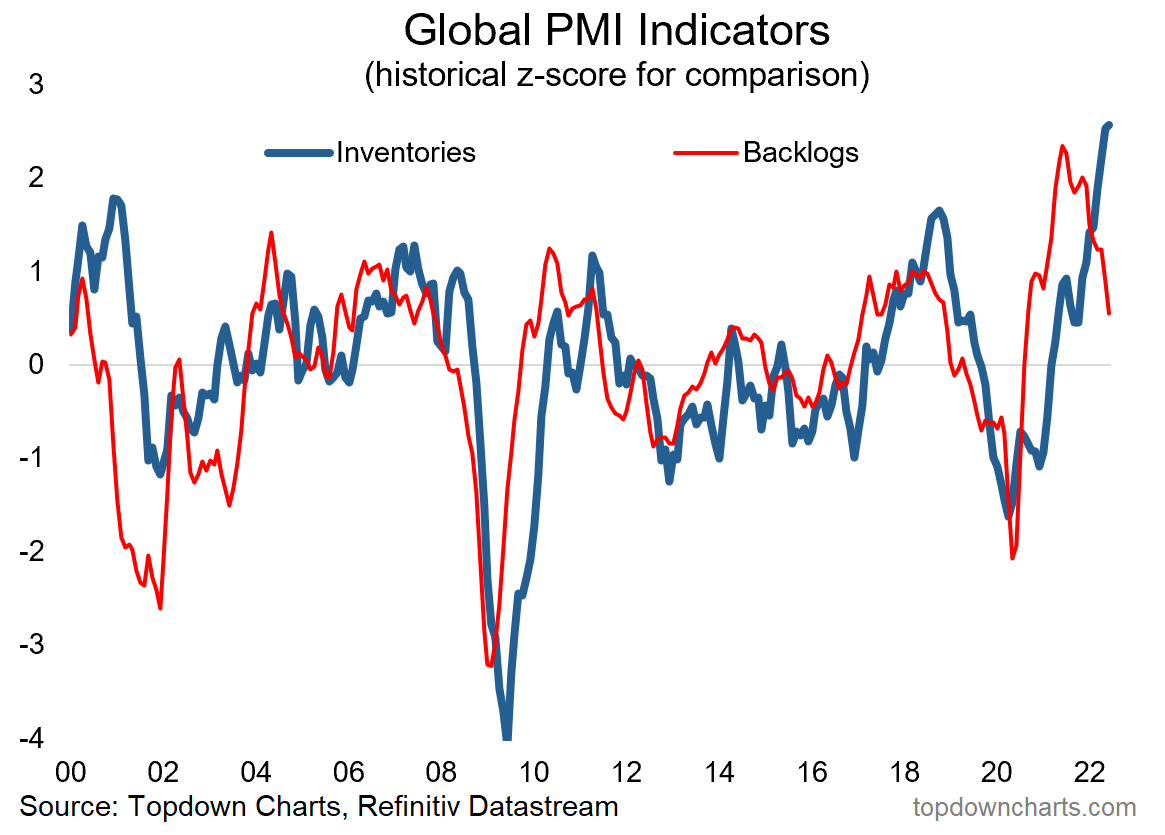

Chart of the Week: From not enough, to too much

Backlog Backdown and Inventory Increase: This is one of the most intriguing charts on my desk at the moment, it shows our composite global PMI backlogs indicator falling to the lowest level in almost 2 years… meanwhile inventories are surging to record levels.

Part of this may well be a transition from the old “Just in Time“ method of inventory management, which was one of many reasons/vulnerabilities that contributed to the chaos and disarray of the pandemic supply chain hell… to more of a “Just in Case“ inventory management strategy.

The slump in backlogs likely reflects an element of simply working through things, reopening, retooling and reinvigorating supply lines, but as I have said all along — if there is no demand then there are no backlogs. So demand is also key.

And in this chart, that notion is affirmed in some respects with the surge in inventories: part of this may indeed be overcompensating for “yesterday’s battle”, but equally, this is the type of thing you expect to see when demand comes to a sudden stop…

Inventories pile up, factory orders plunge, and backlogs are no longer an issue.

The next step is a growth slowdown and disinflationary impulse.

Any questions?

Key Point: Backlogs are backing down, and inventories are surging.

NOTE: This post first appeared on our NEW Substack: (VIEW LINK)

Best regards,

Callum Thomas

Head of Research and Founder of Topdown Charts.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

4 topics