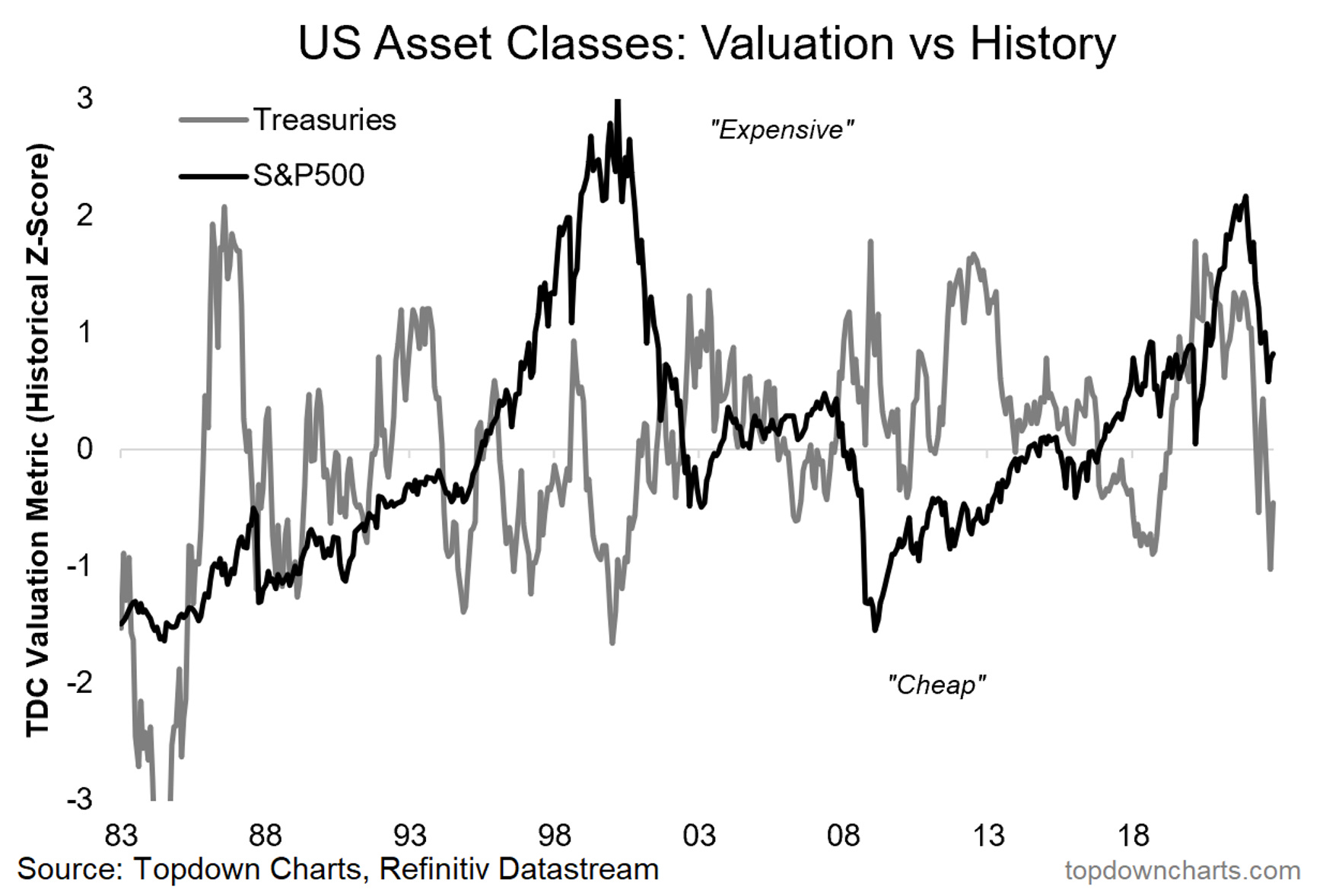

Chart of the Week - Bonds are cheap, stocks are not

US Asset Valuations — Stocks vs Bonds: Both stocks and bonds have seen a decent reset in valuations, but where they stand apart is that after a shocking 2022 (one of the worst years on record) bonds are now materially cheap, whereas equities are still somewhat on the expensive side.

I chose this chart for this edition because it’s interesting to reflect on where this chart sat this time last year. Back then, both stocks and bonds were about 2 standard deviations expensive. And I think this line is uncanny, how I just nonchalantly stated:

It would be nearly unthinkable that both stocks and bonds could fall at the same time to the extent required to drive both of those valuation indicators back to their mean. But a heavy dose of inflation and or/policy tightening could be one thing to do that.

Sometimes we do get it right. But anyway, that’s history, and my job isn’t about patting myself on the back, it’s about trying to figure out what’s coming next!

Back to the chart: as things sit here and now, the odds are in firmly in favor of bonds vs stocks, just from a valuation standpoint. But when you factor in the macro backdrop where next year likely features a global recession — that’s a situation where stocks likely suffer, and bonds outperform.

So a very interesting chart in how it prepared us for this year, but also for its implications headed into next year…

Key point: Bonds are cheap, stocks are not.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

You can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

4 topics