take the view of Macquarie's sell-side team which argues that alcohol earnings remain resilient enough to withstand these headwinds. And in the context of the Australian economy, alcohol is also more of a consumer staple than a discretionary purchase. Unsurprisingly, the broker has an OVERWEIGHT rating on the stock.

So whose view will be vindicated? In this wire, we'll go through the Endeavour Group full-year result with the help of Jim Power, consumer and industrials analyst at Martin Currie.

Note: Endeavour Group is a holding in Martin Currie's Equity Income Fund.

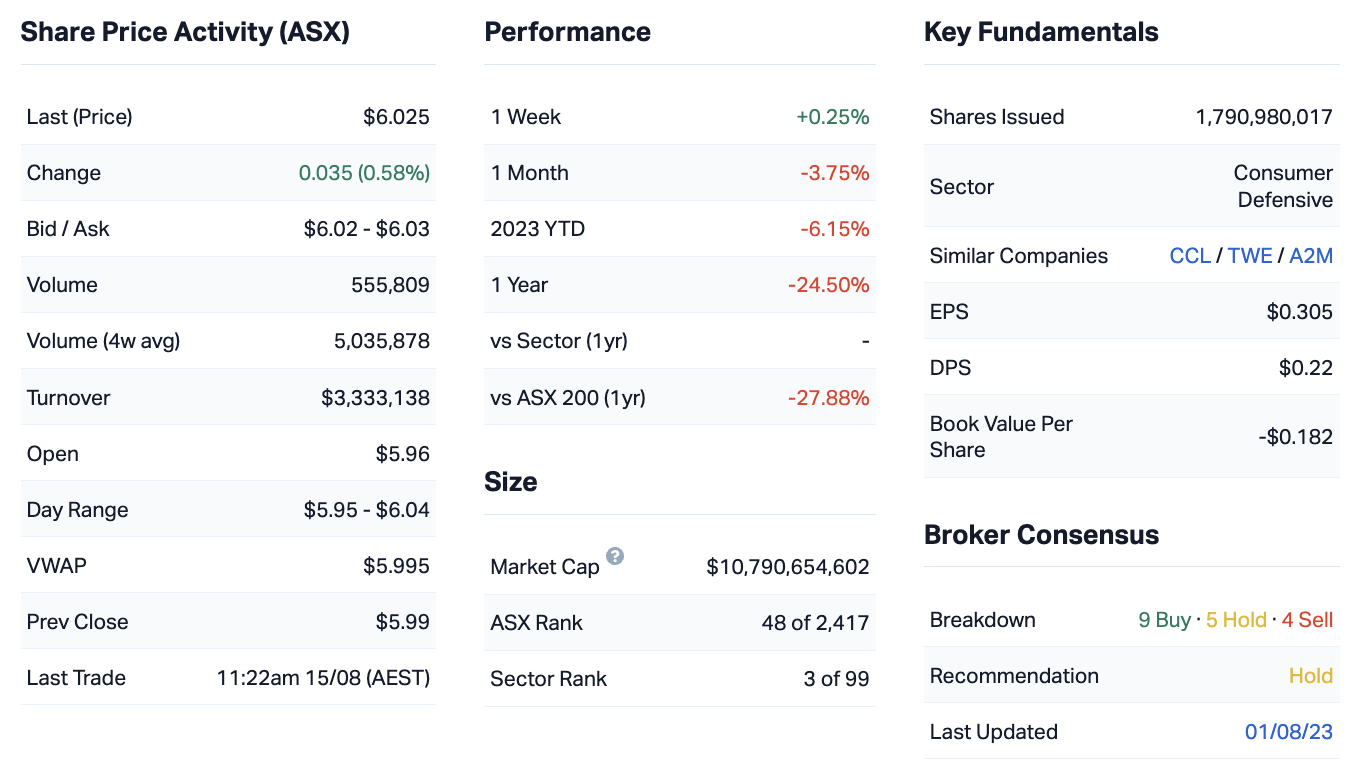

Endeavour Group Chart

Endeavour Group FY23 Key Results

- FY NPAT of $529 million vs $544.6 million FactSet estimate

- FY revenues of $11.88 billion vs $11.94 billion FactSet estimate

- FY EBIT of $1.02 billion vs $1.03 billion FactSet estimate

- Final dividend of 7.5c/share, taking total payout to 21.8c/share

Key Company Data

In one sentence, what was the key takeaway from this result?

They're a good, dependable company and management team providing a dependable and in-line result.

What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

Rating: Appropriate

It's not a bad result considering the market is down 1.4% today. Their share price reaction was muted and that's appropriate.

Would you buy, hold or sell Endeavour Group on the back of these results?

Rating: HOLD

There weren't any surprises really in the result. The only real new piece of information is the cost savings plan which they will use to fund their future growth agenda and independence plans. The market knew they had some capital to invest in growth options and also investments to complete the demerger from Woolworths and to be its own company.

They needed some cost saving plan to fund that so that it wouldn't hit the profit and loss statement. It's a great stock to hold in the current market and given the backdrop.

What’s your outlook on the wider consumer staples sector? Are there any risks to this company and its sector that investors should be aware of?

Broadly, it's [consumer staples] a defensive sector. It's got a lot of great companies in there that do relatively well in tough environments or uncertain environments. We're in an uncertain environment now So, there's a lot of interest in those companies within the sector as a way to provide some protection.

The share prices generally reflect that factor - it's hard to find cheap high quality companies and high quality management teams. So I think that's where owning Endeavour comes into it.

But [we think] it's one of the most fairly valued stocks out of the defensive stalwart-type companies.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing on the ASX right now?

Rating: 3

We're at the point now with interest rates and inflation where the RBA can find the narrow path to a soft landing they are looking for. We are at that inflection point and we'll wait to see which road we take from here.

What parts of the market are you finding the most opportunities in?

Something that is independent of the macro is particularly appealing at the moment. A few stocks to call out here include GUD Holdings (ASX: GUD), which we own and is a company-specific play. They did a big acquisition of AutoPacific Group (APG) and the market lost faith in that specific acquisition and what it meant for their growth story. We bet on the fact that the company they bought was a reasonable company and could create its own destiny.

Another theme that is independent of the macro is decarbonisation. It's going to happen in Australia, regardless of whatever macro [headwinds] comes at it. So a company like Monadelphous (ASX: MND) which is going to play a major role in decarbonising Australia and the world and its tailwind will be there regardless.

10 most recent Director Transactions

Catch all of our August 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

4 topics

4 stocks mentioned

1 fund mentioned

1 contributor mentioned