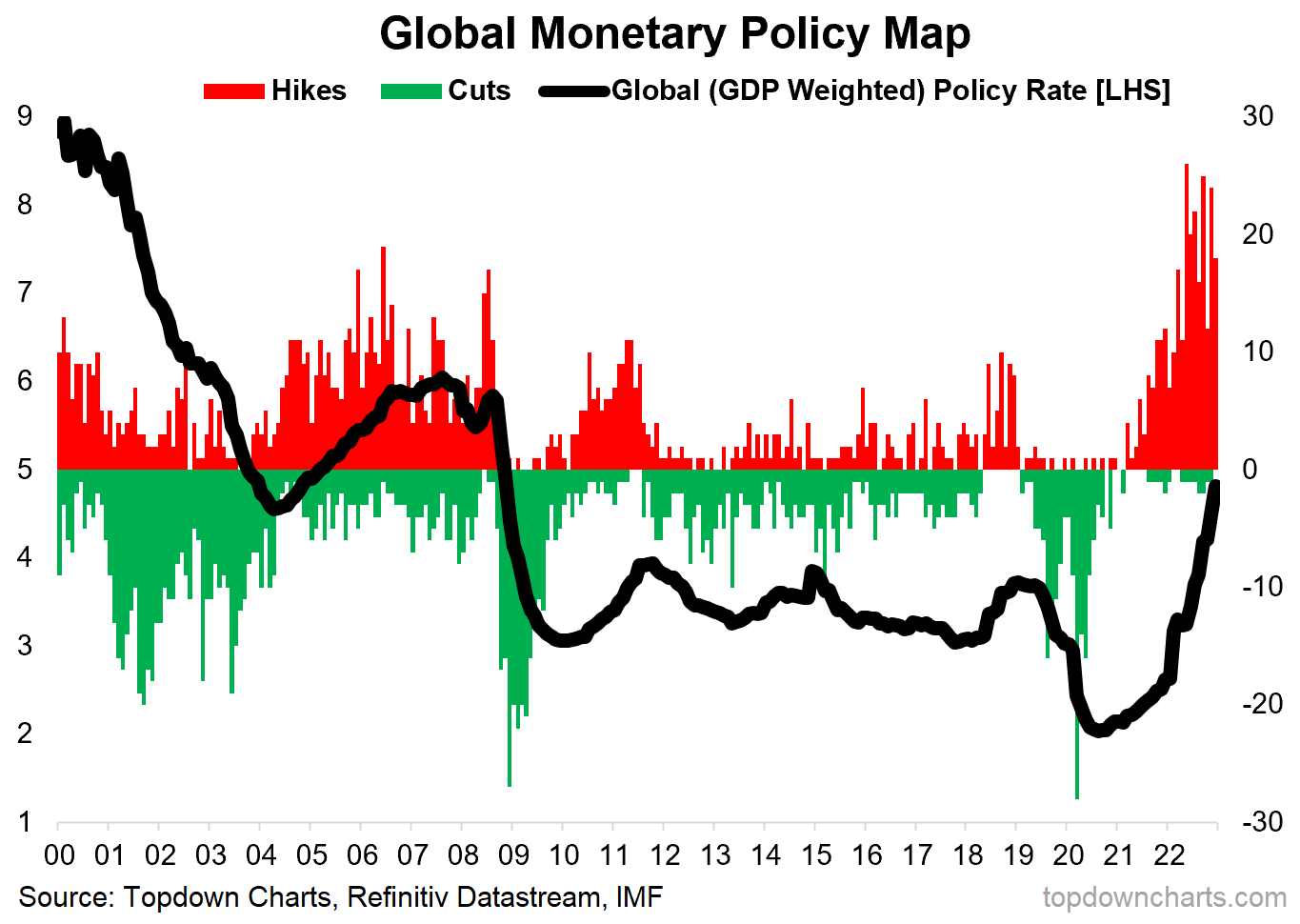

Chart of the Week - Death By 386 Rate Hikes

Monetary Policy in 2022: Monetary policy tightening was the big macro theme of 2022, and it is sure to echo at least for a time into 2023. The 2022 full-year count on my numbers came in at 386 rate hikes across 82 central banks (which compares to 123 rate hikes across 41 central banks in 2021).

The pace, magnitude, and breadth of rate hikes globally is unprecedented in recent years, and the impact of this is going to be felt increasingly this year (especially more-so for the economy, as markets have mostly reacted already to the policy tightening so far e.g. both stocks and bonds falling double-digits last year).

So a very interesting and important chart both in terms of putting last year into context, and in terms of what’s going to matter in macro this year.

Key point: 2022 saw a record pace, magnitude, and breadth of rate hikes globally.

NOTE: This post first appeared on our NEW Substack: (VIEW LINK)

Best regards,

Callum Thomas

Head of Research and Founder of Topdown Charts

5 topics