Chart of the day: Will European equities underperform?

“There can be no doubt that the knowledge of logic is of considerable practical importance for everyone who desires to think and to infer correctly” Alfred Tarski 1901-1983, Mathematician, Academic

Oil is one of those markets, often true with global commodities, where demand and supply is genuinely more visible and calculable in the short-term than others. Notwithstanding oil still ultimately ‘feeds’ final consumer demand, it feeds a broad range of it, not the fickle consumer choice between one brand of car, or one form of transport than another. To this end, the latest collapse in the oil price in the past 24 hours, with near-term contract prices for West Texas falling from under $20 per barrel to zero (and negative for the first time in history), is telling us less about a lack of storage facilities globally and more about a lack of demand and the sharp correction unfolding in mid-2020 global activity.

And here lies (one of) the challenge currently for assessing the outlook for equity markets. Having fallen 30-35% across the world in the wake of the dual Black Swans of the COVID-19 spread and OPEC/Russia falling out, equities have broadly rallied for the past two weeks by around 20% (leaving them roughly 20% off their pre-COVID—19 highs). Yet, while price to earning ratios have corrected, valuations have not fallen to prior levels that have garnered medium-term price support. More worryingly, but not unusually, earnings expectations appear to have only done part of the work required, given the evident sharp weakness in 2020 economic growth that the collapse in the oil price and PMIs globally are flagging.

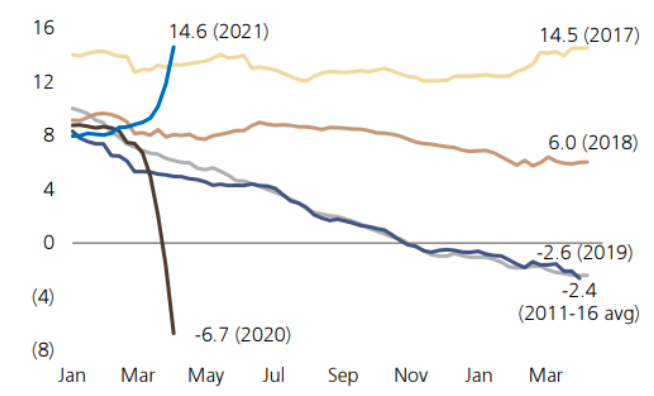

Take Europe—UBS is expecting corporate earnings to fall 33% in 2020 and rebound 25% in 2021. However, across the two years, earnings are still going to be down 16%. However, as our chart below shows (from UBS), the recent 20% rally in European equities has occurred with analysts cutting 2020 earnings to minus 7% and revising up 2021 to positive 15% (as at 14 April when this chart was drawn). While such a rebound may unfold off a weaker base than currently being forecast, the chart also reveals the relatively dismal performance of European earnings over the prior decade, with seven of 10 years ending negatively (on average). As UBS notes, earnings are “finally starting to correct – but still large downside risk”.

This is not unique to European equity markets. In the US, earnings have been downgraded broadly by 15-20%, compared with 30-40% declines in the dot com and GFC drawdowns. But in Europe’s case arguably, the long-term impacts of the COVID-19 crisis on its older demographic economies and more stretched banking systems—not to mention the historical (political and other) challenges of the European project—pose concerns for the outlook for European growth and markets (at least relative to other regions). Still, like the US, if earnings can bounce like our chart suggests, maybe markets will just ‘write off’ 2020 and look over the valley to 2021.

Consensus earnings per share growth progression (%) – January to following April

Source: Thomson Datastream, UBS European Equity Strategy, MSCI.

Be the first to know

I’ll be sharing Crestone Wealth Management's views as new developments unfold. Click the ‘FOLLOW’ button below to be the first to hear from us

1 topic

1 contributor mentioned