Canada’s median CPI flat at 3.4% y/y, US CB consumer confidence soared to 110.7

Let’s hop straight into five of the biggest developments this week.

1. Canada’s median CPI flat at 3.4% y/y

Inflation in Canada remained higher than expected for the year to November. The median CPI reported at 3.4%, which was in line with the previously downward revised figure. This came as a surprise to markets that had bet on a decline to 3.3%. Inflation is proving unyieldingly stubborn in the Canadian context, considering the overly restrictive policy measures of the BOC over the last 18 months.

2. UK CPI slumped to 3.9% y/y

Inflation in the UK has thawed at a far much faster pace than initial estimates according to annual inflation data released Thursday. CPI fell to 3.9% in the twelve months to November from the previous reading of 4.6%. Despite being comparatively higher than most developed economies, the deflationary momentum is notable, coming as a shock to markets that only factored in a minor reduction to 4.3%. The inference is that the BOE’s aggressive monetary policy tightening is having a major impact on inflation.

3. US CB consumer confidence soared to 110.7

Optimism in the American economy surged by the largest metric since early 2021 according to economic surveys of consumers. The CB consumer confidence roared to 110.7 for December from the previously revised down figure of 110.0, substantially overshooting market expectations of 104.6. We can imply that Americans are right into the swing of the festive season with buoyed expectations of the economy and labour market in the medium term.

4. US final GDP growth fell to 4.9% q/q

Economic growth in the US was slower than initially estimated. The final GDP figure registered at 4.9% in the third quarter, undershooting expectations of 5.2%. While growth in the third quarter was considerably higher than the first two of the year, actual growth fell short of optimistic initial and preliminary estimates.

5. US unemployment claims rose marginally to 205k

More Americans seeking jobs are being matched by a stronger than expected labour market, according to seasonally adjusted unemployment claims. Jobless claims rose to 205k from the previous upward revision of 203k, but were markedly less than the 214k figure anticipated by markets.

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Palladium remained hot this week on supply concerns as South African miners intensified their labour stand off over pay and working conditions. Lumber rose on a surge of construction projects in the US. The VIX rose markedly on geopolitical tension as the Middle East conflict threatens to evolve into a regional conflict, also additional hedging activity in the options market distorted the VIX over the course of the week. The energy complex rose on supply chain concerns as Yemen’s Houthis escalated their assault on shipping in the critical Red Sea route even as they ramp up militant mobilization for what could be a protracted conflict. The US response in a coalition of 10 other countries to address the concern through Operation Prosperity Guardian now threatens to turn the red sea into a full scale militarized arena. This came at a time when OPEC+ forecast report indicated 2024 to have the greatest demand for petroleum on record. Global indices fell on geopolitical uncertainty as investors took cover. Orange juice, cotton, coffee sugar and wheat all fell on oversupply and profit taking.

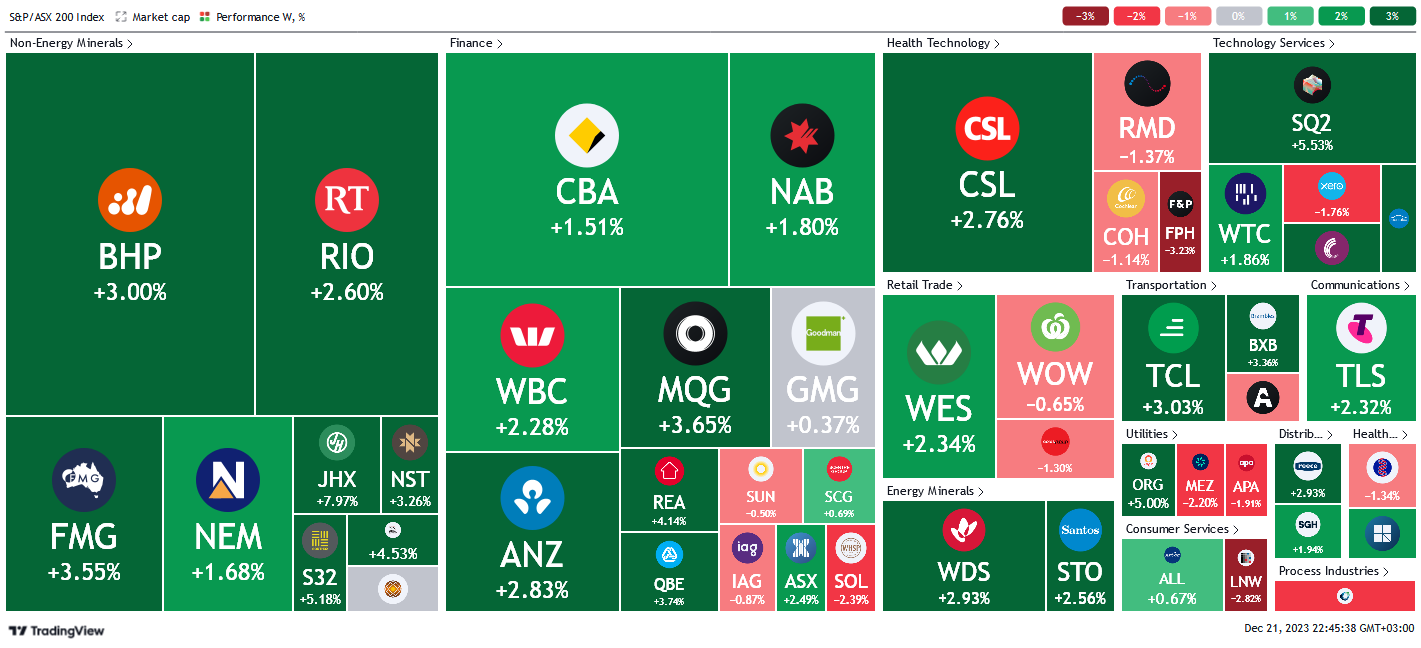

Here is the week's heatmap for the largest companies in the ASX.

The ASX had a mixed week that was broadly bullish. Financials remained hot as waning inflation and geopolitical uncertainty dampened prospects for further rate hikes. REA and MQG were the biggest gainers netting +4.1% and 3.7% respectively. SOL, IAG and SUN were the only let downs in an otherwise green week. Non-energy miners were the most outstanding sector in the week, posting a fully green week with no exception, as listed companies followed good performance from the underlying commodities. JHX and S32 beat the index to close +7.9% and +5.1% respectively. Healthcare tech was mixed but mostly in the red, as was the case with retailers and tech services. Energy miners were however solid green as uncertainty drove up demand for energy.

Below shows our proprietary trend-following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

5 topics

5 stocks mentioned