Car manufacturers in the fight for their life to secure raw materials

Approximately two months ago I began writing to my subscribers that the lithium market could be approaching an important low.

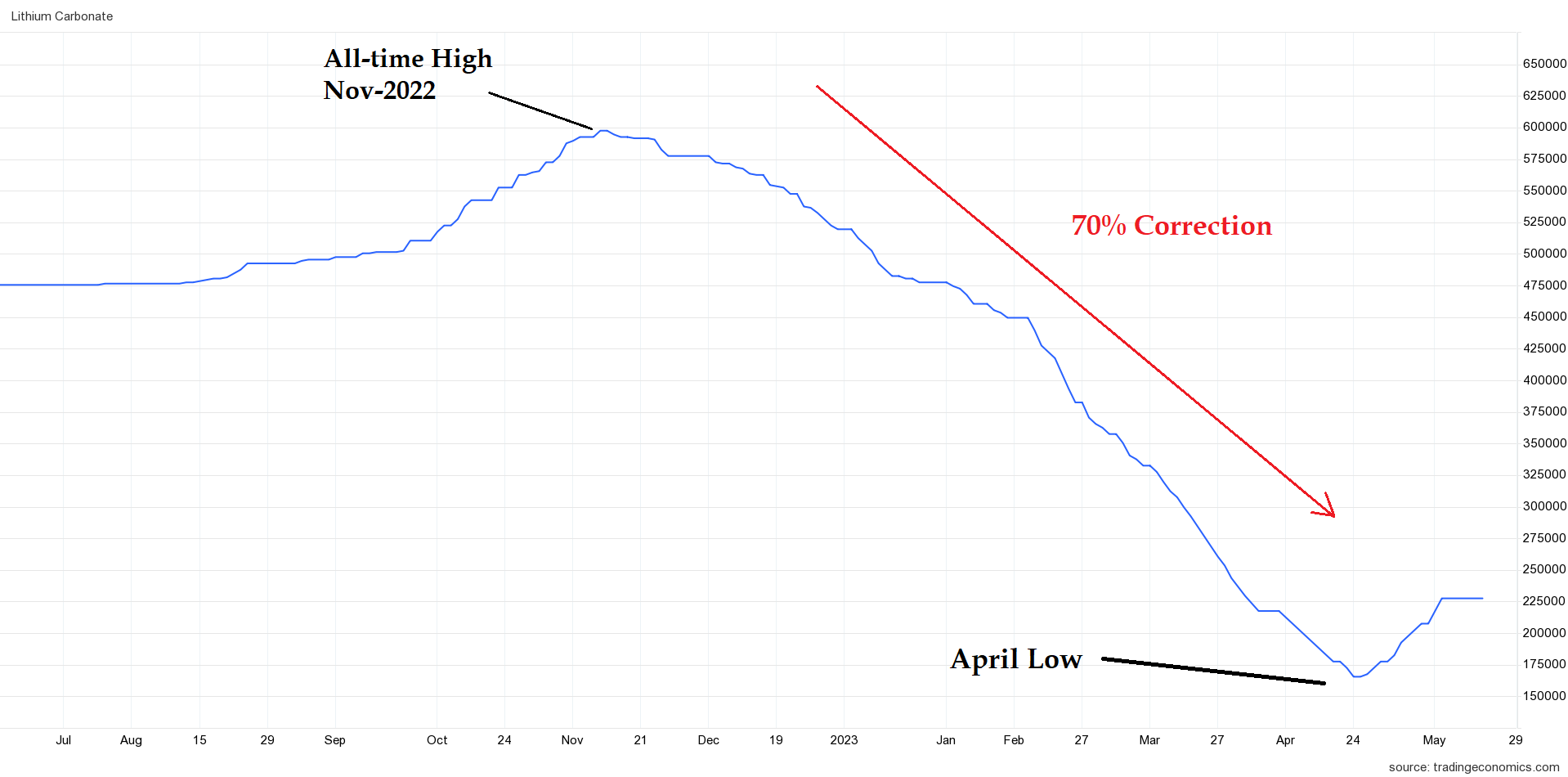

That was on the back of a 70% correction after it peaked in November 2022.

I relayed that message to readers of Livewire earlier this month too, you can read that update here.

That’s why, throughout April, our focus shifted toward the accumulation of lithium explorers and early producers.

Identifying a low in the lithium sector has positioned us well ahead of returning sentiment.

But given there’s relatively few lithium producers for this ‘new kid on the block’ commodity… Operators in Australia have been leading the gains…

After bottoming on 23 March Australia’s lithium producing giant Pilbara Minerals (ASX: PLS) has recovered more than 40% in value and is now just 17% off its all-time highs.

IGO (ASX: IGO) bottomed on the same day and has since gained more than 25% in value… Now just 16% shy of its extreme top from late last year.

So, with gains like these you’d expect the price of lithium to be soaring, right?

Well, not quite.

Carbonate spot prices have certainly bounced off their April lows and are now trading around 30 per cent higher… Hydroxide has recovered around 20 per cent.

It signals an emerging recovery but in relative terms it’s just a small blip in the overall price collapse that’s occurred in 2023, see for yourself below…

That’s why, after a strong rally over recent weeks I believe lithium stocks could be bracing for a pause or a giving back of the gains that were reaped in the early recovery phase.

We already witnessed a pick up in selling pressure last week.

But despite short term weakness there’s still plenty of room for lithium to move higher from here.

It’s why I believe, if you are looking at the sector from a long term perspective, any short term pull-back from here could offer you an opportunity to add exposure.

But don’t expect the pull-back to last…

With falling lithium prices over the last 6 months car manufacturers have been on hiatus or perhaps relieved that price shocks were behind them... Until recently, deals for the miners have dried up.

But the latest lithium up-tick has again exposed major anxiety amongst car manufacturing executives.

The steady lithium recovery is already pushing manufacturers into a frenzy of new supply contracts.

In less than a week, Ford Motor Company has announced THREE major lithium deals.

Last Monday the company announced an offtake deal with US battery chemical giant Albemarle to supply more than 100,000 metric tons of battery-grade lithium hydroxide for approximately 3 million future Ford EV batteries.

The five-year supply agreement starts in 2026 and continues through 2030.

It also signed deals with Chilean lithium giant SQM and secured a 11-year contract with Nemaska Lithium for the supply of lithium hydroxide supplying around 13,000 tonnes per annum.

Vehicle CEO’s turn to mining

In the race to build EV’s manufacturing firms have become far more perceptive to the challenges of supply chains.

Like never before executives are dealing directly with mining developers to ensure quality projects get over the line and enter production.

Its why car manufacturers have been prominent participants at global mining forums.

The idea of these executives attending mining conferences would have been comical a decade ago… But today its becoming the norm and perhaps one of the most important events on a CEO’s calendar.

Critical metals are the building blocks that lead to the development of EV’s… Without stable supply of key materials manufacturing stops and revenue dries up.

But as I’ve highlighted many times in the past, supply of these key metals looms as an enormous threat.

The mining industry has endured years of underinvestment, declining output, and lack of new discovery.

Miners have been sounding the alarm bell for years…

But now it’s the car manufacturers themselves who are calling out the looming shortage… In a recent interview an executive at General Motors, Tanya Skilton, didn’t mix her words when it came to the impetus to secure supplies of raw materials…

“We’re absolutely convinced that this is a race, a zero-sum game and resources are a finite limit.”

Skilton also forecast that the industry will be divided into winners and losers based on which companies will have the minerals to fulfil their “electrified dreams”.

Indeed, this will be a race and only those manufactures that are able to secure the vital raw ingredients will win.

In fact, moving too late on this critical issue could be the eventual undoing for companies that have held multi-decade dominance in the industry.

Surprisingly, one of those could be Toyota…

Japan’s largest vehicle manufacturer has been criticised by analysts for its slow EV uptake… Meaning it has made relatively little attempt to secure exclusive critical metal supplies.

It’s the reason some believe long-standing CEO Akio Toyoda was ousted earlier this year.

Akio has vocally played down the rapid need to move to EV manufacturing suggesting western economies should be more cautious in their attempts to cut off traditional energy and transport.

In some regards I do sympathise with the former CEO…

Securing the vast critical metals needed to eliminate a fleet of combustion vehicles has been undertaken with very little foresight or planning.

Its setting up as desperate situation for car manufacturers as they embark on a corporate arm wrestle against competitors to secure finite resources.

Despite mining and car manufacturing executives voicing their concerns over critical metal supplies… Political leaders continue to demonstrate their hell-bent intentions toward the elimination of fossil fuels from our energy mix.

Don’t get me wrong, finding alternatives to fossil fuels is absolutely something we need to achieve.

But for some unknown reason the political elite have tackled one of humanities biggest ever challenges with virtually no plan on how we’re supposed to achieve this outcome.

The key stakeholders who are intricately involved in understanding mineral supply have not been involved in net zero discussions.

In fact, several key academics have called into question whether we actually hold enough raw materials in the ground to make the transition work.

You see, calculating the volume of critical metals needed to eliminate fossil fuels versus what is actually available (mineral reserves) would be a logical first step toward understanding whether we can achieve history’s greatest ever energy transition.

Yet that was NEVER undertaken.

This is set to be a monumental miscalculation with severe consequences for the global economy.

It’s also highly inflationary.

It will take time to play out… But this is negligence on a colossal scale… The political hierarchy have overlooked this most basic but fundamental calculation.

Next week I’ll detail the research that uncovers this major misstep… For those of you who are anticipating a smooth energy transition this data may come as a shock!

But with a looming crisis on the horizon there is a safety haven… Resource stocks.

Until next time,

James

If you're interested in staying up-to-date on the latest developments in the Australian Commodities space, click this link now to get insights from James Cooper in his publication Diggers and Drillers.

4 topics

2 stocks mentioned