Central banks constantly say they are "data dependent". Here's why you should ignore them

The Fed wants to cut. The RBA wants to cut. But sticky inflation data have made that difficult. So the central banks fall back on “data dependency”. They will let the data tell them what to do. That leaves markets guessing which data is important. Is it the inflation data – which are still far too high for cutting? Is it the jobs data – which are starting to deteriorate? Or the PMIs, which are now in sub-trend growth territory?

The whipsaw in interest rate expectations makes investing challenging. In this wire, we update some scenarios to help with looking through the noise. I'll share what data points are the ones most worth watching and finally, I'll share what all this means for how you should be invested.

Rates will go lower… eventually

The Fed is going to cut rates. But the longer rates stay elevated, the more likely something will break. The market’s daily attempt to decide if the first cut will be March (wrong), July (possibly), September (maybe), December (could be) or some other date is not that important. The bigger question is, will these be “insurance” rate cuts, or “emergency” rate cuts?

Insurance rate cuts and the soft-landing scenario

Back in December, markets were convinced the Fed could nail a soft landing. In the US, seven rate cuts were priced over the subsequent year. Equity markets were priced to perfection, discounting a re-acceleration in growth and a significant move higher in earnings.

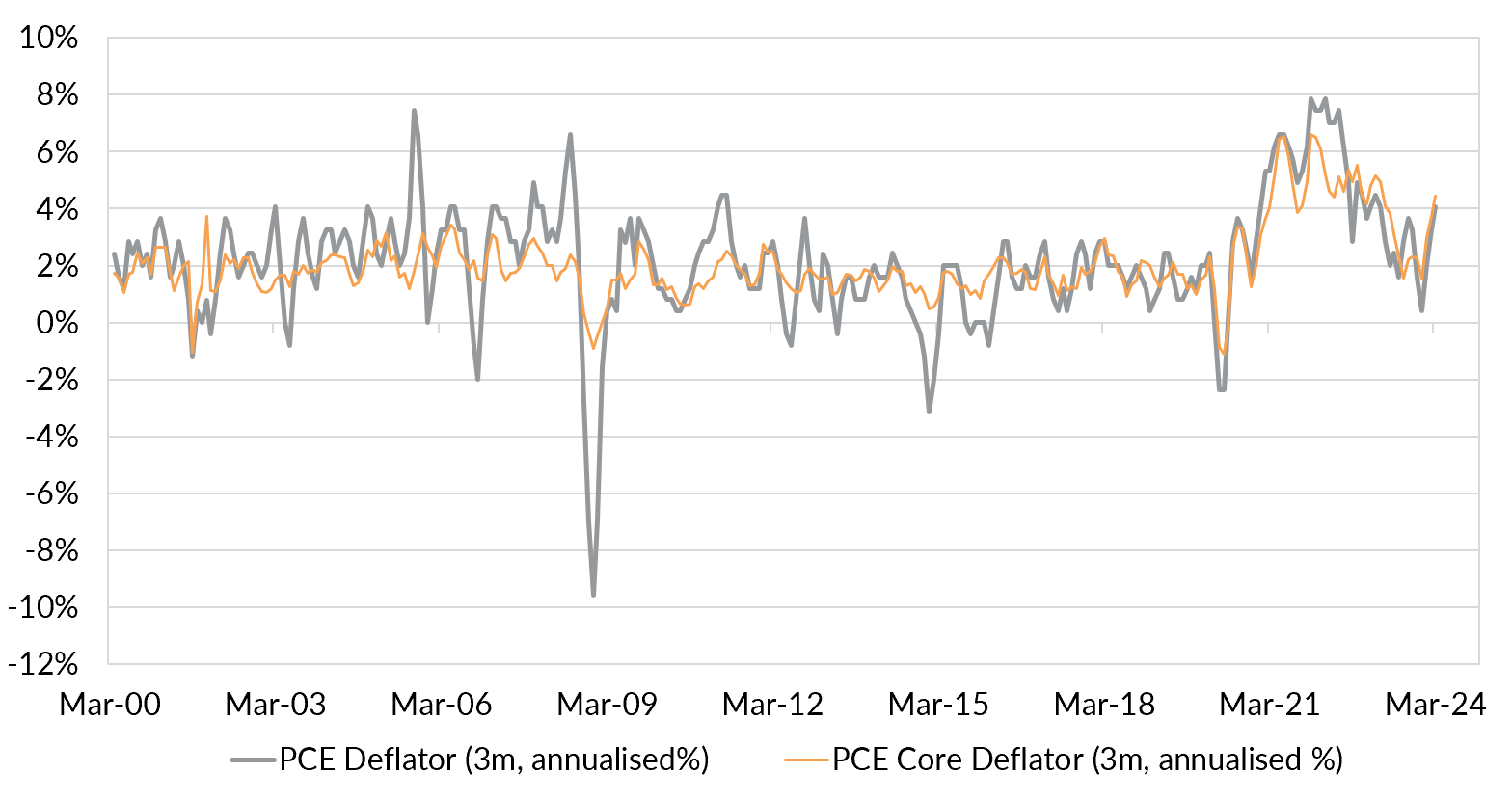

Those insurance rate cuts have since been priced out as the three-month annualised inflation rate moved back above 4%. A soft-landing scenario is still possible if the labour market and consumers remain resilient.

Chart 1: PCE inflation is trending higher in the US

Emergency rate cuts in a “slow-flation” scenario

But growth is slowing in the US, while inflation is proving sticky. Slowing growth and elevated inflation is a challenge for the Fed. It has pushed out the timeframe for cuts. And that increases the risk that something breaks before the Fed can implement insurance rate cuts. In this scenario, the first Fed cut could be an “emergency” cut – a deeper cut required to offset a sudden decline in growth and employment.

Which data matters for the outlook?

The market focus on US inflation is understandable given the Fed’s mandate. It is important to understand why inflation is moving lower. If inflation is slowing because the economy is moving more into balance as growth stabilises around or a bit above trend, then the Fed could deliver “insurance” rate cuts. But if inflation is slowing because the economy is moving rapidly below trend, and consumers retrench as employment growth slows, then the Fed could deliver “emergency” rate cuts.

We suggest three indicators to monitor the US economy’s progress.

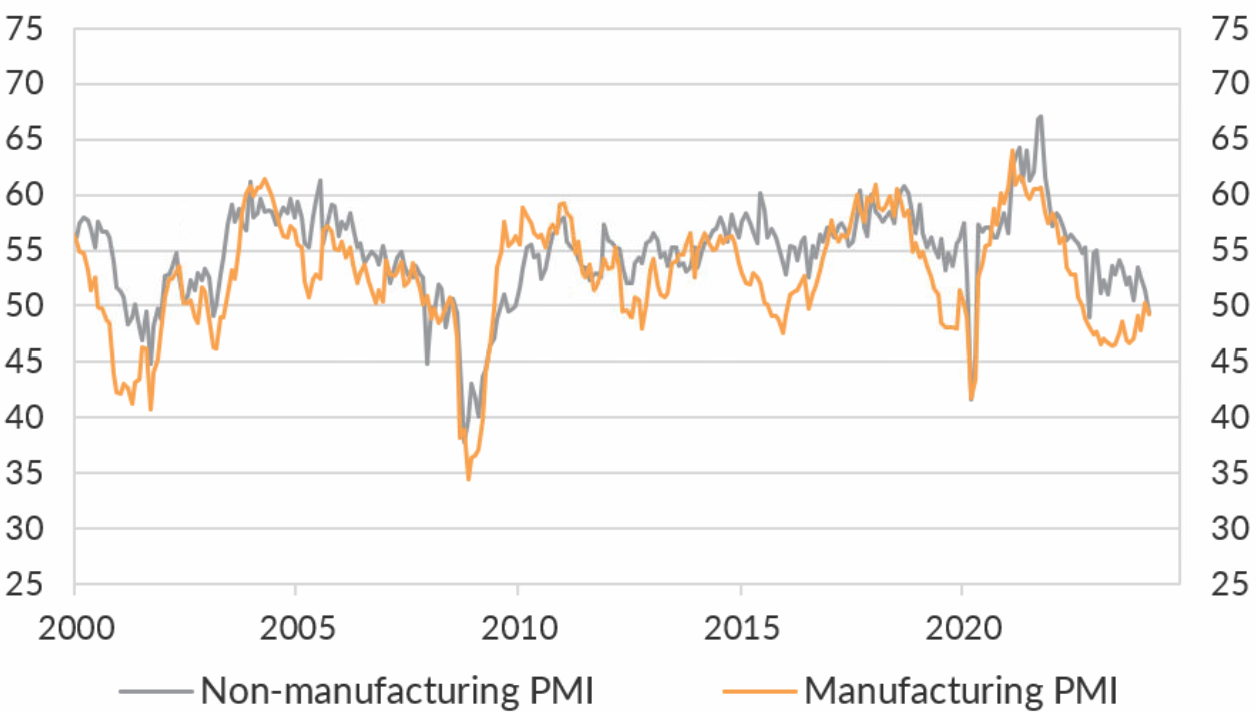

1) The manufacturing PMI The US manufacturing PMI is a good indicator of US economic health. When the indicator is above 50, it suggests above-trend growth. Between 50 and 45 suggests below-trend growth. And a reading below 45 is recessionary. The PMI bumped briefly above 50 in Q1. But it reversed course in the most recent reading – alongside the services PMI. This is a worrying development that growth could be slowing faster than anticipated.

Chart 2: Manufacturing and services PMIs are at below-trend levels

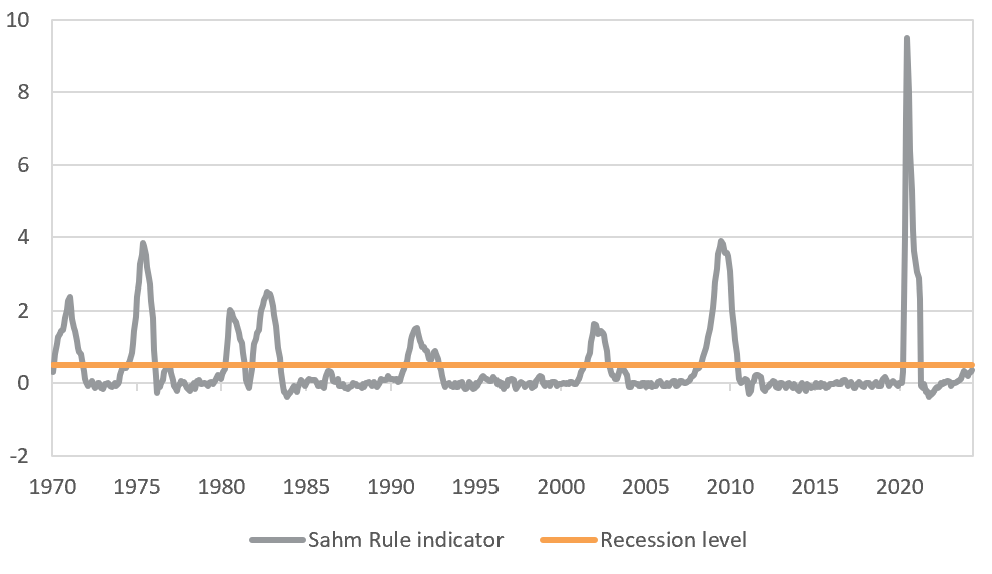

2) The change in the unemployment rate The so-called Sahm rule is a measure of the rate of change of unemployment. A level above 0.5% has historically always correlated with recession. The measure improved in Q1, but more recently weakened as US unemployment edged closer to 4.0%. The robust labour market has been a key measure supporting hopes of a soft landing. But we worry that it is starting to slow – and weaker jobs will impact the ability of consumers to continue spending.

Chart 3: The change in unemployment is closing in on recessionary levels

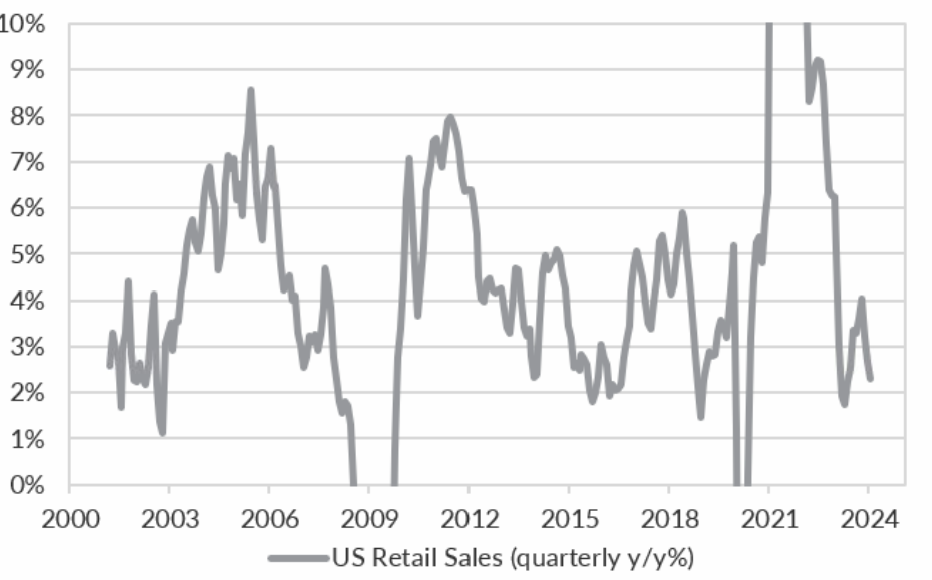

3) Consumer spending The US consumer has been resilient, supported by pandemic-era savings, fiscal support and solid jobs. However, the aggregate numbers hide weakness in the lower end of the income distribution. And that weakness will make it difficult for the economy to reaccelerate.

We think it is sensible to monitor retail spending to gauge whether US consumer resilience will continue. Another area to keep an eye on is consumer loan delinquencies, which have started to pick up recently – and could further retrench consumer spending.

Chart 4: Consumer spending remains resilient in aggregate but retail sales growth is slowing

Look through the data and focus on the big picture

The Fed is going to cut, but the near term could bring further volatility as markets try to understand the Fed’s commitment to “data dependency”. We think the big picture question is whether these rate cuts are insurance or emergency. There is still time for the Fed to manage a soft-ish landing with insurance cuts. But time is running out as the US economy cools. The risk of a more negative outcome increases the longer the Fed is forced to wait.

Equity markets are still pricing a very positive outcome. The data indicate that is still plausible. But the risk of weaker outcomes relative to that pricing is elevated, suggesting investors should be cautious.

Investors may ask whether they even really need to take a view on data dependency or whether the first cut is emergency or insurance. Instead, investors can choose to lock in recent solid equity returns, dial down risk and add some government bonds at attractive yield levels.

5 topics